Copyright 2002-2021 V

W - All Rights Reserved.

QuickBooks Online Requirements and Set Up

Requirements

Any QuickBooks® Online Company that will be the recipient of data sent from

VinNOW will be an as-new QBO Company, free of any data. It cannot have

any existing data that may cause conflict with the data coming from

VinNOW. This includes data that has been imported from a QB Desktop

Company which held VinNOW data. The structures underlying the Desktop

and the online versions of QB are considerably different. The difference is

enough so that records imported from the QB Desktop to QB Online will likely

require a substantial effort to "match" their source.

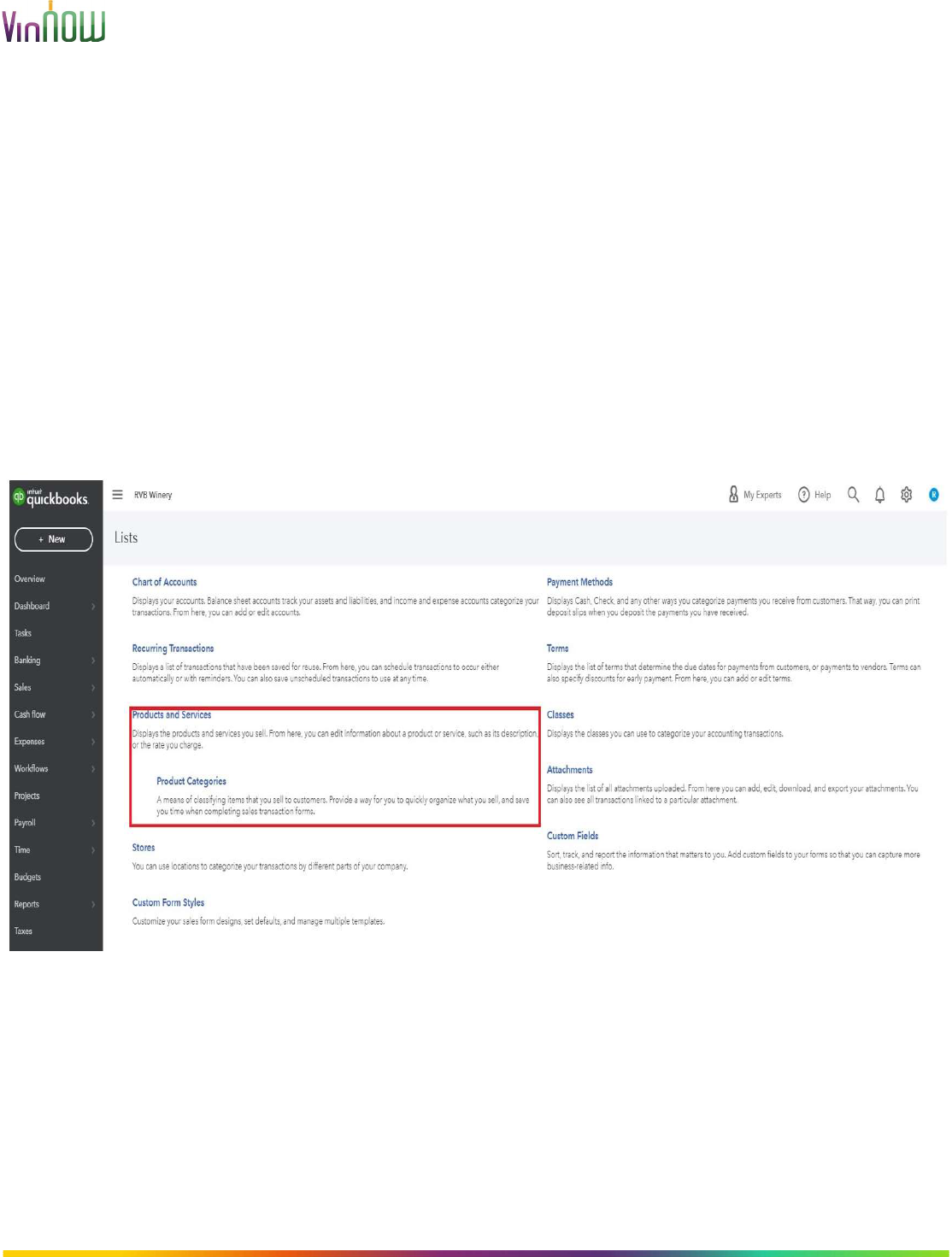

Within the QBO Products and Services realm, the "Product Categories" feature

must be available and active. This will be the default arrangement in QBO at

some point. But at the present time, it may have to be set manually in

QBO. Without it, data uploads from VinNOW will fail. The "Product

Categories" in QBO are analogous to the QB Desktop's "Sub-Items" usage.

For each state for which you collect and pay taxes based on product sales, a

Tax Agency must be created. This process is documented below.

Setup

Before you use the VinNOW to QuickBooks® Online Integration you must

complete the following:

1. QuickBooks® Online Company Settings

2. Authorize VinNOW to Access Your QuickBooks® Online Company

3. VinNOW Option Settings for QuickBooks® Online Uploads

4. VinNOW Product Settings for QuickBooks® Online

QuickBooks® Online Company Settings

From within the QuickBooks® Online program, there are several Company

Settings that should be configured to insure your VinNOW data is uploaded

successfully. These should be set prior to your first data upload.

Copyright 2002-2021 V

W - All Rights Reserved.

REQUIRED: Automated Sales Tax

From Intuit’s documentation for QuickBooks Online: “…US QuickBooks Online

companies created after November 10, 2017 manage sales tax calculations

via an automated sales tax (AST) engine. Sales tax is determined based on

the source and destination address. The source address is the company’s

legal address as available in the company settings. The destination address is

the shipping address provided on the sales transaction. If a shipping address

is not provided, the company address is considered as the destination

address. The ability to customize the source address based on location of a

given transaction is not supported...”

