Electricity Market

Report 2023

The IEA examines the full spectrum of energy

issues including oil, gas and coal supply and

demand, renewable energy technologies,

electricity markets, energy efficiency, access to

energy, demand side management and much

more. Through its work, the IEA advocates

policies that will enhance the reliability,

affordability and sustainability of energy in its 31

member countries, 11 association countries and

beyond.

This publication and any map included herein are

without prejudice to the status of or sovereignty

over any territory, to the delimitation of

international frontiers and boundaries and to the

name of any territory, city or area.

Source: IEA.

International Energy Agency

Website: www.iea.org

IEA member countries:

Australia

Austria

Belgium

Canada

Czech Republic

Denmark

Estonia

Finland

France

Germany

Greece

Hungary

Ireland

Italy

Japan

Korea

Lithuania

Luxembourg

Mexico

Netherlands

New Zealand

Norway

Poland

Portugal

Slovak Republic

INTERNATIONAL ENERGY AGENCY

Spain

Sweden

Switzerland

Republic of Türkiye

United Kingdom

United States

The European Commission

also participates in the work

of the IEA

IEA association countries:

Argentina

Brazil

China

Egypt

India

Indonesia

Morocco

Singapore

South Africa

Thailand

Ukraine

Electricity Market Report 2023

P

AGE | 3

Abstract

IEA. CC BY 4.0.

Abstract

Electricity is central to many parts of life in modern societies and will

become even more so as its role in transport and heating expands

through technologies such as electric vehicles and heat pumps.

Power generation is currently the largest source of carbon dioxide

(CO

2

) emissions globally, but it is also the sector that is leading the

transition to net zero emissions through the rapid ramping up of

renewables such as solar and wind. At the same time, the current

global energy crisis has placed electricity security and affordability

high on the political agenda in many countries.

The International Energy Agency’s Electricity Market Report 2023

offers a deep analysis of recent policies, trends and market

developments. It also provides forecasts through 2025 for electricity

demand, supply and CO

2

emissions – with a detailed study of the

evolving generation mix. This year’s report contains a

comprehensive analysis of developments in Europe, which faced a

variety of energy crises in 2022. The Asia Pacific region also

receives special focus, with its fast-growing electricity demand and

accelerating clean energy deployment.

The IEA’s Electricity Market Report has been published since 2020.

Its relevance goes beyond energy and climate issues, since

electricity supply impacts economies, regional development, the

budgets of businesses and households, and many other areas. It is

indispensable reading for anyone interested in the multifaceted

importance of energy in our economies and societies today.

Electricity Market Report 2023

P

AGE | 4

Table of contents

IEA. CC BY 4.0.

Table of contents

Executive summary ......................................................................................... 5

Global overview ............................................................................................. 11

Demand ........................................................................................................ 12

Supply .......................................................................................................... 20

Emissions ..................................................................................................... 31

Wholesale prices .......................................................................................... 34

Carbon pricing trends ................................................................................... 38

Regional perspectives................................................................................... 41

Asia Pacific ................................................................................................... 42

Americas ...................................................................................................... 63

Europe .......................................................................................................... 74

Eurasia ......................................................................................................... 93

Middle East .................................................................................................. 99

Africa .......................................................................................................... 108

General annex .............................................................................................. 118

Electricity Market Report 2023

P

AGE | 5

Executive summary

IEA. CC BY 4.0.

Executive summary

Electricity Market Report 2023

P

AGE | 6

Executive summary

IEA. CC BY 4.0.

Executive Summary

Global electricity demand growth slowed only slightly in 2022 despite energy crisis headwinds

World electricity demand remained resilient in 2022 amid the

global energy crisis triggered by Russia’s invasion of Ukraine.

Demand rose by almost 2% compared with the 2.4% average

growth rate seen over the period 2015-2019. The electrification of

the transport and heating sectors continued to accelerate globally,

with record numbers of electric vehicles and heat pumps sold in

2022 contributing to growth. Nevertheless, economies around the

world, in the midst of recovering from the impacts of Covid-19, were

battered by record-high energy prices. Soaring prices for energy

commodities, including natural gas and coal, sharply escalated

power generation costs and contributed to a rapid rise in inflation.

Economic slowdowns and high electricity prices stifled electricity

demand growth in most regions around the world.

Electricity consumption in the European Union recorded a

sharp 3.5% decline year-on-year (y-o-y) in 2022 as the region was

particularly hard hit by high energy prices, which led to significant

demand destruction among industrial consumers. Exceptionally mild

winter added further downward pressure on electricity consumption.

This was the EU’s second largest percentage decrease in electricity

demand since the global financial crisis in 2009 – with the largest

being the exceptional contraction due to the Covid-19 shock in

2020.

Electricity demand in India and the United States rose, while

Covid restrictions affected China’s growth. China’s zero-Covid

policy weighed heavily on its economic activity in 2022, and a

degree of uncertainty remains over the pace of its electricity

demand growth. We currently estimate it to be 2.6% in 2022,

substantially below its pre-pandemic average of over 5% in the

2015-2019 period. Further data expected in due course will provide

greater clarity on trends in China in 2022, which could also have

implications for the global picture. Electricity demand in India rose

by a strong 8.4% in 2022, due to a combination of its robust post-

pandemic economic recovery and exceptionally high summer

temperatures. The United States recorded a significant 2.6% y-o-y

demand increase in 2022, driven by economic activity and higher

residential use to meet both heating and cooling needs amid hotter

summer weather and a colder-than-normal winter.

Low-emissions sources are set to cover almost all the

growth in global electricity demand by 2025

Renewables and nuclear energy will dominate the growth of

global electricity supply over the next three years, together

meeting on average more than 90% of the additional demand.

China accounts for more than 45% of the growth in renewable

Electricity Market Report 2023

P

AGE | 7

IEA. CC BY 4.0.

Executive summary

generation in the period 2023-2025, followed by the EU with 15%.

The substantial growth of renewables will need to be accompanied

by accelerated investments in grids and flexibility for their

successful integration into the power systems. The increase in

nuclear output results from an expected recovery in French nuclear

generation as more plants complete their scheduled maintenance,

and from new plants starting operations, largely in Asia.

Global electricity generation from both natural gas and coal is

expected to remain broadly flat between 2022 and 2025. While

gas-fired generation in the European Union is forecast to decline,

significant growth in the Middle East will partly offset this decrease.

Similarly, drops in coal-fired generation in Europe and the Americas

will be matched by a rise in Asia Pacific. However, the trends in

fossil-fired generation remain subject to developments in the global

economy, weather events, fuel prices and government policies.

Developments in China, where more than half of the world’s coal-

fired generation occurs, will remain a key factor.

China’s share of global electricity consumption is forecast to

rise to one-third by 2025, compared with one-quarter in 2015.

Over the next three years, more than 70% of the growth in global

electricity demand is set to come from China, India and Southeast

Asia combined. Emerging and developing economies’ growth is

accompanied by a corresponding rise in demand for electricity. At

the same time, advanced economies are pushing for electrification

to decarbonise their transportation, heating and industrial sectors.

