Park Hotels & Resorts and Chesapeake

Lodging Trust Merger Presentation

MAY 6, 2019

PK: Waldorf Astoria Orlando

PK: Hilton Hawaiian Village Waikiki Beach ResortCHSP: Hyatt Regency Boston

2 |

(10.0%)

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

1/4/2017 4/20/2017 8/4/2017 11/18/2017 3/4/2018 6/18/2018 10/2/2018 1/16/2019 5/3/2019

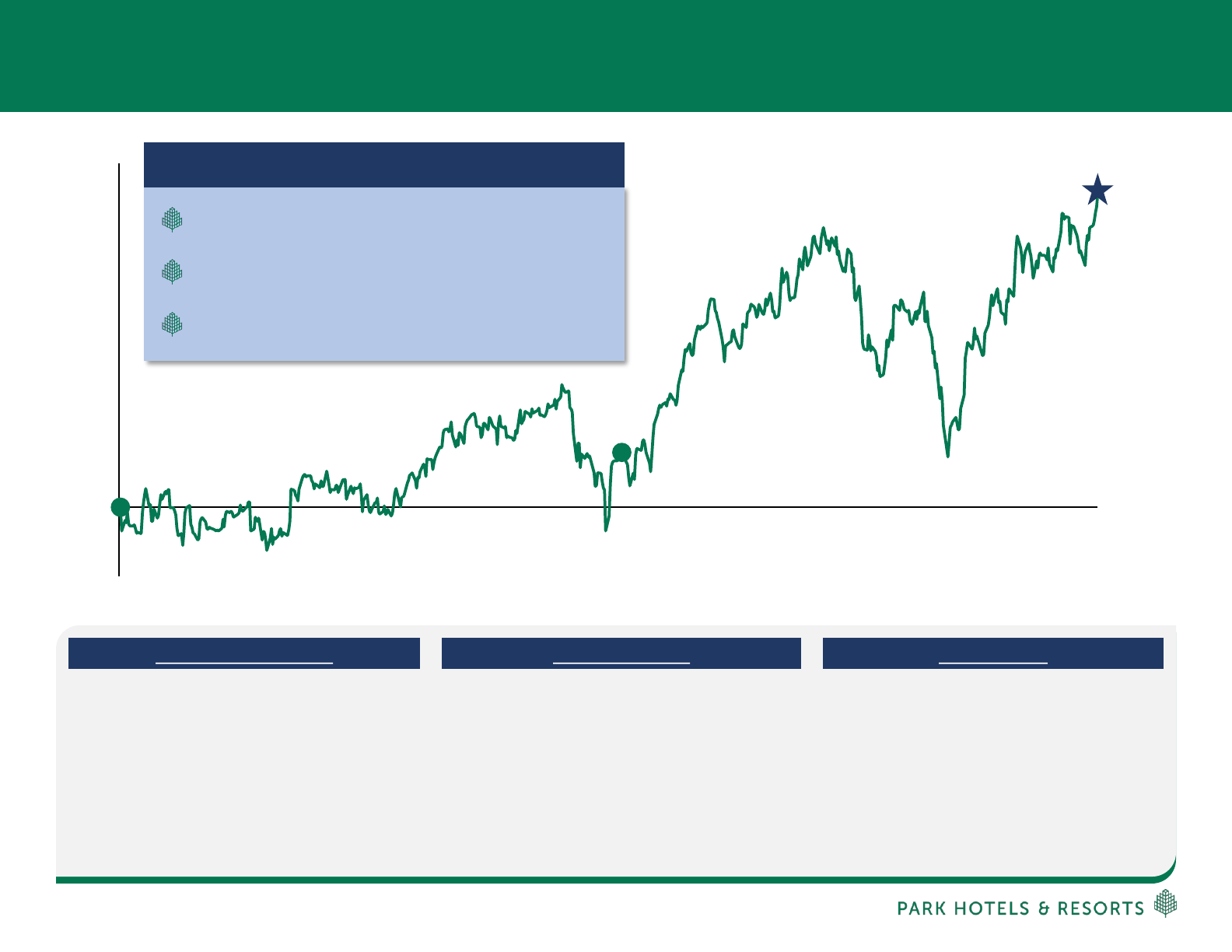

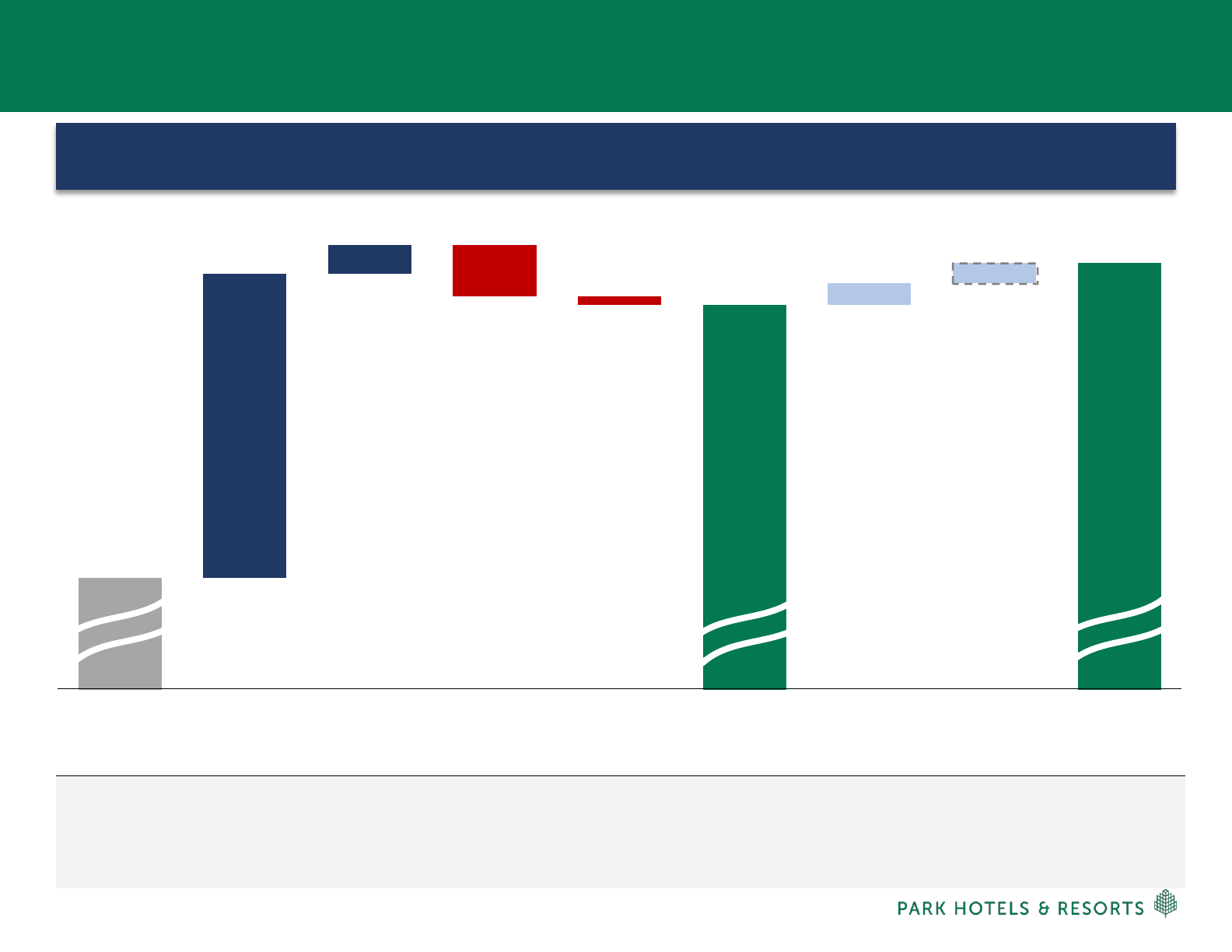

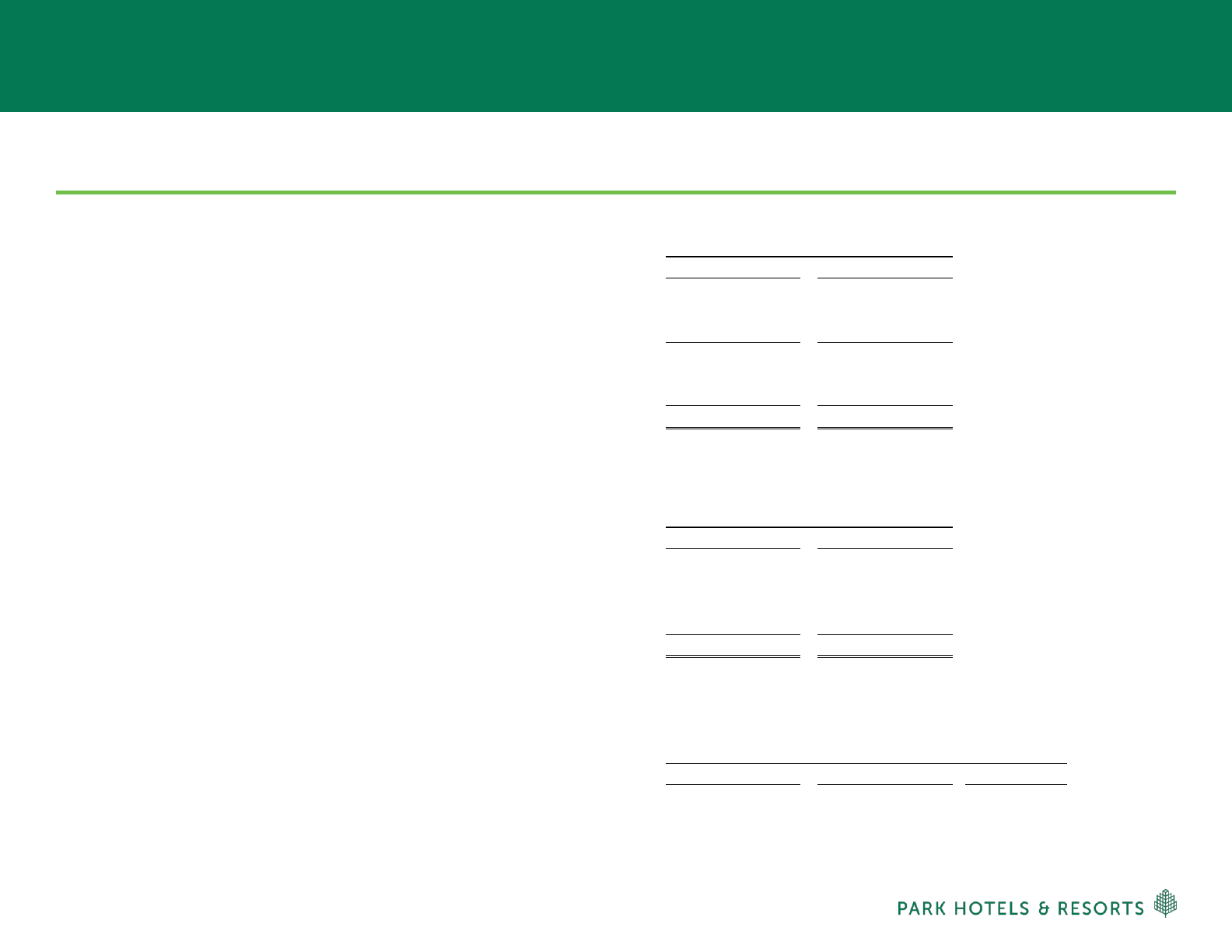

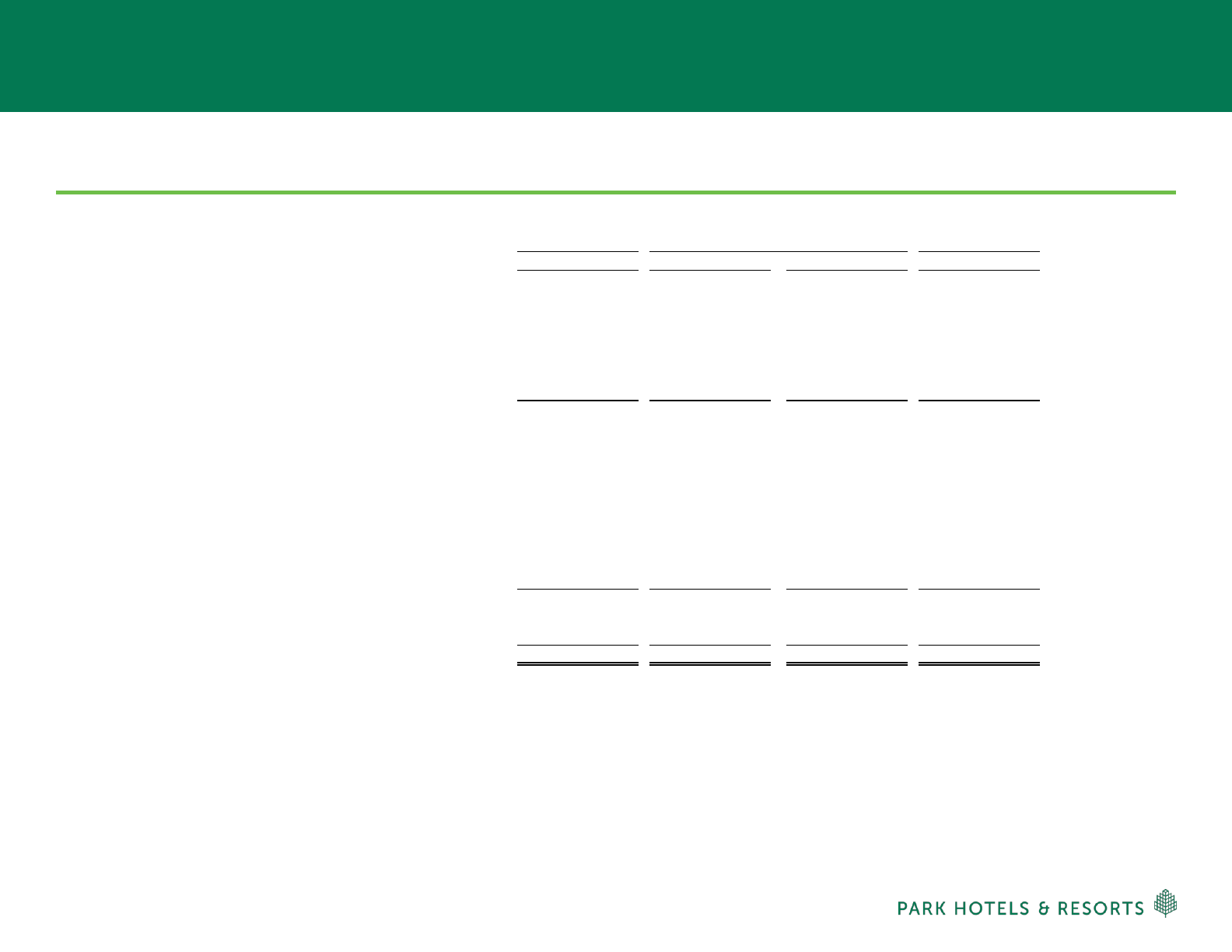

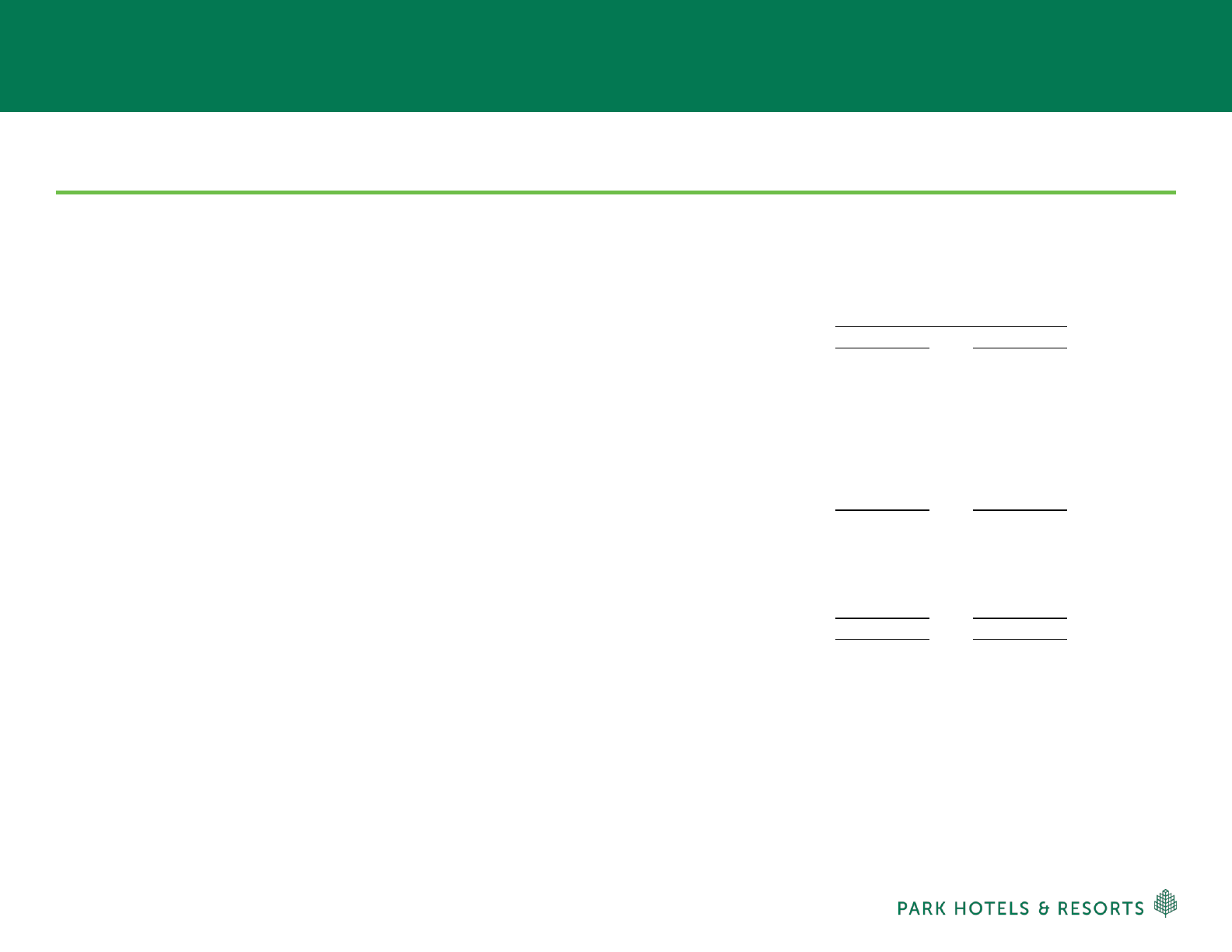

Park’s Track Record Since Spin-Off

Source: FactSet; data as of May 3, 2019

(1) Peers include all hotel REITs with a market-cap over $1 billion

(2) Excludes CHSP in 2019

(3) Pro Forma for PK hotels owned as of March 31, 2019

Hilton Spin

JAN 2017

HNA

Secondary

Follow-On

MAR 2018

CHSP

Merger

Announcement

MAY 2019

46% Total Return Since Spin-Off

3,400 bps Above Peers

(1)

