Federal Trade Commission

October 18, 2022

Protecting

Older

Consumers

2021–2022

A Report of the

Federal Trade Commission

Protecting

Older Consumers

2021–2022

A Report of the Federal Trade Commission

October 18, 2022

FEDERAL TRADE COMMISSION

Lina M. Khan, Chair

Noah Joshua Phillips, Commissioner

Rebecca Kelly Slaughter, Commissioner

Christine S. Wilson, Commissioner

Alvaro M. Bedoya, Commissioner

Contents

I. Introduction ...................................................................................................... 1

II. FTC Enforcement Activities Affecting Older Consumers ........................... 2

A. Enforcement Actions .......................................................................................................3

B. Case Resolutions .............................................................................................................6

C. Other Enforcement Highlights ........................................................................................9

1. Covid-19 Demand Letters ...........................................................................................9

2. Consumer Monetary Relief .......................................................................................11

3. Criminal Liaison Unit ...............................................................................................15

4. Referrals to the FBI’s Recovery Asset Team ...........................................................16

D. FTC Strategies to Provide Additional Tools to Enhance FTC Enforcement Efforts ....18

1. Advance Notice of Proposed Rulemaking on Impersonation of

Government and Business.........................................................................................18

2. Advance Notice of Proposed Rulemaking on Deceptive or

Unfair Earnings Claims.............................................................................................20

3. Advance Notice of Proposed Rulemaking on the Telemarketing Sales Rule ...........21

III. Outreach and Education Activities .............................................................. 22

A. Pass It On Education Campaign ....................................................................................22

B. Outreach Relating to Older Adults ................................................................................23

1. AARP members ........................................................................................................24

2. Senior Medicare Patrol Volunteers ...........................................................................24

3. Members of Congress ...............................................................................................24

4. Consumer Financial Protection Bureau, SAGE, and others .....................................24

5. Older Adult Advocates and Allied Professionals .....................................................24

C. Pandemic Response .......................................................................................................25

IV. Developing Effective Strategies to Protect Older Consumers ................... 26

A. Research and Data Analysis ..........................................................................................26

1. Consumer Sentinel Reports from Older Adults ........................................................27

2. Analysis of Social Security Administration Scam Reports ......................................43

3. Hearing Directly from Older Adults About FTC Impersonators ..............................45

B. Coordinated Efforts to Protect Older Consumers ..........................................................46

V. Conclusion ....................................................................................................... 48

Appendix A - Federal Trade Commission FY 2022 ........................................... 49

FEDERAL TRADE COMMISSION FTC.GOV 1

I. Introduction

The Federal Trade Commission (“FTC” or “Commission”) is the nation’s primary

consumer protection agency and has a broad mandate to protect consumers from unfair and

deceptive acts or practices in the marketplace. Protecting older consumers

1

continues to be one

of the FTC’s top priorities, which it pursues using a multi-pronged approach.

2

First, it files law

enforcement actions to stop unlawful practices and, when possible, return money to consumers.

3

Given the ongoing global health crisis, the FTC continues to focus on schemes that capitalize on

the fears and economic uncertainty of the pandemic to deceptively peddle products related to the

prevention and treatment of COVID-19. This year the FTC also initiated several important

rulemakings on topics impacting older adults to bolster its ability to return money to consumers

in light of the impact of the Supreme Court’s ruling in AMG Capital Management v. FTC.

4

Second, the FTC continues to employ innovative education and outreach campaigns that

reach older adults throughout the country. These important efforts help consumers protect

themselves against emerging frauds and alert them to prevalent consumer protection issues. As

the population of older adults grows, the FTC’s outreach mission to help consumers protect

themselves and their communities becomes increasingly important.

5

1

This report refers to persons 60 and older when using the terms “older adults” or “older consumers” to be

consistent with the requirements in Section 2(1) of the Elder Abuse Prevention and Prosecution Act, which

references Section 2011 of the Social Security Act (42 U.S.C. 1397j(5)) (defining “elder” as an individual age 60 or

older).

2

This report focuses on the Bureau of Consumer Protection’s work to protect older adults. The FTC’s Bureau of

Competition also serves older adults through its work in various sectors of the economy, such as health care,

consumer products and services, technology, manufacturing, and energy. The primary drafters of this staff report are

Michelle Chua, Division of Marketing Practices; Emma Fletcher, Division of Consumer Response and Operations;

and Bridget Small, Division of Consumer and Business Education. Additional acknowledgement goes to Kati

Daffan, Patti Poss, and Patricia Hsue, Division of Marketing Practices; Karen Mandel and Christine DeLorme,

Division of Advertising Practices; Jennifer Leach and Marlena Patterson, Division of Consumer and Business

Education; Shiva Koohi and Michel Grosz, Bureau of Economics; and Summer Law Clerk Tyler Ritchie. This report

reflects the work of staff throughout the Federal Trade Commission’s Bureau of Consumer Protection and its

Regional Offices, with much of the work stemming from the FTC’s Every Community Initiative. Lois C. Greisman

is the FTC’s Elder Justice Coordinator.

3

The FTC has wide-ranging law enforcement responsibilities under the Federal Trade Commission Act, 15 U.S.C. §

41 et seq. and enforces a variety of other laws ranging from the Telemarketing and Consumer Fraud and Abuse

Prevention Act to the Fair Credit Reporting Act. In total, the Commission has enforcement or administrative

responsibilities under more than 70 laws. See http://www.ftc.gov/ogc/stats.shtm

.

4

AMG Capital Mgmt., LLC v. FTC, 593 U. S. ___; 141 S. Ct. 1341 (2021) (holding that Section 13(b) of the FTC

Act does not authorize federal courts to require defendants to refund monies to consumers or give up unjust gains).

FEDERAL TRADE COMMISSION FTC.GOV 2

Finally, the FTC conducts research and collaborates with a diverse array of partners, which

inform the strategies it employs to help ensure that its efforts achieve the maximum benefits for

consumers, including older adults. For example, the FTC’s analysis of fraud and other reports

filed by consumers nationwide helps the agency understand and respond to patterns and trends

related to older adults, including the differences in how older adults in different demographic

populations may experience fraud.

The FTC submits this fifth annual report to the Committees on the Judiciary of the United

States Senate and the United States House of Representatives to fulfill the reporting requirements

of Section 101(c)(2) of the Elder Abuse Prevention and Prosecution Act of 2017.

6

The report

details the FTC’s recent comprehensive efforts to protect older consumers. The report also

includes, pursuant to the law’s requirements, a list in Appendix A of every administrative and

federal district court action filed in the last year that has impacted older adults.

7

II. FTC Enforcement Activities Affecting Older

Consumers

Aggressive law enforcement is a key component in the FTC’s efforts to protect older

consumers. Nearly all FTC enforcement actions involve numerous consumers of all ages, and

while the actual ages of people affected in a given case are not typically known, in the

Commission’s view, older adults are among those affected in every consumer protection case

filed this past fiscal year. Therefore, Appendix A to this report lists all new enforcement actions

brought by the FTC between October 1, 2021, and September 30, 2022. The cases listed in

Appendix A involve a wide range of matters, including allegations regarding money transfer

services, business opportunity and money-making schemes, unsubstantiated product claims, false

claims about COVID-19 treatment or prevention, and more.

8

5

The Census Bureau projects that by 2030 all baby boomers will be older than 65 and “one in every five Americans

is projected to be [at] retirement age.” See Jonathan Vespa, Lauren Medina, and David M. Armstrong, U.S. Dep’t of

Commerce, U.S. Census Bureau, Demographic Turning Points for the United States: Population Projections for

2020 to 2060 (Mar. 2018, Rev. Feb. 2020), at 1, available at

https://www.census.gov/content/dam/Census/library/publications/2020/demo/p25-1144.pdf

.

6

Public Law 115–70, 115th Congress (enacted Oct. 18, 2017).

7

The law requires the FTC Chair to file a report listing the FTC’s enforcement actions “over the preceding fiscal

year in each case in which not less than one victim was an elder or that involved a financial scheme or scam that was

either targeted directly toward or largely affected elders.” Given the large number and broad range of consumers

affected in FTC actions, this report includes, in Appendix A, a list of every administrative and federal district court

action filed in the one-year period.

8

This list includes cases involving violations of children’s privacy laws. The perpetrators of such schemes may not

typically target older adults, but the cases are listed because they involve large and diverse groups of consumers.

The affected consumers may include an older parent or grandparent caring for children who go online and wish to

protect their privacy.

FEDERAL TRADE COMMISSION FTC.GOV 3

This section highlights five enforcement actions filed within the last fiscal year where the

Commission notes a significant impact on older adults. Also listed are additional agency actions

that affected older consumers, including case resolutions, cease and desist demand letters,

consumer refunds, and subsequent criminal action by other agencies relating to FTC matters.

This section also describes the Commission’s issuance of three advance notices of proposed

rulemakings (“ANPRs”), as part of its ongoing efforts and strategies to provide better tools to

enhance its law enforcement efforts. It discusses how the three proposed rulemakings are

relevant to certain critical areas that heavily impact older adults.

A. Enforcement Actions

The Commission filed the following new enforcement actions in the last fiscal year that

likely had a significant impact on older adults:

In Walmart Inc., the FTC sued Walmart for alleged practices that allowed its money

transfer services to be used for fraud.

9

The complaint asserted, among other things, that older

consumers were financially exploited by telemarketing scams that made use of money transfers

from Walmart stores. The FTC complaint alleged,

In many cases, older consumers (ages 65 and older) have been financially exploited by

sending money transfers in connection with common telemarketing scams, such as

grandparent scams,

10

Good Samaritan scams, lottery or prize scams, and romance scams,

from Walmart locations. The average loss suffered by older consumers is usually greater

than for younger consumers. In addition, perpetrators of the scams, or those acting on

their behalf, including fraud rings and money mules, frequently collect the proceeds of

the frauds from Walmart locations, and in some instances, those individuals have even

been employees of Walmart.