As a result, global electricity demand is expected to grow at a much

faster pace of 3% per year over the 2023-2025 period compared

with the 2022 growth rate. The total increase in global electricity

demand of about 2 500 terawatt-hours (TWh) out to 2025 is more

than double Japan's current annual electricity consumption.

Nevertheless, uncertainties exist regarding the growth of electricity

demand in China. While the country recently eased its stringent

Covid restrictions in early December 2022, the full extent of the

economic impacts remain unclear.

After reaching an all-time high in 2022, power

generation emissions are set to plateau through 2025

Global CO

2

emissions from electricity generation grew in 2022

at a rate similar to the 2016-2019 average. Their increase of 1.3%

in 2022 is a significant slowdown from the staggering 6% rise in

2021, which was driven by the rapid economic recovery from the

Covid shock. Nonetheless, electricity generation-related CO

2

emissions reached a record high in 2022.

The share of renewables in the global power generation mix is

forecast to rise from 29% in 2022 to 35% in 2025. As renewables

expand, the shares of coal- and gas-fired generation are set to fall.

As a result, emissions of global power generation will plateau to

2025 and its CO

2

intensity will further decline in the coming years.

Electricity Market Report 2023

P

AGE | 8

IEA. CC BY 4.0.

Executive summary

The European Union saw gas-fired generation increase

during a turbulent 2022

Due to historic drought conditions, hydropower generation in

Europe was particularly low in 2022. Italy saw a drop in

hydropower generation of more than 30% compared with its 2017-

2021 average, followed closely by Spain. Similarly, France recorded

a 20% decline in its hydro output compared with the previous five-

year average.

Nuclear generation in the European Union was 17% lower in

2022 than in 2021 due to closures and unavailabilities. Plant

closures in Germany and Belgium reduced the available nuclear

capacity in 2022. At the same time, France faced record-low nuclear

availability due to ongoing maintenance work and other challenges

in its nuclear fleet. The constrained nuclear output and low

hydropower supply in Europe – combined with reduced

dispatchable capacity due to previous retirements of thermal

generation plants – put additional pressure on remaining

dispatchable capacities to meet demand. As a result, although

variable renewable generation grew and record-high gas prices

supported fuel-switching from gas to coal, gas-fired generation grew

in 2022 by 2% in the European Union.

These factors have also

contributed to significant changes in the traditional import-export

structure of electricity in Europe: France became a net importer and

the United Kingdom a net exporter for the first time in decades.

In order to increase the security of electricity supply, reserve

capacities of conventional power generation have been

brought back in Europe for the 2022-2023 and 2023-2024

winters. Similarly, some plants that were previously set to be

decommissioned were also extended. Germany had the highest

share of such plants in Europe, having delayed the planned

shutdown of its three remaining nuclear reactors, as well as

delaying the closure or reactivating fossil-fired plants that make up

15% of its current fossil-fired generation capacity. An increased risk

of power outages was reported in some European countries during

several weeks of cold weather combined with lower-than-average

hydro and nuclear output. Security of supply was achieved through

successful short-term planning and management.

While the CO

2

intensity of global power generation

decreased in 2022, it increased in the European Union

After 2021, 2022 marks the highest percentage growth in CO

2

emissions of EU power generation since the oil crises of the

1970s, recording a 4.5% year-on-year growth. Excluding the 2021

post-pandemic rebound, the European Union also saw in 2022 the

highest absolute growth in power generation emissions since 2003.

This was mainly due to a rise in coal-fired generation of more than

6% in stark contrast to the almost 8% average annual rate of

decline in coal-fired generation over the pre-pandemic period of

2015-2019.

The setback in the European Union will be temporary, however,

as power generation emissions are expected to decrease on

average by about 10% annually through 2025. Both coal- and gas-

Electricity Market Report 2023

P

AGE | 9

IEA. CC BY 4.0.

Executive summary

fired generation are expected to see sharp falls, with coal declining

by 10% and gas by almost 12% annually on average over the

outlook period as renewables ramp up and nuclear generation

recovers.

Electricity prices remain high in many regions, with risks

of tight supply in Europe next winter

The increase in wholesale electricity prices was most

pronounced in Europe in 2022, where they were, on average,

more than twice as high as in 2021. The exceptionally mild winter so

far in 2022/23 in Europe has helped temper wholesale electricity

prices, but they remain high compared with recent years. Elevated

futures prices for winter 2023/24 reflect the uncertainties regarding

gas supply in Europe over the coming year.

In the European Union, a wide range of responses to the

energy crisis have been observed. In order to reduce reliance on

fossil fuels and to increase resilience to price shocks, the European

Commission published its REPowerEU plan in May 2022 to

accelerate clean energy deployment. At the same time, discussions

about electricity market design gained momentum due to soaring

wholesale prices, and the Commission launched a consultation on

market design reform. To dampen the effects of high electricity

prices on consumers, many countries introduced measures such as

the regulation of wholesale and retail prices; revenue caps on infra-

marginal technologies such as renewables, nuclear and coal-

plants; reductions of energy taxes and VAT; and direct subsidies.

While such market interventions can help mitigate the impacts of the

energy crisis, the potential creation of uncertainty in the investment

landscape needs to be minimised to ensure that responses to the

crisis do not come at the expense of much-needed investment.

Affordability will continue to be a challenge for emerging

and developing economies

Globally, higher electricity generation costs in 2022 were

driven by surging energy commodity prices. While the cost

increases were more moderate in countries with regulated tariffs

and long-term fuel supply agreements (oil-indexed LNG, long-term

contracts or fuel supply contracts), regions dependent on short-term

markets for fuel procurement were severely affected. In particular,

record-high LNG prices led to difficulties for South Asian countries

trying to procure gas for the power sector, which contributed to

blackouts and rationing of electricity in the region. If prices of energy

commodities remain elevated, fuel procurement will continue to be a

serious issue for emerging and developing economies.

Nuclear power is gathering pace in Asia, curbing the

CO

2

intensity of power generation

The energy crisis has renewed interest in the role of nuclear

power in contributing to energy security and reducing the CO

2

intensity of power generation. In Europe and the United States,

discussions on the future role of nuclear in the energy mix have

resurfaced. At the same time, other parts of the world are already

Electricity Market Report 2023

P

AGE | 10

IEA. CC BY 4.0.

Executive summary

seeing an accelerated deployment of nuclear plants. As a result,

global nuclear power generation is set to grow on average by

almost 4% over 2023-2025, a significantly higher growth rate than

the 2% over 2015-2019. This means that in every year to 2025,

about 100 TWh of additional electricity is set to be produced by

nuclear power, the equivalent of about one-eighth of US nuclear

power generation today.

More than half of the growth in global nuclear generation to

2025 comes from just four countries: China, India, Japan and

Korea. Among these countries, while China leads in terms of

absolute growth from 2022 to 2025 (+58 TWh), India is set to have

the highest percentage growth (+81%), followed by Japan. This

results from the Japanese government’s push to ramp up nuclear

generation in order to reduce reliance on gas imports and

strengthen energy security. Outside Asia, the French nuclear fleet

provides more than one-third of the absolute growth in global

nuclear generation to 2025 as it gradually recovers.