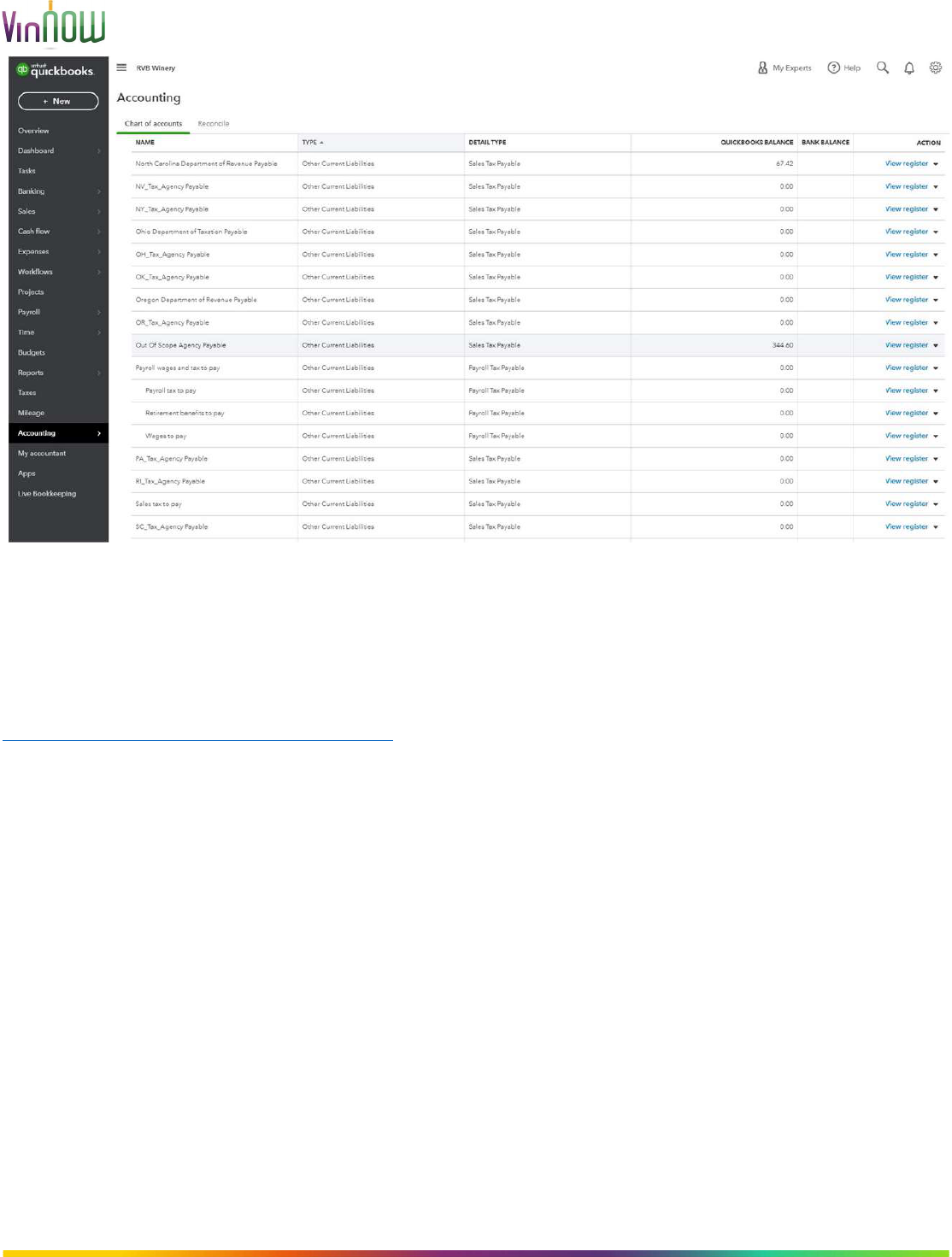

How the QuickBooks Automated Sales Tax affects invoices imported

from VinNOW:

The VinNOW export to your QB Online Company is able to override the QB

automated sales tax value. For each invoice, VinNOW sends the tax value

which was charged on that invoice at the time the invoice was created in

VinNOW. As long as the Tax Agency applicable to the destination address has

been created by the User in the QB Online Company, the tax amount will now

be the same in VinNOW and QuickBooks. If the destination Tax Agency is not

already created, then the tax value for the invoice will be calculated by

QuickBooks’ automated sales tax engine. That value may be different from

what is on the VinNOW invoice. In other words, we cannot override the

QuickBooks automated sales tax value if the User has not created a tax

agency for the applicable state. Additionally, if the destination tax agency has

not been created, the invoice tax amount will be lumped into a general-

purpose Chart of Accounts category of type ‘Sales Tax Payable’. That

particular Chart of Account name will likely default to “Out of Scope Agency

Payable”. As illustrated below:

Copyright 2002-2021 V

W - All Rights Reserved.

Setting up QB Online Company for Tax:

The YouTube video at the following link provides instruction for setting up Tax

Agencies for your QuickBooks Online Company. You should create a Tax

Agency for each state your products are sold.

https://youtu.be/eNyXZ8GbR5M

For VinNOW purposes, it is necessary only to create a Tax Agency at the

State level for any state you sell product and collect taxes. This can be

accomplished quite easily and takes minimal time to complete. Even if adding

Tax Agencies for dozens of states.

NOTE: The following steps are copied directly from QuickBooks Online Help.

Step 1: Check your business address

Make sure your business address is correct, so QuickBooks can set up the

right tax agency for you.

1. Go to Taxes.

2. Select Get started.

Copyright 2002-2021 V

W - All Rights Reserved.

3. You'll see your business name here if you updated your business

info in Settings

⚙

. If not, select Edit

✎

to add your business address.

4. Review your address and then select Next.

Note: In your next invoice or sales receipt, QuickBooks will automatically use

your business address as the sale location. If you need to, you can

always change the location on the transaction.

Step 2: Add multiple tax rates and agencies

QuickBooks automatically locates tax names and rates according to your

business address. You just need to match the tax agency for each rate.

1. Select the TAX RATE NAME checkbox that applies to your business

location.

2. Select the OFFICIAL AGENCY NAME ▼ dropdown menu, then select

the appropriate agency for the tax name.

3. Select Next.

4. Review your rates. If the rates are correct, select Save.

5. Once you have set up your sales tax, select Continue.

Step 3: Tell QuickBooks how often you file

You’re almost finished. Just make sure to set up your filing frequency so

QuickBooks can remind you when it’s time to file.

Note: Not sure how often you should file? Check your sales tax business

registration or go to your tax agency’s website to know your filing frequency.

1. Select the Filing frequency ▼ dropdown, then choose how often you

file.

2. When you’re done, select Save.

That’s it. On your next invoice or sales receipt, QuickBooks will do all sales

tax calculations for you. Check out how QuickBooks automates sales tax

calculations.

Add a new tax rate and agency

If you charge sales tax outside your state, you can add other tax agencies

you pay. Here’s how to add or edit sales tax rates and agencies.

Copyright 2002-2021 V

W - All Rights Reserved.

To add a tax rate and agency:

1. From the left menu, select Taxes.

2. Under the Related Tasks list on the right, select Add/edit tax rates

and agencies.

3. Select New and choose either a single or a combined tax rate.

4. Enter a name for the tax, the agency you pay, and the percentage for

the rate. Use a single rate if you pay just one rate to a single agency.