The complaint further stated that among all of MoneyGram’s complaints of fraud that involved

Walmart from 2013 to 2018, MoneyGram reported 19,035 complaints about person-in-need or

grandparent scams, more than any other single category. The complaint also alleged that at one

location in Teterboro, New Jersey, 72.6 percent of complaints about fraud-induced transfers

involved the grandparent or emergency scam.

Money transfers have long been a common vehicle for fraud targeting older consumers.

According to the FTC’s complaint, Walmart has been a particularly popular processor for

fraudulent money transfers, in large part because of Walmart’s ineffective, poorly enforced anti-

9

FTC v. Walmart Inc., No. 1:22-cv-3372 (N.D. Ill., filed June 28, 2022) (The Commission vote to file the civil

penalty complaint was 3-2.), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/182-3012-

walmart-ftc-v.

10

In a “grandparent scam,” the caller pretends that a relative is in distress due to a legal or medical emergency and

asks the victim to send money immediately.

FEDERAL TRADE COMMISSION FTC.GOV 4

fraud policy.

11

The FTC alleged that many of the Walmart staff handling money transfers had

insufficient training or no anti-fraud training at all; Walmart employees were told “If you suspect

fraud, complete the transaction.” Walmart allegedly adopted this practice despite knowing that

once the money transfers were paid out to suspected fraudsters, fraud victims usually could not

get their money back. The FTC is seeking to obtain redress for consumers, as well as

civil penalties.

In Universal Guardian Acceptance, LLC (“UGA”), the FTC brought an action against

defendants that had allegedly serviced and funded payment plans for expensive and often

ineffective investment “trainings.”

12

The case arose out of previously settled litigation against

Online Trading Academy (“OTA”), a company that allegedly targeted older consumers with an

investment trading strategy based on false or unfounded earnings claims.

13

According to the

FTC, OTA had secured payment through the use of short-term, high-interest retail installment

contracts.

14

The FTC alleged that UGA facilitated OTA’s deceptive scheme by underwriting,

funding, and servicing OTA’s retail installment contracts. The FTC further alleged that UGA

ignored red flags that OTA was engaged in deception, including consumer complaints, a high

cancellation rate, and the fact that the vast majority of purchasers were not paying off their debt

within the six month no-interest grace period included in the contracts. The terms of the

settlement required the UGA defendants to offer debt forgiveness to OTA purchasers whose debt

was held by UGA. The settlement also requires the defendants to screen prospective clients that

claim consumers can make money using their products or services, and to monitor such clients’

transactions and business practices.

In Gravity Defyer, the FTC filed suit against a footwear company, claiming that the

company made deceptive pain relief claims about its products.

15

The FTC alleged that the

defendants targeted older adults suffering from arthritis, joint pain, and other medical

conditions.

16

The company claimed in its marketing to offer “clinically proven pain defying

11

Press Release, FTC, FTC Sues Walmart for Facilitating Money Transfer Fraud That Fleeced Customers Out of

Hundreds of Millions (June 28, 2022), available at

https://www.ftc.gov/news-events/news/press-

releases/2022/06/ftc-sues-walmart-facilitating-money-transfer-fraud-fleeced-customers-out-hundreds-millions.

12

FTC v. Universal Guardian Acceptance, LLC, No. 21-8260 (C.D. Cal., filed Oct. 19, 2021), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/2123021-universal-guardian-acceptance-llc

.

13

FTC v. OTA Franchise Corporation, No. 8:20-cv-287 (C.D. Cal., filed Feb. 12, 2020), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/182-3175-x200032-online-trading-academy

.

14

Press Release, FTC, Funder and Servicer of Online Trading Academy Payment Plans Will Forgive Debt in

Settlement with FTC (Oct. 21, 2021), available at

https://www.ftc.gov/news-events/news/press-

releases/2021/10/funder-servicer-online-trading-academy-payment-plans-will-forgive-debt-settlement-ftc.

15

FTC v. Gravity Defyer Medical Technology Corporation, No. 1:22-cv-01464 (D.D.C., filed May 25, 2022),

available at https://www.ftc.gov/legal-library/browse/cases-proceedings/1923117-gravity-defyer-ftc-v

.

FEDERAL TRADE COMMISSION FTC.GOV 5

footwear,” but the FTC asserted that it lacked competent and reliable scientific evidence to

support such a claim. According to the FTC complaint, the defendants claimed that the unique

technology in the soles of their shoes would relieve knee, back, and foot pain, as well as pain in

people suffering from plantar fasciitis, arthritis, joint pain, and heel spurs. The owner of Gravity

Defyer was previously barred from deceptive advertising by a 2001 FTC order, and the FTC

alleged that the Gravity Defyer advertisements were violations of that order.

Excerpt of Advertisement from Gravity Defyer

17

False claims about COVID-19 treatment and prevention products continue to pose a

threat to the health and finances of older adults.

18

In two instances, the FTC has used its

16

Press Release, FTC, Federal Trade Commission Sues Gravity Defyer and its Owner for Violating FTC Order and

Making Baseless Pain-Relief Claims to Market Footwear (June 7, 2022), available at

https://www.ftc.gov/news-

events/news/press-releases/2022/06/federal-trade-commission-sues-gravity-defyer-its-owner-violating-ftc-order-

making-baseless-pain-relief-claims.

17

FTC v. Gravity Defyer, supra n.15, Complaint ¶ 25, Exhibit B.

18

Not only are older adults more likely to get sick from COVID, they are also more likely to face drastic health-

related consequences as a result. See Center for Disease Control and Prevention Guidance (Updated Aug. 2, 2021),

available at https://www.cdc.gov/coronavirus/2019-ncov/need-extra-precautions/older-adults.html

.

FEDERAL TRADE COMMISSION FTC.GOV 6

authority under the COVID-19 Consumer Protection Act to seek civil penalties in actions against

entities for deceptively pitching products that purported to treat or cure COVID-19.

In Xlear, Inc., the FTC asserted that the defendant falsely marketed its nasal sprays as

effective ways to prevent and treat COVID-19.

19

According to the FTC, Xlear promoted its

sprays by falsely claiming they can provide four hours of protection against infection from the

coronavirus and called them “a simple, safe, and cheap option that could be an effective solution

to the pandemic,” among other claims.

20

Another ad claimed that “Xlear nasal spray provides

additional tested protection for up to four hours, helping keep you and others around you safe.”

The FTC alleged that the defendants’ advertising grossly misrepresented the purported findings

and relevance of several scientific studies. Even after a warning letter from the FTC in 2020 to

stop its unlawful advertising, the defendants continued to make such statements on their website

and social media pages, even modifying or removing the unlawful claims, only to reinstate them

or add additional deceptive statements later, according to the complaint. The lawsuit was filed by

the Department of Justice on the behalf of the FTC and asks for monetary penalties and an order

barring the defendants from making false and unsupported claims.

In B4B Earth Tea LLC, the Department of Justice filed a complaint on behalf of the FTC

and FDA alleging that the defendants had falsely claimed their product was clinically proven to

treat, cure, and prevent COVID-19.

21

According to the complaint, the defendants claimed that

the defendants’ tea, which sells for $60 for a 16-ounce bottle, could cure COVID-19 in 24 to 48

hours.

22

Ads claimed that the tea was completely effective at preventing hospitalization (“100%

effective with 0 side effects”) and specifically claimed that it was better than vaccination

(“Vaccines trial shows preventing hospitalization is 85%-96% while so far Earth Tea Extra

Strength is 100%...”). According to the complaint, those health claims were unsubstantiated

because the single small study cited by the defendants did not meet the standard of competent

and reliable scientific evidence.

B. Case Resolutions

The Commission reached resolution in four pending cases involving older adults in the

last fiscal year.

19

U.S. v. Xlear, Inc., No. 2:21-cv-00640-RJS (D. Utah, filed Oct. 28, 2021), available at https://www.ftc.gov/legal-

library/browse/cases-proceedings/2123045-xlear-inc.

20

Press Release, FTC, FTC Sues Utah-based Company for Falsely Claiming Its Nasal Sprays Can Prevent and

Treat COVID-19 (Oct. 28, 2021), available at

https://www.ftc.gov/news-events/news/press-releases/2021/10/ftc-

sues-utah-based-company-falsely-claiming-its-nasal-sprays-can-prevent-treat-covid-19.

21

U.S. v. B4B Earth Tea LLC, no. 22-CV-1159 (E.D.N.Y., filed Mar. 3, 2022), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/2223007-b4b-corp

.

22

Press Release, FTC, FTC, DOJ, and FDA Take Action to Stop Marketer of Herbal Tea from Making False

COVID-19 Treatment Claims (Mar. 3, 2022), available at

https://www.ftc.gov/news-events/news/press-

releases/2022/03/ftc-doj-fda-take-action-stop-marketer-herbal-tea-making-false-covid-19-treatment-claims.

FEDERAL TRADE COMMISSION FTC.GOV 7

In GDP Network LLC, the FTC and the Office of the Attorney General of Florida

reached a settlement with the operators of an alleged credit card interest rate reduction scam.

23

The complaint, filed in July 2020, alleged that the defendants made telemarketing calls in which

they promised to permanently and substantially reduce the consumer’s credit card interest

rates.

24

After posing as representatives or affiliates of consumers’ credit card companies, the

defendants allegedly claimed they could save consumers thousands of dollars in credit card

interest, thereby allowing them to pay off their debt much faster. All these claims were false or

unsubstantiated, according to the complaint. At most, the defendants sometimes opened new

credit card accounts at low introductory rates and transferred consumers’ existing debt to the new

cards. Instead of producing the savings that customers expected, the defendants’ service

allegedly often left people even deeper in debt after they paid upfront fees of between $995 and

$4,995, as well as substantial fees to transfer their existing debt to new cards.

As part of the court

order, the defendants will be permanently banned from the debt relief industry. According to the

complaint, the defendants often targeted financially distressed consumers and older adults.

In RagingBull.com, the FTC reached a settlement with an online stock trading site in a

case filed in December 2020.

25

According to the complaint, the company falsely advised

consumers that by joining its program they could make a substantial income without a lot of

time, money, or experience.