Extreme weather events highlight the need for

increased security of supply and resilience

In a world where both the demand and supply of electricity are

becoming increasingly weather-dependent, electricity security

requires increased attention. Along with the high cost of electricity

generation, the world’s power systems also faced challenges from

extreme weather events in 2022. In addition to the drought in

Europe, there were heatwaves in India, where the hottest March in

over a century was recorded, resulting in the country’s highest ever

peak in power demand. Similarly, central and eastern China were

hit by heatwaves and drought, which caused demand for air

conditioning to surge amid reduced hydropower generation in

Sichuan. The United States saw severe winter storms in December,

triggering massive power outages. Mitigating the impacts of climate

change requires faster decarbonisation and accelerated deployment

of clean energy technologies. At the same time, as the clean energy

transition gathers pace, the impact of weather events on electricity

demand will intensify due to the increased electrification of heating,

while the share of weather-dependent renewables will continue to

grow in the generation mix. In such a world, increasing the flexibility

of the power systems while ensuring security of supply and

resilience will be crucial.

Electricity Market Report 2023

P

AGE | 11

IEA. CC BY 4.0.

Global overview

Global overview

Electricity Market Report 2023

P

AGE | 12

IEA. CC BY 4.0.

Global overview

Demand

Electricity Market Report 2023

P

AGE | 13

IEA. CC BY 4.0.

Global overview

Global electricity demand growth eased in 2022, but is set to accelerate from 2023, led by Asia

The energy crisis sparked by the Russian Federation’s (hereafter

“Russia”) invasion of Ukraine has been characterised by record-high

commodity prices, weaker economic growth and high inflation.

Higher fuel prices increased the cost of electricity generation around

the world, putting downward pressure on consumption in many

regions. Despite the worsening crisis, global electricity demand

remained relatively resilient, growing by almost 2% in 2022.

By 2025, for the first time in history, Asia will account for half of the

world’s electricity consumption and one-third of global electricity will

be consumed in China. Over the outlook period, global electricity

demand is set to grow at an accelerated pace, by an annualised

3%, as electricity consumption increases in emerging markets and

developing economies (EMDEs), led by the People’s Republic of

China (hereafter “China”), India and Southeast Asia.

As the energy crisis abates, global electricity demand growth is set

to rise from 2.6% in 2023 to an average 3.2% in 2024-2025. This

stronger growth is well above the pre-pandemic rate of 2.4%

observed in the 2015-2019 period. Indeed, by 2025 demand will

increase by 2 500 TWh from 2022 levels, which means that over the

next three years the electricity consumption added each year is

roughly equivalent to that of the United Kingdom and Germany

combined. More than half of the increase will come from China. The

remaining growth will largely take place in India and Southeast Asia.

In China, electricity demand growth was subdued on weaker

economic activity in 2022, rising at an estimated 2.6%, and

significantly below its trend of 5.4% in 2015-2019. China is by far

the world’s largest electricity consumer at 31% of global demand in

2022. For 2023-2025 we expect an average annual growth of 5.2%.

In India, the robust post-pandemic recovery continued to support

strong electricity demand of over 8.4% in 2022, which was

substantially higher than the average annual growth rate of 5.3%

seen in the 2015-2019 period. The peak summer season also

arrived early in 2022, resulting in the hottest March in over a

century. Electricity demand from March to July was 12% higher than

the same period in 2021. For the 2023-2025 period, we expect

slightly slower growth, averaging 5.6% per year.

Electricity demand in the European Union (EU) fell 3.5% in 2022,

with spiking electricity prices, demand destruction in electricity-

intensive industries, energy saving measures and a mild winter all

contributing to the decline. We expect EU demand to grow by

around 1.4% on average in 2023-2025.

In the United States, electricity demand rose by 2.6% in 2022,

surpassing pre-Covid levels. But an expected economic slowdown

in 2023 is expected to lead to a decline of about 0.6%, before

returning to growth of 1.2% in 2024 and 1.3% in 2025.

In Africa, electricity demand rose by 1.5% in 2022, with growth

tempered by both lofty energy prices and high inflation rates. Our

2023-2025 outlook for the region shows much stronger growth of an

average 4.1%, led by a post-crisis economic recovery.

Electricity Market Report 2023

P

AGE | 14

IEA. CC BY 4.0.