Returned $2B in Capital

Operational Excellence Capital Allocation Balance Sheet

▪ Successfully sold 15 non-core assets for $590M,

while reducing exposure to international markets

to ~1% of Hotel Adjusted EBITDA

▪ Highly successful HNA secondary—buying back

14M shares at $24.85

▪ Returned $2B of capital to shareholders in the

form of dividends and HNA stock buyback

▪ Sector leading RevPAR growth in 2018 and 2019;

exceeded peers by 65bps in 2018 and expected to

exceed peers by more than 180bps in 2019

(2)

▪ Continuing to narrow the margin gap with peers;

forecasted to close the gap by an estimated 130bps

by year-end 2019

(2)

▪ Increased Group segmentation by 80bps to 32% for

Pro Forma Comp Top 25 hotels in 2018

▪ Net Debt/Adjusted EBITDA

(3)

of 3.9x as of 1Q19;

maintained Net Debt/2019E Adj. EBITDA within

stated target range of 3x to 5x

▪ $1B undrawn line of credit

▪ Well-covered dividend with sector leading yield;

increased recurring dividend from $0.43/share

to $0.45/share in 2019

Superior Results Delivered

3 |

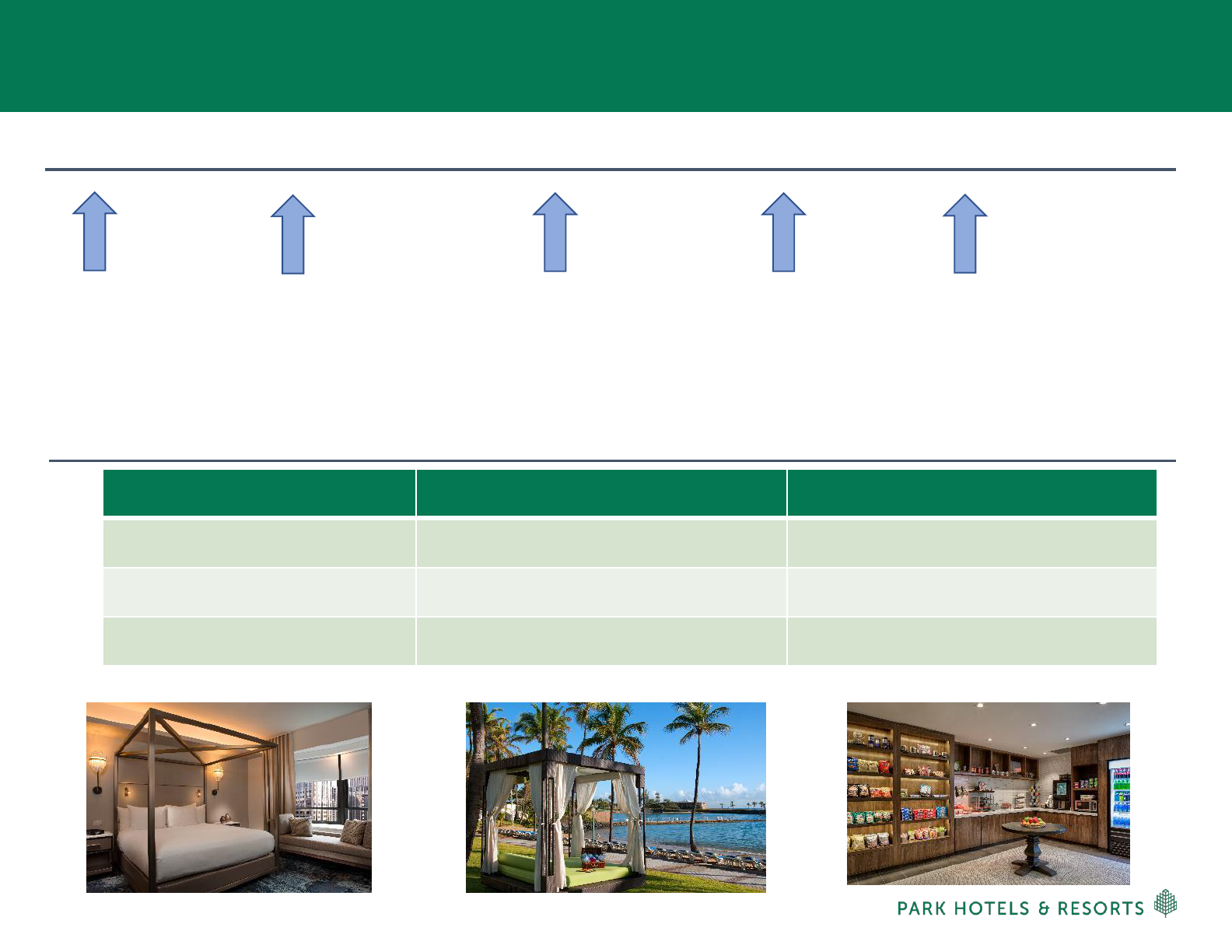

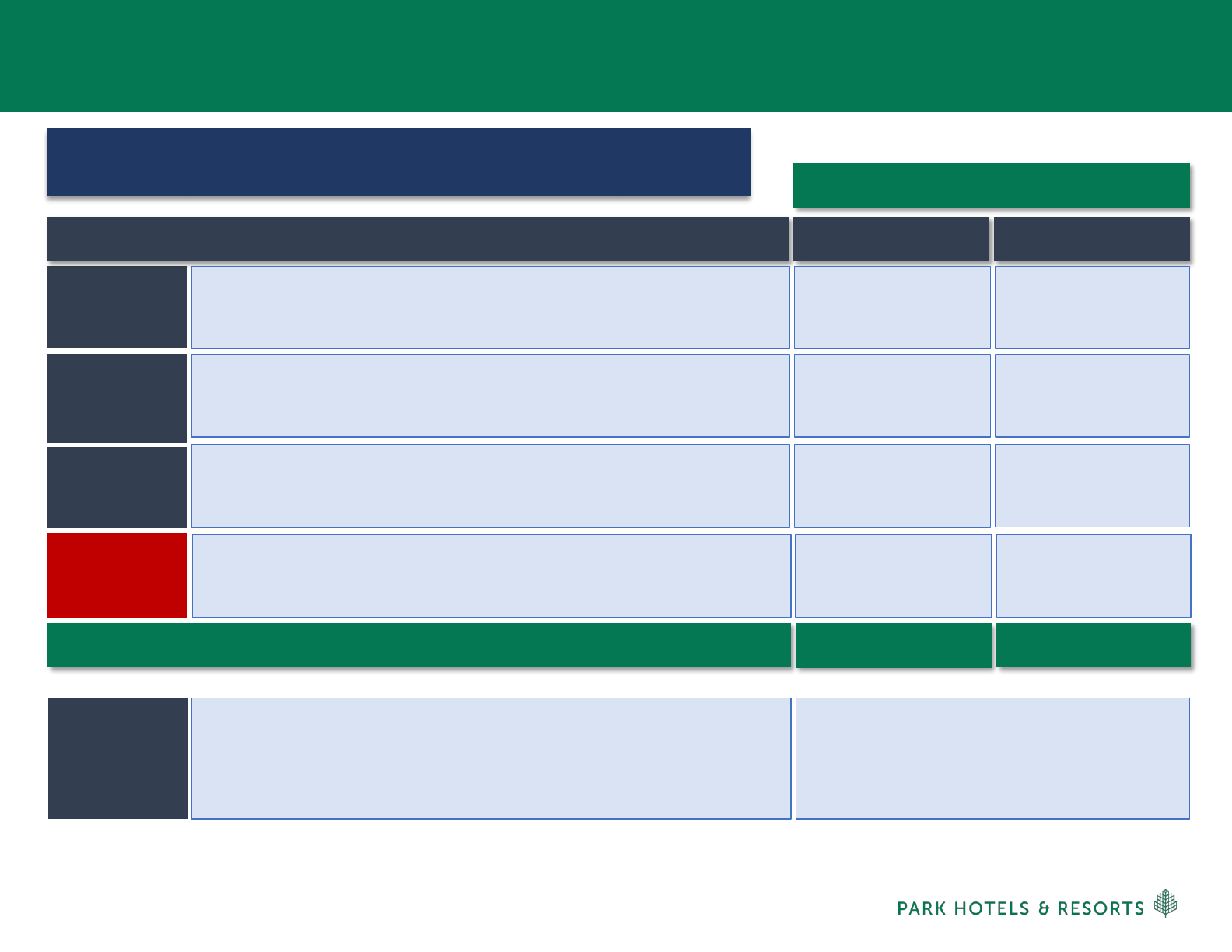

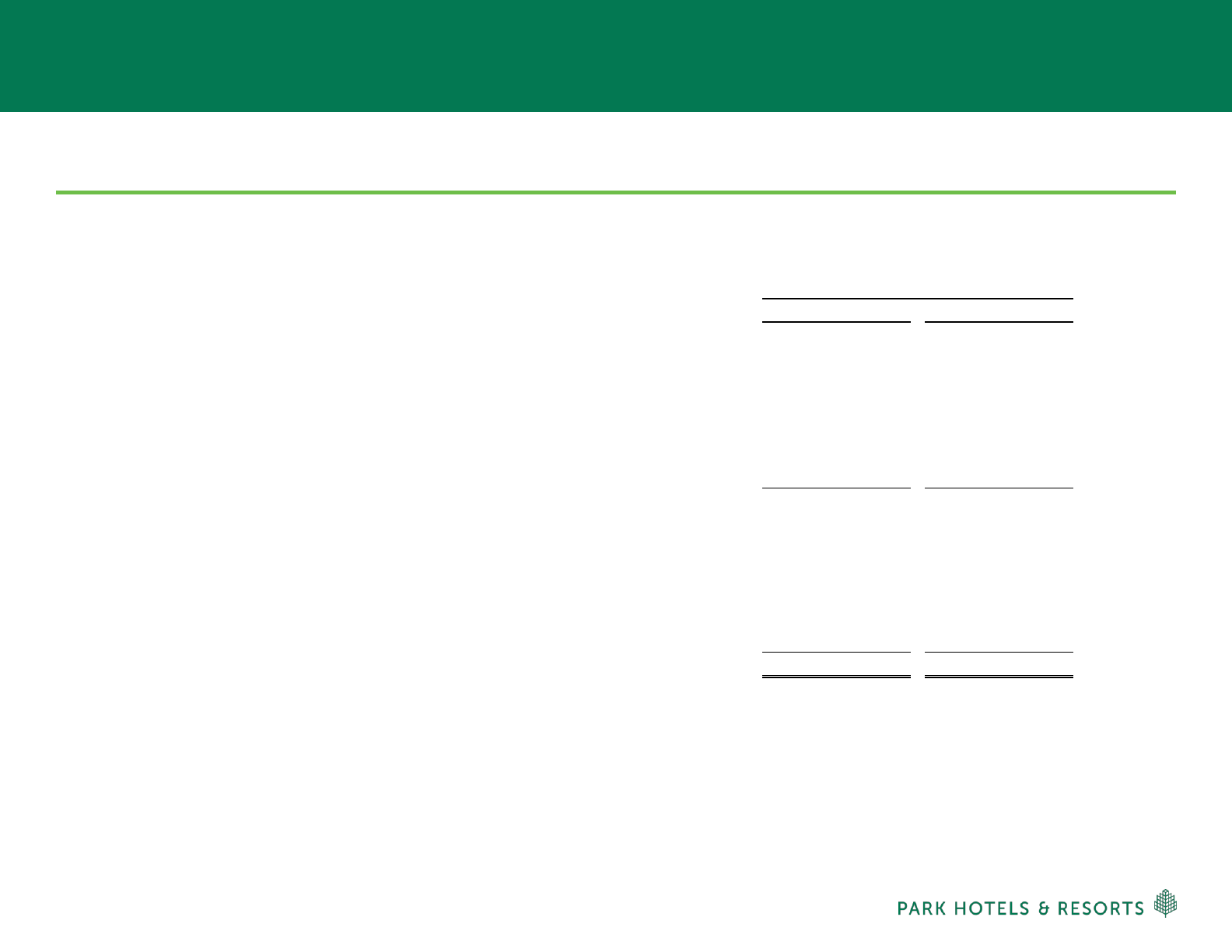

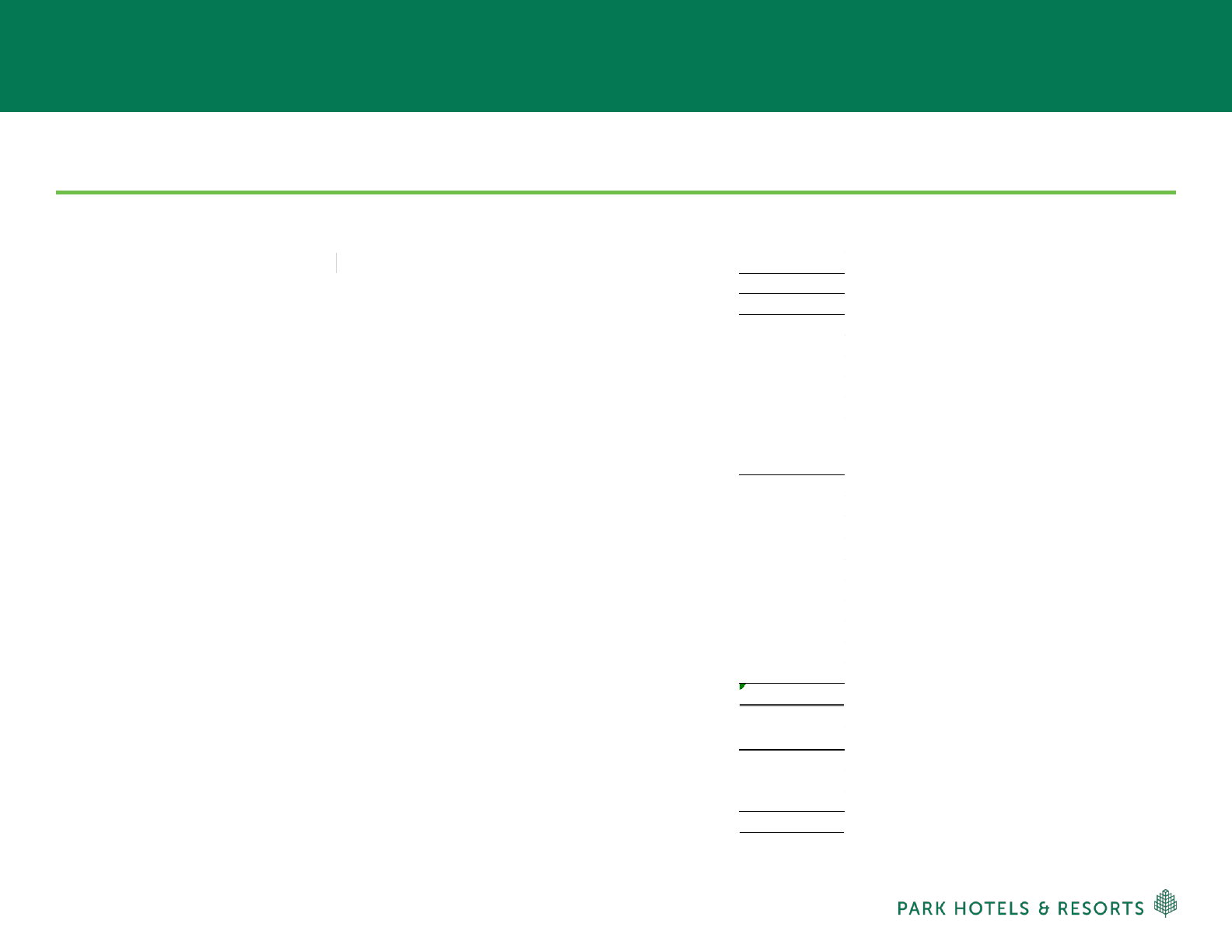

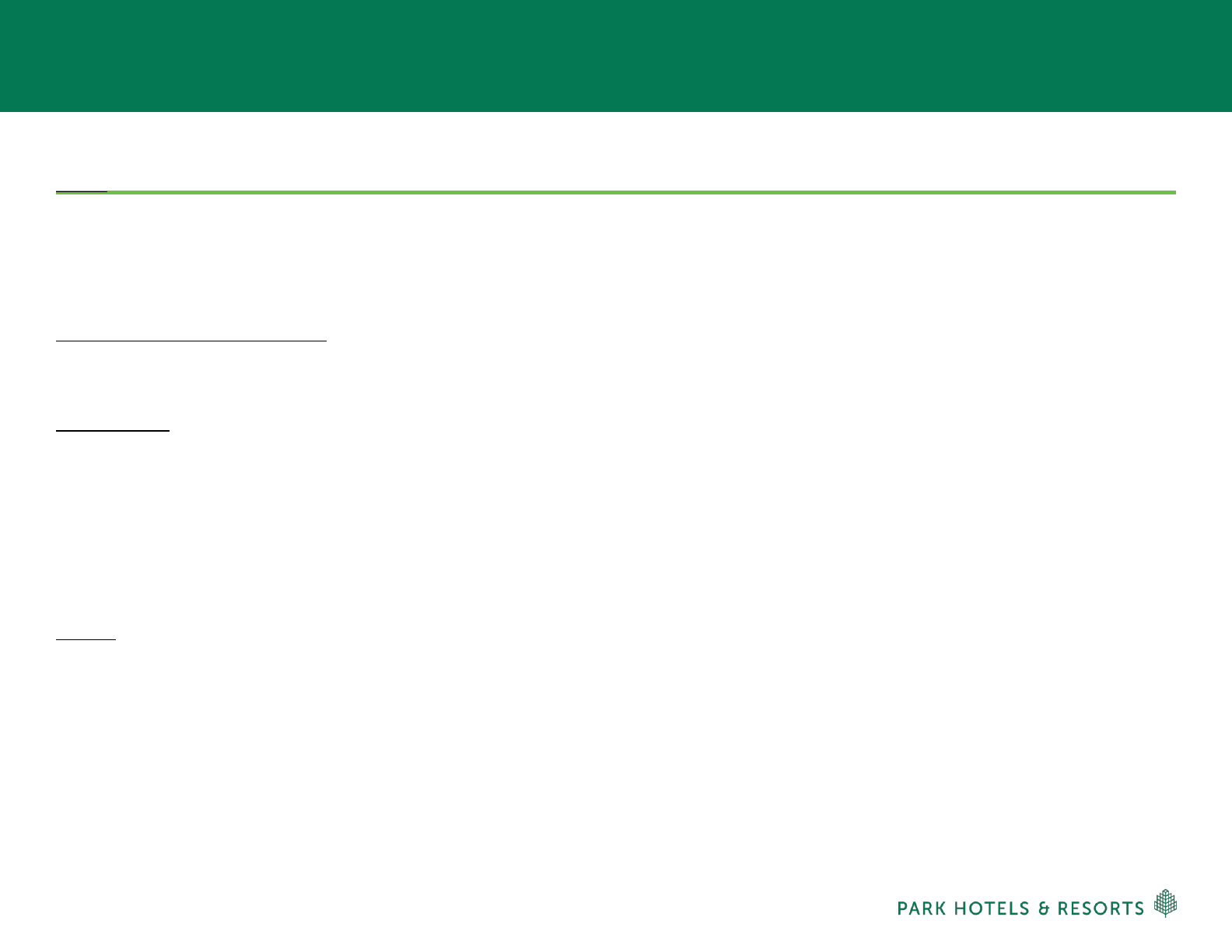

1Q19 Performance and Updated 2019 Outlook

Updated 2019 Outlook

1Q19: Strong Operating Results

4.5%

Comp

RevPAR

100bps

Comp Hotel

Adj. EBITDA

Margin

10.3% 8%

Increase in

‘Other Hotels

Revenues’