26

The complaint further alleged that the company made it difficult

for consumers to cancel their subscriptions. According to the FTC, consumers lost more than

$197 million in subscription fees for defendants’ services. Those consumers included retirees,

older adults, and immigrants. As part of the stipulated final order, the Raging Bull defendants

were required to pay over $2.4 million, end the earnings deception, get affirmative approval from

customers for subscription sign-ups, and provide them with a simple method to cancel recurring

charges. The FTC is planning to use funds collected in this matter to provide redress to

affected consumers.

23

Press Release, FTC, Operators of Credit Card Interest Rate Reduction Scam Permanently Banned from Debt

Relief Business Under Settlement with the FTC and Florida Attorney General (Feb. 28, 2022), available at

https://www.ftc.gov/news-events/news/press-releases/2022/02/operators-credit-card-interest-rate-reduction-scam-

permanently-banned-debt-relief-business-under.

24

FTC and Office of the Attorney General, State of Florida v. GDP Network LLC, no. 6:20-cv-1192-78DCI (M.D.

Fla., filed July 6, 2020), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3137-gdp-

network-llc-yf-solution.

25

Press Release, FTC, Online Investment Site to Pay More Than $2.4 Million for Bogus Stock Earnings Claims and

Hard-to-Cancel Subscription Charges (Mar. 8, 2022), available at

https://www.ftc.gov/news-events/news/press-

releases/2022/03/online-investment-site-pay-more-24-million-bogus-stock-earnings-claims-hard-cancel-

subscription.

26

FTC v. RagingBull.com, No. 1:20-cv-3538 (Dec. 7, 2020), available at https://www.ftc.gov/legal-

library/browse/cases-proceedings/2023073-ragingbullcom.

FEDERAL TRADE COMMISSION FTC.GOV 8

In Health Research Laboratories, LLC, the FTC settled an administrative complaint

filed in 2020.

27

The complaint alleged that the respondents marketed their supplements, the

Ultimate Heart Formula, BG18, and Black Garlic Botanicals, as being able to prevent or treat

cardiovascular disease, without appropriate substantiation.

28

The FTC also alleged that

respondents made unsubstantiated claims that their supplement Neupathic could cure, mitigate,

or treat diabetic neuropathy. The settlement banned the companies and their owner from

advertising or selling dietary supplements and from making claims their products treat, cure, or

reduce the risk of disease. In 2017, the owner of the companies and Health Research

Laboratories had settled a previous complaint by the FTC and the State of Maine for deceptive

marketing of health products.

In Electronic Payment Systems (“EPS”), the FTC finalized an order against EPS for

allegedly opening credit card processing merchant accounts for fictitious companies on behalf of

Money Now Funding, a business opportunity scam that the FTC sued in 2013.

29

In the Money

Now Funding case, the FTC alleged that “many victims affected by this scam are seniors with

limited income and savings.”

30

In the FTC’s complaint against EPS, the FTC alleged that by

ignoring warning signs that the merchants were fake, EPS assisted and facilitated Money Now

Funding in laundering more than $4.6 million of consumers’ credit card payments through

different bank accounts for fictitious companies on behalf of the scammers from 2012 to 2013.

31

Under the terms of the settlement order, the respondents are prohibited from providing payment

processing services to any merchant that is, or is likely to be, engaged in deceptive or misleading

conduct, and any merchant that credit card industry monitoring programs have flagged as high-

risk for certain reasons. The respondents are also required to conduct detailed screening of

potential merchants who conduct outgoing telemarketing or are engaged in certain activities that

could harm consumers.

32

27

In the Matter of Health Research Laboratories, LLC, No. 9397 (FTC filed Nov. 13, 2020), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/x180007-health-research-laboratories-llc-matter

.

28

Press Release, FTC, FTC Finalizes Order Banning Deceptive Marketing by Supplement Seller (June 30, 2022),

available at

https://www.ftc.gov/news-events/news/press-releases/2022/06/ftc-finalizes-order-banning-deceptive-

marketing-supplement-seller?utm_source=govdelivery.

29

Press Release, FTC, Federal Trade Commission Finalizes Order Against Electronic Payment Systems for

Opening Credit Card Merchant Accounts for Fake Companies and Helping a Bogus Business Opportunity (May 24,

2022), available at

https://www.ftc.gov/news-events/news/press-releases/2022/05/federal-trade-commission-

finalizes-order-against-electronic-payment-systems-opening-credit-card.

30

FTC v. Money Now Funding, LLC, No. CV-13-01583-PHX-ROS (D. Ariz., filed Aug. 5, 2013), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/122-3216-x130063-money-now-funding-llc

.

31

In the Matter of Electronic Payment Systems, LLC, No. C-4764 (FTC filed Mar. 15, 2022), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/1523213-electronic-payment-systems-matter

.

FEDERAL TRADE COMMISSION FTC.GOV 9

C. Other Enforcement Highlights

Other FTC enforcement highlights during the past fiscal year include the issuance of

cease and desist demand letters, providing consumer redress to consumers in cases previously

brought by the FTC, and criminal action by other agencies that relate to prior FTC matters.

1. Covid-19 Demand Letters

Throughout the pandemic, the FTC has seen many potentially false and unsubstantiated

claims about the treatment or prevention of COVID-19 that exploit consumers’ fear of the

disease and its effects. As mentioned above, COVID-19 has had, and continues to have, a

particularly devastating impact on the health and finances of older Americans. In some

circumstances, to swiftly address troubling claims related to COVID-19, the FTC has sent cease

and desist demand letters to companies and individuals. These letters warn recipients that their

conduct is likely unlawful, and that they can face serious legal consequences, such as a federal

lawsuit and civil penalties, if they do not immediately cease and desist from engaging in

such conduct.

33

Since October 2021, the FTC has sent thirty one cease and desist demand letters to a

range of companies and individuals about potentially false or deceptive advertising or marketing

related to the coronavirus pandemic. Sixteen of these letters were sent jointly with the FDA.

Almost all of the thirty one cease and desist demand letters went to companies allegedly

violating the law by making deceptive or scientifically unsupported claims about their products’

ability to prevent, treat or cure the coronavirus. The unsubstantiated claims included patient

testimonials and references to clinical trials or studies touting the products’ effectiveness against

COVID-19, as described below. Although COVID-19 affects people of all ages, some of the

letters highlighted examples of representations in the companies’ marketing that specifically

related to older adults. For example:

• In November 2021, the FTC sent a cease and desist demand letter to Austin

Compounding Pharmacy based on its promotion of ivermectin and various supplements

to prevent or treat COVID-19.

34

The company made a Facebook post stating “Noone

[sic] needs to die[.] Ivermectin does work.” Another Facebook post described a study of

hospitalized “older patients” with COVID-19 that found that “patients aged 50 and

32

Press Release, FTC, FTC Imposes Restrictions on Electronic Payment Systems for Opening Merchant Accounts

for Fictitious Companies, Assisting a Business Opportunity Scam (Mar. 15, 2022), available at

https://www.ftc.gov/news-events/news/press-releases/2022/03/ftc-imposes-restrictions-electronic-payment-systems-

opening-merchant-accounts-fictitious-companies.

33

Information about the letters sent by the FTC can be found at https://www.ftc.gov/news-

events/features/coronavirus/enforcement/warning-letters.

34

See FTC letter to Austin Compounding Pharmacy (Nov. 4, 2021), available at

https://www.ftc.gov/system/files/warning-letters/cease_and_desist_letter_to_austin_compounding_pharmacy_2021-

11-04_dap.pdf.

FEDERAL TRADE COMMISSION FTC.GOV 10

above” who received vitamin supplements upon admission were less likely to require

oxygen or be admitted to the intensive care unit.

• Also in November 2021, the FTC sent a cease and desist demand letter to Sunshine

Health Foods & Wellness Center challenging its social media claims about the efficacy

of vitamins and supplements in preventing or curing COVID-19.

35

For example, one

Facebook post stated that “School is about to be back in session … immune support is

even more important this year with COVID-19,” and included the text of a previous post

claiming their supplements would keep grandparents healthy.

• In December 2021, the FTC sent a cease and desist demand letter to RhinoSystems Inc.

for its marketing of a nasal irrigation system to prevent and treat COVID-19.

36

The

company sent an email to consumers claiming that a clinical trial had found “individuals

age 55+” who were treated with nasal irrigation were 8.4 times less likely to be

hospitalized or die.

• Also in December 2021, the FTC sent a cease and desist demand letter to TerraMune

Health, LLC, citing its claims about its ViralHalt Supplement, including calling it “A

Natural Covid-19 Vaccine Alternative.”

37

Among other things, the company’s website

provided a testimonial of two customers, identified as aged 76 and 78, reporting that they

contracted COVID-19 and that their use of the company’s supplement “helped our bodies

minimize our symptoms!”

• In February 2022, the FTC sent a cease and desist demand letter to Ohana

Hyperbarics.

38

According to the FTC, the company’s website said that “Research

around the US and Internationally is showing excellent results for those suffering with

COVID-19 being treated with hyperbaric therapy.” One Instagram post shared an article

reporting that a study found that hyperbaric treatment produced relief of COVID-19

symptoms in a group of “predominantly men age 30 to 79.”

35

See FTC letter to Sunshine Health Foods & Wellness Center (Nov. 4, 2021), available at

https://www.ftc.gov/system/files/warning-letters/cease_and_desist_letter_to_sunshine_health_food_2021-11-

04_dap.pdf.

36

See FTC letter to RhinoSystems Inc. (Dec. 14, 2021), available at https://www.ftc.gov/system/files/warning-

letters/cease_and_desist_letter_to_rhinosystems_2021-12-14_dap.pdf.

37

See FTC letter to TerraMune Health, LLC (Dec. 20, 2021), available at https://www.ftc.gov/system/files/warning-

letters/warning_letter-dap-terramune.pdf.

38

See FTC letter to Ohana Hyperbarics (Feb. 22, 2022), available at

https://www.ftc.gov/system/files/ftc_gov/pdf/2022-02-22%20DAP%20Ohana%20Hyperbarics.pdf

.