Global overview

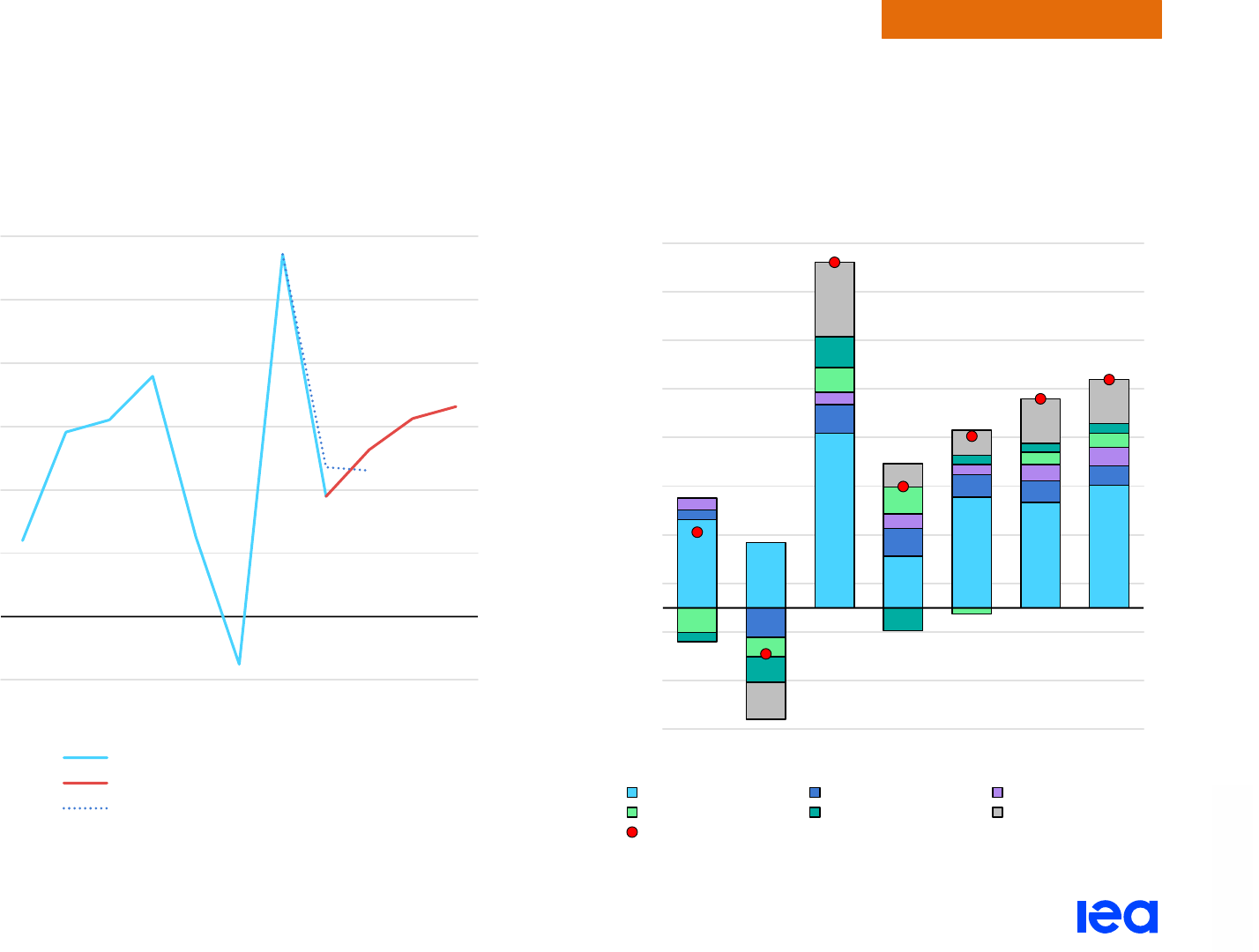

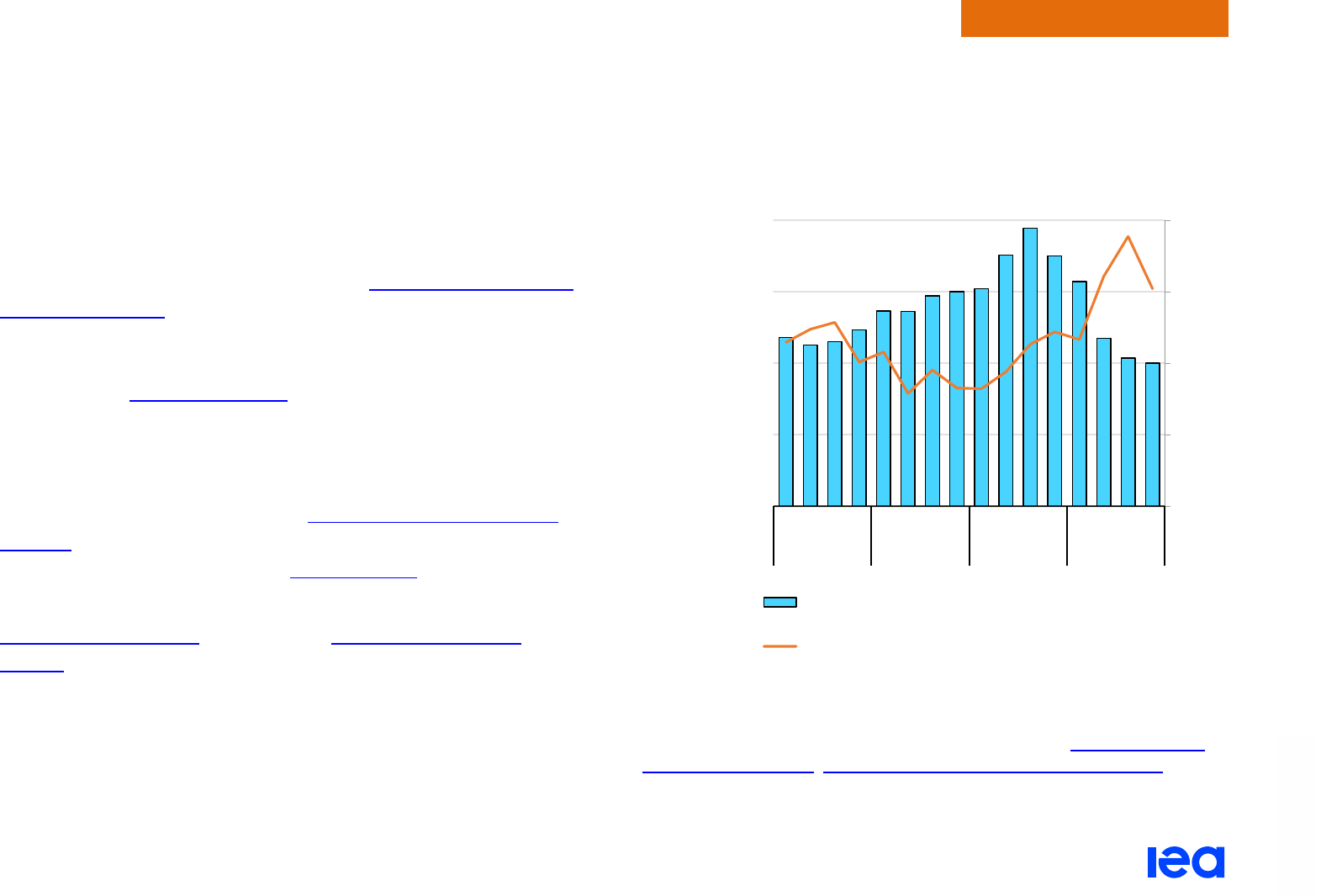

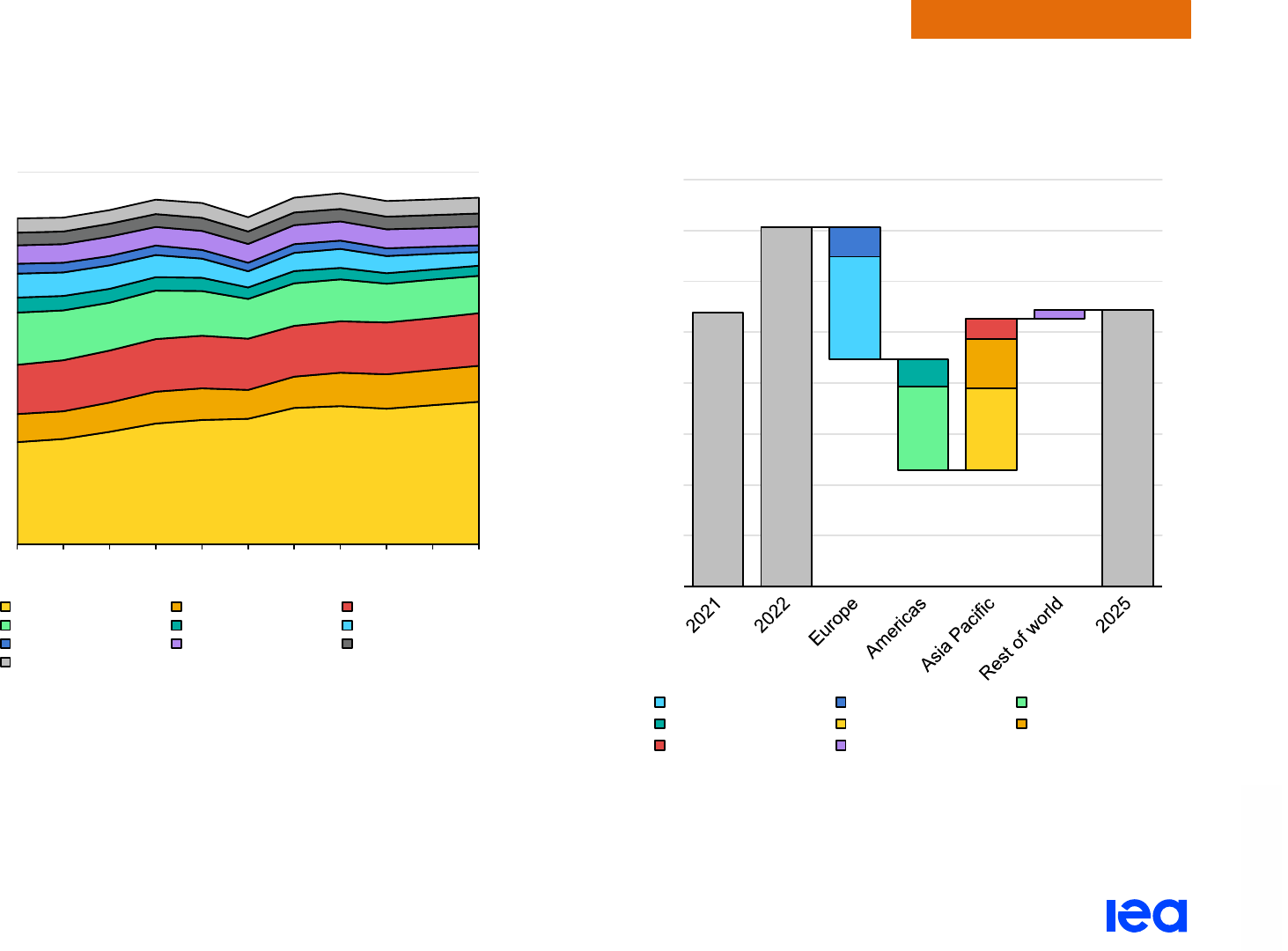