5. Select Save.

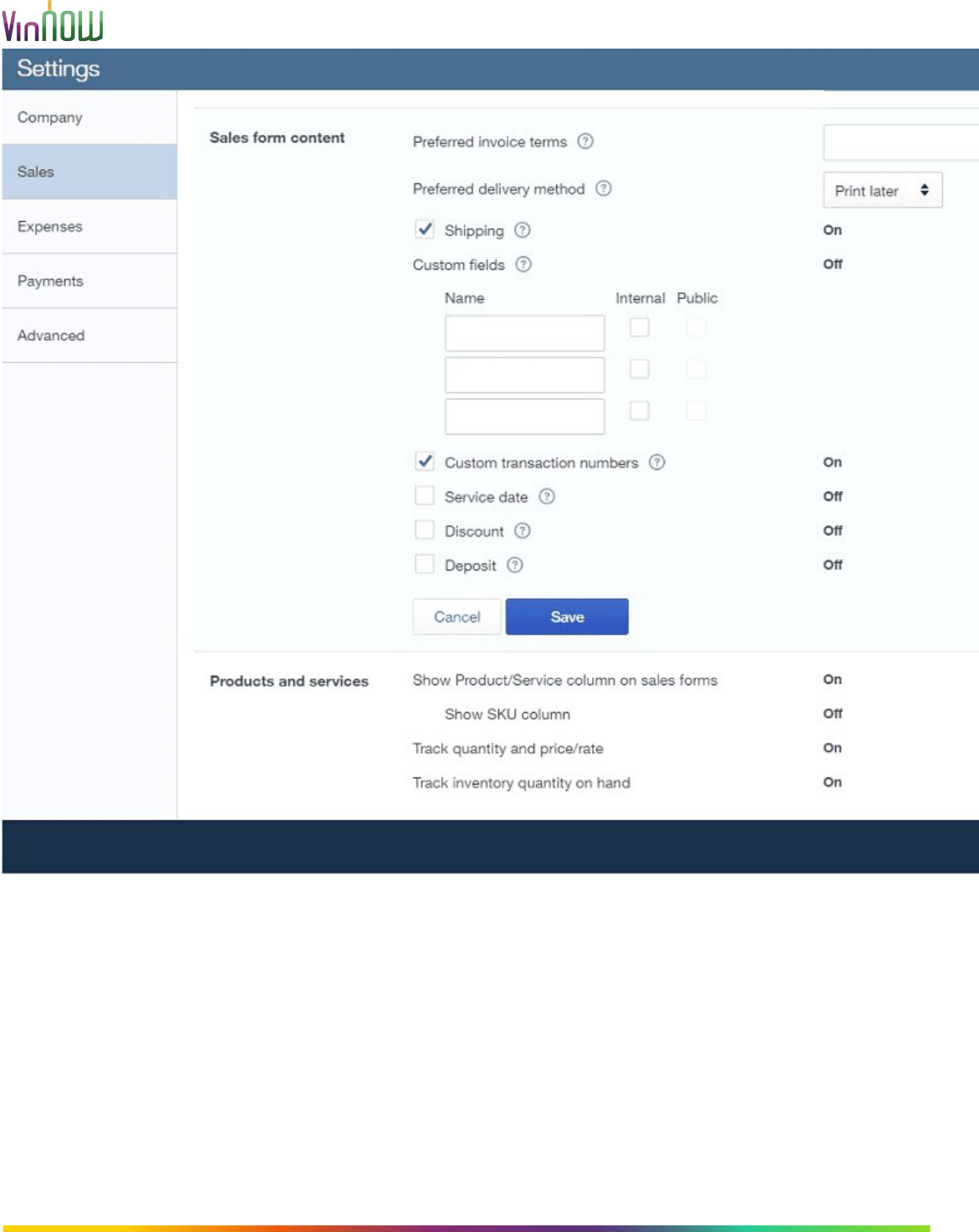

From within the QuickBooks® Online Company Settings screen:

1. On the "Settings Sales" tab: Within the "Sales Form Content" section,

the "Shipping" option should be set to true/checked.

2. On the "Settings Sales" tab: Within the "Sales Form Content" section,

the "Custom Transaction Numbers" option should be set to true/checked.

3. On the "Settings Sales" tab: Within the "Sales Form Content" section,

the "Service Date" option should be set to true/checked.

4. On the "Settings Sales" tab: Within the "Sales Form Content" section,

the "Discount" and "Deposit" options should be left at their default value of

false/unchecked.

5. On the "Settings Sales" tab: Within the "Products and Services"

section, the "Show Product/Service Column on Sales Form” option should be

set to true/checked.

6. On the "Settings Sales" tab: Within the "Products and Services"

section, the "Track Quantity and Price/Rate” option should be set to

true/checked. Failure to check this setting will cause the VinNOW upload of

Products and Invoices to fail

7. On the "Settings Sales" tab: Within the "Products and Services"

section, the "Track Inventory Quantity on Hand” option should be set to

true/checked. Failure to check this setting will cause the VinNOW upload of

Products and Invoices to fail

8. On the "Settings Advanced" tab: Within the "Categories" section, set

"Track Classes" to true/checked. Under "Assign Classes", select the "One to

Entire Transaction" option. The VinNOW Invoice Order Type field is passed to

QuickBooks as a Class.

Copyright 2002-2021 V

W - All Rights Reserved.

9. On the "Settings Advanced" tab: Within the "Categories" section, set

"Track Locations" to true/checked. Choose whichever value you want for the

"Location Label". NOTE: This option is primarily for VinNOW locations that

operate multiple stores. Using this will allow you to filter QBO selections by

individual stores on reports and queries.

10. On the "Settings Advanced" tab: Within the "Chart of Accounts"

section, a value should be selected for the "Shipping Account". QBO defaults

this to "Shipping Income".

11. Under the "Lists - Products and Services" page, make certain that

the "Product Categories" feature is active for your QBO Company. If it is not,

then it needs to be activated prior to any data upload from VinNOW.

Copyright 2002-2021 V

W - All Rights Reserved.

Authorizing VinNOW to Access Your QuickBooks® Online Company

Your VinNOW data is uploaded into your QuickBooks® Online Company by

our VinNOW to QuickBooks® Online integration program. Before we can

upload data to your QBO Company, you must grant authorization to VinNOW

to access your QBO Company data.

This Authorization can only be granted by a User having Administrator rights

within the QuickBooks® Online Company.

Copyright 2002-2021 V

W - All Rights Reserved.

Authorization is a one-time process. Once granted, it is good for 180

days. Within 30 days of Authorization expiration, the VinNOW integration

program will renew the Authorization for another 180 days. This renewal

process should be transparent to the User. In the event the renewal fails,

you will be notified and prompted to manually renew the Authorization.