(1)

Group

Revenues

Metric Updated Guidance

Increase

Comp RevPAR Growth:

+2.5% to +4.5% +50bps

Comp EBITDA Margins:

+20bps to +80bps +20bps

Adjusted EBITDA:

$750M to $780M $5M

Note: Guidance does not include the impact of the proposed Chesapeake Lodging Trust merger and other future hotel acquisitions or dispositions

(1) Ancillary hotel revenues for our comparable hotels

480bps

Market

Share Gains

4 |

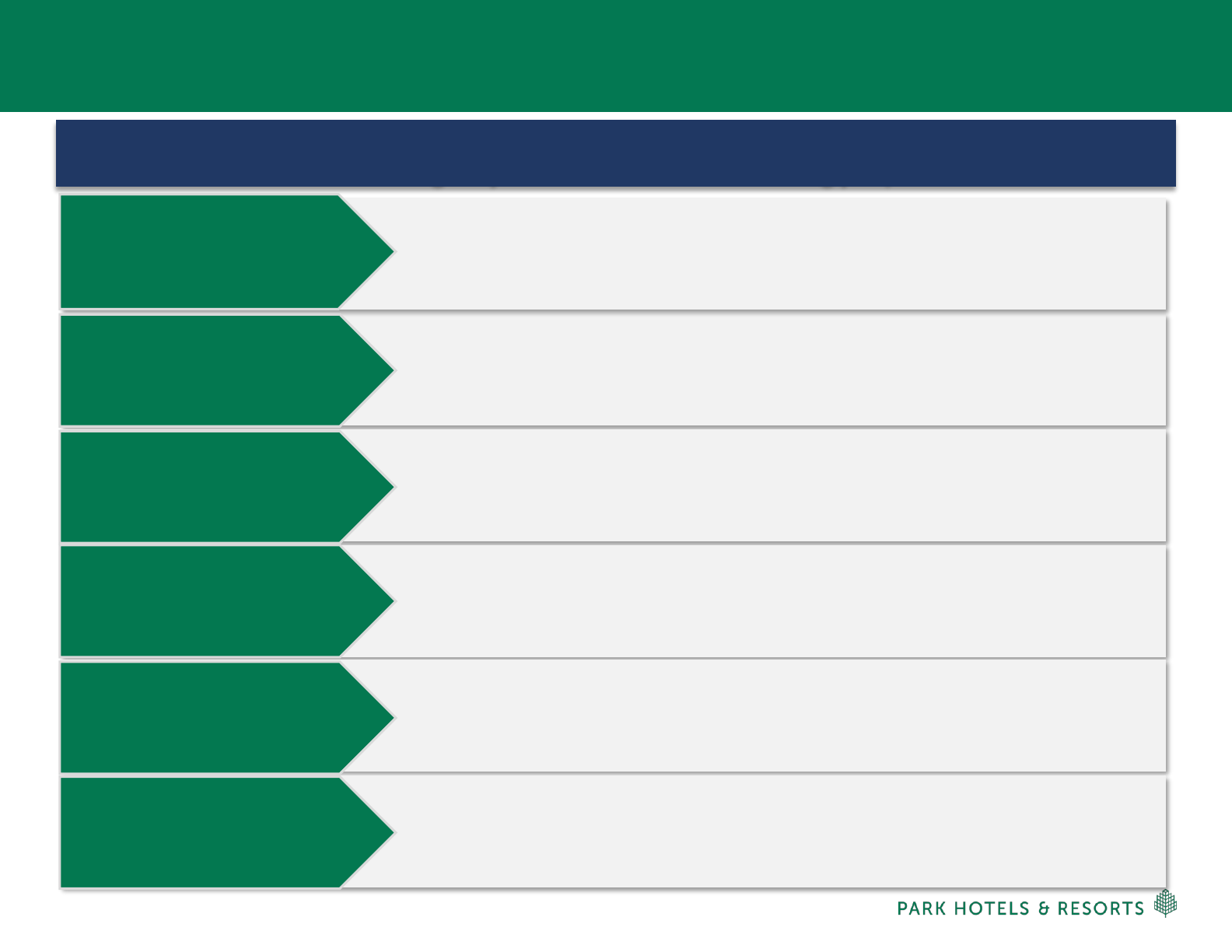

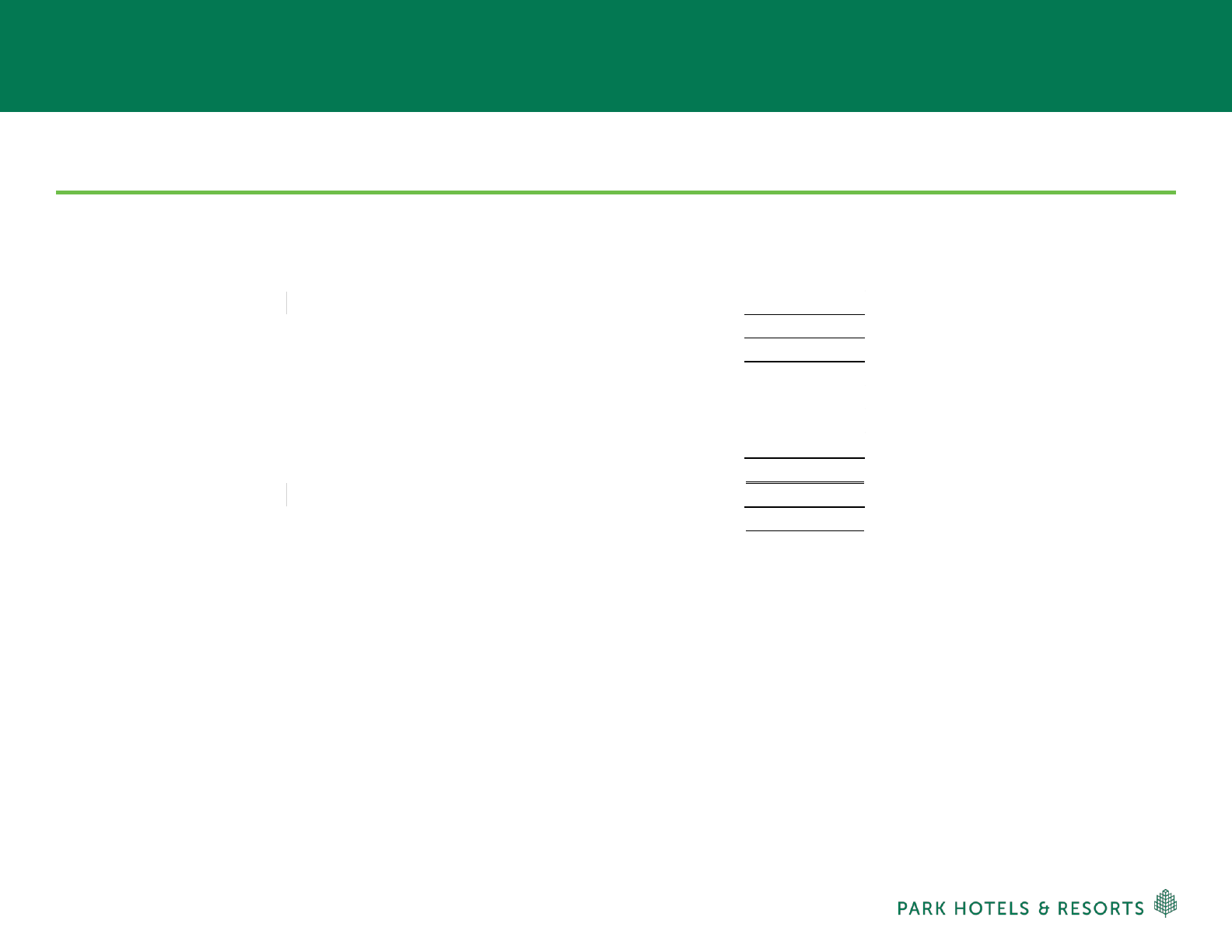

Experienced Team with Track Record of Creating Value

Chairman, President

& CEO

Tom Baltimore

EVP, GC

Tom Morey

EVP, HR

Jill Olander

EVP, CIO

Matt Sparks

EVP, Asset

Management

Rob Tanenbaum

EVP, CFO &

Treasurer

Sean Dell’Orto

SVP, CAO

Darren Robb

SVP, FP&A

Diem Larsen

SVP, Strategy

Ian Weissman

SVP, Tax

Scott Winer

Executive Management

Senior Management

EVP, D&C

Carl Mayfield

Finance: Team is responsible for balance sheet management, financial reporting, forecasting and budgeting (FP&A), tax matters, investor relations

and corporate strategy functions, and all capital markets activity

Asset Management: Diligent oversight of revenue management initiatives with a core focus on improving operating margin; Optimize food and

beverage operations; Responsible for identifying ROI opportunities to improve property level operating performance; Dedicated retail leasing and

revenue management functions

Design & Construction: Responsible for all capital expenditures including general maintenance, ROI redevelopment projects; Leverage internal design

team to yield cost effective and creative capital improvements; Deliver 10%+ yield on invested capital; Centralized procurement

Investments: Responsible for sourcing and underwriting single asset and portfolio acquisitions/dispositions

5 |

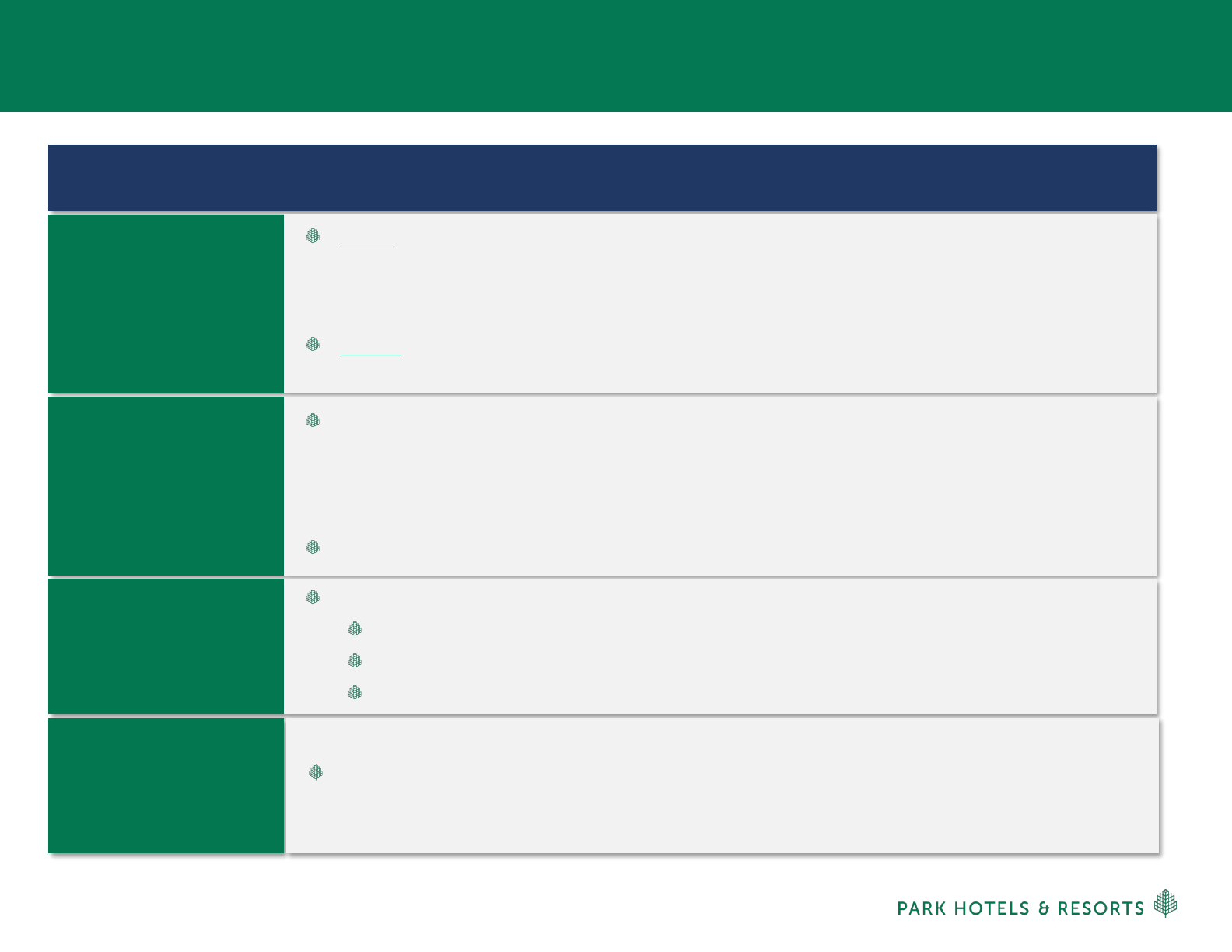

Strategic Rationale for Merger

Unique opportunity to acquire a high-quality, well-maintained portfolio

that is strategically consistent with Park’s existing platform

QUALITY

◼ CHSP: High RevPAR (2

nd

highest among peers) and high margin portfolio in outstanding

physical condition

◼ 12 of CHSP’s 18 assets are represented in Pro Forma Park’s top 25 assets by 2018 RevPAR

◼ Well-maintained portfolio; CHSP reinvested ~$35k per key over the past 5 years

GEOGRAPHIC

DIVERSITY

◼ Increased exposure to San Francisco, expected to be one of the strongest hotel markets over

the next two years, and penetration into key submarkets (Miami Beach, Downtown LA,

Boston, San Diego & Denver)

◼ Reduces Park’s exposure to Hawaii from 24% to 20% of 2018 Pro Forma Hotel Adj. EBITDA

(1)

BRAND & OPERATOR

DIVERSITY

◼ Broadens Park’s brand mix, providing exposure to Marriott, Hyatt and IHG

◼ Diversifies Park’s operator mix, adding exposure to 8 new operators, including Marriott, Hyatt

and other third party operators

UPSIDE

OPPORTUNITY

POSITIVE

FINANCIAL IMPACT

◼ Outsized organic growth profile positions the combined company for enhanced NAV growth

◼ Opportunity to aggressively asset manage the portfolio to drive higher margins

◼ Source attractive / accretive ROI opportunities, including meeting space expansions and

additional keys

◼ Accretive to Adjusted FFO per share in 2020 and beyond

(1)

◼ RevPAR accretive – improves comparable RevPAR from $176 to $182 (3.5%)

(1)

◼ Post asset sales, Park maintains a well-capitalized and flexible balance sheet to support

future growth

GROWTH

◼ Combined portfolio will include 66 hotels in 17 states and D.C.

(1)

◼ Combined enterprise value of $12.0B

(1)

, solidifying Park’s position as the 2nd largest lodging

REIT

◼ Enhanced liquidity and potential cost of capital advantages

10

(1) Reflects the following Pro Forma changes – the anticipated sales, prior to the closing of the merger with Chesapeake, of the two Chesapeake New York properties (the

122-room Hyatt Herald Square New York and the 185-room Hyatt Place New York Midtown South) and three non-core PK legacy hotels that are currently under contract.

This pro forma presentation is referred to throughout as “Pro Forma PK” or “Pro Forma Park”, which includes 48 legacy Park hotels, plus 18 Chesapeake hotels

6 |

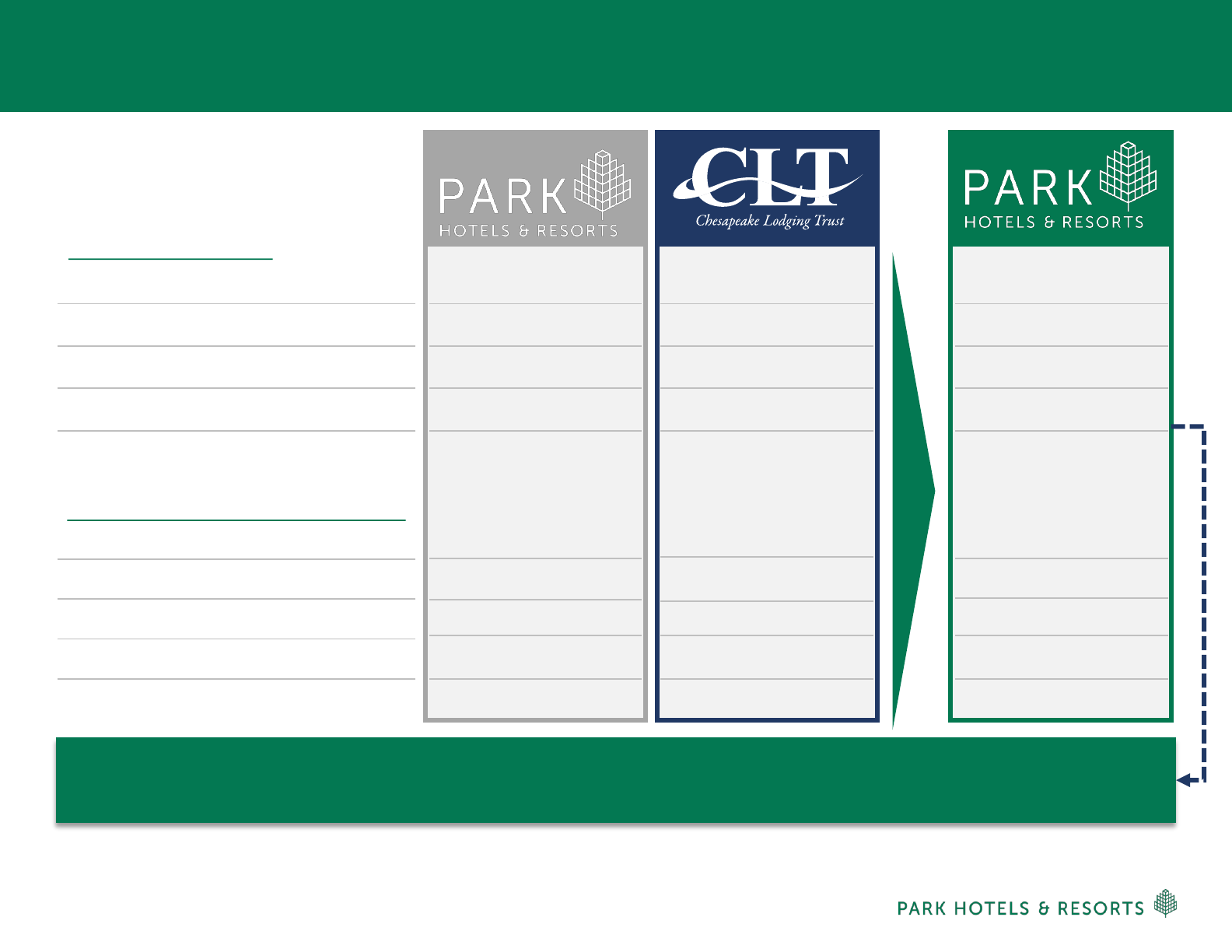

Transaction Overview

Park to acquire 100% of Chesapeake stock for $2.7B

– Consideration of $31.00/share -- 0.628x fixed exchange ratio; $11.00 per share of cash

Pro-forma ownership of ~84% Park / ~16% Chesapeake

Transaction equates to a 13.9x multiple on 2019E Adjusted EBITDA; 12.7x on 2020E Adjusted EBITDA

(1)

Park anticipates Chesapeake’s two NYC hotels and three Park hotels being sold at or prior to closing

Park executives maintain existing management positions

At closing, Park’s Board of Directors will be expanded by two seats to be filled from members of

Chesapeake’s Board

Estimated annual general and administrative cost savings of $17M (current base of $19M)

– $9M cash G&A savings / $8M non-cash G&A savings

Potential for $8M of incremental EBITDA in 2020 and $17M in 2021

(2)

from asset management initiatives,

including grouping up, enhanced food & beverage profitability and increased ancillary income

Expected closing in late 3Q / early 4Q 2019

Requires Chesapeake shareholder approval, regulatory approval and customary closing conditions

Park stockholder approval not required

Strategic combination creates premier, best-in-class lodging REIT

TRANSACTION

DETAILS

BOARD

COMPOSITION &

MANAGEMENT

SYNERGIES

TIMING &

APPROVALS

Pro Forma Adjusted FFO per share expected to be accretive in 2020 (2.0%) and 2021 (3.0%+)

Pro Forma Net Debt to Adjusted EBITDA expected to fall to 4.4x when accounting for planned asset sales

(3)

Park expects to maintain its quarterly dividend of $0.45 per share

Park continues to have ample liquidity to execute on its strategic initiatives – $1B undrawn Credit Facility

FINANCIAL

IMPACT

(1) Based on Park’s underwriting of Chesapeake 20-hotels portfolio, inclusive of anticipated synergies

(2) Net of incremental property taxes

(3) Reflects the following Pro Forma changes – the anticipated sales, prior to the closing of the merger with Chesapeake, of the two Chesapeake New York properties

(the 122-room Hyatt Herald Square New York and the 185-room Hyatt Place New York Midtown South) and three non-core PK legacy hotels that are currently under

contract

8

7 |

Transaction Overview

Key Elements of the Transaction

Planned

Asset Sales

(1) Net of incremental property taxes

8

Financing

Synergies

Misc.