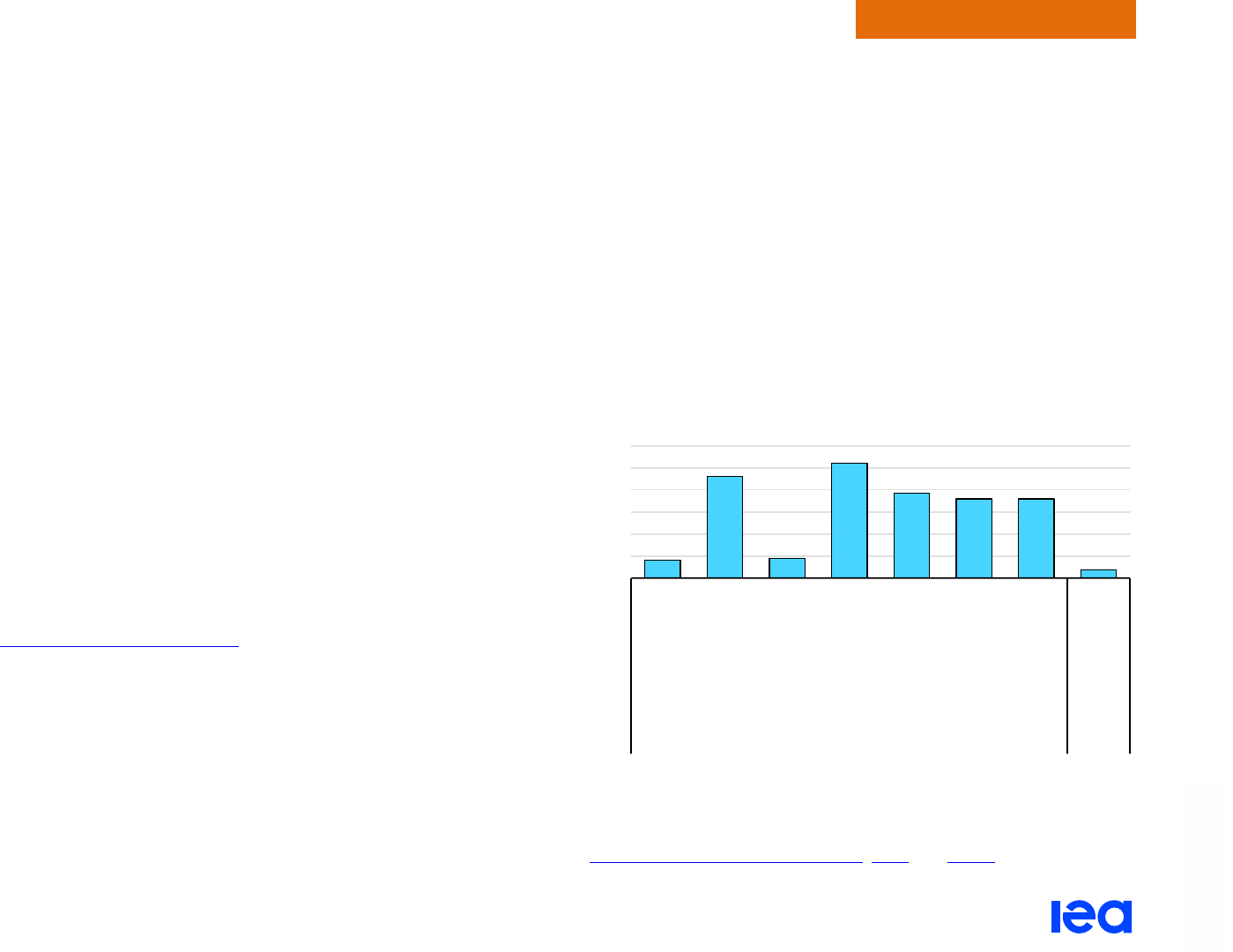

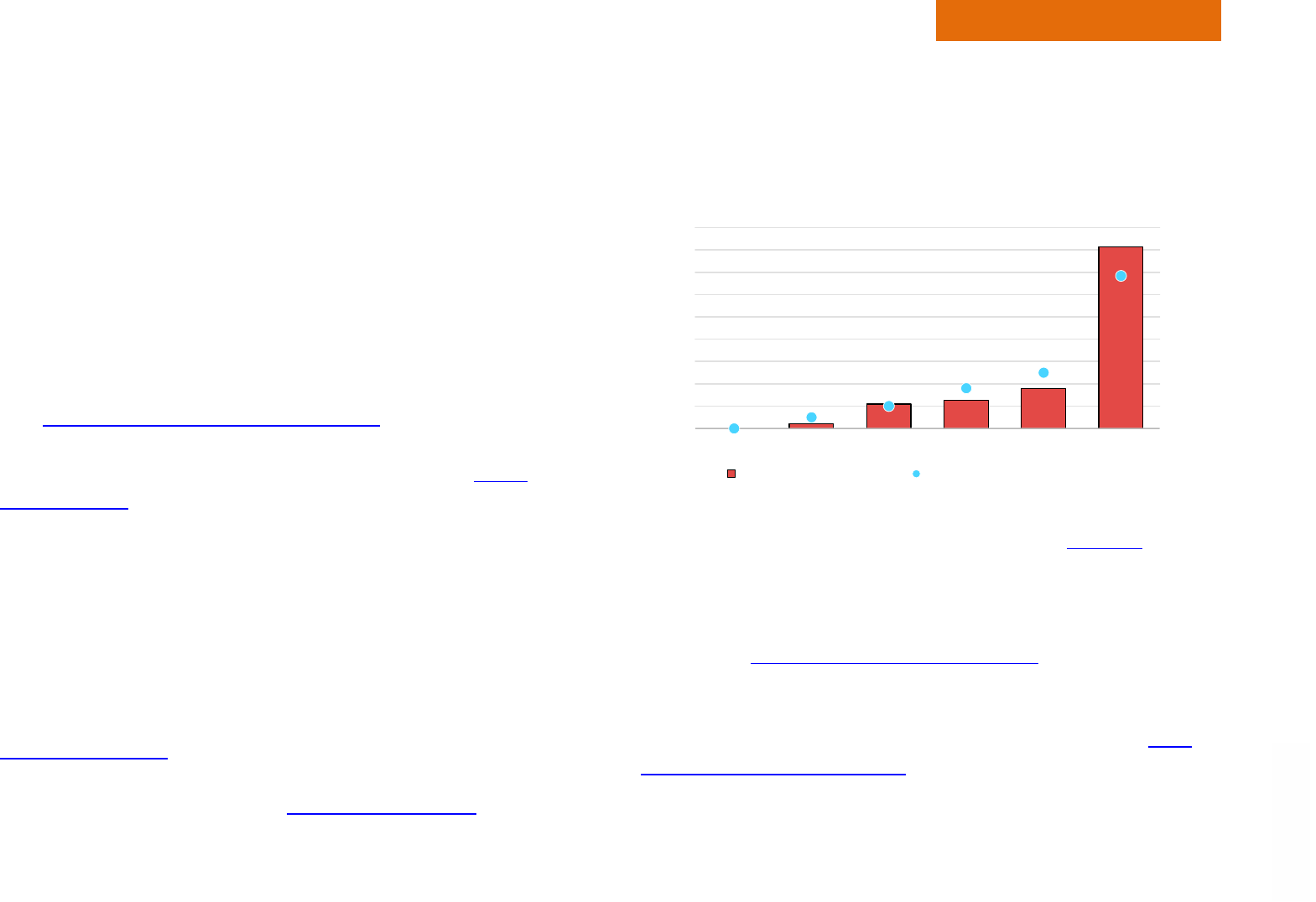

Out to 2025, more than 70% of the growth in global electricity demand is set to come from