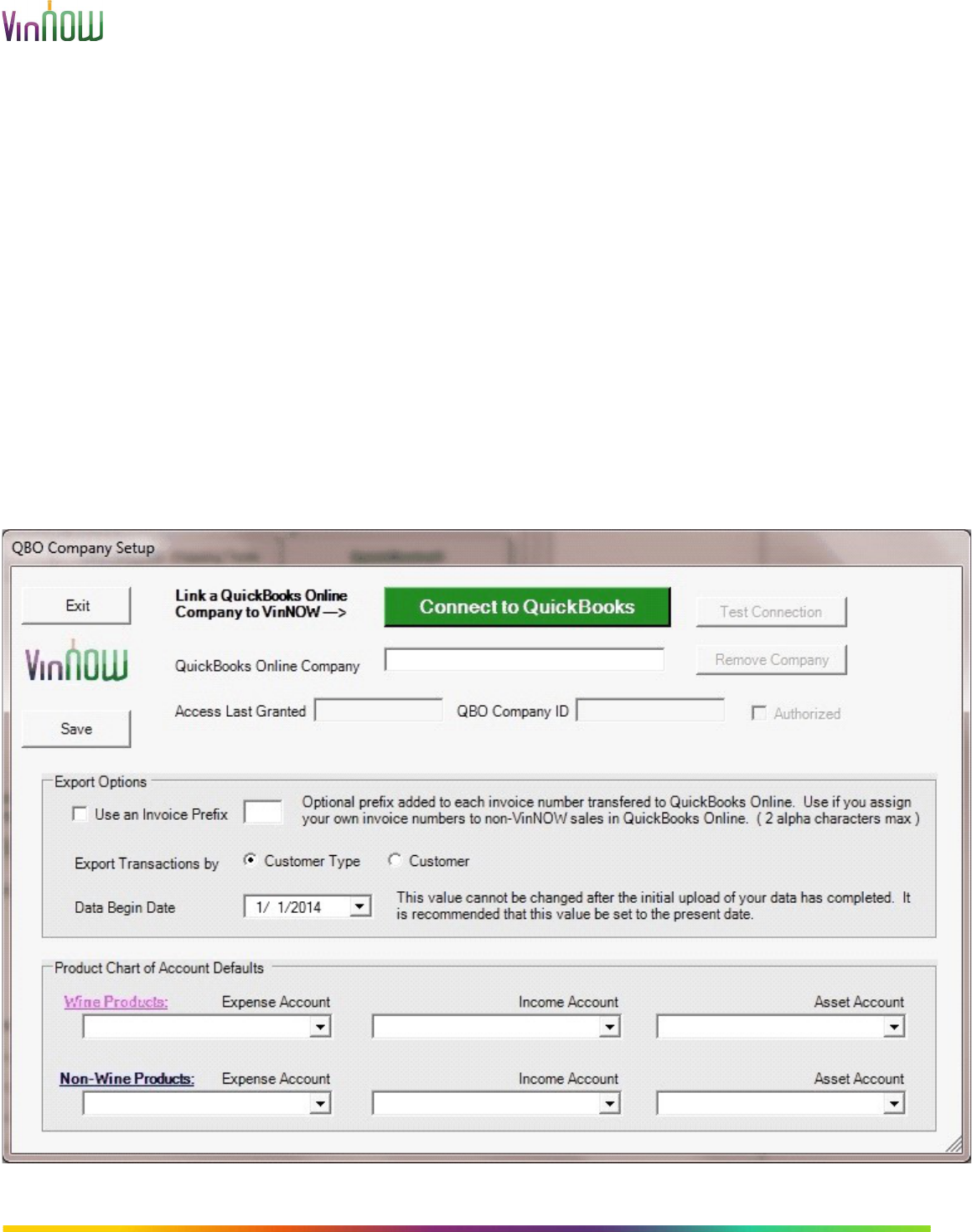

Granting Authorization

The Authorization process is initiated from the QuickBooks® Online Company

Setup form.

On the main Customer Search screen select the Setup / System Option

Settings menu and select the QuickBooks® tab. Click the "QuickBooks®

Online Setup..." button located toward the bottom right of the screen. This

will bring up the QuickBooks® Online Company Setup form

Begin by clicking the green "Connect to QuickBooks".

Copyright 2002-2021 V

W - All Rights Reserved.

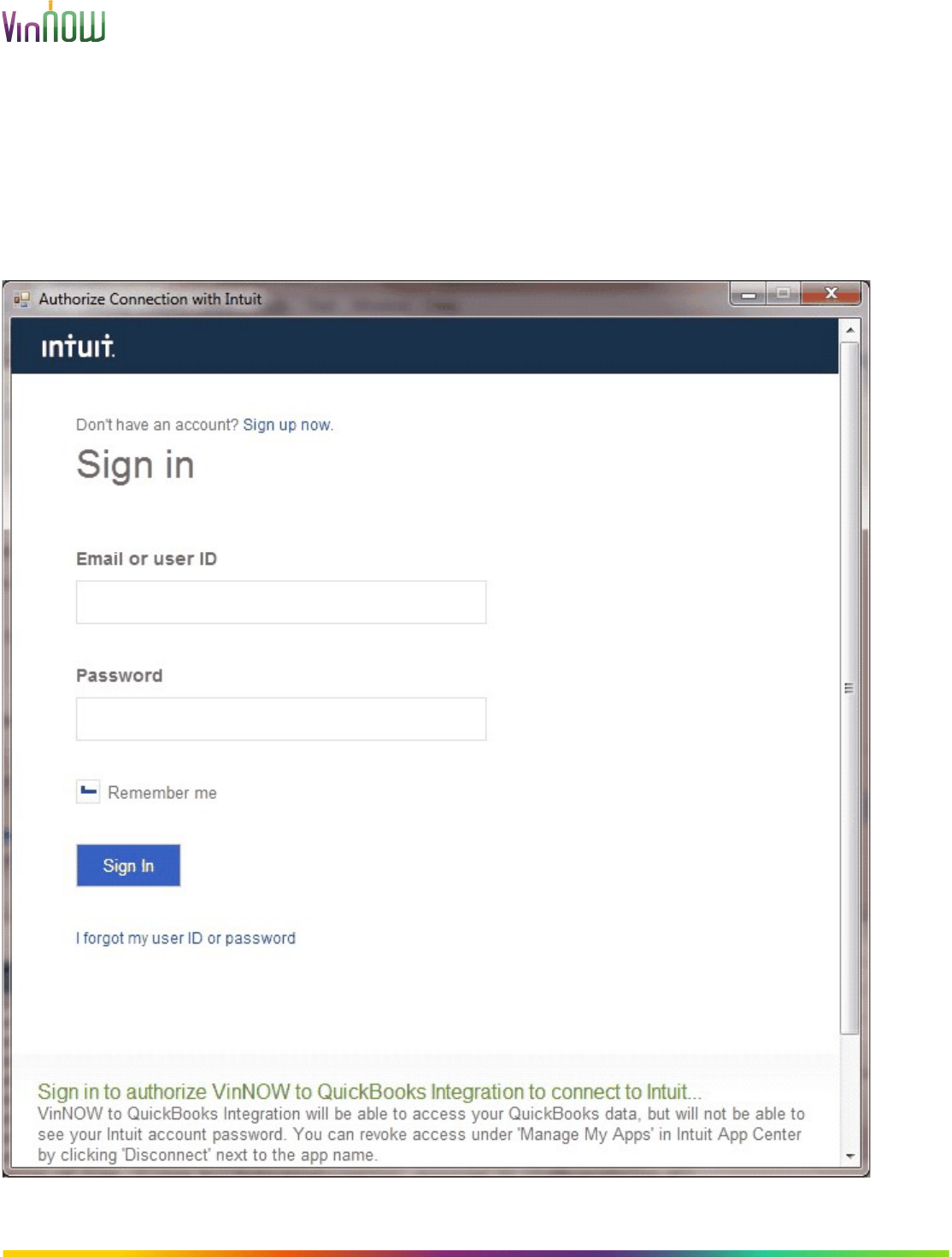

Clicking the green "Connect to QuickBooks" button will brings up the Intuit

Sign In form. Enter the User ID and the Password belonging to the

QuickBooks Online Company you are granting authorization for. Click "Sign

In".