Phase I: Sale of five non-core assets at or prior to closing including both of Chesapeake’s New York City

hotels (the 122-room Hyatt Herald Square New York and the 185-room Hyatt Place New York Midtown

South) in addition to three non-core Park hotels located in secondary markets

– Gross proceeds from these sales are expected to be approximately $300M

Phase II: Post closing, Park plans to sell 2 additional non-core hotels; proceeds expected to be $170 to

$180M

Park has secured a financing commitment for $1.1B to fund the following:

– $0.7B equity cash component

– $0.4B repayment of Chesapeake debt (term loan and two mortgages)

– Portion of transaction costs

Financing commitment to be reduced if assets are sold prior to funding

Synergies:

2020: ~$24M ($17M G&A savings + $8M net

(1)

Asset Management initiatives)

2021: ~$34M ($17M G&A savings + $17M net

(1)

Asset Management initiatives)

$8 to $12M of additional upside: (Ancillary fees, parking, ROI)

Chesapeake shareholders expected to receive their normal quarterly dividend payment between signing

and closing

8 |

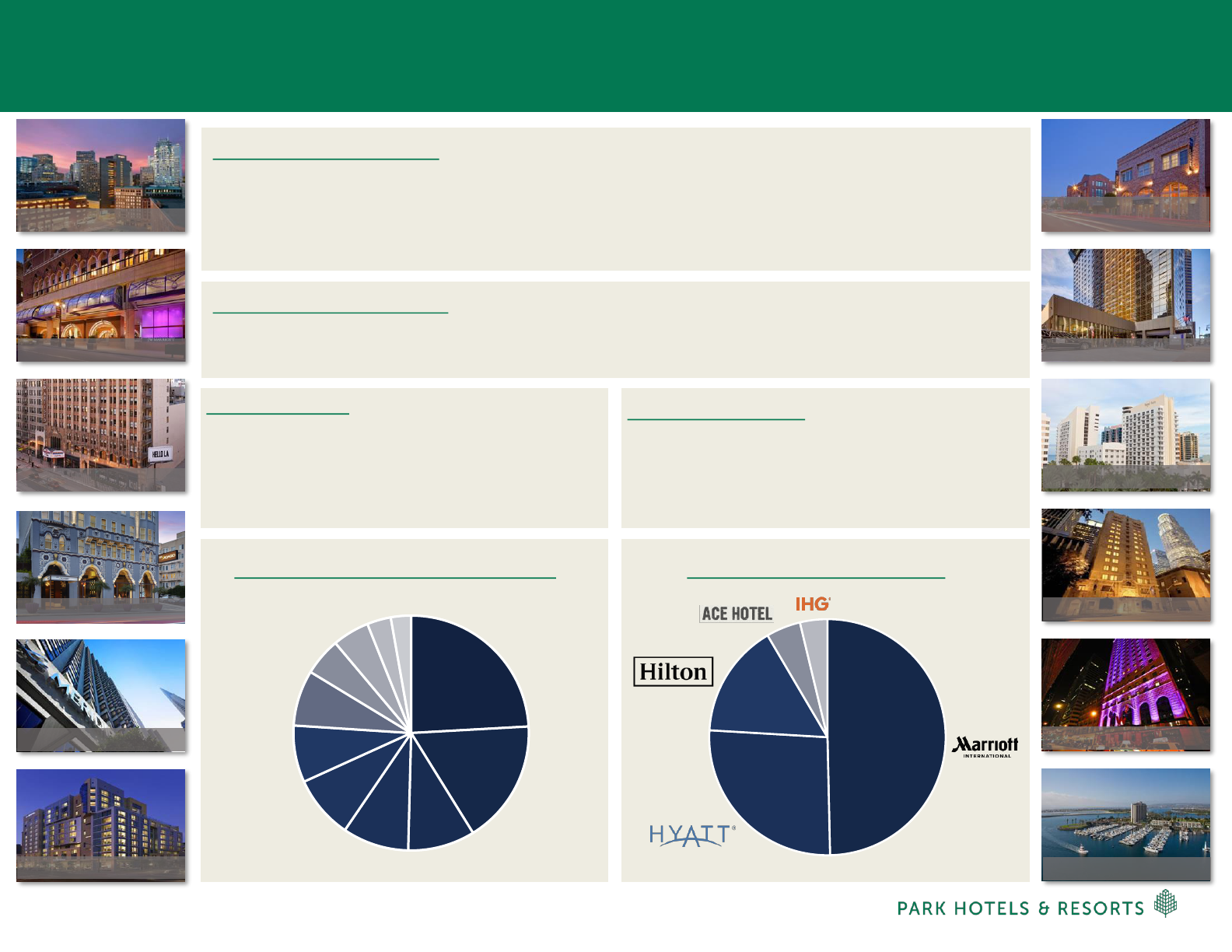

Chesapeake Lodging Trust at a Glance

COMPANY OVERVIEW

▪ Full-service hotel REIT with an ownership in 20 high quality hotels (6,288 keys). The portfolio is

concentrated across several high growth markets including San Francisco, Boston, Miami, Denver, San

Diego, Los Angeles and Chicago

OPERATING STATISTICS

▪ ‘18 RevPAR: $195 (2

nd

highest among peers)

▪ ‘18 Hotel Adj. EBITDA Margins: 32.4% (2

nd

highest among peers)

2018 RESULTS

▪ ’18 RevPAR Growth: +4.3% (highest among

peers)

▪ ’18 Hotel Adj. EBITDA Margins: +80bps (2

nd

highest among peers)

2019 OUTLOOK

(2)

▪ RevPAR Growth: +1.5% to +3.5% (peers at 1.7%)

▪ Hotel Adj. EBITDA Margins: -15bps to +60bps

(50bps above peers)

BRAND DIVERSIFICATION

(1)

50%

26%

15%

5%

4%

GEOGRAPHIC DIVERSIFICATION

(1)

San

Francisco

Boston

Denver

Miami

San

Diego

Los

Angeles

Chicago

New Orleans

New York

Seattle

D.C.

24%

17%

9%

9%

9%

8%

8%

5%

5%

3%

3%

(1) Based on 2018 Adjusted Hotel EBITDAre as reported for CHSP’s 20 hotels

(2) Based on full-year guidance provided by Chesapeake on February 21, 2019

Hyatt Regency Boston

JW Marriott San Francisco

Ace Hotel and Theater

Hotel Adagio, Autograph

Le Meridien San Francisco

Hotel Indigo San Diego

Hyatt Centric Fisherman’s Wharf

Royal Palm South Beach

Hilton Checkers LA

W Chicago City Center

Hyatt Regency Mission Bay

6

Hilton Denver City Center

9 |

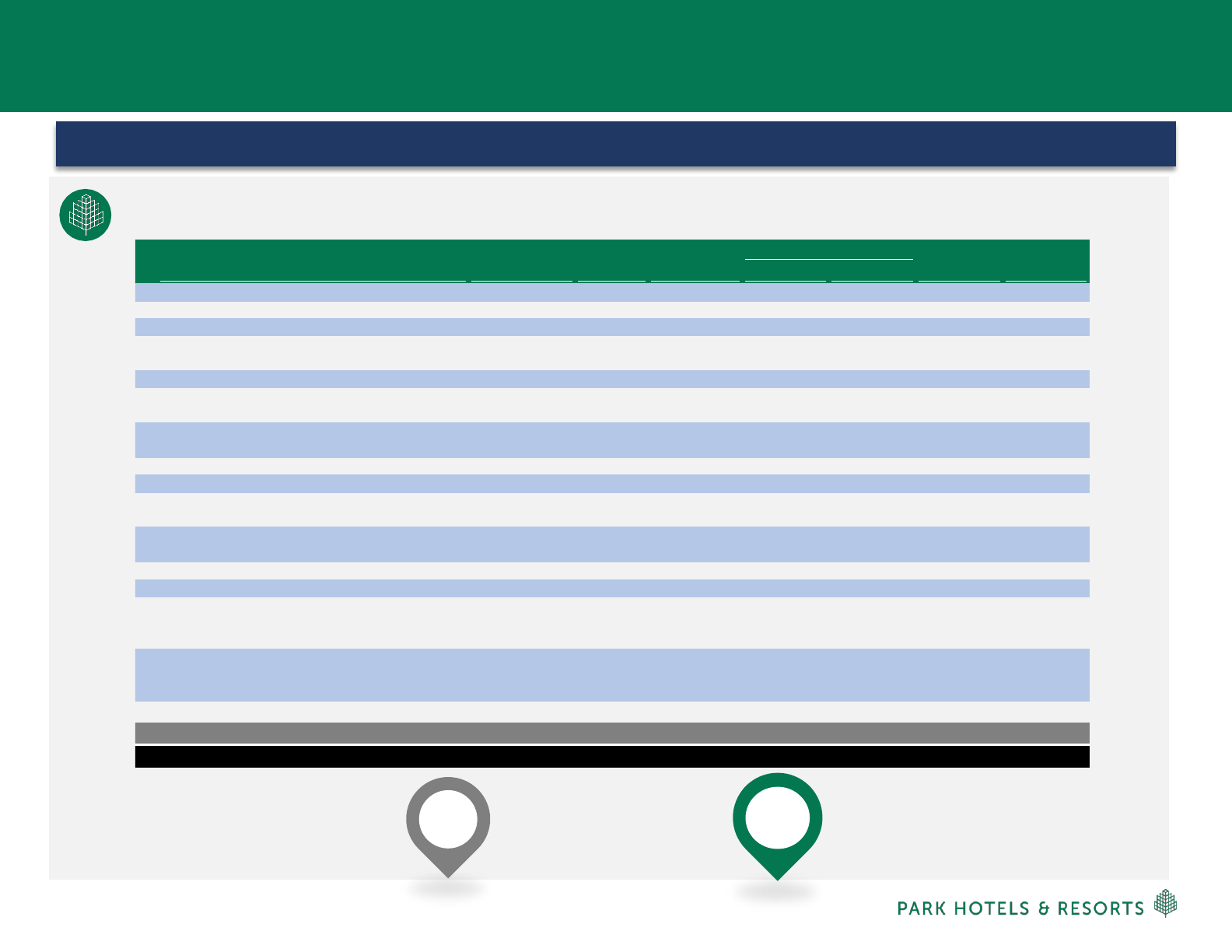

Combination Creates Unparalleled Portfolio of High Quality

Upper Upscale and Luxury Hotels

COMPARABLE OPERATING METRICS

(4)

Occupancy (FY 2018)

Average Daily Rate (FY 2018)

Room RevPAR (FY 2018)

82.7%

$221

$182

82.0% 85.5%

$215 $229

$176 $195

PRO FORMA

# of Keys (at 100%)

Meeting Space (SF)

35,383

2,694K

# of Hotels

66

51 20

30,500 6,288

2,499K 259K

2018 Hotel Adjusted EBITDA per Key

(2)

$29.7K

$29.0K $30.3K

(1) Standalone Park property level data excludes Hilton Chicago O’Hare Airport, where the ground lease expired in December 2018, Pointe Hilton Squaw Peak Resort sold in

February 2019 and Hilton Nuremberg sold in March 2019

(2) Hotel Adjusted EBITDA per key figures based on consolidated properties plus unconsolidated JVs at share

(3) Includes Park’s pro rata share of EBITDA from unconsolidated joint ventures

(4) 2018 operating results based on comparable portfolio of 57 hotels. Comparable operating metrics exclude unconsolidated joint venture properties and Caribe Hilton, and

assets disposed of prior to 3/31/19. Pro Forma Park also excludes assets anticipated to be sold in the contemplated transaction

12

PROPERTY LEVEL DATA

Prior to closing, Park expects that the sales of both of Chesapeake’s NYC hotels, plus three non-core PK legacy hotels, will be

completed. Gross proceeds for all five hotels are expected to be approximately $300M

(1)

2018 Hotel Adjusted EBITDA

(3)

2018 Hotel Adjusted EBITDA Margin

$942M

29.7%

$779M $191M

29.1% 32.4%

# of Hotels

57

42 20

Note: Figures reflect the 48 legacy Park hotels, plus 18 Chesapeake hotels comprising Pro Forma Park. EBITDA in 2018 for the five hotels to be sold was approx. $27M

10 |

Strategic Rationale

PK: Waldorf Astoria Orlando CHSP: Royal Palm South Beach Miami

PK: Casa Marina, A Waldorf-Astoria Resort CHSP: Hotel Adagio San Francisco

9

11 |

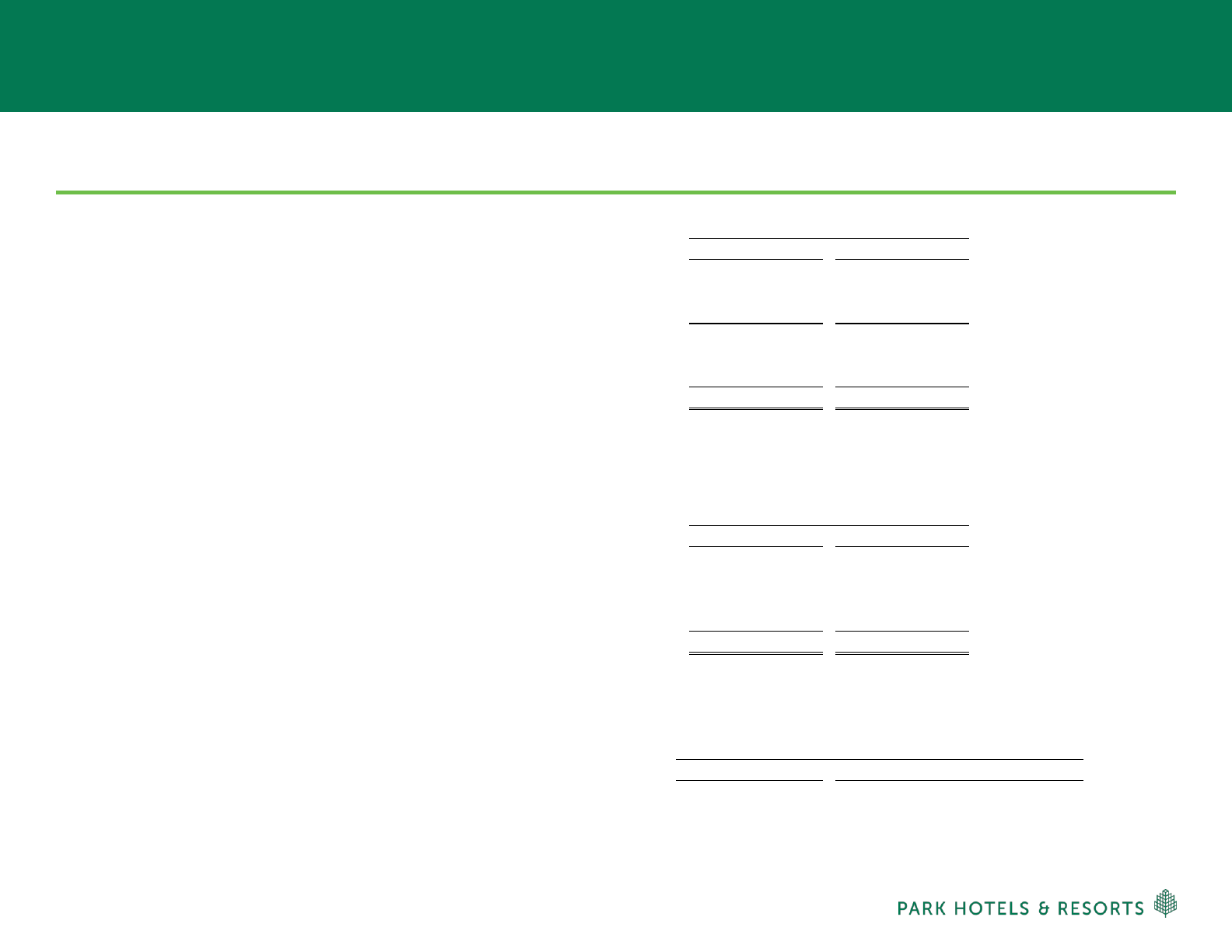

Quality: CHSP Complements PK with a High Quality Portfolio

Top 25 Hotels by RevPAR

(1)

Contribute 58% of Total Pro Forma PK Hotel EBITDA

$197

Legacy PK

Top 25 Hotel RevPAR

$235

Pro Forma PK

Top 25 Hotel RevPAR

12 (shaded blue) of CHSP’s 18 assets are in the Top 25 Hotels of Pro Forma Park by 2018 RevPAR

13

Rooms

2018 Operating Results

2018 EBITDA /

Hotel City State

(UJV At Share)