FEDERAL TRADE COMMISSION FTC.GOV 11

2. Consumer Monetary Relief

In the last fiscal year, FTC enforcement actions have resulted in relief of more than $462

million to consumers of all ages.

39

Although the FTC’s ability to seek monetary relief for harmed

consumers is now substantially limited following the Supreme Court’s decision in AMG Capital

Mgmt.,

40

the FTC continues to deliver refunds to consumers when possible. These payments

provide people some recompense for the losses that occurred due to illegal conduct.

In October 2021, the FTC began sending payments totaling $1.1 million to consumers

who had paid for a business opportunity scheme called 8 Figure Dream Lifestyle.

41

According

to the FTC, the company used a combination of illegal robocalls, live telephone calls, text

messaging, internet ads, emails, social media, and live events to market and sell consumers

fraudulent money-making opportunities. The FTC alleged that the defendants made false or

unsubstantiated claims in their marketing about how much consumers could earn using their

programs. According to the FTC complaint, the defendants “directly targeted older consumers

who may need extra money for living expenses or retirement.”

42

During one webinar, defendants

targeted retirees with the tagline “Make sure those golden years are actually ‘Golden’!”

Later in October 2021, the FTC began sending checks totaling nearly $300,000 to people

who paid Elite IT Partners Inc. for unnecessary computer repair services.

43

According to the

FTC, the company’s telemarketers claimed consumers’ computers and personal information

were in imminent danger, and convinced many consumers to pay large sums for immediate

cleaning of their computers, antivirus software, and ongoing technical support services. The

complaint asserted that “the vast majority of consumers Elite contacts are elderly and/or

unfamiliar with the workings of computers or the internet. Defendants use intimidation and scare

tactics to take advantage of these consumers’ limited knowledge about such technology.”

44

39

The FTC provides updated statistics about where refunds were sent, the dollar amounts refunded, and the number

of people who benefited from FTC refund programs at www.ftc.gov/refunds

.

40

AMG Capital Mgmt., 141 S. Ct. at 1341. See also discussion in Section II(D) below.

41

Press Release, FTC, FTC Returns $1.1 Million to Consumers Who Lost Money to Alleged Scammers Selling

Bogus Income Opportunities (Oct. 4, 2021), available at

https://www.ftc.gov/news-events/news/press-

releases/2021/10/ftc-returns-11-million-consumers-who-lost-money-alleged-scammers-selling-bogus-income-

opportunities.

42

FTC v. 8 Figure Dream Lifestyle LLC, No. 8:19-cv-01165-AG-KES (C.D. Cal., filed June 12, 2019), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/182-3117-8-figure-dream-lifestyle-llc

.

43

Press Release, FTC, FTC Sends Refunds Totaling Nearly $300,000 to People who Lost Money to a Tech Support

Scheme (Oct. 12, 2021), available at

https://www.ftc.gov/news-events/news/press-releases/2021/10/ftc-sends-

refunds-totaling-nearly-300000-people-who-lost-money-tech-support-scheme.

44

FTC v. Elite IT Partners, Inc., No. 2:19-cv-00125-RJS (D. Utah, filed Feb. 25, 2019), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/182-3114-elite-it-partners-inc

.

FEDERAL TRADE COMMISSION FTC.GOV 12

Also in October 2021, the FTC sent checks worth more than $1.1 million to consumers

who purchased the supplements Neurocet, Regenify, and Resetigen-D from five related

companies including Mile High Madison Group, Inc.

45

The FTC alleged that the companies

who marketed those supplements deceptively promoted their products using false or

unsubstantiated claims that the supplements could stop pain and treat age-related ailments. For

example, the complaint asserted that the defendants made false or unsubstantiated claims that

their supplements could “repair or reverse age-related damage in human cells” and “repair or

reverse all age-related health conditions,” including improving memory and brain function, and

eliminate or significantly reduce arthritis and bone, joint, and muscle pain.

46

In November 2021, consumers who purchased certain publications from Agora

Financial LLC received full refunds totaling more than $2 million as the result of a stipulated

final order.

47

According to the FTC, the defendants convinced consumers to buy pamphlets,

newsletters, and other publications through false promises and deceptive marketing. The refunds

provided full compensation for consumers who bought certain publications. The FTC alleged

that the defendants falsely marketed one publication as providing a clinically proven protocol

that can permanently cure type 2 diabetes and falsely promised that another book would show

consumers how to claim hundreds of thousands of dollars from the government. According to the

FTC, the defendants primarily targeted their publications at older consumers nationwide. The

defendants’ marketing included testimonials purporting to be from an 88-year-old retiree and a

73-year-old retiree who had each made thousands of dollars.

48

In December 2021, the FTC sent checks totaling more than $1.8 million to people who

were charged by Lifewatch Inc. for products that were advertised as free.

49

The FTC joined with

the Florida Attorney General’s Office to assert that the defendants had made at least one billion

robocalls to pitch medical alert systems available to senior citizens “at no cost whatsoever.” The

45

Press Release, FTC, FTC Sends Refunds to Consumers Who Bought Deceptively Marketed Supplements to Treat

Pain and Age-related Health Conditions (Oct. 20, 2021), available at

https://www.ftc.gov/news-events/news/press-

releases/2021/10/ftc-sends-refunds-consumers-who-bought-deceptively-marketed-supplements-treat-pain-age-

related.

46

FTC v. Mile High Madison Group, Inc., No. 1:20-cv-21622-FAM (S.D. Fla., filed Apr. 17, 2020), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/172-3132-172-3143-nordic-clinical-inc-encore-plus-

solutions-inc.

47

Press Release, FTC, FTC Sends Full Refunds Totaling Over $2 Million to Consumers who Lost Money Through

Deceptive Direct Mail Publications Scheme (Nov. 2, 2021), available at

https://www.ftc.gov/news-

events/news/press-releases/2021/11/ftc-sends-full-refunds-totaling-over-2-million-consumers-who-lost-money-

through-deceptive-direct.

48

FTC v. Agora Financial, LLC, No. 1:19-cv-03100-JMC (D. Md., filed Oct. 24, 2019), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/182-3116-agora-financial-llc

.

49

Press Release, FTC, FTC Issues Refunds Totaling More Than $1.8 Million to Consumers Defrauded by Lifewatch,

Inc.’s Deceptive Medical Alert Telemarketing Scheme (Dec. 1, 2021), available at

https://www.ftc.gov/news-

events/news/press-releases/2021/12/ftc-issues-refunds-totaling-more-18-million-consumers-defrauded-lifewatch-

incs-deceptive-medical.

FEDERAL TRADE COMMISSION FTC.GOV 13

messages allegedly claimed that the system was endorsed or recommended by reputable

organizations like the American Heart Association. According to the FTC, consumers eventually

learned that they were responsible for monthly fees and that it was difficult to cancel without

paying a penalty.

The complaint alleged that “Many of the consumers who receive these

unsolicited calls are elderly, live alone, and have limited or fixed incomes. They often are in poor

health, suffer from memory loss or dementia, and rely on family members, friends, or health

professionals to manage their finances and to make financial or health related decisions for

them.”

50

Also in December 2021, the FTC sent a second round of checks totaling more than $6.5

million to people who lost money to an alleged debt relief scam orchestrated by Helping

America Group.

51

The FTC first sent payments to affected consumers in July 2020. In total, the

agency has mailed more than $20 million to consumers in this matter. According to a complaint

by the FTC and the State of Florida, the defendants tricked consumers into paying hundreds of

thousands of dollars per month under the false pretense that defendants would pay, settle, or

obtain dismissals of customers’ debts and improve their credit.

52

The complaint alleged that the

affected consumers carried significant debt and included the elderly and disabled.

In February 2022, the FTC began sending checks to consumers who had purchased

indoor TV antennas or signal amplifiers from Wellco, Inc.

53

The refunds total more than

$580,000. The FTC alleged that the defendants had made deceptive performance claims and used

deceptive consumer endorsements and web pages that looked like objective news reports to

market their products. According to the complaint, the defendants claimed that their antennas

would enable some consumers to receive one hundred or more premium channels in HD and that

users of the antennas and related amplifiers would receive cable or subscription channels like

HBO and AMC.

54

One of their advertisements was titled “New York: Seniors Are Taking

Advantage of New 2018 Rule That Allows Americans To Get FREE TV In HD, Causing

Millions To Cancel Cable.”

50

FTC and State of Florida, Office of the Attorney General v. Lifewatch Inc., No. 1:15-cv-05781 (N.D. Ill., filed

June 30, 2015), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/152-3216-x160047-life-

management-services-inc.

51

Press Release, FTC, Helping America Group Refunds (Dec. 2021), available at

https://www.ftc.gov/enforcement/refunds/helping-america-group-refunds

.

52

FTC and State of Florida v. Jeremy Lee Marcus, No. 0:17-cv-60907-CMA (S.D. Fla., filed May 8, 2017),

available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/162-3125-x170037-jeremy-lee-marcus-et-

al.

53

Press Release, FTC, FTC Sending Refunds to Consumers who Bought Deceptively Marketed Indoor TV Antennas

and Signal Amplifiers from Wellco, Inc. (Feb. 18, 2022), available at

https://www.ftc.gov/news-events/news/press-

releases/2022/02/ftc-sending-refunds-consumers-who-bought-deceptively-marketed-indoor-tv-antennas-signal-

amplifiers.

54

FTC v. Wellco, Inc., No. 1:21-cv-02081 (S.D.N.Y., filed Mar. 10, 2021), available at https://www.ftc.gov/legal-

library/browse/cases-proceedings/192-3004-wellco-inc-ftc-v.

FEDERAL TRADE COMMISSION FTC.GOV 14

In April 2022, the FTC returned more than $23 million in redress to consumers who were

allegedly defrauded by a business coaching scheme based out of Malaysia called My Online

Business Education, or MOBE Ltd.