Note: VinNOW Support does not have access at any time to your

passwords and cannot assist you if there is an issue with it.

Copyright 2002-2021 V

W - All Rights Reserved.

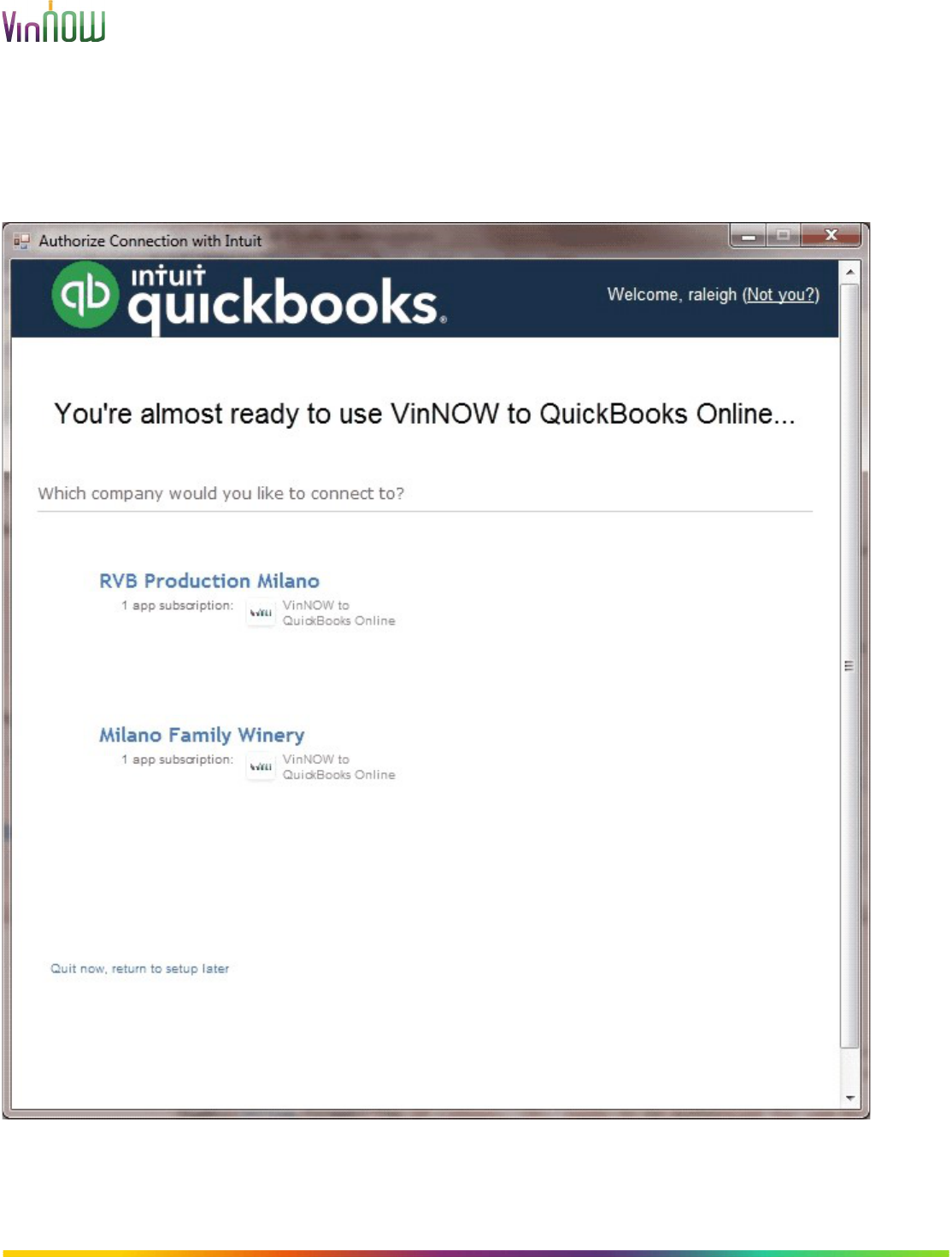

If the login is successful, you will be presented with a list of your QuickBooks

Online Companies. Select the QuickBooks Online Company by clicking on the

Company name.

Copyright 2002-2021 V

W - All Rights Reserved.