RevPAR Margin EBITDA Key

1. JW Marriott San Francisco Union Square San Francisco CA 344 $310 28.0% $14 $40K

2. Casa Marina, A Waldorf Astoria Resort Key West FL 311 299 39.7% 20 $66K

3. Le Meridien San Francisco San Francisco CA 360 289 35.9% 16 $45K

4. The Reach, A Waldorf Astoria Resort Key West FL 150 280 37.2% 8 $55K

5. New York Hilton Midtown New York NY 1,878 260 18.4% 53 $28K

6. Hotel Adagio SF Autograph Collection San Francisco CA 171 253 37.8% 7 $39K

7. Hilton Hawaiian Village Waikiki Beach Resort Honolulu HI 2,860 244 39.6% 159 $56K

8. Parc 55 San Francisco - a Hilton Hotel San Francisco CA 1,024 241 31.6% 33 $32K

9. Hyatt Centric Fishermans Wharf San Francisco CA 316 237 27.8% 10 $30K

10. Ace Hotel and Theater Los Angeles Los Angeles CA 182 234 30.8% 9 $49K

11. Hilton San Francisco Union Square San Francisco CA 1,921 232 28.8% 66 $35K

12. Hyatt Regency Boston Boston MA 502 232 40.5% 22 $43K

13. Waldorf Astoria Orlando Orlando FL 502 221 29.7% 22 $44K

14. Juniper Hotel Cupertino, Curio Collection by Hilton Cupertino CA 224 216 40.3% 9 $38K

15. W New Orleans French Quarter New Orleans LA 97 216 24.9% 3 $28K

16. Hilton Checkers Los Angeles Los Angeles CA 193 211 34.9% 6 $31K

17. Hilton Boston Logan Airport Boston MA 599 210 29.2% 17 $28K

18. Royal Palm South Beach Miami Miami FL 393 204 42.9% 17 $44K

19. Embassy Suites by Hilton Washington DC Georgetown Washington D.C. DC 197 193 35.8% 6 $30K

20. DoubleTree by Hilton Hotel San Jose San Jose CA 505 193 30.8% 15 $30K

21. Hilton Santa Barbara Beachfront Resort Santa Barbara CA 180 192 38.0% 15 $83K

22. Hotel Indigo San Diego Gaslamp Quarter San Diego CA 210 186 42.2% 7 $34K

23. W Chicago City Center Chicago IL 403 183 22.0% 7 $19K

24. Homewood Suites Seattle Seattle WA 195 181 45.5% 6 $32K

25. Embassy Suites by Hilton Austin Downtown Town Lake Austin TX 259 163 31.4% 5 $21K

Pro Forma Top 25 Hotels by RevPAR - Total / Wtd. Avg. 13,976 $235 31.8% $552 $40k

Total Pro Forma Portfolio (66 Hotels) - Total / Wtd. Avg. 31,503 $182 29.7% $942 $30k

Note: 2018 operating results based on comparable portfolio of 57 hotels. Comparable operating metrics exclude Unconsolidated Joint Venture properties and Caribe Hilton, and

assets disposed of prior to 3/31/19. Pro Forma Park also excludes assets anticipated to be sold in the contemplated transaction

(1) Top 25 excludes unconsolidated joint venture properties

12 |

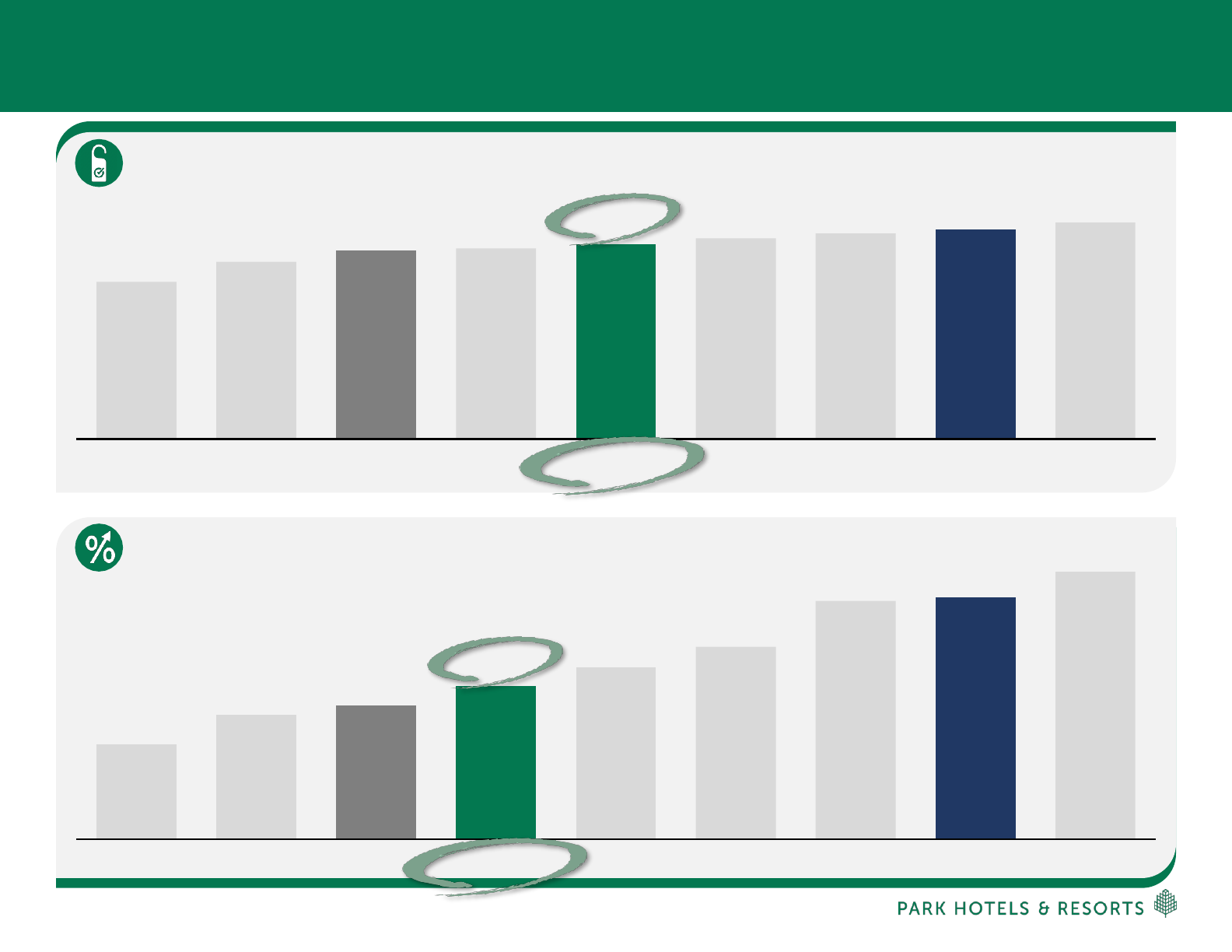

$202

$195

$192

$187

$182

$178 $176

$165

$147

PEBCHSPSHODRHPro Forma PKHSTPKXHRRHP

33.2%

32.4%

32.3%

30.9%

30.3%

29.7%

29.1%

28.8%

27.9%

RHPCHSPPEBSHODRHPro Forma PKPKHSTXHR

Quality: Accretive to Key Operating Metrics

2018 Comparable RevPAR: PRO FORMA PK vs. PEERS

2018 Comparable Hotel EBITDA Margin: PRO FORMA PK vs. PEERS

13 |

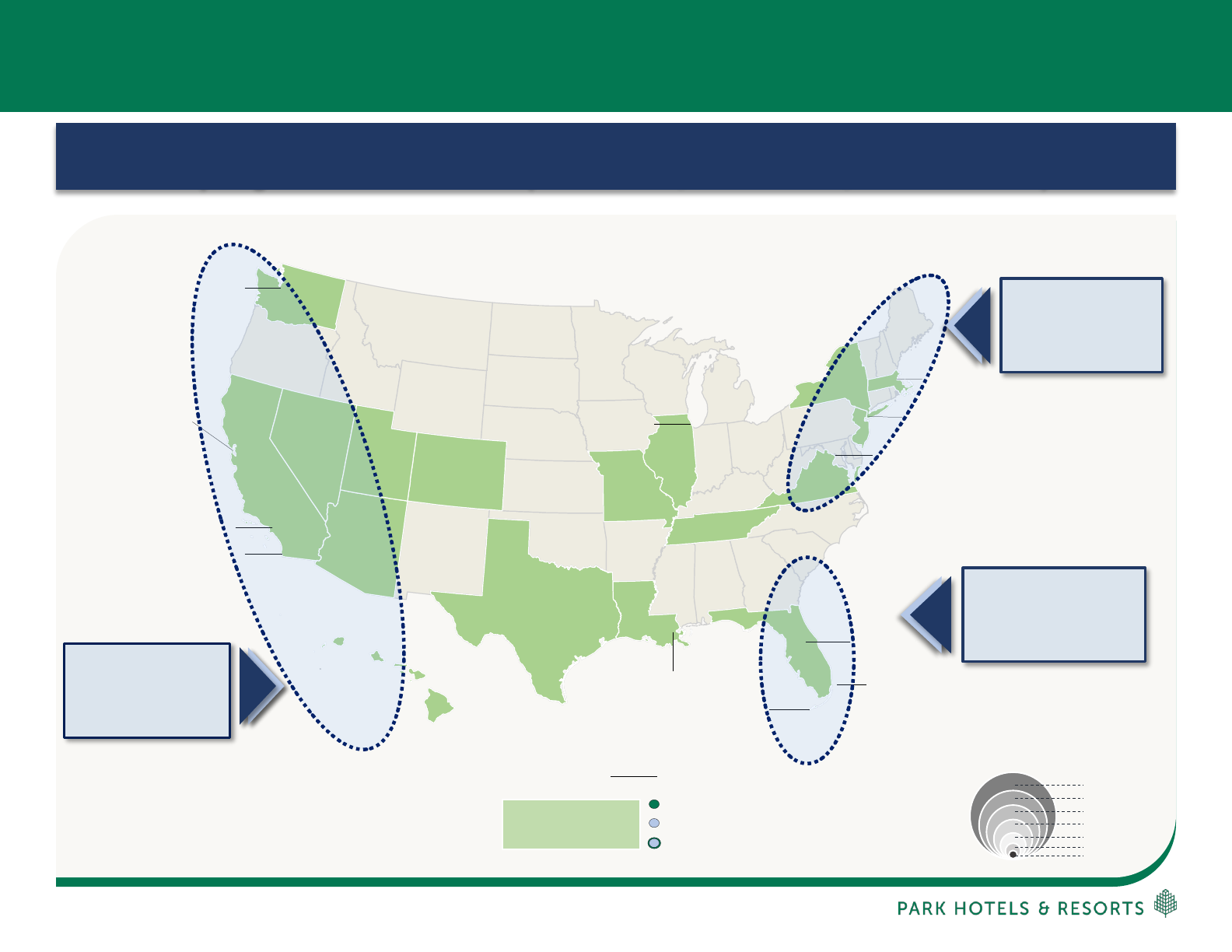

Diversification: Pro Forma Park Operating Portfolio

14

Transaction expands presence across San Francisco, San Diego and New Orleans, while

layering in several new markets (Miami Beach, Downtown LA, Boston & Denver)

$100M+

$50M+

$25M+

$10M+

$5–10M

<$5M

$200M+

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

⚫

1175587_2.wor (NY008V6E)

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

New York

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Boston

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Washington D.C.

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

Los Angeles

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

San Diego

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

New Orleans

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Key West

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Miami

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Orlando

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Seattle

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

Chicago

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

San Francisco

⚫

1175587_1.wor (NY008V6E)

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

⚫

⚫

Puerto Rico International

15%

2018 Hotel EBITDA

(1)

Northeast Markets

17%

2018 Hotel EBITDA

(1)

Florida Markets

50%

2018 Hotel EBITDA

(1)

West Coast &

Hawaii Markets

States with

PF PK Presence

PK

CHSP

Overlapping

Legend

Note: Circle Size Based on Hotel EBITDA

(1) Pro Forma 2018 Hotel Adjusted EBITDA

14 |

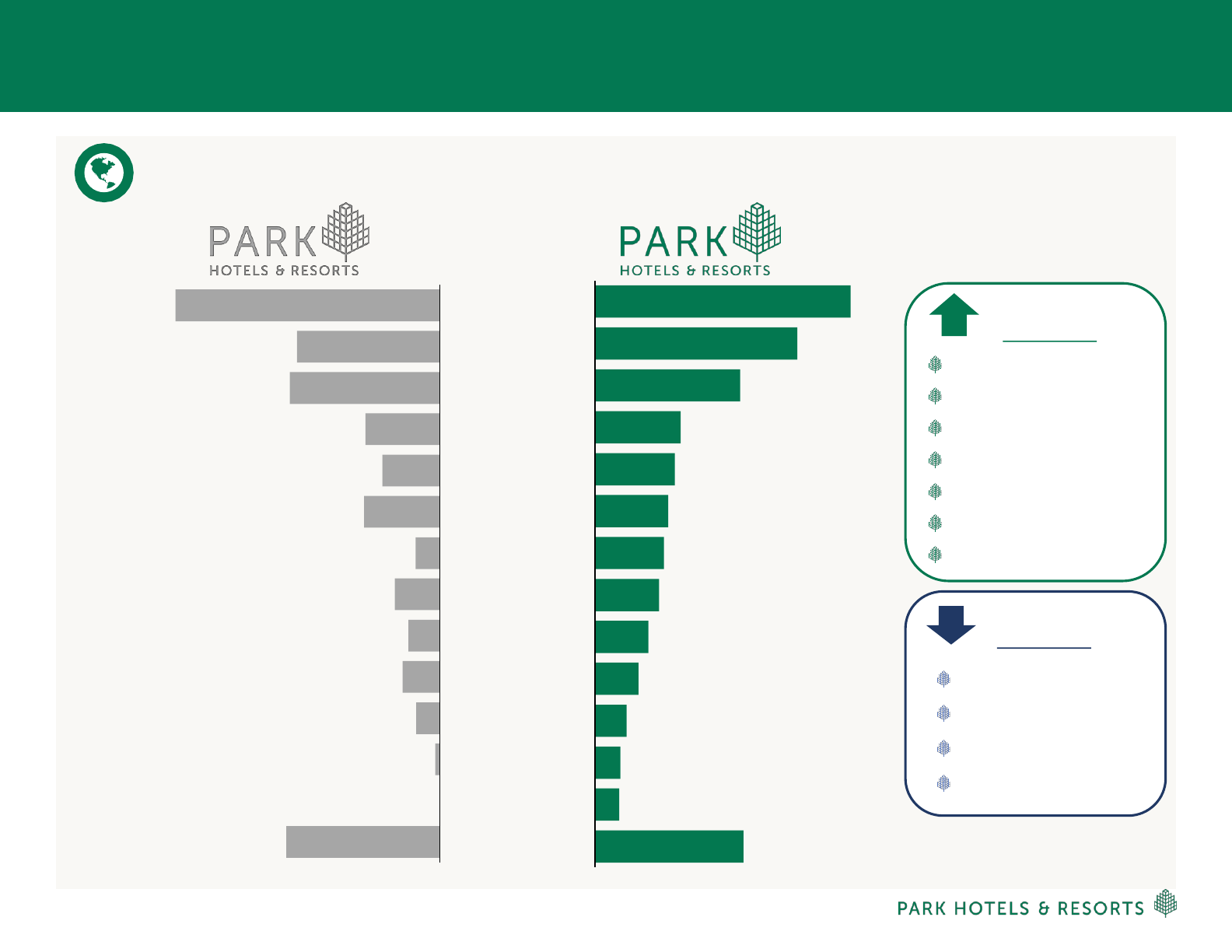

Diversification: Enhanced Geographic Exposure

(1) Defined by FY 2018 Hotel Adjusted EBITDA by market on an as reported and Pro Forma basis, respectively

STANDALONE PK VS. PRO FORMA PK GEOGRAPHIC DIVERSITY

(1)

Increased

Exposure

San Francisco: +300bps

Boston: +300bps

Los Angeles: +200bps

Denver: +200bps

South Florida: +100bps

San Diego: +100bps

Chicago: +100bps

Reduced

Exposure

Hawaii: -400bps

Orlando: -300bps

New York: -100bps

Other: -300bps

PRO FORMASTANDALONE

15

20%

16%

11%

7%

6%

6%

5%

5%

4%

3%

2%

2%

2%

11%

Hawaii

San Francisco

Orlando

New Orleans

New York

South Florida

Boston

Chicago

San Diego

Washington D.C.

Seattle

Los Angeles

Denver

Other

24%

13%

14%

7%

5%

7%

2%

4%

3%

3%

2%

0%

0%

14%

15 |

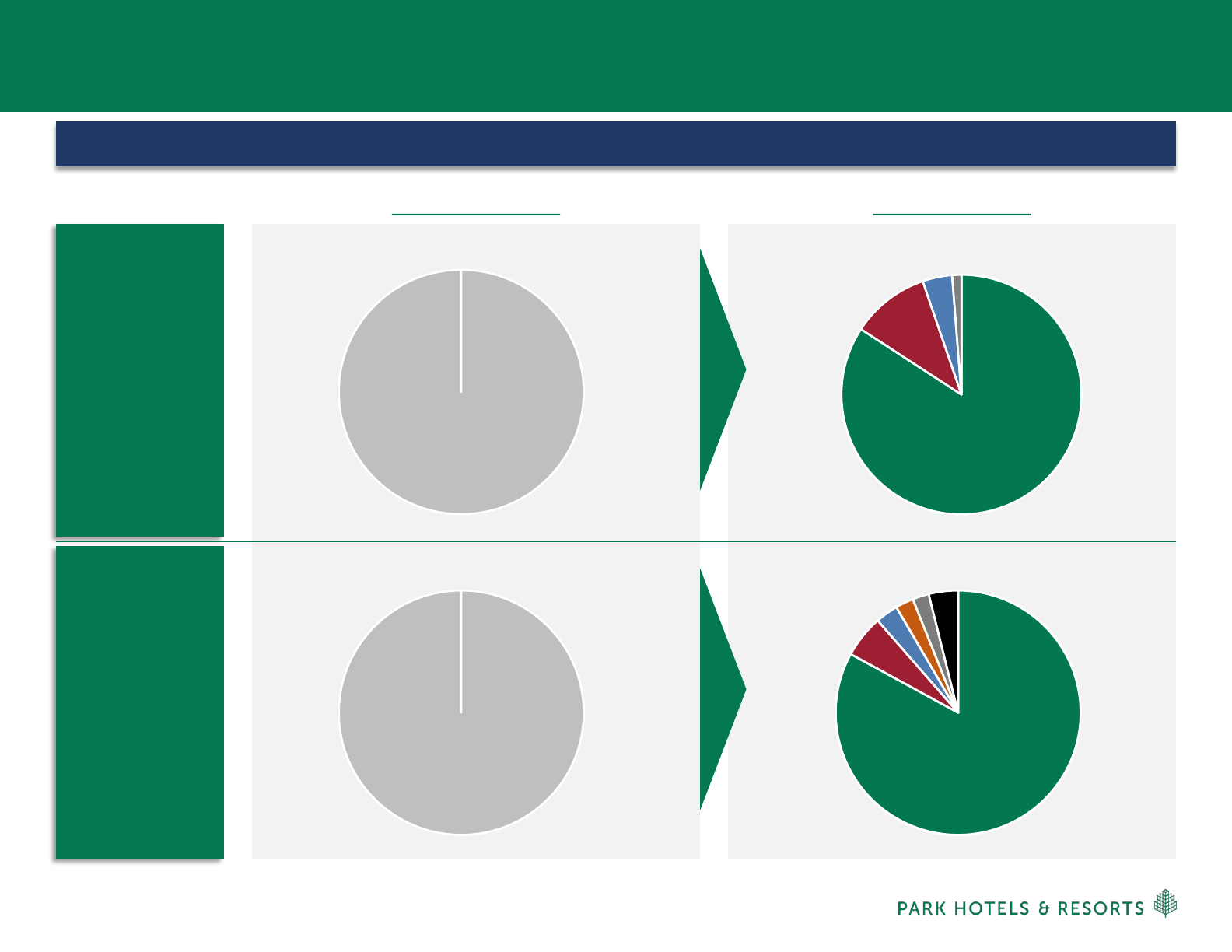

Hilton

100%

Hilton

84%

Marriott ⁽¹⁾

11%

Hyatt ⁽¹⁾

4%

Other ⁽¹⁾

1%

Hilton

100%

Diversification: Brand and Operator Mix

Transaction advances Park’s brand strategy, providing exposure to Marriott and Hyatt