55

The defendants made allegedly false claims that MOBE

would enable its members to start their own online businesses and earn substantial income

quickly and easily using a “proven” 21-step system. The FTC asserted that the defendants’

international operation targeted U.S. consumers—including service members, veterans, and older

adults—through online ads, social media, direct mailers, and live events held throughout the

country. According to the complaint, the defendants created and promoted a system called the

“Ultimate Retirement Breakthrough,” a re-branded version of the 21-step system aimed at older

adults and retirees.

56

A banner advertisement touted it as “The Surefire Way To Create A Six-

Figure Retirement Income In Less Than 12 Months.”

Later in April 2022, the FTC sent checks totaling $423,000 to consumers who had

purchased the purported anti-aging pill ReJuvenation from Quantum Wellness Botanical

Institute, LLC and filed a valid claim with the FTC.

57

The FTC first sent refunds to consumers

in June 2020. In total, the agency has mailed more than $556,000 to consumers in this matter.

According to the FTC, the defendants marketed the pill as a cure-all for a range of age-related

ailments, including cell damage, heart attack damage, brain damage, and deafness.

58

For

example, one challenged advertisement for ReJuvenation stated: “Flood your body with youth

hormones … NATURALLY! Increase your HGH up to 682% … Stunning age reversal study:

Stem cells boost life span three-fold … Repair every aging cell in your body—damaged tissues

and organs, too! Visibly fade wrinkles overnight.”

59

Another challenged advertisement stated

ReJuvenation would: “Rejuvenate every tissue, organ and gland of the body to levels you

enjoyed when you were young … Improve your skin’s elasticity and tone, thereby reducing

wrinkles, furrows and lines … Dramatically boost memory and mental clarity … Slow down or

even halt aspects of the normal aging process.”

55

Press Release, FTC, Federal Trade Commission Returns More Than $23 Million To Consumers Deceived by

Online Business Coaching Scheme MOBE (Apr. 5, 2022), available at

https://www.ftc.gov/news-events/news/press-

releases/2022/04/federal-trade-commission-returns-more-23-million-consumers-deceived-online-business-coaching-

scheme.

56

FTC v. MOBE Ltd., No. 6:18-cv-862-Orl-37DCI (M.D. Fla., filed June 4, 2018), available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/172-3072-mobe-ltd-et-al

.

57

Press, Release, FTC, ReJuvenation Refunds (April 2022), available at

https://www.ftc.gov/enforcement/refunds/rejuvenation-refunds

.

58

Press Release, FTC, FTC Sending Refund Checks Totaling Almost $149,000 to Consumers Who Bought

ReJuvenation “Anti-Aging” Pill (June 1, 2020), available at

https://www.ftc.gov/news-events/news/press-

releases/2020/06/ftc-sending-refund-checks-totaling-almost-149000-consumers-who-bought-rejuvenation-anti-

aging-pill.

59

FTC v. Quantum Wellness Botanical Institute, LLC, No. 2:20-cv-00244-SMB (D. Ariz., filed Feb. 3, 2020),

available at

https://www.ftc.gov/legal-library/browse/cases-proceedings/172-3131-quantum-wellness-botanical-

institute-llc.

FEDERAL TRADE COMMISSION FTC.GOV 15

In July 2022, the FTC began sending refunds to consumers who were allegedly defrauded

by the Next-Gen sweepstakes scam.

60

The FTC is sending almost $25 million to affected

consumers in dozens of countries, including more than $18 million to U.S. consumers.

According to the complaint filed jointly by the FTC and the State of Missouri, the defendants

sent tens of millions of deceptive personalized mailers to consumers around the world since

2013. The defendants’ mailers allegedly falsely told recipients they had won or were likely to

win a substantial cash prize, as much as $2 million, in exchange for a fee ranging from $9.00 to

$139.99. The FTC alleged that many consumers paid the defendants several times before

realizing they had been scammed. According to the complaint, many of the victims were

elderly consumers.

61

3. Criminal Liaison Unit

The FTC’s Criminal Liaison Unit works with federal and state criminal prosecutors to

better address consumer fraud.

62

Notably, in November 2021, the Commission issued a policy

statement to enhance its efforts to combat the criminal misconduct it uncovers in its consumer

protection and antitrust investigations.

63

Through this work, prosecutors have brought criminal

cases built on facts the FTC exposed in bringing its civil law enforcement actions.

For example, in March 2022, former FTC defendant Travis Peterson was sentenced to

nearly three and a half years (41 months) in prison for a fraudulent charity scheme that targeted

older adults.

64

Peterson’s operation made millions of robocalls asking for donations and falsely

claiming those donations were tax-deductible and would benefit veterans’ charities.

65

The FTC’s

60

Press Release, U.S. Federal Trade Commission Returning Almost $25 Million to Consumers Worldwide Who

Were Defrauded by Next-Gen Sweepstakes Scheme (July 19, 2022), available at

https://www.ftc.gov/news-

events/news/press-releases/2022/07/us-federal-trade-commission-returning-almost-25-million-consumers-

worldwide-who-were-defrauded-next?utm_source=govdelivery.

61

FTC and State of Missouri ex rel. Hawley v. Next-Gen, Inc., No. 4:18-CV-00128-DGK (W.D. Mo., filed Sept. 24,

2018), available at https://www.ftc.gov/legal-library/browse/cases-proceedings/172-3133-x180023-next-gen-inc

.

62

Information about the FTC’s Criminal Liaison Unit is available at https://www.ftc.gov/enforcement/criminal-

liaison-unit.

63

Commission Statement Regarding Criminal Referral and Partnership Process (Nov. 18, 2021), available at

https://www.ftc.gov/system/files/documents/public_statements/1598439/commission_statement_regarding_criminal

_referrals_and_partnership_process_updated_p094207.pdf.

64

Press Release, U.S. Department of Justice, Utah Man who Operated Fraudulent Veteran Charities Sentenced to

Federal Prison (Mar. 29, 2022), available at

https://www.justice.gov/usao-ndga/pr/utah-man-who-operated-

fraudulent-veteran-charities-sentenced-federal-prison.

65

Press Release, FTC, FTC Crackdown Stops Operations Responsible for Billions of Illegal Robocalls (March 26,

2019), available at

https://www.ftc.gov/news-events/news/press-releases/2019/03/ftc-crackdown-stops-operations-

responsible-billions-illegal-robocalls.

FEDERAL TRADE COMMISSION FTC.GOV 16

action against Peterson was part of Operation Donate with Honor, a state-and-federal sweep

combating fraudulent charities that claimed to help veterans and servicemembers.

66

In 2022, Maricopa County Attorney’s Office in Arizona obtained guilty pleas against

David Johnson and Brandon Randis, and sentenced Johnson to five years in prison, for their roles

in a telemarketing scheme that targeted older adults, among others.

67

The FTC previously sued

the ringleaders of this operation, which tricked consumers into purchasing ecommerce websites

through false promises of substantial income and a money-back guarantee.

68

The FTC obtained

more than $7 million in redress for consumers through the civil case.

69

Maricopa County has

obtained a total of 13 pleas in this criminal case to date, and the case is ongoing against the

remaining defendants, including the former-FTC-defendant ringleaders.

Following extradition from Costa Rica, Jamaican nationals Derrick Levy and Maurice

Levy pled guilty in January and June of 2022, respectively, for running a telemarketing scam

targeting older adults in the United States.

70

The scammers contacted their elderly victims by

telephone and falsely claimed the individuals had won sweepstakes prizes, sometimes even

impersonating FTC officials, to induce the victims to send “fees” in order to claim their prizes.

71

The FTC provided assistance to DOJ in this case.

4. Referrals to the FBI’s Recovery Asset Team

Since 2019, the FTC has referred reports involving high dollar losses to the Federal

Bureau of Investigations (“FBI”) Internet Crime Complaint Center (IC3) Recovery Asset Team.

This team’s goal is to “streamline communication with financial institutions and assist FBI field

offices with the freezing of funds for victims who made transfers to domestic accounts under

66

Press Release, FTC, FTC and States Combat Fraudulent Charities That Falsely Claim to Help Veterans and

Servicemembers (July 19, 2018), available at

https://www.ftc.gov/news-events/news/press-releases/2018/07/ftc-

states-combat-fraudulent-charities-falsely-claim-help-veterans-servicemembers.

67

Maricopa County Criminal Court Case Information (accessed July 5, 2022), available at

http://www.superiorcourt.maricopa.gov/docket/CriminalCourtCases/caseInfo.asp?caseNumber=CR2019-006125

.

68

Press Release, FTC, Business Opportunity Scheme Operators Banned from Telemarketing and Selling Investment

Opportunities; Will Return Millions to Consumers (Mar. 13, 2017), available at

https://www.ftc.gov/news-

events/press-releases/2017/03/business-opportunity-scheme-operators-banned-telemarketing.

69

Press Release, FTC, FTC to Send Refund Checks to Consumers who Lost Money in Business Opportunity

Telemarketing Scam (Mar. 5, 2019), available at

https://www.ftc.gov/news-events/press-releases/2019/03/ftc-send-

refund-checks-consumers-who-lost-money-business.

70

Press Release, U.S. Department of Justice, Two Men Plead Guilty to International Telemarketing Sweepstakes

Fraud Scheme (June 30, 2022), available at

https://www.justice.gov/opa/pr/two-men-plead-guilty-international-

telemarketing-sweepstakes-fraud-scheme.

71

Indictment, United States v. Levy, et al., Case No. 3:14-cr-143 (W.D.N.C. Aug. 5, 2014), available at

https://www.justice.gov/criminal-fraud/file/1395791/download

.

FEDERAL TRADE COMMISSION FTC.GOV 17

fraudulent pretenses.”

72

The FTC refers reports received through its website and call center that

meet certain criteria (typically larger dollar losses) to the FBI IC3 Recovery Asset Team when

the consumer agrees to the referral. In the past year, the FTC has referred over 700 reports

through its Consumer Sentinel Network to the FBI IC3’s Recovery Asset Team for review and

potential action.

In 2021, the FBI IC3 Recovery Asset Team responded to 1,726 incidents and froze an

impressive $328.32 million of the $443.48 million reported losses, making recovery possible for

many victims.