China, India and Southeast Asia combined

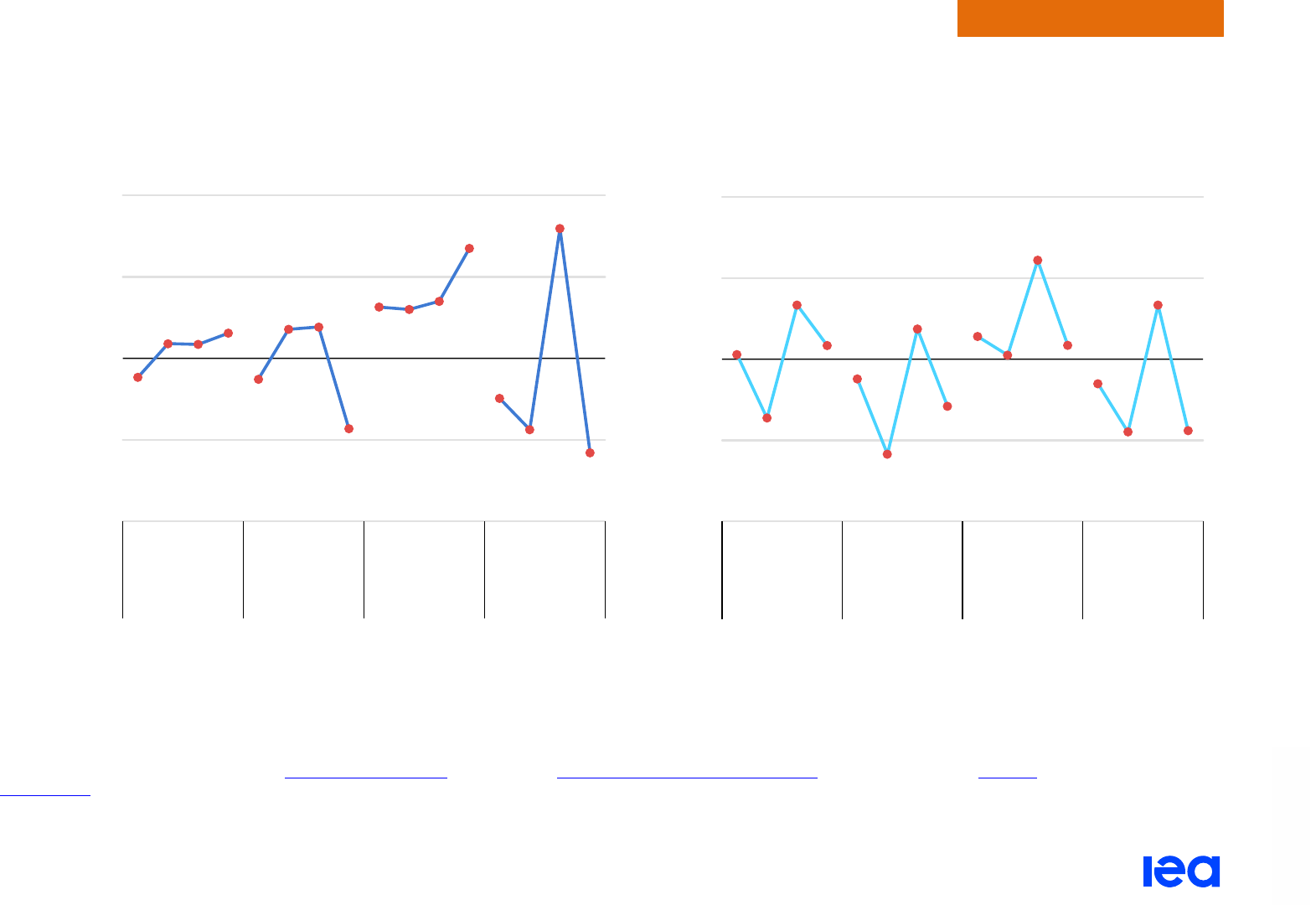