Note: Based on the total number of guestrooms (consolidated + Unconsolidated JVs at share) of the Pro Forma combined company

Note: Other Brands include IHG and Ace. Other Operators include TPG Hospitality, Crestline Hotels & Resorts, IHG and Ace Hotel Group

(1) Pro Forma Park will own 51 Hilton branded hotels, 10 Marriott branded hotels, 3 Hyatt branded hotels, 1 IHG branded hotel and 1 Ace branded hotel

Standalone Park Pro Forma Park

Hilton

Marriott

Hyatt

HEI

Aimbridge

Other

83%

6%

3%

2%

2%

4%

16

BRAND

MIX

OPERATOR

MIX

16 |

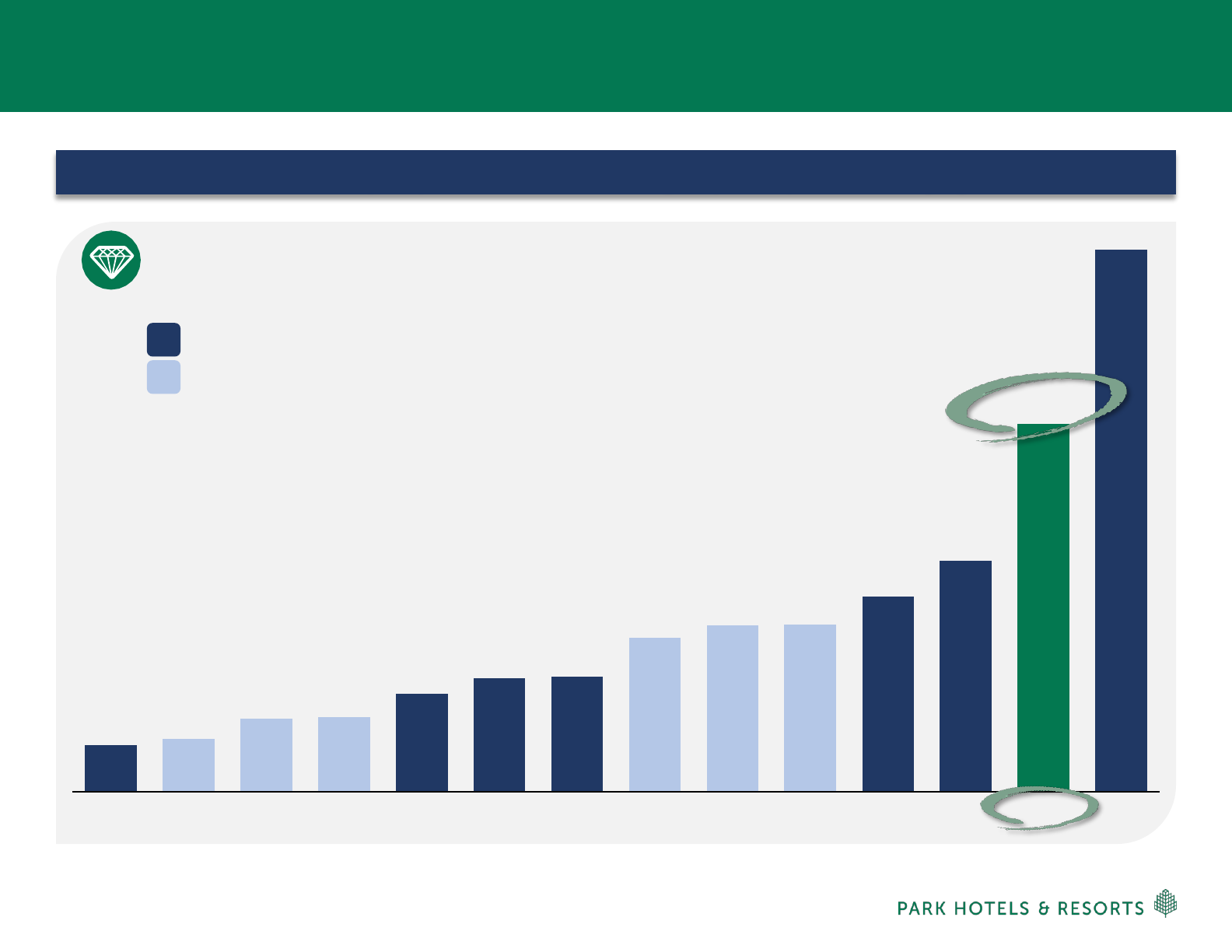

Park will solidify its position as the 2nd largest publicly traded Lodging REIT

Source: Public company filings as of December 31, 2018 and FactSet. Market data as of May 3, 2019

(1) Average Lodging REIT Total Enterprise Value equates to $4.1 billion, which excludes HST and PK

ENTERPRISE VALUE: PRO FORMA PK vs. PEERS

Full Service

Mixed & Limited Service

$1.5B

$1.7B

$2.4B

$2.5B

$3.2B

$3.7B

$3.8B

$5.0B

$5.4B

$5.5B

$6.4B

$7.6B

$12.0B

$17.7B

BHR CLDT INN HT DRH XHR SHO AHT APLE RLJ RHP PEB PF PARK HST

Size & Scale: Nearly 3x the Size of the Average Lodging REIT

(1)

17 |

Value Creation: Internal Growth Story 2.0

G&A Savings

8

Near-Term

Revenue

Synergies

Expense

Savings

Incremental

Expenses

Future

Potential

Expect to Realize Full-Run Rate in 2+ Years 2020 2021

Estimated Synergies

Estimated Synergies

~$24 Million

~$34 Million

◼ Cash G&A of $9M

◼ Non-Cash comp of $8M

$17M

$17M

◼ New Destination Fees

◼ Parking upside

◼ Other fee reductions

◼ ROI Projects: Additional keys; Expand meeting space

$8M to $12M

◼ Revenue Management: Grouping Up (150bps of upside) and Remixing the Mix

◼ F&B Revenues: Menu engineering/pricing, added group catering contribution

◼ Destination Fees: Marginally increase rates, while improving capture rate

$11M

$20M

◼ Renegotiate fees

◼ Franchise conversions

◼ F&B Expense: Food costs, menu engineering, productivity, hours of operations

$2M

$3M

◼ Incremental property tax (Prop 13) and insurance expense

($5M)

($6M)

Incremental EBITDA of Approx. $24M in 2020 & $34M in 2021

Translating into ~$375M

(1)

of Value Creation, or $1.50+ per share

(1) Assumes a 12.5x valuation multiple, discounted back 2 years

Note: Actual future incremental EBITDA may differ materially from this hypothetical presentation. Please see the forward-looking statements disclaimer on slide 36 of this presentation for a

discussion of the risks that could cause actual results to differ materially from any potential or estimated results

18 |

Adjusted EBITDA Bridge

$925

$950

$178

$17

($30)

($5)

$13

$8 to $12M

$765

2019E PK

Standalone

Adj. EBITDA

+ 2019E CHSP

Standalone

Corporate

Adj. EBITDAre

+ Corporate G&A

Savings

- Hotel EBITDA from

Asset Sales

- Incremental

Property Tax &

Insurance

Pro Forma

Adj. EBITDA

+ 2020E Upside

Opportunities

+ Future Upside

Opportunities

Combined

Company with

Upside

Opportunities

Combined company projected to generate ~$925M of Adjusted EBITDA on a run-rate basis Pro Forma for 2019

and potential for an additional ~$25M of incremental EBITDA from upside opportunities over time

Addition of

destination fees,

parking upside &

select ROI projects;

see slide 17 for

details

2020E Asset

management

initiatives, see slide

17 for details

Mgmt. estimate,

assumes ~$2M of

incremental G&A

to operate

combined platform

Includes sale of

CHSP’s 2 NYC

assets and 3 non-

core legacy Park

assets

1Q19 Updated

Outlook, Midpoint

2019 Outlook, as

reflected in CHSP’s

2/21/19 press

release,

Midpoint

(1)

ASSUMPTIONS:

Note: Dollar in millions

Mgmt. estimate;

see slide 17 for

details

Note: Actual future Adj. Corporate EBITDA may differ materially from this hypothetical presentation. Please see the forward-looking statements disclaimer on slide 36 of this

presentation for a discussion of the risks that could cause actual results to differ materially from any potential or estimated results

(1)

Chesapeake’s 2019 Outlook was prepared by Chesapeake in February 2019 (and has not been updated) and is based on a number of factors, many of which are outside Chesapeake’s

control and all of which are subject to change (and do not reflect the impacts and other effects of the proposed merger transactions).

19 |

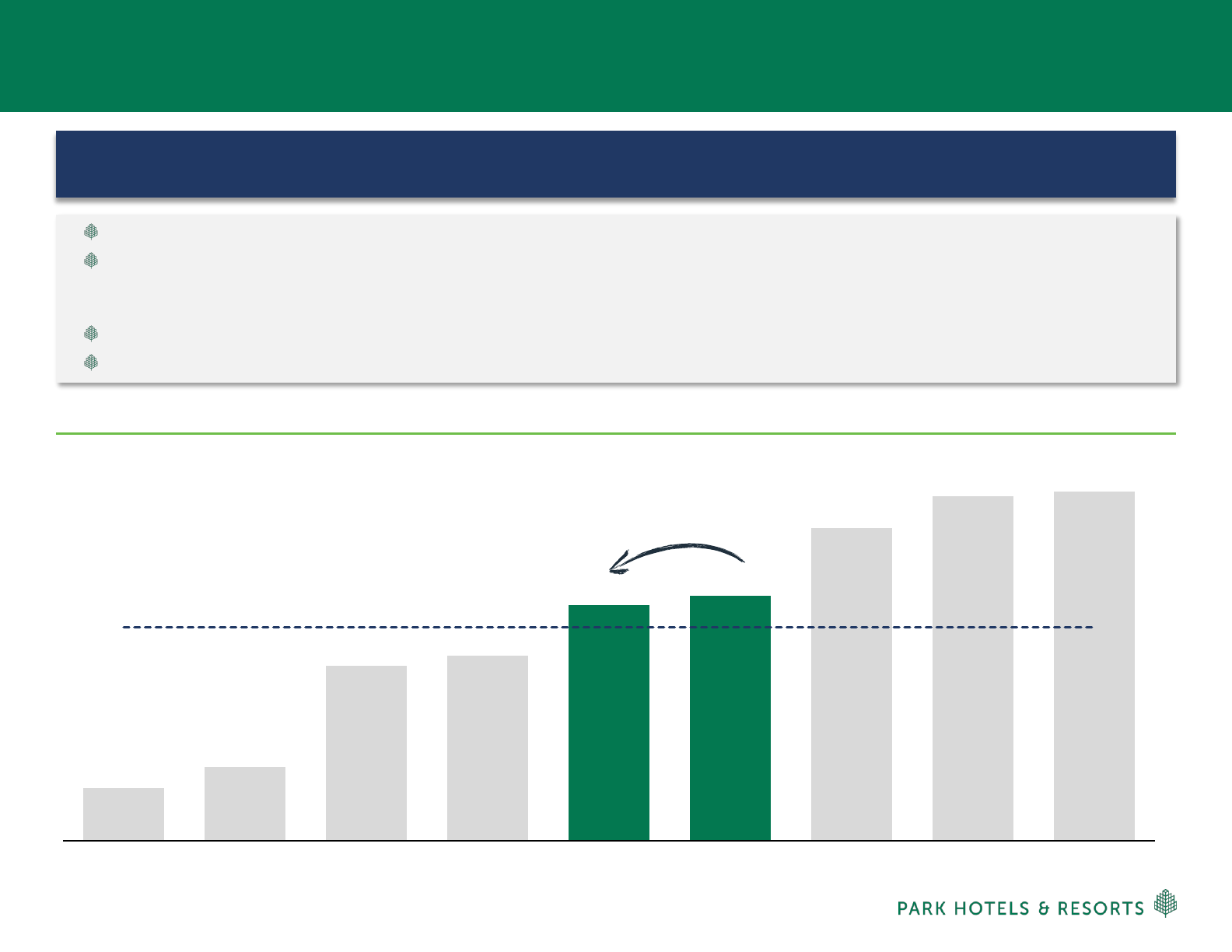

1.0x

1.4x

3.3x

3.5x

4.4x

4.6x

5.9x

6.5x

6.6x

SHO HST XHR DRH Pro Forma PK ⁽²⁾ Pro Forma PK

(At Announcement)

RHP BHR PEB

Peer Average (Excl. PK): 4.0x

Proactive Deleveraging Plan

Park Plans To Reduce Leverage By Selling Up To $500M Of Assets Pre And Post Transaction

Transaction results in modest increase in leverage with Net Debt to Adjusted EBITDA

(1)

increasing to 4.6x from 3.9x as of 1Q19

Phase I (Pre-Closing): Disposition of five identified assets including both of Chesapeake’s NYC hotels (Hyatt Herald Square New York and

Hyatt Place New York Midtown South) in addition to three non-core Park hotels at or prior to closing. Gross proceeds are expected to be

approximately $300M. Post Phase I asset sales, net debt to Adjusted EBITDA falls to 4.4x

Phase II (Post-Closing): Disposition of two additional assets for $170M to $180M to reduce overall leverage to 4.3x

Since spin, Park has preserved a strong and flexible balance sheet within its targeted leverage ratio of 3x to 5x

Pro Forma Park Leverage vs. Peers

(1)

Asset Sales Post

Announcement of

Transaction

23

(1) Benchmarking based on net debt and Adjusted EBITDA for peers as of 12/31/2018 and projected net debt and Adjusted EBITDA of Pro Forma Park as of 3/31/2019

(2) Reflects the following Pro Forma changes – the anticipated sales, prior to the closing of the merger with Chesapeake, of the two Chesapeake New York properties (the

122-room Hyatt Herald Square New York and the 185-room Hyatt Place New York Midtown South) and three non-core PK legacy hotels that are currently under contract

20 |

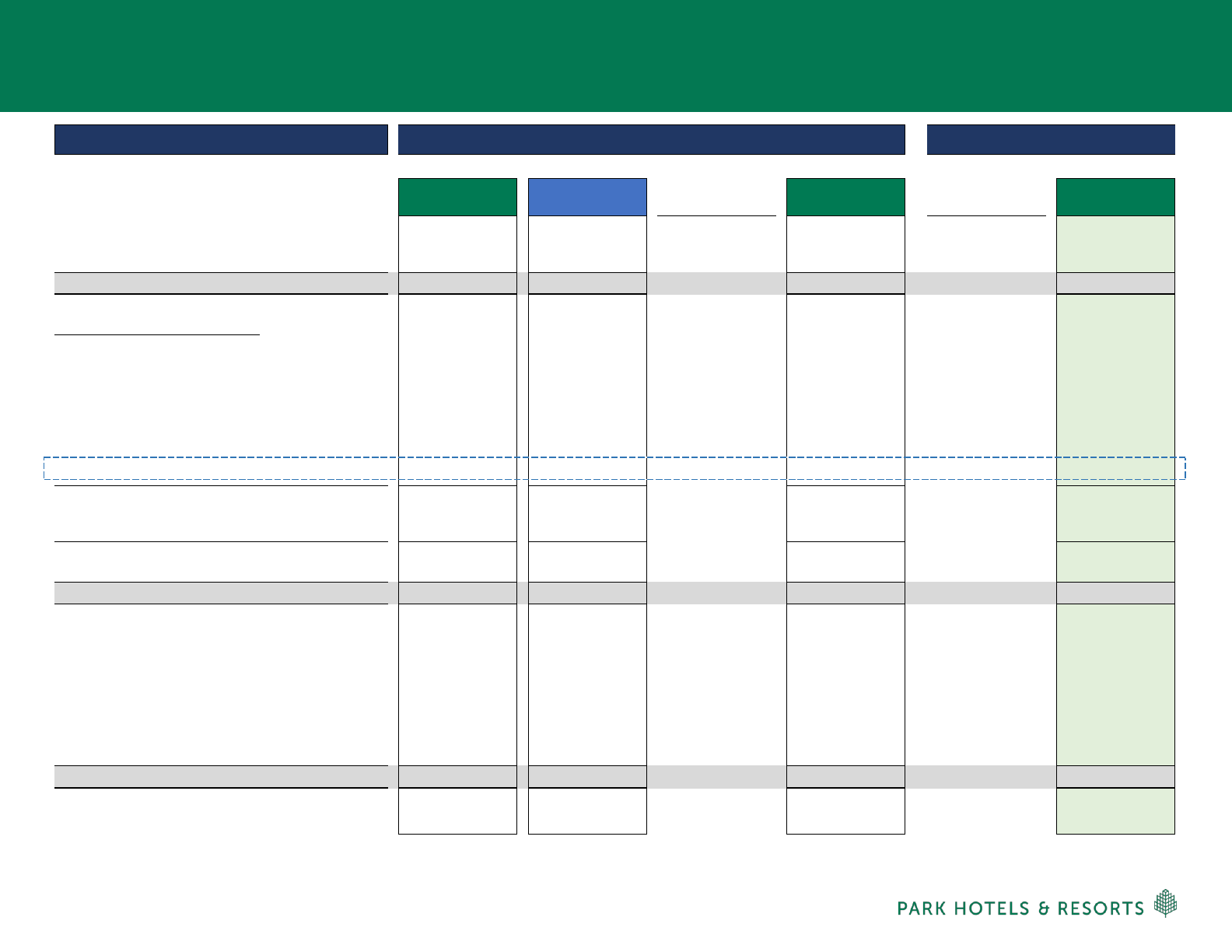

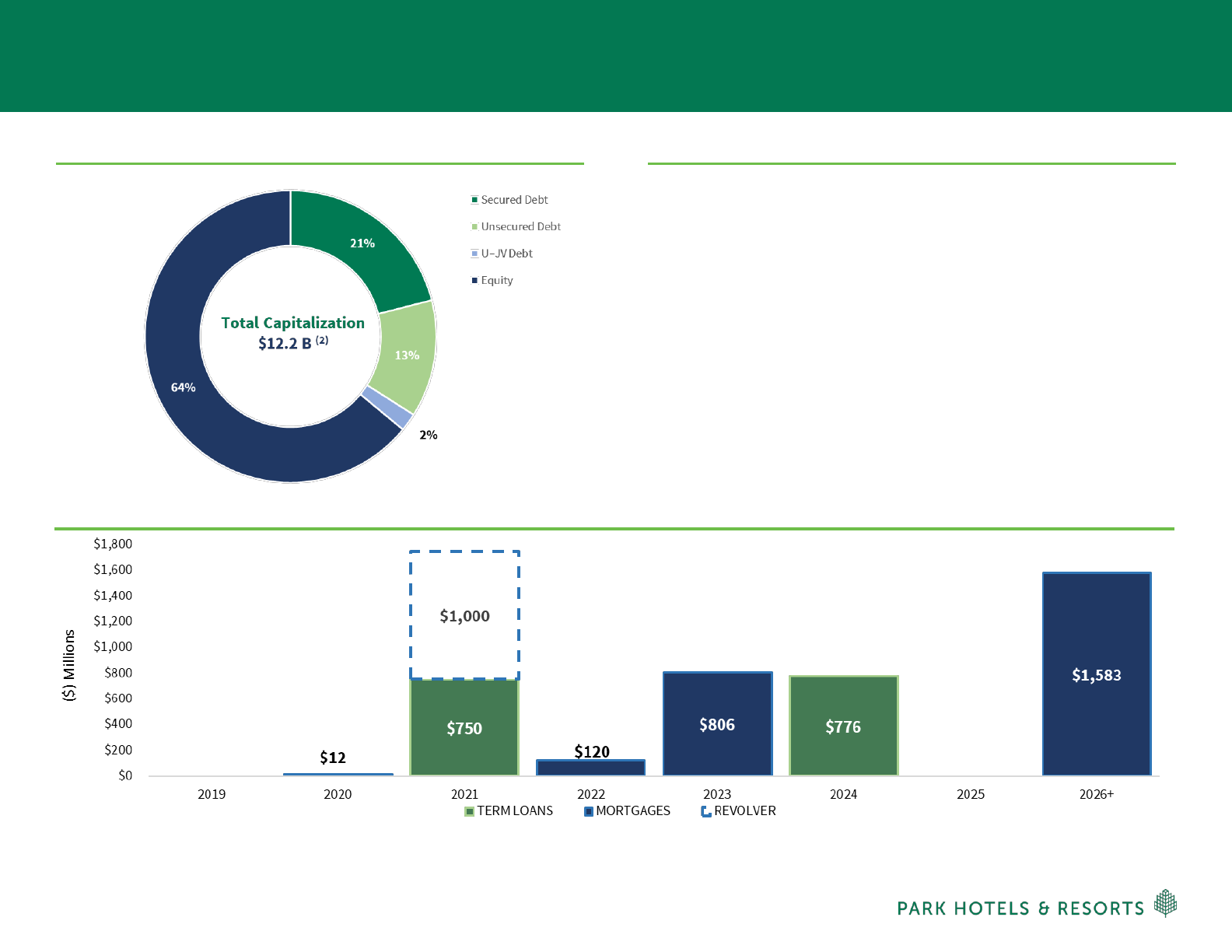

Pro Forma Capitalization

(1) As of 3/31/2019 and held constant for all periods; includes unvested share-based compensation on a diluted basis