73

Here are some recent success stories shared by the FBI IC3 Recovery

Asset Team:

• In June 2022, an elder victim reported to the FTC that the victim had been contacted by

an individual claiming to be from customer support at the victim’s bank. The subject then

instructed the victim to complete a wire transfer to a fraudulent domestic account in order

to “save their money.” Since the victim reported the incident quickly, the FBI IC3

Recovery Asset Team was able to contact the recipient bank and freeze the full wired

amount of almost $100,000 for possible recovery.

• In May 2022, an elder victim reported to the FTC that the victim had been contacted by

an individual claiming to be from McAfee Anti-Virus, claiming that their protection plan

was due to update. The victim called the number contained in the spoofed email and gave

the victim’s bank account access to the subject, where the subject then initiated a wire

transfer for almost $50,000. Again, since the victim reported the incident quickly, the FBI

IC3 Recovery Asset Team was able to contact the recipient bank and freeze the full wired

amount for possible recovery.

• Also in May 2022, an elder victim reported to the FTC that the victim had been contacted

by an individual claiming to be from Amazon Support. The subject claimed that the

victim had a fraudulent purchase on their account and threated they would be arrested if

they did not complete a wire transfer in order to “protect their money.” The victim

completed a wire to a fraudulent domestic account of almost $100,000. The FBI IC3

Recovery Asset Team was able to contact the recipient bank and freeze a majority of the

funds for possible recovery.

The FTC is proud to partner with the FBI IC3’s Recovery Asset Team to help consumers,

particularly those experiencing large dollar losses, recover funds when possible.

72

Federal Bureau of Investigation Internet Crime Report 2021, Dept of Justice Federal Bureau of Investigation

(2021) at 10 available at https://www.ic3.gov/Media/PDF/AnnualReport/2021_IC3Report.pdf

.

73

Id. at 11.

FEDERAL TRADE COMMISSION FTC.GOV 18

D. FTC Strategies to Provide Additional Tools to Enhance

FTC Enforcement Efforts

In the past fiscal year, the FTC focused on developing additional tools to enhance its law

enforcement efforts. These efforts were made in part as a result of a 2021 United States Supreme

Court ruling in AMG Capital Mgmt., which held, among other things, that the FTC did not have

authority to seek equitable monetary relief in cases brought under Section 13(b) of the FTC

Act.

74

Prior to this ruling, the FTC had used its Section 13(b) authority to provide billions of

dollars in monetary restitution to consumers affected by unfair or deceptive acts or practices,

including older adults.

75

Following the AMG decision, the Commission is constrained in its

ability to obtain redress for consumers and has sought to increase the tools at its disposal to do

so. While additional tools to enhance the FTC’s enforcement efforts would affect all

consumers,

76

the particular initiatives described below apply to deceptive or unfair practices that

often disproportionately impact older adults, among other population segments.

1. Advance Notice of Proposed Rulemaking on Impersonation of

Government and Business

In December 2021, the FTC issued an Advance Notice of Proposed Rulemaking to

address deceptive or unfair acts or practices relating to impersonation fraud (“Impersonation

ANPR”).

77

The proposed rulemaking is aimed at combatting government and business

impersonation fraud, a pernicious problem that has grown worse during the pandemic.

78

74

AMG Capital Mgmt., LLC v. FTC, 141 S. Ct. 1341 (2021).

75

15 U.S.C. § 53(b). From FY 2017 to 2021, the Commission returned $11.4 billion to consumers across all FTC

cases, including those brought solely under the FTC’s Section 13(b) authority.

76

In addition to the Commission’s rulemaking efforts, the FTC has also revitalized its authority to put bad actors on

notice that their conduct violates the FTC Act by sending them a Notice of Penalty Offenses. These notices outline

a number of practices that the Commission has previously found to be unfair or deceptive and highlight that

engaging in this conduct could lead to civil penalties. See, e.g., Press Release, FTC, FTC Targets False Claims by

For-Profit Colleges (Oct. 6, 2021), available at

https://www.ftc.gov/news-events/news/press-releases/2021/10/ftc-

targets-false-claims-profit-colleges.

77

Trade Regulation Rule on Impersonation of Government and Businesses, 86 Fed. Reg. 72901 (Dec. 23, 2021),

available at

https://www.federalregister.gov/documents/2021/12/23/2021-27731/trade-regulation-rule-on-

impersonation-of-government-and-businesses. The FTC unanimously approved the ANPR earlier in December

2021. See Press Release, FTC, FTC Launches Rulemaking to Combat Sharp Spike in Impersonation Fraud (Dec. 16,

2021), available at https://www.ftc.gov/news-e

vents/news/press-releases/2021/12/ftc-launches-rulemaking-combat-

sharp-spike-impersonation-fraud.

78

Press Release, FTC, FTC Launches Rulemaking to Combat Sharp Spike in Impersonation Fraud. “The COVID-19

pandemic has spurred a sharp spike in impersonation fraud, as scammers capitalize on confusion and concerns

around shifts in the economy stemming from the pandemic. Incorporating new data from the Social Security

Administration, reported costs have increased an alarming 85 percent year-over year, with $2 billion in total losses

between October 2020 and September 2021. Notably, since the pandemic began, COVID-specific scam reports have

included 12,491 complaints of government impersonation and 8,794 complaints of business impersonation.”

FEDERAL TRADE COMMISSION FTC.GOV 19

Government and business impersonators can take many forms, posing as government officials or

representatives from well-known businesses or charities, for example. The perpetrators of

impersonation fraud commonly seek monetary payment or information that they can use to

commit identity theft.

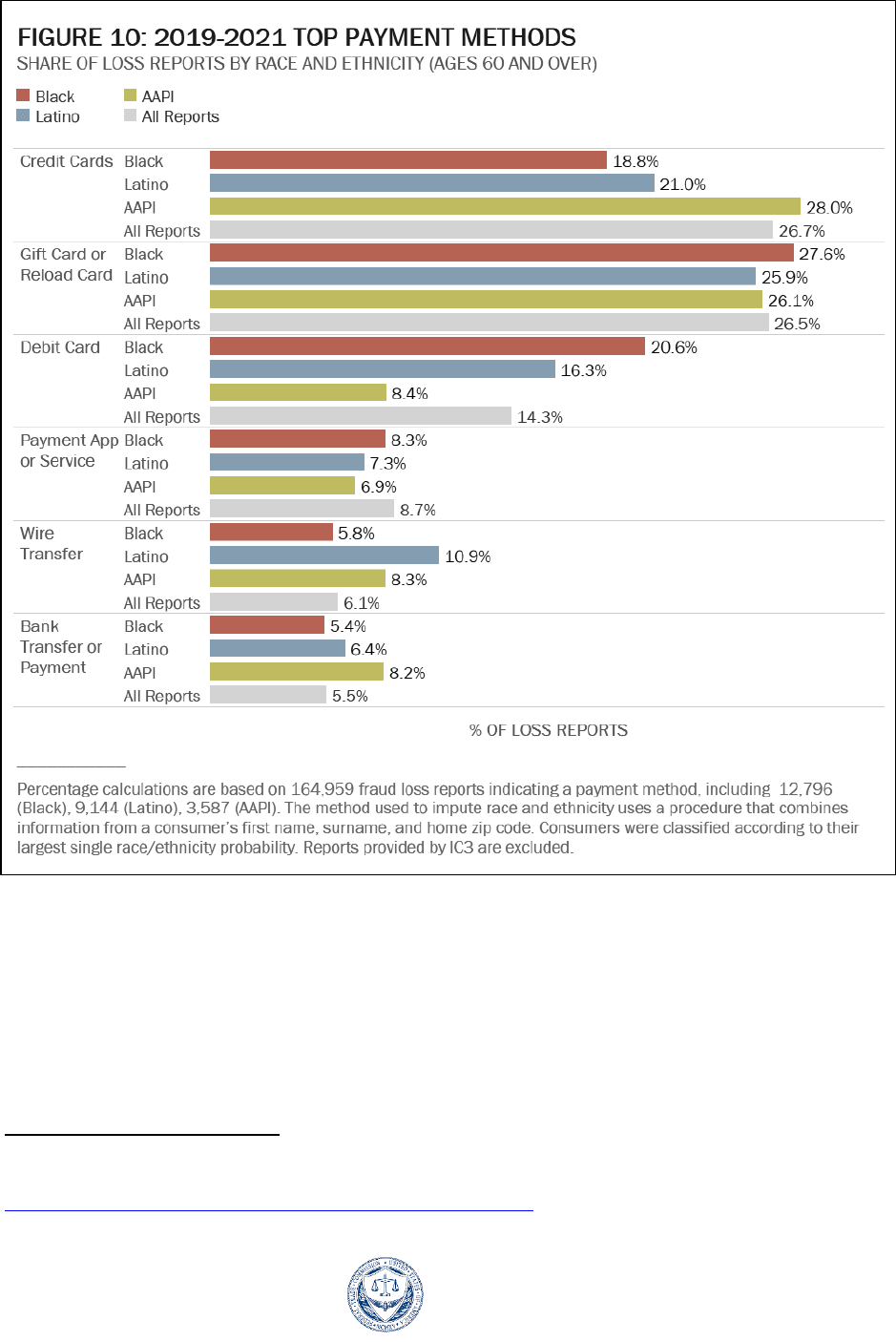

Government impersonators often pretend to represent institutions such as the Social

Security Administration, Medicare/Health and Human Services, IRS, or law enforcement, and

may threaten their targets with a discontinuation of government benefits, enforcement of tax

liability, and even arrest or prosecution. Business impersonators may claim there is suspicious

activity on a customer’s account or offer a refund or prize if the victim will provide some

personal information. According to the FTC, the most common type of government

impersonation fraud involved the Social Security Administration, with more than 308,000

complaints between 2017 and 2021, more than twice the number of the next type.