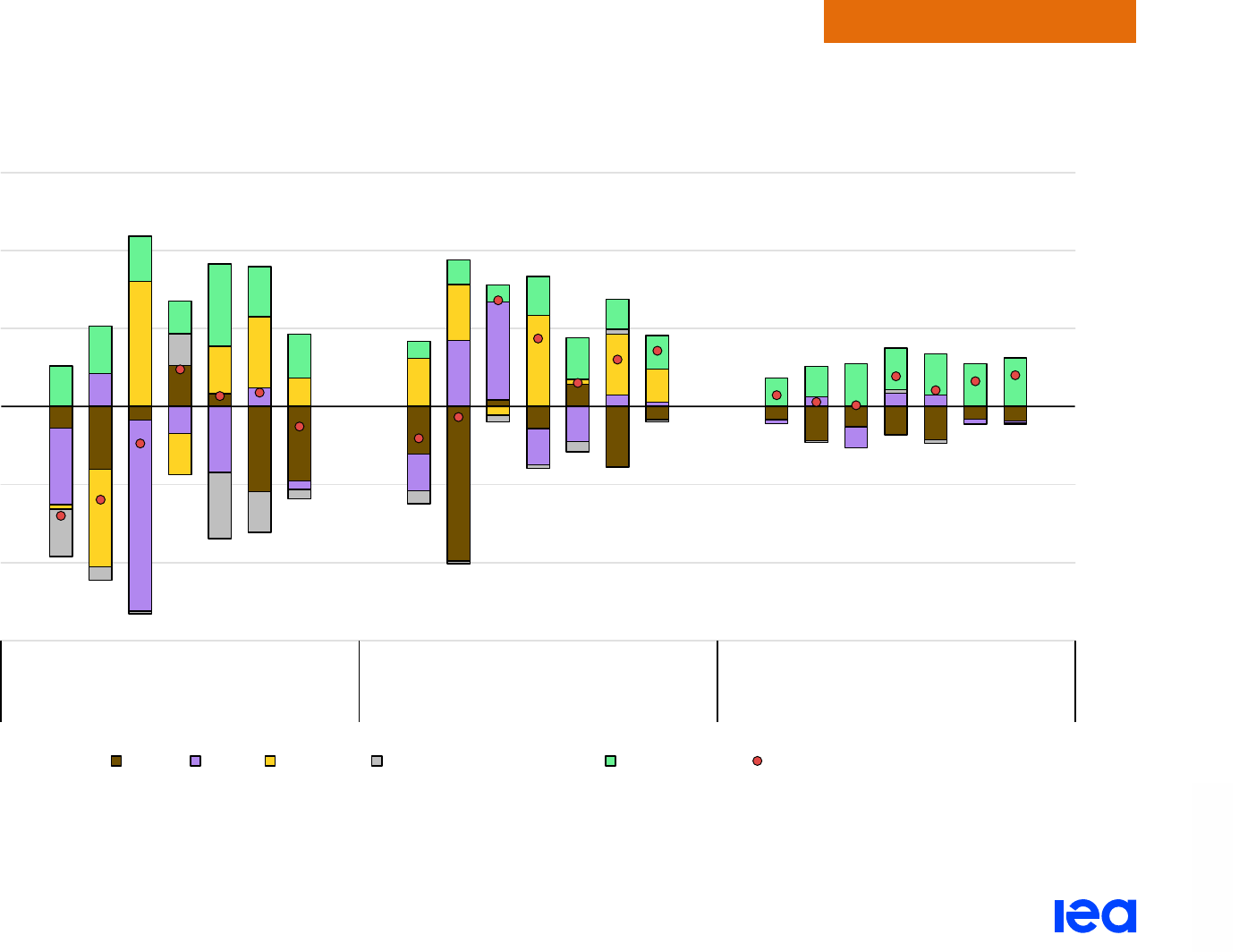

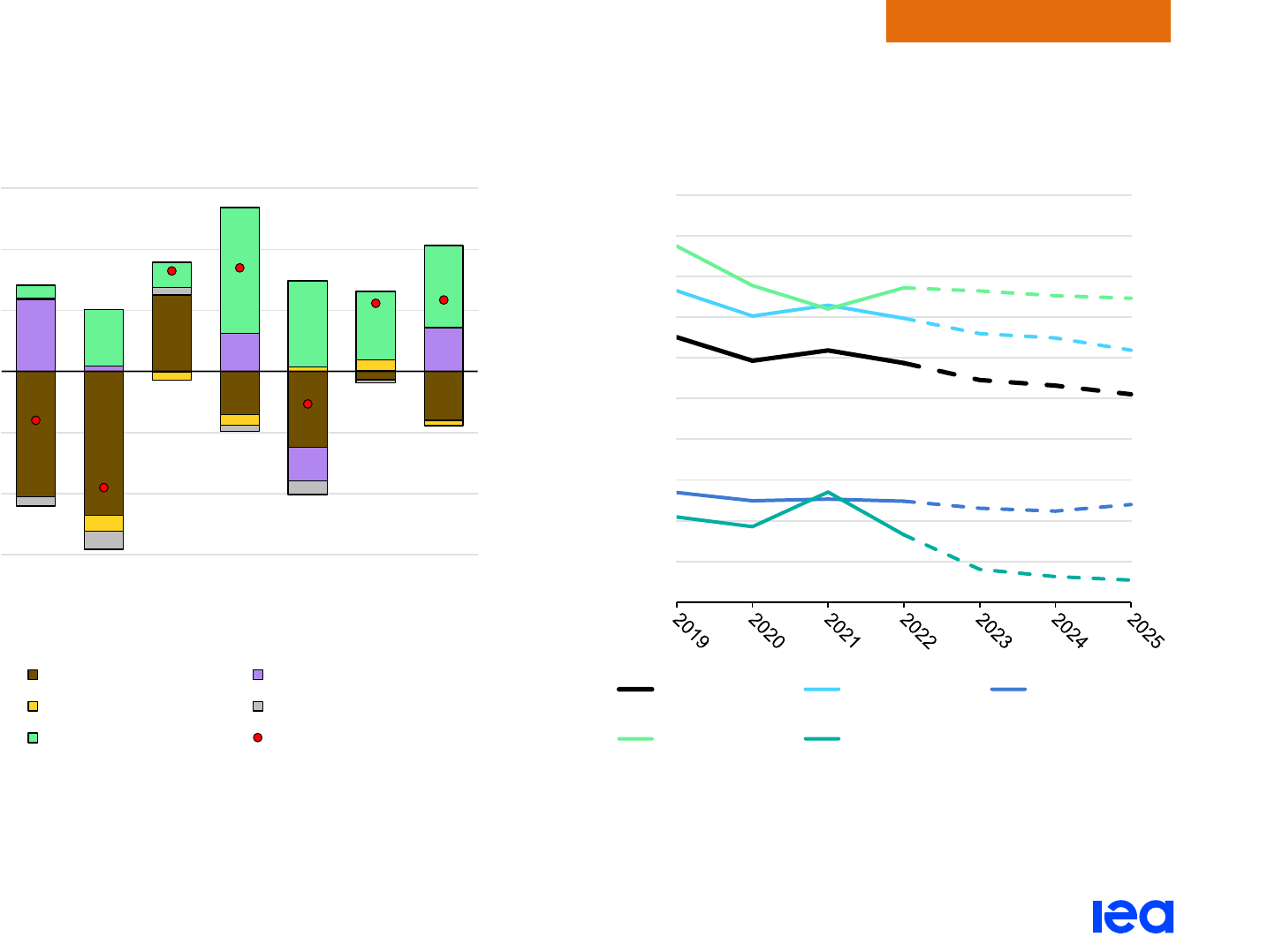