(2) Reflects the anticipated sales, prior to closing of the two Chesapeake New York properties and three non-core PK legacy hotels that are currently under contract

(3) Excludes Park's unamortized deferred financing costs, debt discounts, and capitalized lease obligations

(4) Adjusted EBITDA reflects midpoint of PK 2019 full year guidance provided on May 6, 2019 and the midpoint of Chesapeake’s 2019 full year guidance provided on February

21, 2019. 2019 guidance is based on a number of factors, many of which are outside Park’s and Chesapeake’s control and all of which is subject to change and do not

reflect, among other things, the impacts of the proposed transaction

22

$ in millions (except per share) amounts

Transaction Phase I

Adjustments

Asset Sales

(2)

Stock Price (as of 05/03/2019) 32.98$ 29.31$ 32.98$ 32.98$

Shares Outstanding (at end of period)

(1)

202.0 60.8 38.2 240.2 240.2

Equity Market Capitalization 6,662$ 1,781$ 7,920$ 7,920$

Debt

(1)(3)

Secured Debt - Wholly Owned 2,000$ 529$ (129) 2,400$ (86) 2,314$

Secured Debt - Consolidated Joint Venture 207 - - 207 - 207

Unsecured Term Loans (Existing) 750 225 (225) 750 - 750

Revolving Credit Facility - - - - - -

Pro Rata Share Of Unconsolidated Joint Ventures

234 - - 234 - 234

New Term Loan Issuances - - 990 990 (214) 776

Total Debt 3,191$ 754$ 4,581$ 4,281$

Less: Cash & Cash Equivalents

(1)

(276) (46) 152 (170) - (170)

Net Debt 2,915$ 708$ 4,412$ 4,112$

Total Enterprise Value (TEV) 9,577$ 2,489$ 12,332$ 12,032$

Net Debt / TEV 30.4% 28.4% 35.8% 34.2%

2019E Adjusted EBITDA

(4)

765$ 178$ 943$ - 943$

Plus: G&A Synergies - - 17 17 - 17

Less: EBITDA From Asset Dispositions

- - - (30) (30)

Less: Incremental Fixed Costs - - (5) (5) - (5)

Pro Forma 2019E Adjusted EBITDA 765$ 178$ 955$ 925$

Net Debt / Pro Forma 2019E Adjusted EBITDA 3.8x 4.0x 4.6x 4.4x

PK Capitalization

PK

CHSP

PF PK

PF PK

Excludes Potential Asset Dispositions

Includes Phase I Asset Dispositions

21 |

Transaction Sources & Uses: Assumes Phase I Asset Sales

34

Note: Debt figures as of 3/31/2019

U.S. $ in millions

SOURCES AND USES

Sources

$ %

Stock Issued to Target Shareholders $1,215 44%

Assumed Mortgage Debt 314 11%

Cash from Target's Balance Sheet 125 5%

Cash from Acquirer's Balance Sheet 27 1%

Cash from Phase I Asset Sales (Net of Selling Costs) 300 11%

New Debt 776 28%

Total Sources

$2,758

Uses

$ %

Target Stock Consideration $1,215 44%

Target Cash Consideration 668 24%

CHSP Repaid Term Loan 225 8%

CHSP Repaid Mortgage Debt 129 5%

Repaid Mortgage Debt (Associated with Phase I Asset Sales) 86 3%

Assumed Mortgage Debt 314 11%

Transaction Costs 120 4%

Total Uses

$2,758

22 |

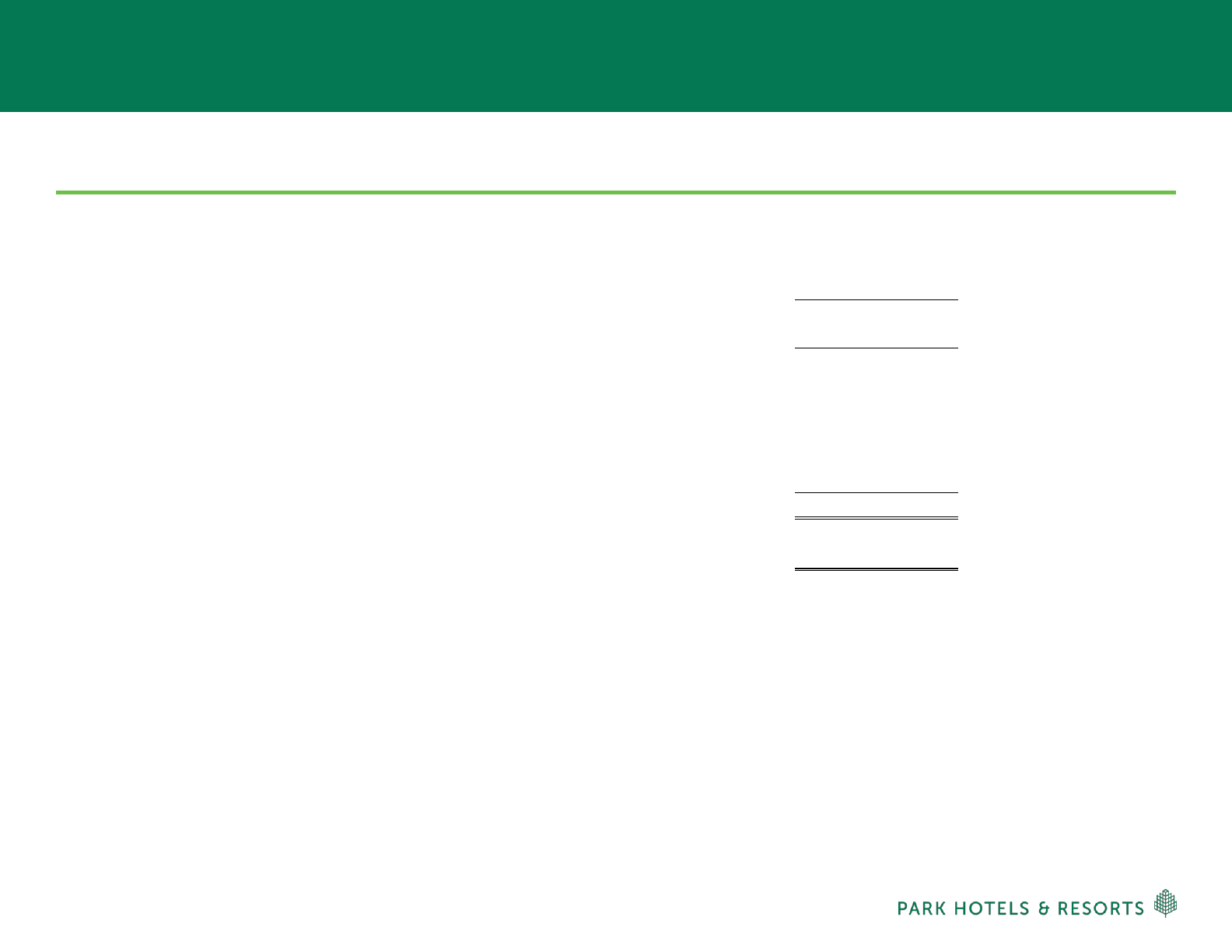

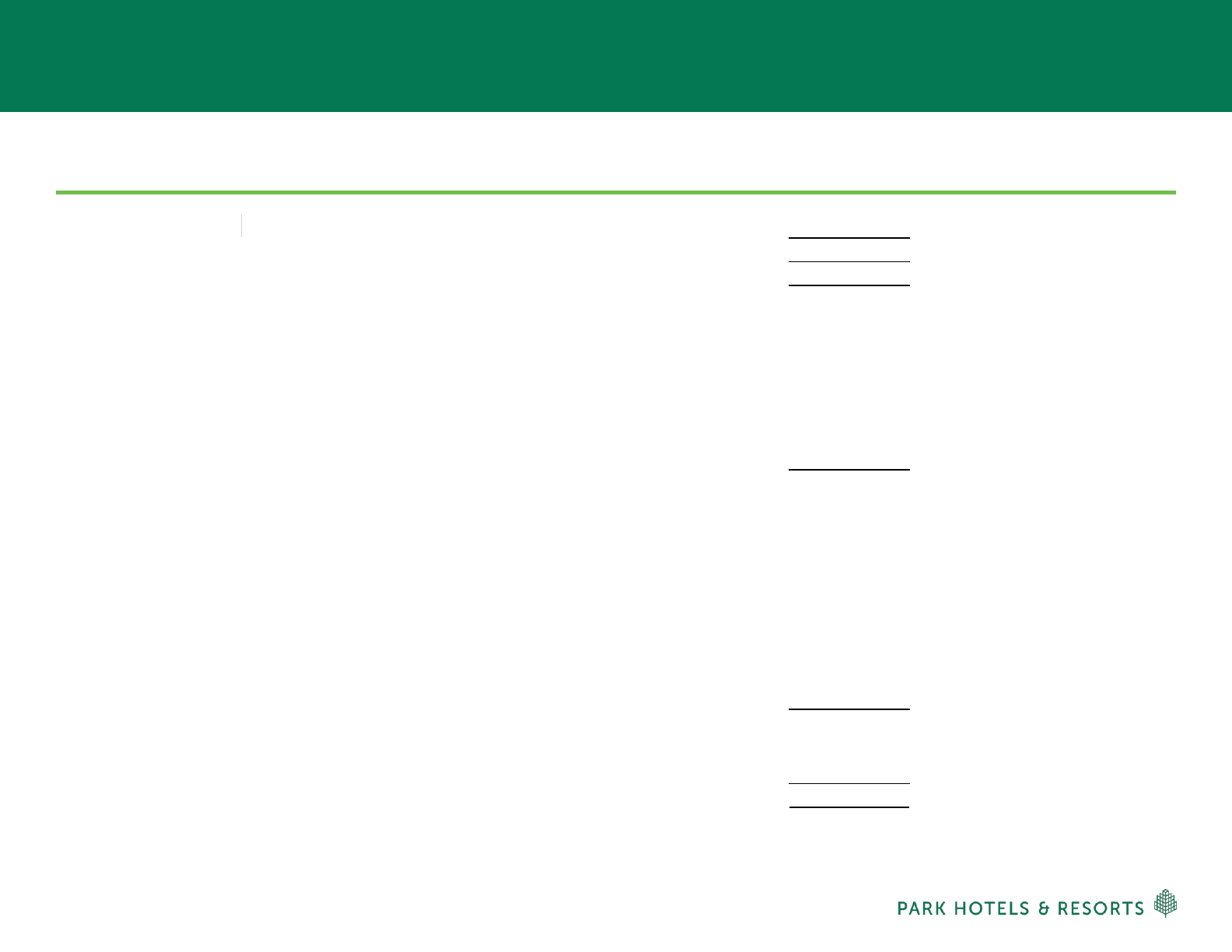

Pro Forma Balance Sheet & Credit Metrics

Pro Forma Capital Structure

(1)(2)

Post Transaction Position Highlights

Pro Forma Debt Maturity Schedule

(5)

(1) Reflects actual debt balances for 3/31/19 after approx. $440 million of existing CHSP debt paydowns

(2) Equity capitalization based on market pricing of equity as of 5/3/19 and Pro Forma debt balances as of 3/31/2019; includes $170 million of cash

(3) Adjusted EBITDA reflects midpoint of PK 2019 full year guidance provided on May 6, 2019 and the midpoint of Chesapeake’s 2019 full year guidance provided on February 21, 2019. 2019 guidance is based on a number of factors, many of

which are outside Park’s and Chesapeake’s control and all of which are subject to change and do not reflect, among other things, the impacts of the proposed transaction

(4) Includes PK 2023 Convertible Notes, Capital Leases, and PK pro-rata share of unconsolidated joint venture debt

(5) Excludes pro-rata share of unconsolidated joint venture debt

(6) Reflects prepayment of Hilton Denver City Center mortgage on the “At Par” date of 2/1/2022 stated in the loan agreement, which is before the stated maturity in 8/1/2042

▪ 50 unencumbered hotels, or 62% of Adjusted EBITDA

(3)

▪ Despite increase in leverage, Pro Forma WACD remains

constant at 4.1% to PK standalone

▪ Undrawn $1 billion revolving credit facility

▪ 59% Fixed Debt vs. 41% Floating Debt

(4)

▪ 36% Unsecured Debt vs. 64% Secured Debt

(4)

(6)

23 |

Appendix: Non-GAAP Financial Measures Reconciliations

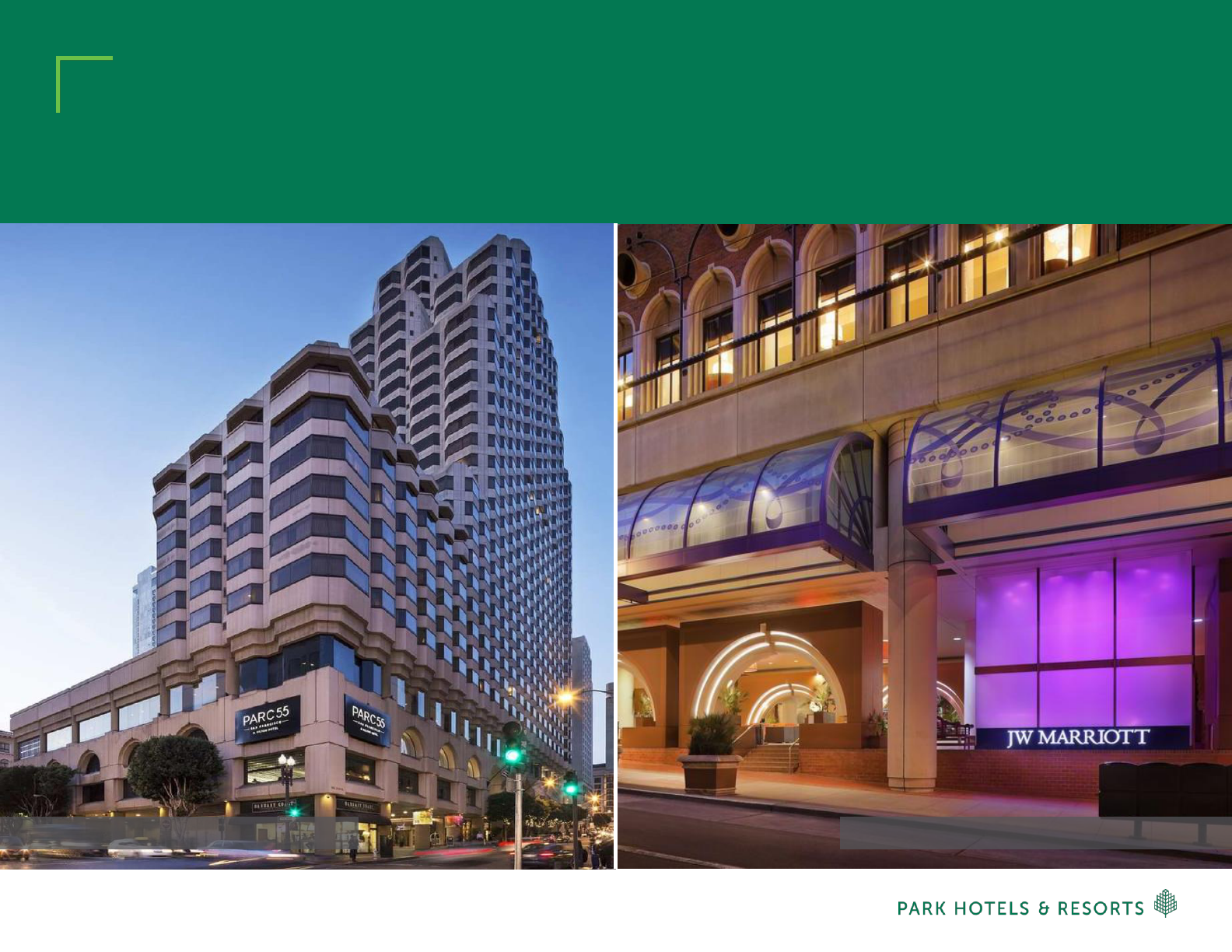

PK: Parc 55 San Francisco – A Hilton Hotel CHSP: JW Marriott San Francisco Union Square

31

24 |

Non-GAAP Financial Measures Reconciliations

EBITDA and Adjusted EBITDA

Guidance (continued) EBITDA and Adjusted EBITDA Year Ending (unaudited, in millions) December 31, 2019 Low Case High Case Net income $ 294 $ 323 Depreciation and amortization expense 278 278 Interest income (8) (8) Interest expense 130 130 Income tax expense 13 14 Interest expense, income tax and depreciation and amortization included in equity in earnings from investments in affiliates 23 23 EBITDA 727 757 Share-based compensation expense 15 15 Adjusted EBITDA $ 745 $ 775

(1)

Included in other (loss) gain, net in the consolidated statement of operations.

(2)

For 2017, includes $18 million of distributions received from investments in affiliates in excess of the investment balance that

were included within equity in earnings from investments in affiliates in the consolidated statement of operations.