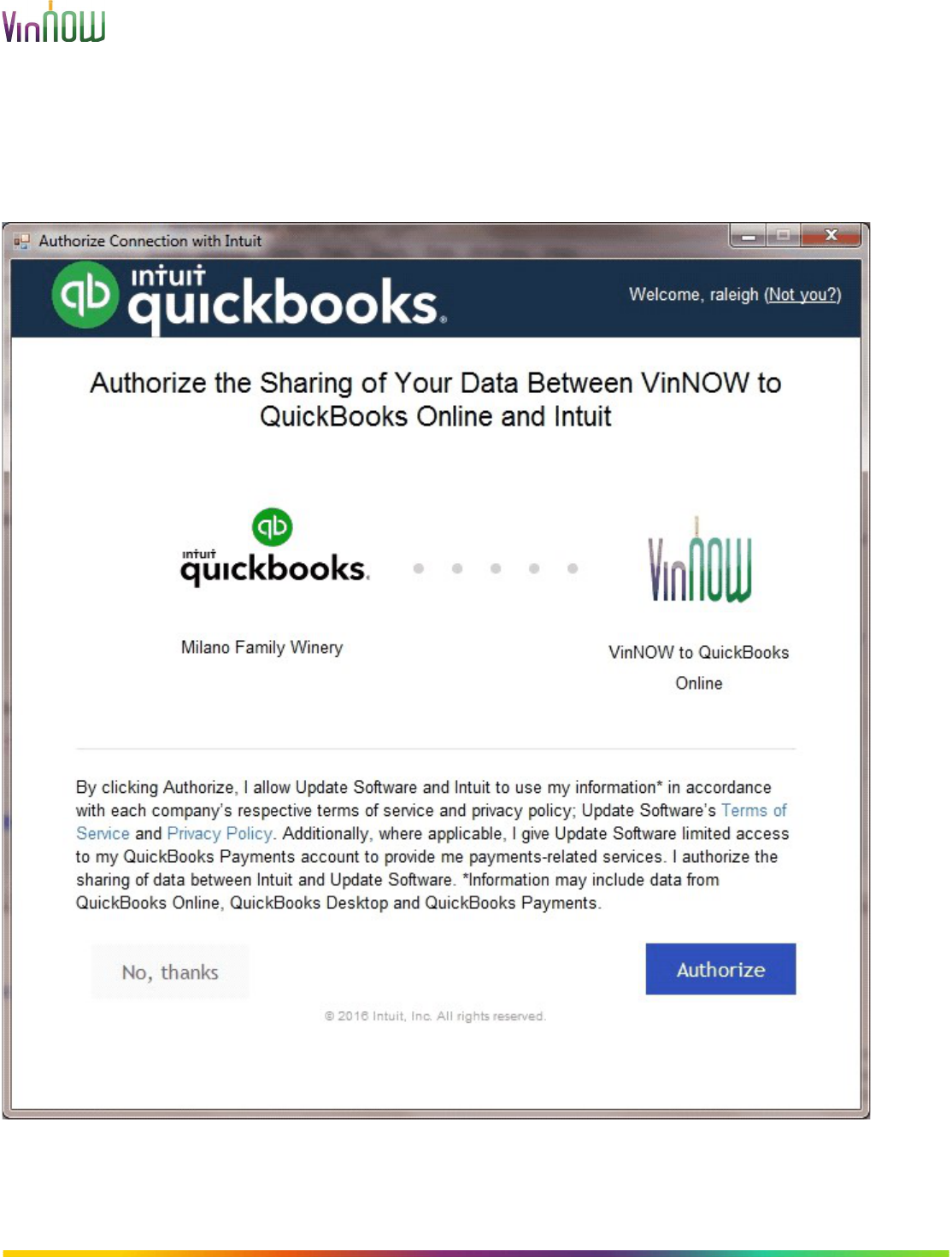

The final form in the authorization process should now be displayed. To

grant authorization to VinNOW, click the "Authorize" button on the displayed

form.

Copyright 2002-2021 V

W - All Rights Reserved.

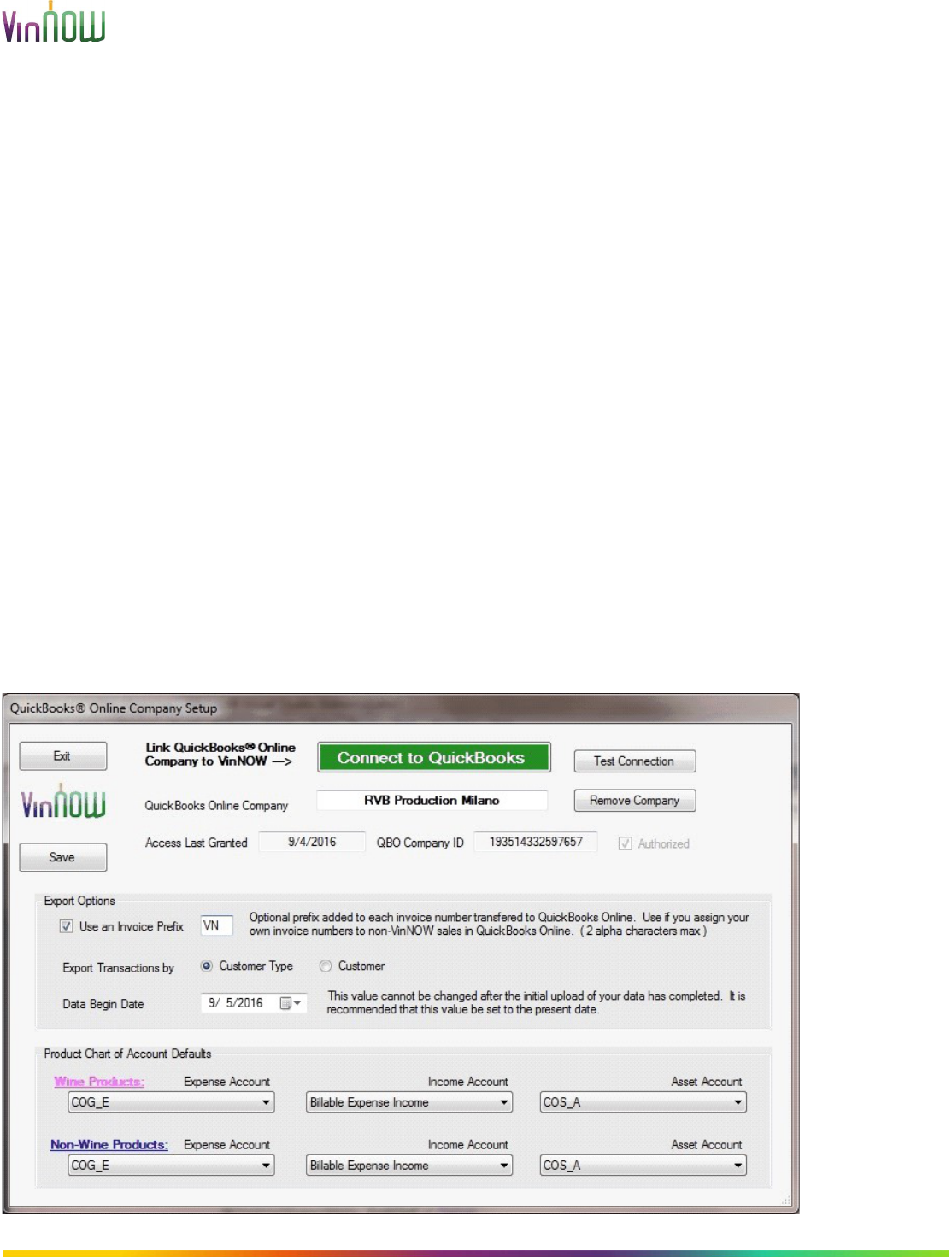

Once the Authorization process is completed, you are returned to the

QuickBooks® Online Company Setup form in VinNOW.

Values should now be displayed for each of the following read-only items on

the form:

QuickBooks Online Company; Access Last Granted; QBO Company ID.

The "Authorized" box should be checked.

If desired, you can check the connection between VinNOW and QuickBooks

Online by clicking the "Test Connection" button.

After successfully completing the Authorization process, the upload options

present on the form should all be set before saving the form by clicking the

"Save" button.

VinNOW Option Settings for QuickBooks® Online Uploads

On the main Customer Search screen select the Setup / System Option

Settings menu and select the QuickBooks® tab. Click the "QuickBooks®

Online Setup..." button located toward the bottom right of the screen. This

will bring up the QuickBooks® Online Company Setup form.

Copyright 2002-2021 V

W - All Rights Reserved.

Export Options:

Use an Invoice Prefix

The Invoice Prefix is an optional setting which will add a prefix to each invoice

uploaded to QuickBooks. If you manually add non-VinNOW invoices into

QuickBooks it is recommended that you set a prefix to insure that your

VinNOW invoices are unique. The value of the prefix is a maximum of 2

alphabetic characters. To activate this option, click on the 'Use an Invoice

Prefix' box and then enter your desired prefix in the adjacent textbox.

Warning: If you manually add non-VinNOW invoices to QuickBooks you need

to make sure the QuickBooks invoice numbers are changed so they will not

conflict with VinNOW invoice numbers that will be uploaded to QuickBooks.