79

As discussed

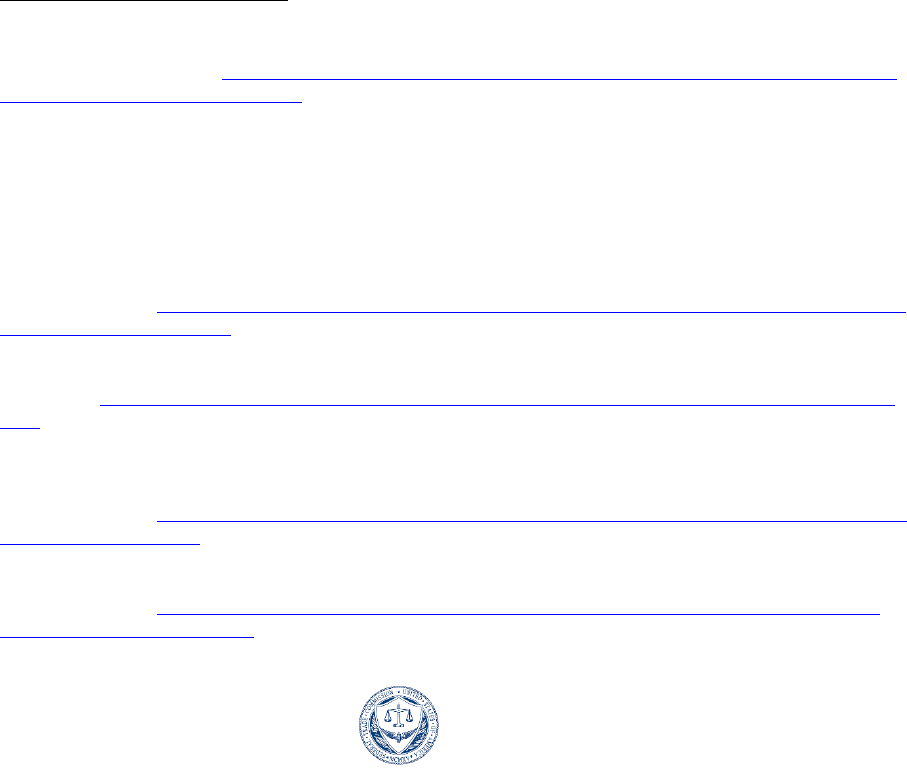

in Section IV, analysis of the FTC reports shows older adults reported tremendous losses to

impersonation scams, topping $151 million for business impersonation scams and $122 million

for government impersonation scams in 2021.

With the Impersonation ANPR, the FTC seeks to determine if a Trade Regulation Rule

targeting deceptive or unfair impersonation practices is warranted. The ANPR noted that while

the FTC in the past has brought many cases relating to impersonation under different authorities,

it is currently limited in its remedial authority,

80

and solicited comment on whether the FTC

should propose a rule that could more comprehensively outlaw government and business

impersonation.

81

The ANPR also sought comment on the prevalence of impersonation schemes,

the costs and benefits of a rule to address them, and alternative or additional actions, such as

publication of educational materials and hosting of public workshops. On September 15, 2022,

79

Trade Regulation Rule on Impersonation of Government and Businesses, 86 Fed. Reg. 72901, 72902. “From

January 1, 2017 through September 30, 2021, consumers reported 1,362,996 instances of government impersonation

and associated total losses of roughly $922,739,109.

The most common such schemes involved Social Security

Administration (SSA) impersonators, with more than 308,000 complaints alleging SSA impersonation, followed by

the IRS (124,000) and Health and Human Services/Medicare programs (125,000).”

80

See, e.g., Trade Regulation Rule on Impersonation of Government and Businesses, 86 Fed. Reg. 72901, 72902

(“Although the Commission has brought many cases involving impersonator scams under Section 5 of the FTC

ACT, 15 U.S.C. 45, its current remedial authority is limited. The U.S. Supreme Court recently held that equitable

monetary relief, including consumer redress, is not available under Section 13(b) of the FTC Act.”).

81

Trade Regulation Rule on Impersonation of Government and Businesses, 86 Fed. Reg. 72901, 72903. “Both the

Mortgage Assistance Relief Services (MARS) Rule and the Telemarketing Sales Rule (TSR) already proscribe

impersonation involving false government and business (including nonprofit) affiliation and endorsement claims ….

An impersonator rule that builds on the existing sector- and method-specific rules could more comprehensively

outlaw government and business impersonation. By focusing on practices that are the subject of its law enforcement

experience and the subject of consumer fraud reports, the Commission anticipates streamlining this proposed

rulemaking for the benefit of consumers.”

FEDERAL TRADE COMMISSION FTC.GOV 20

the Commission approved a Notice of Proposed Rulemaking addressing impersonation of

government and businesses.

82

2. Advance Notice of Proposed Rulemaking on Deceptive or Unfair

Earnings Claims

In March 2022, the FTC issued an Advance Notice of Proposed Rulemaking to address

deceptive or unfair earnings claims (“Earnings Claims ANPR”).

83

This ANPR is aimed at

misleading earnings claims, which both deprive consumers of the ability to make informed

decisions and unfairly advantage bad actors in the marketplace at the expense of

honest businesses.

84

As prior FTC cases demonstrate, sales pitches containing deceptive earnings claims can

appeal to retirees and older adults living on fixed incomes who are looking to supplement their

income.

85

The FTC has taken aggressive law enforcement action related to earnings claims made

by targets engaged in coaching or mentoring schemes, multi-level marketing companies, work-

from-home, e-commerce, or other business opportunity scams, chain referral schemes, gig

companies and employers, job scams, and businesses purporting to offer educational

opportunities. However, despite the FTC’s aggressive enforcement program, deceptive earning

claims continue to proliferate in the marketplace.

86

The FTC anticipates that a rule prohibiting the use of misleading earnings claims would

enhance deterrence and help the FTC move quickly to stop illegal conduct. Such a rule may also

further clarify for businesses what constitutes a deceptive earnings claim. In addition, a rule

would enable the FTC to seek monetary relief for consumers harmed by deceptive earnings

82

Press Release, FTC, FTC Proposes New Rule to Combat Government and Business Impersonation Scams (Sept.

15, 2022), available at

https://www.ftc.gov/news-events/news/press-releases/2022/09/ftc-proposes-new-rule-

combat-government-business-impersonation-scams.

83

Deceptive or Unfair Earnings Claims, 87 Fed. Reg. 13951 (Mar. 11, 2022), available at

https://www.federalregister.gov/documents/2022/03/11/2022-04679/deceptive-or-unfair-earnings-claims#. The FTC

unanimously approved the ANPR in February 2022. Press Release, FTC, FTC Takes Action to Combat Bogus

Money-Making Claims Used to Lure People into Dead-end Debt Traps (Feb. 17, 2022), available at

https://www.ftc.gov/news-events/news/press-releases/2022/02/ftc-takes-action-combat-bogus-money-making-

claims-used-lure-people-dead-end-debt-traps.

84

The Earnings Claims ANPR follows the Commission’s announcement of a new Notice of Penalty Offenses

Concerning Money-Making Opportunities in October 2021. The Commission served this notice on more than 1,100

businesses, putting them on notice that if they deceive or mislead consumers about potential earnings, they could be

subject to civil penalties. Press Release, FTC, FTC Puts Business on Notice that False Money-Making Claims Could

Lead to Big Penalties (Oct. 26, 2021), available at

https://www.ftc.gov/news-events/news/press-

releases/2021/10/ftc-puts-businesses-notice-false-money-making-claims-could-lead-big-penalties.

85

Deceptive or Unfair Earnings Claims, 87 Fed. Reg. 13951, 13952–53 n.23–33 (citing FTC v. OTA Franchise

Corp., FTC v. Ragingbull.com, FTC v. Mobe Ltd., FTC v. 8 Figure Dream Lifestyle LLC, among others).

86

Deceptive or Unfair Earnings Claims, 87 Fed. Reg. 13951, 13952.

FEDERAL TRADE COMMISSION FTC.GOV 21

claims, as well as civil penalties against those who make the deceptive claims. The FTC has

previously promulgated rules regulating the use of earnings claims in certain instances,

including: The Franchise Rule, the Business Opportunity Rule, and the Telemarketing Sales

Rule. However, the scope of coverage of these rules is limited.

87

The FTC’s Earnings Claims ANPR requests input on whether and how it can most

effectively use its authority to address the use of false, unsubstantiated, or otherwise misleading

earnings claims. If promulgated, a rule in this area would allow the FTC to recover redress for

defrauded consumers and seek significant penalties against those who make these claims. The

FTC will determine whether to issue a notice of proposed rulemaking after it reviews the public

comments it receives in response to the ANPR.

3. Advance Notice of Proposed Rulemaking on the Telemarketing

Sales Rule

In June 2022, the FTC issued an Advance Notice of Proposed Rulemaking seeking public

comment on a number of possible amendments to the Telemarketing Sales Rule (“TSR”) (“ TSR

ANPR”).

88

One of the major issues the TSR ANPR highlights is the rise of computer technical

support scams (or “tech support services”) and the disproportionate impact on older adults.

89

In

many instances, these scams commence with an inbound call from a consumer to a telemarketer

who proceeds to deceive the consumer into purchasing unnecessary computer technology

services to fix phantom problems. Such calls, however, are typically exempt from the TSR’s

protections.

90

The TSR ANPR describes the Commission’s law enforcement experience addressing

such scams and explains how they have been a rising trend that particularly impacts

87

Deceptive or Unfair Earnings Claims, 87 Fed. Reg. 13951, 13952. “Numerous different types of enterprises that

do not clearly fall under the scope of these existing rules continue to use misleading earnings claims to deceive

consumers in violation of section 5.”