(unaudited, in millions)

2018 2017

Net income 477$ 2,631$

Depreciation and amortization expense 277 288

Interest income (6) (2)

Interest expense 127 124

Income tax expense (benefit) 23 (2,346)

Interest expense, income tax and depreciation and

amortization included in equity in earnings

from investments in affiliates

26 24

EBITDA 924 719

Loss (gain) on sales of assets, net (96) (1)

Gain on sale of investments in affiliates

(1)

(107) —

(Gain) loss on foreign currency transactions 3 4

Transition expense 3 9

Transaction expense 2 2

Severance expense 2 1

Share-based compensation expense 16 14

Casualty loss (gain) and impairment loss, net (1) 26

Other items

(2)

8 (17)

Adjusted EBITDA 754$ 757$

Year Ended

December 31,

25 |

Non-GAAP Financial Measures Reconciliations

Comparable Hotel Adjusted EBITDA and Comparable Hotel Adjusted EBITDA Margin

(unaudited, dollars in millions)

2018 2017

Adjusted EBITDA 754$ 757$

Less: Adjusted EBITDA from investments in affiliates 45 45

Less: All other

(1)

(52) (46)

Hotel Adjusted EBITDA 761 758

Less: Adjusted EBITDA from hotels disposed of 1 33

Less: Adjusted EBITDA from non-comparable hotels 44 44

Comparable Hotel Adjusted EBITDA 716$ 681$

2018 2017

Total Revenues 2,737$ 2,791$

Less: Other revenue 72 64

Less: Revenues from hotels disposed of 17 131

Less: Revenues from non-comparable hotels

(1)

161 184

Comparable Hotel Revenues 2,487$ 2,412$

(1)

Includes revenues from Park's non-comparable hotels and rental revenues from office space and antenna rent leases located at our hotels.

2018 2017 Change

(1)

Comparable Hotel Revenues 2,487$ 2,412$ 3.1%

Comparable Hotel Adjusted EBITDA 716$ 681$ 5.2%

Comparable Hotel Adjusted EBITDA margin 28.8% 28.2% 60 bps

December 31,

Year Ended

Year Ended

December 31,

Year Ended

December 31,

(1)

Includes other revenues and other expenses, non-income taxes on REIT leases included in other property-level expenses and corporate general and

administrative expenses

26 |

Non-GAAP Financial Measures Reconciliations

EBITDA and Adjusted EBITDA

(unaudited, in millions)

2019 2018

Net income 97$ 149$

Depreciation and amortization expense 62 70

Interest income (1) (1)

Interest expense 32 31

Income tax expense 7 —

Interest expense, income tax and depreciation and

amortization included in equity in earnings

from investments in affiliates

5 7

EBITDA 202 256

Gain on sales of assets, net (31) (89)

Gain on foreign currency transactions — (1)

Transition expense — 2

Severance expense 1 —

Share-based compensation expense 4 4

Other items — 2

Adjusted EBITDA 176$ 174$

Three Months Ended

March 31,

27 |

Non-GAAP Financial Measures Reconciliations

Comparable Hotel Adjusted EBITDA and Comparable Hotel Adjusted EBITDA Margin

(unaudited, dollars in millions)

2019 2018

Adjusted EBITDA 176$ 174$

Less: Adjusted EBITDA from investments in affiliates 10 12

Less: All other

(1)

(15) (12)

Hotel Adjusted EBITDA 181 174

Less: Adjusted EBITDA from hotels disposed of 1 8

Less: Adjusted EBITDA from non-comparable hotels (1) —

Comparable Hotel Adjusted EBITDA 181$ 166$

administrative expenses in the consolidated statement of operations.

2019 2018

Total Revenues 659$ 668$

Less: Other revenue 18 17

Less: Revenues from hotels disposed of 6 47

Less: Revenues from non-comparable hotels

(1)

3 3

Comparable Hotel Revenues 632$ 601$

2019 2018 Change

(1)

Comparable Hotel Revenues 632$ 601$ 5.2%

Comparable Hotel Adjusted EBITDA 181$ 166$ 9.0%

Comparable Hotel Adjusted EBITDA margin 28.7% 27.7% 100 bps

(1)

Percentages are calculated based on unrounded numbers.

Three Months Ended

March 31,

Three Months Ended

March 31,

Three Months Ended

March 31,

(1)

Includes other revenues and other expenses, non-income taxes on REIT leases included in other property-level expenses and corporate general and

(1)

Includes revenues from Park's non-comparable hotels and rental revenues from office space and antenna rent leases located at our hotels.

28 |

Non-GAAP Financial Measures Reconciliations

Net Debt and Net Debt to Pro-forma Adjusted EBITDA Ratio

(1)

See Slide 29 for Pro-forma Adjusted EBITDA at March 31, 2019. Pro-forma Adjusted EBITDA excludes results from the 13 hotels

disposed of in 2018, 1 hotel returned to the ground lessor in 2018 and 2 hotels disposed of in 2019.

(unaudited, in millions)

Debt 2,949$

Add: unamortized deferred financing costs 9

Long-term debt, including current maturities and excluding

unamortized deferred financing costs

2,958

Add: Park's share of unconsolidated affiliates debt,

excluding unamortized deferred financing costs

234

Less: cash and cash equivalents 276

Less: restricted cash 14

Net debt 2,902$

Pro-forma Adjusted EBITDA

(1)

739$

Net debt to Pro-forma Adjusted EBITDA ratio 3.9x

March 31, 2019

29 |

Non-GAAP Financial Measures Reconciliations

Pro-forma TTM Adjusted EBITDA

Year Ended

TTM

(1)

(unaudited, in millions)

December 31, March 31,

2018 2019 2018 2019

Net income 477$ 97$ 149$ 425$

Depreciation and amortization expense 277 62 70 269

Interest income (6) (1) (1) (6)

Interest expense 127 32 31 128

Income tax expense 23 7 — 30

Interest expense, income tax and depreciation and amortization

included in equity in earnings from investments in affiliates

26 5 7 24

EBITDA 924 202 256 870

Gain on sales of assets, net (96) (31) (89) (38)

Gain on sale of investments in affiliates

(2)

(107) — — (107)

Loss (gain) on foreign currency transactions 3 — (1) 4

Transition expense 3 — 2 1

Transaction expense 2 — — 2

Severance expense 2 1 — 3

Share-based compensation expense 16 4 4 16

Casualty (gain) loss and impairment loss, net (1) — — (1)

Other items 8 — 2 6

Adjusted EBITDA 754 176 174 756

Less: Adjusted EBITDA from hotels disposed of 23 1 8 16

Less: Adjusted EBITDA from investments in affiliates disposed of 2 — 1 1

Pro-forma Adjusted EBITDA

729$ 175$ 165$ 739$

Three Months Ended

March 31,

(1) TTM March 31, 2019 is calculatd as year ended December 31, 2018 plus the three months ended March 31, 2019 less the three months ended March 31, 2018.

(2) Included in other (loss) gain, net in the consolidated statement of operations.

30 |

Non-GAAP Financial Measures Reconciliations

Comparable Hotel Adjusted EBITDA

The financial information below is for the 42 comparable hotels owned as of March 31, 2019.

(1) Included in other (loss) gain, net in the consolidated statement of operations.

(2) Includes other revenues and other expenses, non-income taxes on REIT leases included in other property-level expenses and corporate general and administrative

expenses in the consolidated statement of operations.

Full Year

(unaudited, dollars in millions)

December 31,

2018

Net income

477$

Depreciation and amortization expense

277

Interest income

(6)

Interest expense

127

Income tax expense

23

Interest expense, income tax and depreciation and

amortization included in equity in earnings from

investments in affiliates

26

EBITDA

924

(Gain) loss on sales of assets, net

(96)

(Gain) loss on sale of investments in affiliates

(1)

(107)

Loss (gain) on foreign currency transactions

3

Transition expense

3

Transaction expense

2

Severance expense

2

Share-based compensation expense

16

Casualty loss (gain) and impairment loss, net

(1)

Other items

8

Adjusted EBITDA

754$

Less: Adjusted EBITDA from investments in affiliates

45

Less: All other

(2)

(52)

Hotel Adjusted EBITDA

761

Less: Adjusted EBITDA from hotels disposed of

23

Less: Adjusted EBITDA from non-comparable hotels

11

Comparable Hotel Adjusted EBITDA

727$

31 |

Non-GAAP Financial Measures Reconciliations

Comparable Hotel Metrics

The financial information below is for the 42 comparable hotels owned as of March 31, 2019.

(1)

Includes revenues from Park’s non-comparable hotels and rental revenues from office space and antenna rent leases located at our hotels.

Full Year

(unaudited, dollars in millions)

December 31,

2018

Total Revenues

2,737$

Less: Other revenue

72

Less: Revenues from hotels disposed of

135

Less: Revenues from non-comparable hotels

(1)

32

Comparable Hotel Revenues

2,498$

Comparable Hotel Adjusted EBITDA Margin

29.1%

32 |

Non-GAAP Financial Measures Reconciliations

Hotel Adjusted EBITDA Including Unconsolidated Joint Ventures

Full Year

(unaudited, dollars in millions)

December 31,

2018

Net income

477$

Depreciation and amortization expense

277

Interest income

(6)

Interest expense

127

Income tax expense

23

Interest expense, income tax and depreciation and

amortization included in equity in earnings from

investments in affiliates

26

EBITDA

924

(Gain) loss on sales of assets, net

(96)

(Gain) loss on sale of investments in affiliates

(1)

(107)

Loss (gain) on foreign currency transactions

3

Transition expense

3

Transaction expense

2

Severance expense

2

Share-based compensation expense

16

Casualty loss (gain) and impairment loss, net

(1)

Other items

8

Adjusted EBITDA

754$

Less: All other

(2)

(52)

Less: Adjusted EBITDA from hotels disposed of (including UJV)

27

Hotel Adjusted EBITDA (including UJV)

779$

(1) Included in other (loss) gain, net in the consolidated statement of operations.

(2) Includes other revenues and other expenses, non-income taxes on REIT leases included in other property-level expenses and corporate general and administrative

expenses in the consolidated statement of operations.

33 |

Guidance

EBITDA and Adjusted EBITDA

(unaudited, in millions)

Low Case High Case

Net income 358$ 386$

Depreciation and amortization expense 245 245

Interest income (8) (8)

Interest expense 128 129

Income tax expense 15 16

Interest expense, income tax and depreciation and amortization included in equity

in earnings from investments in affiliates

22 22

EBITDA 760 790

Gain on sale of assets, net (31) (31)

Severance expense 3 3

Share-based compensation expense 15 15

Other items 3 3

Adjusted EBITDA 750$ 780$

Year Ending

December 31, 2019

Park’s full-year 2019 guidance is based on a number of factors, many of which are outside Park’s control and all of which are subject to change. This guidance does not reflect the impacts

of the proposed merger transaction with Chesapeake. Park may change the guidance provided during the year as actual and anticipated results vary from these assumptions. Park

undertakes no obligation to update or revise publicly any guidance. Please see the forward-looking statements disclaimer on slide 36 of this presentation for a discussion of the risks that

could cause actual results to differ materially from any potential or estimated results.

34 |

Definitions

EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA Margin

Earnings before interest expense, taxes and depreciation and amortization (“EBITDA”), presented herein, reflects net income excluding depreciation and amortization,

interest income, interest expense, income taxes and interest expense, income tax and depreciation and amortization included in equity in earnings from investments in

affiliates.

Adjusted EBITDA, presented herein, is calculated as EBITDA, as previously defined, further adjusted to exclude:

• Gains or losses on sales of assets for both consolidated and unconsolidated investments;

• Gains or losses on foreign currency transactions;

• Transition expense related to the Company’s establishment as an independent, publicly traded company;

• Transaction costs associated with hotel acquisitions or dispositions expensed during the period;

• Severance expense;

• Share-based compensation expense;

• Casualty and impairment losses; and

• Other items that management believes are not representative of the Company’s current or future operating performance.

Hotel Adjusted EBITDA measures hotel-level results before debt service, depreciation and corporate expenses of the Company’s consolidated hotels, including both

comparable and non-comparable hotels but excluding hotels owned by unconsolidated affiliates, and is a key measure of the Company’s profitability. The Company

presents Hotel Adjusted EBITDA to help the Company and its investors evaluate the ongoing operating performance of the Company’s consolidated hotels.

Hotel Adjusted EBITDA margin is calculated as Hotel Adjusted EBITDA divided by total hotel revenue.

EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin are not recognized terms under United States (“U.S.”) GAAP and should not

be considered as alternatives to net income (loss) or other measures of financial performance or liquidity derived in accordance with U.S. GAAP. In addition, the

Company’s definitions of EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin may not be comparable to similarly titled measures

of other companies.

The Company believes that EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin provide useful information to investors about the

Company and its financial condition and results of operations for the following reasons: (i) EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted

EBITDA margin are among the measures used by the Company’s management team to make day-to-day operating decisions and to evaluate its operating

performance between periods and between REITs by removing the effect of its capital structure (primarily interest expense) and asset base (primarily depreciation and

amortization) from its operating results; and (ii) EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin are frequently used by

securities analysts, investors and other interested parties as a common performance measure to compare results or estimate valuations across companies in the

industry.

EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin have limitations as analytical tools and should not be considered either in

isolation or as a substitute for net income (loss) or other methods of analyzing results as reported under U.S. GAAP.

35 |

Definitions (cont’d)

Net Debt

Net debt, presented herein, is a non-GAAP financial measure that the Company uses to evaluate its financial leverage. Net debt is calculated as (i) long-term debt, including current maturities and

excluding unamortized deferred financing costs; and (ii) the Company’s share of investments in affiliate debt, excluding unamortized deferred financing costs; reduced by (a) cash and cash equivalents;

and (b) restricted cash and cash equivalents.

The Company believes Net debt provides useful information about its indebtedness to investors as it is frequently used by securities analysts, investors and other interested parties to compare the

indebtedness of companies. Net debt should not be considered as a substitute to debt presented in accordance with U.S. GAAP. Net debt may not be comparable to a similarly titled measure of other

companies.

Net Debt to Pro-forma Adjusted EBITDA Ratio

Net debt to Pro-forma Adjusted EBITDA ratio, presented herein, is a non-GAAP financial measure and is included as it is frequently used by securities analysts, investors and other interested parties to

compare the financial condition of companies. Net debt to Pro-forma Adjusted EBITDA ratio should not be considered as an alternative to measures of financial condition derived in accordance with

U.S. GAAP and it may not be comparable to a similarly titled measure of other companies.

Comparable Hotels

The following disclosure is applicable only to the non-GAAP financial measures reconciliations on slides 24-33 of this presentation: The Company presents certain data for its consolidated hotels on a

comparable hotel basis as supplemental information for investors. The Company defines its comparable hotels as those hotels that: (i) were active and operating in the Company’s portfolio since

January 1st of the previous year; and (ii) have not sustained substantial property damage, business interruption, undergone large-scale capital projects or for which comparable results are not

available. The Company presents comparable hotel results to help the Company and its investors evaluate the ongoing operating performance of its comparable hotels. Of the 43 hotels that the

Company consolidated as of March 31, 2019, 42 have been classified as comparable hotels. Due to the continued effects of business interruption from Hurricane Maria at the Caribe Hilton in Puerto

Rico, the results from that property were excluded from the Company’s comparable hotels. The Company’s comparable hotels as of March 31, 2019 also exclude one hotel returned to the lessor after

the expiration of the ground lease in December 2018 and two consolidated hotels that were sold in February and March 2019. Of the 46 hotels that the Company consolidated as of December 31,

2018, 44 hotels were classified as comparable hotels. Due to the conversion of a significant number of rooms at the Hilton Waikoloa Village to HGV timeshare units in 2017, and due to the effects of

business interruption from Hurricane Maria at the Caribe Hilton in Puerto Rico, the results from these properties were excluded from the Company’s comparable hotels. The Company’s comparable

hotels as of December 31, 2018 also exclude the 12 consolidated hotels that were sold in January and February 2018.

Pro-forma

The following disclosure is applicable only to the non-GAAP financial measures reconciliations on slides 24-33 of this presentation: Certain financial measures and other information have been adjusted

to reflect the effects of hotels disposed of during the periods presented. When presenting such information, the amounts are identified as “Pro-forma.”

36 |

About Park and Safe Harbor Disclosure

About Park Hotels & Resorts Inc.

Park (NYSE: PK) is the second largest publicly traded lodging real estate company with a diverse portfolio of market-leading hotels and resorts with significant underlying real estate value. Park’s portfolio

consists of 51 premium-branded hotels and resorts with over 30,000 rooms, primarily located in prime U.S. markets with high barriers to entry. Visit www.pkhotelsandresorts.com for more information.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements include, but are not limited to, statements related to Park’s current expectations regarding the performance of its business, financial results, liquidity and capital

resources, the effects of competition and the effects of future legislation or regulations, the expected completion of anticipated acquisitions and dispositions, the declaration and payment of future

dividends, statements about the benefits of the proposed transaction involving Park and Chesapeake and statements that address operating performance, events or developments that Park expects or

anticipates will occur in the future, including but not limited to statements regarding anticipated synergies and G&A savings, future financial and operating results, plans, objectives, expectations and

intentions, expected sources of financing, anticipated asset dispositions, anticipated leadership and governance, creation of value for stockholders, benefits of the proposed transaction to customers,

employees, stockholders and other constituents of the combined company, the integration of Park and Chesapeake, cost savings and the expected timetable for completing the proposed transaction,

and other non-historical statements. Forward-looking statements include all statements that are not historical facts, and in some cases, can be identified by the use of forward-looking terminology such

as the words “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of

these words or other comparable words.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in these forward-looking statements for various reasons, including risks

associated with Park’s ability to consummate the proposed transaction and the timing of the closing of the proposed transaction; the ability to satisfy conditions necessary to close the proposed

transaction; applicable regulatory changes; the availability of financing; risks associated with acquisitions generally, including the integration of the combined companies’ businesses; risks associated with

execution of anticipated asset dispositions; risks associated with achieving expected revenue synergies or cost savings; as well as other risks and uncertainties detailed from time to time in Park’s filings

with the SEC. You should not put undue reliance on any forward-looking statements and Park urges investors to carefully review the disclosures Park makes concerning risk and uncertainties in Item 1A:

“Risk Factors” in Park’s Annual Report on Form 10-K for the year ended December 31, 2018, as such factors may be updated from time to time in Park’s periodic filings with the SEC, which are

accessible on the SEC’s website at www.sec.gov. Except as required by law, Park undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new

information, future events or otherwise.

Additional Information about the Proposed Transaction and Where to Find It

In connection with the proposed transaction, Park intends to file with the SEC a registration statement on Form S-4 that will include a proxy statement of Chesapeake and also constitutes a prospectus of

Park. Park and Chesapeake also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY

STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED TRANSACTION. A definitive proxy statement/prospectus will be sent to Chesapeake’s shareholders. Investors may obtain a free copy of the proxy statement/prospectus (if and

when it becomes available) and other relevant documents filed by Park and Chesapeake with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by Park with the SEC will be

available free of charge on Park’s website at http://www.pkhotelsandresorts.com or by contacting Park’s Investor Relations at (571) 302-5591. Copies of the documents filed by Chesapeake with the SEC

will be available free of charge on Chesapeake’s website at http://www.chesapeakelodgingtrust.com or by contacting Chesapeake’s Investor Relations at (571) 349-9452.

Chesapeake and its trustees and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed

transaction. Information about trustees and executive officers of Chesapeake is available in the proxy statement for its 2019 Annual Meeting, which was filed with the SEC on April 30, 2019. Other

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus

and other relevant materials filed with the SEC regarding the proposed transaction when they become available. Investors should read the proxy statement/prospectus carefully before making any voting

or investment decisions when it becomes available before making any voting or investment decisions. Investors may obtain free copies of these documents from Park or Chesapeake using the sources

indicated above.

This communication and the information contained herein shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.