QuickBooks by default will always set the invoice number to the last number

used plus 1, when adding an invoice manually. Therefore if you manually add

an invoice to QuickBooks and the VinNOW prefix is “VN”, you should change

the prefix on the invoice you are adding to insure it will not conflict with a

subsequent data upload from VinNOW.

Export Transactions by

Transaction data can be uploaded to QuickBooks® Online by individual

Customer, or by the associated Customer's Customer Type. The default

setting is to upload using the Customer Type.

The default is to use the Customer Type. This will create a single customer

record in QuickBooks® Online for each VinNOW Customer Type. This means

that all of your invoices uploaded to QuickBooks® Online will be grouped

together by their respective customer type. You will still be able to view the

actual customer name and number because each invoice’s Bill To information

is passed to QuickBooks® Online.

If electing to export by Customer, individual customer records will be created

in QuickBooks® Online. The Customer's full demographics data will exported.

The QuickBooks Customer Name field for customer records created by the

upload program will be in the format: “last name, first name (VinNOW

Customer #)”. For example, VinNOW Customer John Smith #1101 in

QuickBooks will be: Smith, John Smith (1101).

Note: We recommend that unless you absolutely need all of your

VinNOW customer records duplicated in QuickBooks, that you go with

the default of using the Customer Type.

Copyright 2002-2021 V

W - All Rights Reserved.

Data Begin Date

This setting allows you to control how much historical data will be uploaded

into your QuickBooks company file. The Data Begin Date sets the point from

which your VinNOW transaction data (Invoices, Payments) will be selected for

export into QuickBooks® Online during the Initial Upload.

The Initial Upload is used to upload any historic data from VinNOW to

QuickBooks® Online. It also uploads all supporting lists needed for creation

of Invoices and Reports within QuickBooks® Online. Supporting lists include

Products, Payment Terms, Classes, Customers/Customer Types and Vendors.

The Initial Upload is run once. It must complete successfully before any

subsequent exports to QuickBooks® Online can be executed.

Once the Initial Upload has been completed, the 'Data Begin Date' cannot be

changed. Subsequent QBO uploads will be based on the ending date of any

prior upload. That prior end date sets the start point for the next upload. The

upload will select VinNOW data from that date through to the current date.

Note: We highly recommend that you set Transfer beginning date to the

current date or a future date so as to use the VinNOW to QuickBooks upload

feature on a go-forward basis rather than attempt to load historical data into

QuickBooks.

VinNOW Product Chart of Account Settings for QuickBooks® Online

Product Chart of Account Defaults

Each Product uploaded to QuickBooks® Online is required to provide a value

for each of its Asset, Expense and Income general ledger accounts.

The QuickBooks® Online Company Setup form provides controls for setting

the default general ledger account values for your products. There is one set

of controls for Wine products, and another set of controls for NonWine

products. A default value for each account type is required.

The selection list for each general ledger account type is created using

existing accounts from your QBO Company. If there are specific general

ledger accounts that you want your Products linked to, they should be created

in QBO prior to completing the QBO Company Setup form in VinNOW. The

only values included in an account selection list are the account names for the

applicable general ledger account type (asset, expense, income) being set.

Copyright 2002-2021 V

W - All Rights Reserved.

If no general ledger accounts are available from the QBO Company for any

account type, then our program will create one. That account name will be

based on the account type. Something along the lines of “VN Proxy Asset" for

asset account type. Or "VN Proxy Expense" for expense account type.

For any VinNOW Product uploaded to QBO, its general ledger account values

will be set to the default values set on this form. Please note that a Product's

account values can be modified from within the QuickBooks® Online

program.

For VinNOW Users who have set their Product's general ledger account values

for the Desktop version of QuickBooks®. The upload program will attempt to

use those account values for each Product as it is uploaded to QuickBooks®

Online. Those general ledger accounts will be created in QBO if they do not

already exist. If necessary, to avoid duplicate names, our program may

modify the account name by appending it with an account qualifier of _A, _E

or _R. Denoting respectively: Asset, Expense, Income/Revenue account.

Uploading Data From VinNOW To QuickBooks® Online

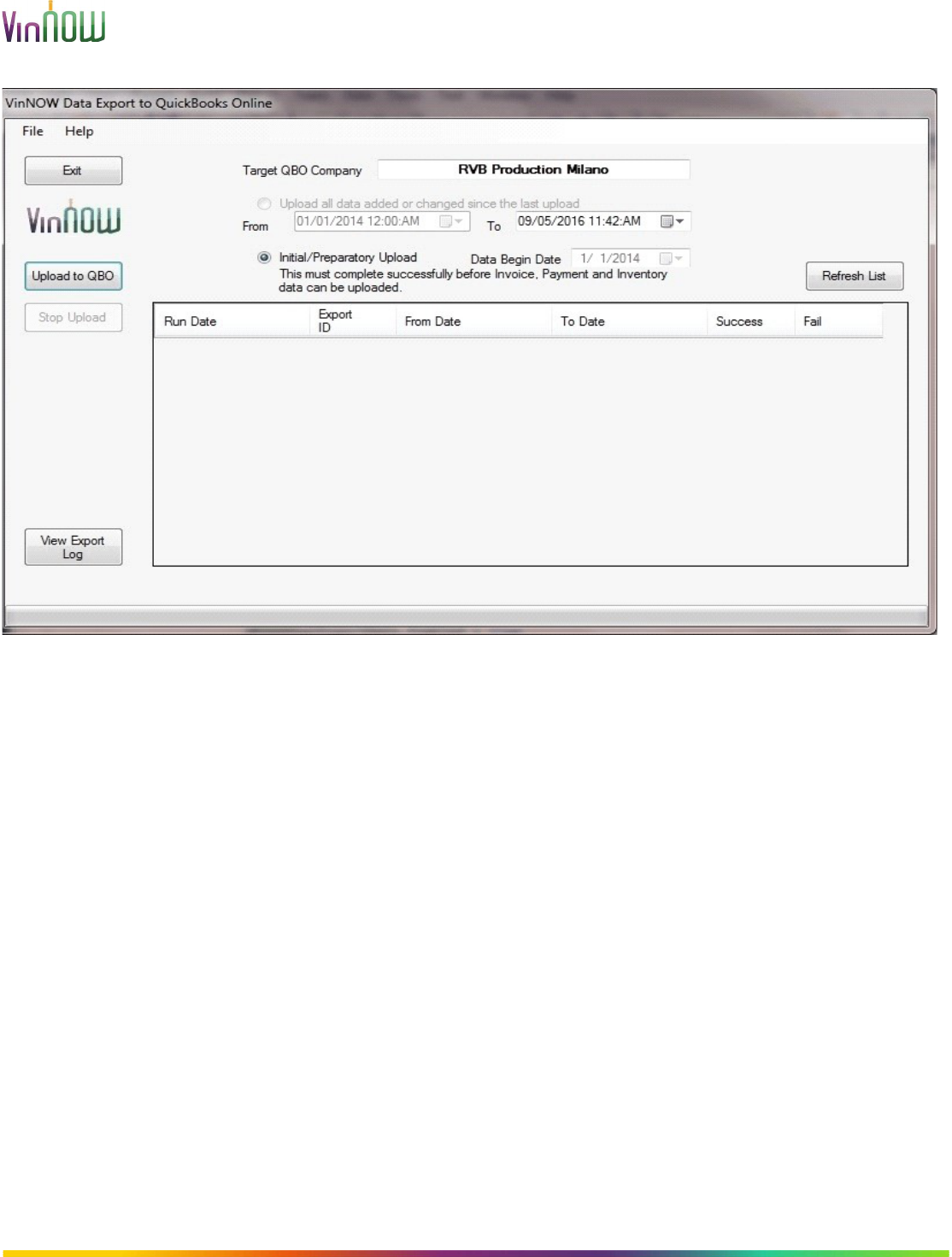

Initial Upload:

The first upload to QuickBooks® Online is the Initial Upload. The initial

upload will lay the groundwork in QBO so that subsequent uploads of Invoices

and Payments can occur.