88

Telemarketing Sales Rule, 87 Fed. Reg. 33662 (June 3, 2022), available at

https://www.federalregister.gov/documents/2022/06/03/2022-10922/telemarketing-sales-rule

. The FTC unanimously

approved the ANPR in April 2022. Press Release, FTC, Federal Trade Commission Proposes Small Business

Protections Against Telemarketing Tricks and Traps (April 28, 2022), available at https://www.ftc.gov/news-

events/news/press-releases/2022/04/federal-trade-commission-proposes-small-business-protections-against-

telemarketing-tricks-traps. The FTC also issued a concurrent Notice of Proposed Rulemaking (“TSR NPRM”)

proposing additional amendments to the TSR. Telemarketing Sales Rule, 87 Fed. Reg. 33677 (June 3, 2022),

available at

https://www.federalregister.gov/documents/2022/06/03/2022-09914/telemarketing-sales-rule.

89

The FTC’s last fraud survey found a higher prevalence for this type of fraud for older adults. FTC Bureau of

Economics Staff Report, Mass-Market Consumer Fraud in the United States: A 2017 Update 76–79 (Oct. 2019),

available at

https://www.ftc.gov/system/files/documents/reports/mass-market-consumer-fraud-united-states-2017-

update/p105502massmarketconsumerfraud2017report.pdf.

90

Press Release, FTC, Federal Trade Commission Proposes Small Business Protections Against Telemarketing

Tricks and Traps.

FEDERAL TRADE COMMISSION FTC.GOV 22

older adults.

91

It highlights the Commission’s analysis of consumer complaints about tech

support scams showing they increased dramatically over the last few years, ranging from

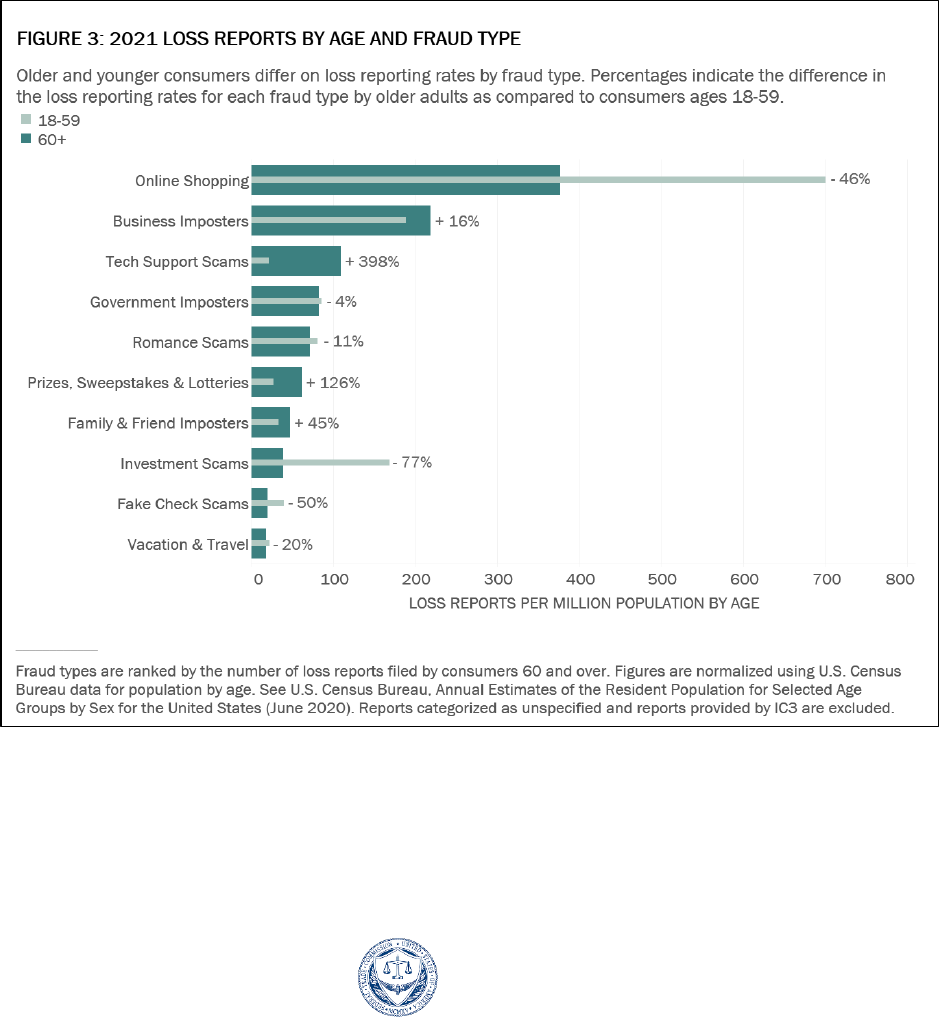

approximately 40,000 complaints in 2017 to approximately 100,000 complaints in 2020. Indeed,

tech support scams disproportionately harm older consumers; in 2021, consumers age 60 and

over were nearly five times more likely to report a financial loss to tech support scams compared

to younger consumers.

92

From 2015 to 2018, older adults filed more reports on tech support

scams than on any other category.

93

The TSR ANPR thus seeks comment on whether the Commission should amend the TSR

to cover all deceptive telemarketing of tech support services. The FTC will determine whether to

proceed with a notice of proposed rulemaking once it reviews the public comments submitted in

response to the ANPR.

III. Outreach and Education Activities

A. Pass It On Education Campaign

Pass It On is the FTC’s ongoing fraud prevention education campaign for older adults.

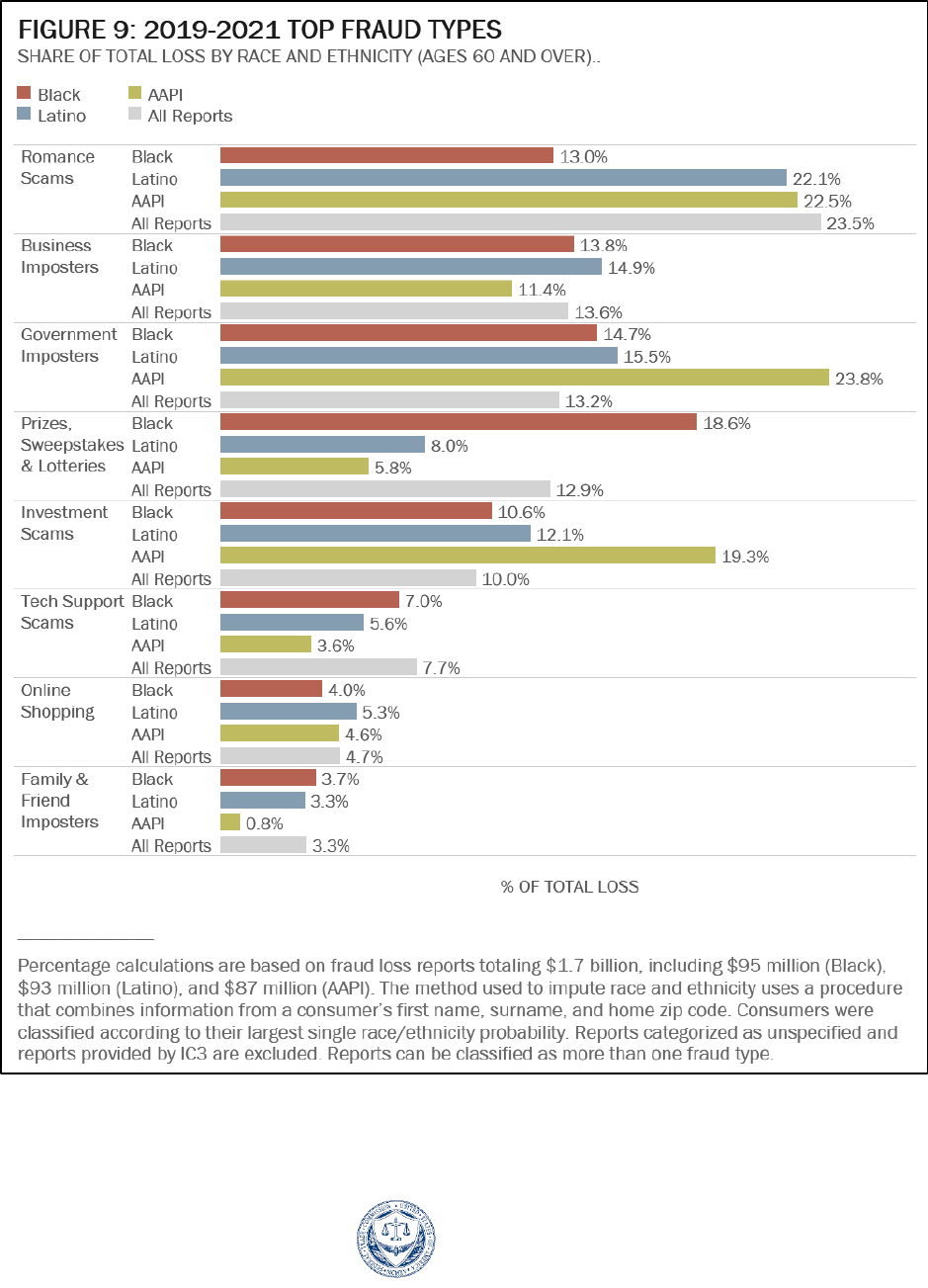

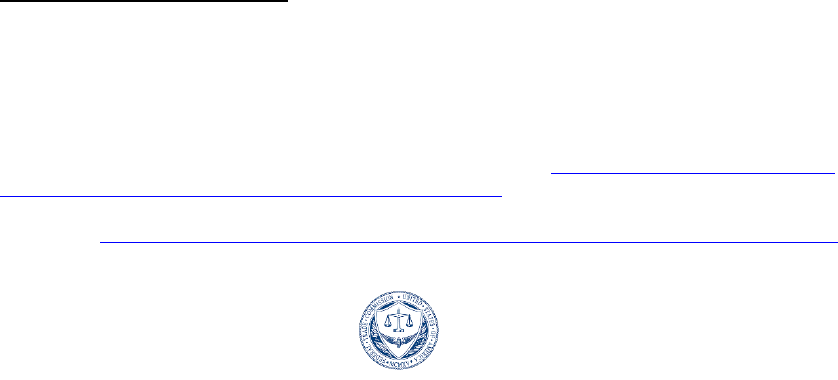

Campaign materials show respect for the readers’ life experience and accumulated knowledge,