The form is accessed by clicking the "QuickBooks® Online Data Transfer..."

item under the VinNOW Utilities menu.

Copyright 2002-2021 V

W - All Rights Reserved.

For the Initial Upload, the only relevant date on the form is the "Data Begin

Date". This value should be set to the earliest date that your VinNOW Orders

must have to be selected for export to QBO. This date value can be set only

from the "QuickBooks® Online Company Setup" form.

Clicking the "Upload to QBO" button will present a confirmation dialog. Upon

confirming that you want the export to continue, the export of your VinNOW

data will begin. The initial upload process can take a substantial amount of

time, depending upon the number of Customer, Invoice and Payment records

selected for export.

Once the export begins the form will display a progress bar to indicate how

many records have been exported out of the total that are selected for

export. Text messages are displayed to detail which Invoice / Payment is

currently being uploaded.

If the export must be stopped, click the "Stop Upload" button.

Copyright 2002-2021 V

W - All Rights Reserved.

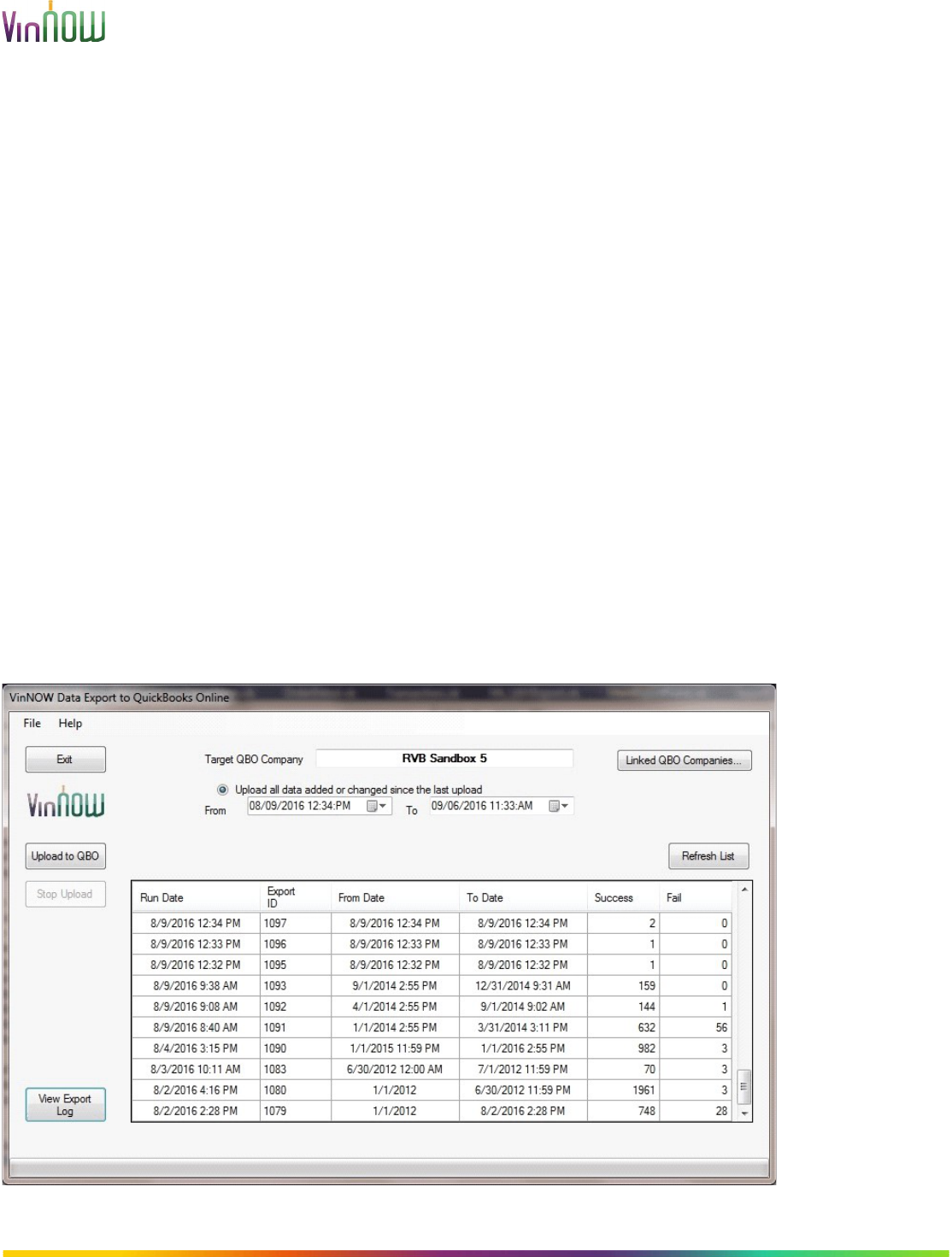

Transaction Uploads:

Once the Initial Upload has successfully completed, the data selected for

export to QBO is based on a date range. That range begins with the most

recent successful export date and ends with the current date. Only records

that have been ADDED or UPDATED within that date range will be selected for

export to QBO.

Both ends of the export date range are determined by the VinNOW program.

Clicking the "Upload to QBO" button will present a confirmation dialog. Upon

confirming that you want the export to continue, the export of your VinNOW

data will begin.

Once the export begins the form will display a progress bar to indicate how

many records have been exported out of the total that are selected for

export. Text messages are displayed to detail which Invoice / Payment is

currently being uploaded.

Copyright 2002-2021 V

W - All Rights Reserved.

The Export Log

A log, or report, of the records exported to QBO is available from the form by

clicking the "View Export Log" button. Prior to clicking the button, you must

select a row in the grid to indicate the export the report will be based on.

The Export Log can also be run using the "QuickBooks® Online Upload Log"

item under the VinNOW "Reports 2" menu. This method provides numerous

filters that you can apply to the report data.

Running the Export Log report for any QBO export that has a fail count will

allow you to see a description of why the attempted transaction failed. In

most cases, the description should provide enough information for the User to

resolve the issue. It that resolution results in a change to VinNOW data, then

the associated record should be selected as part of the next export to QBO.