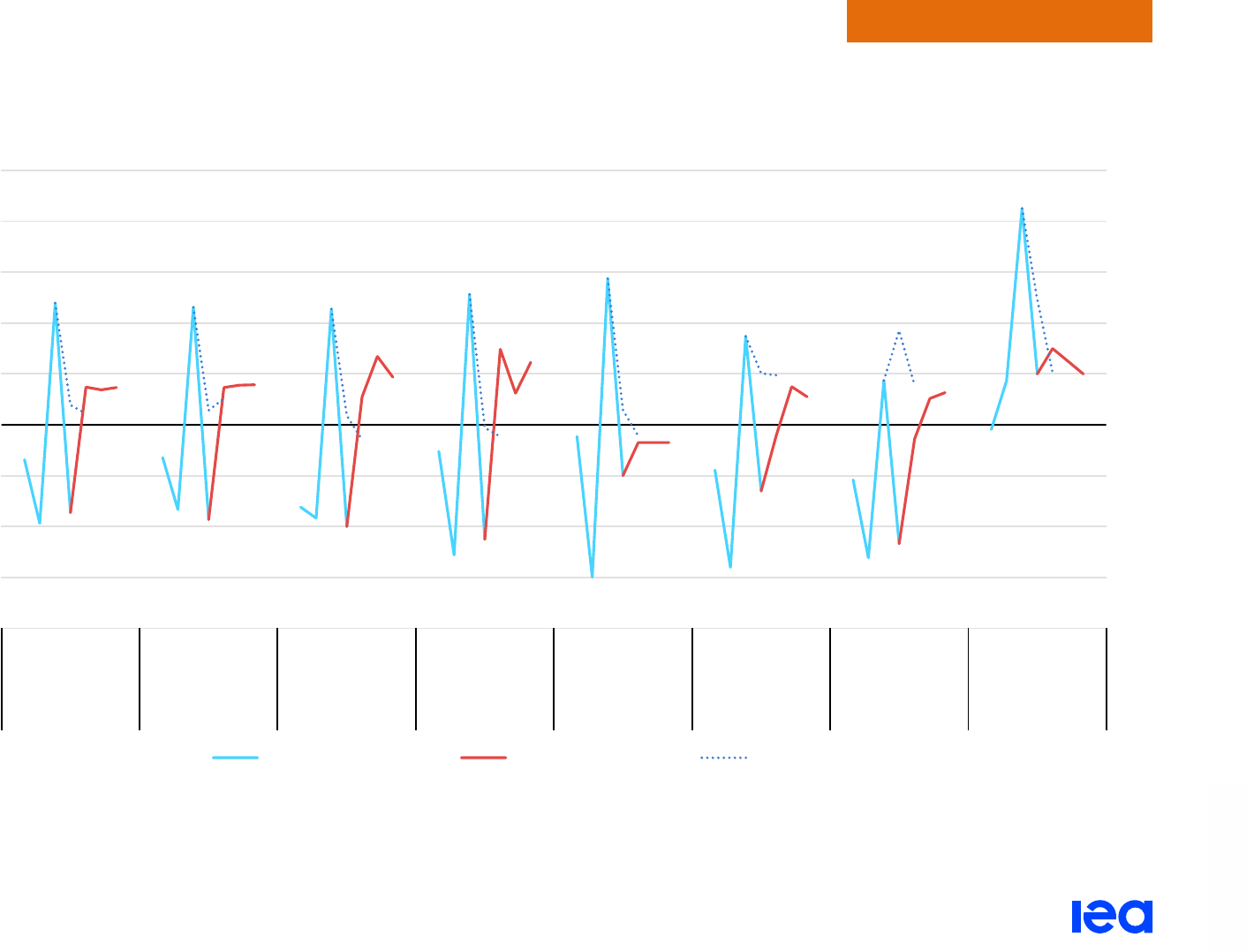

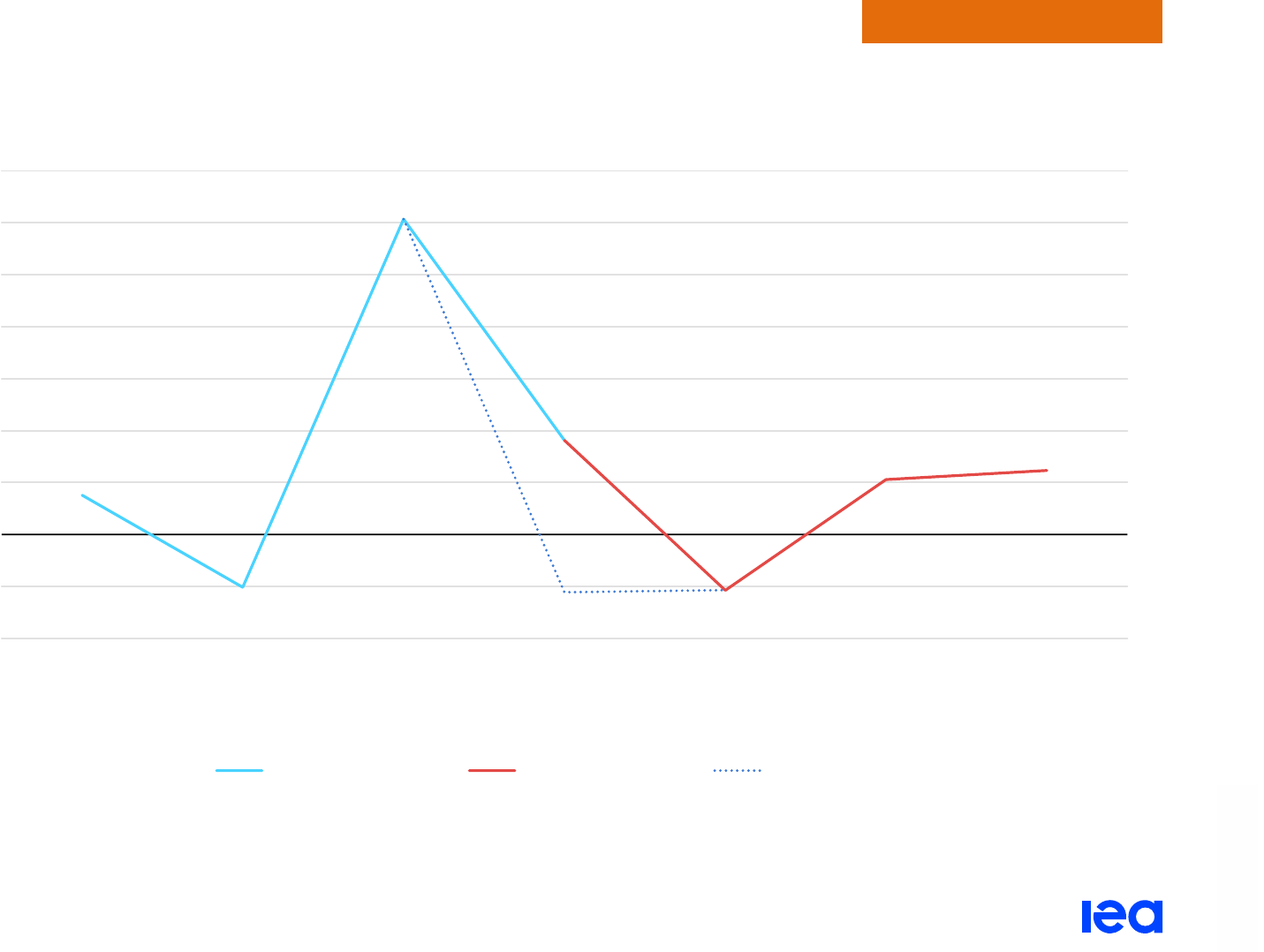

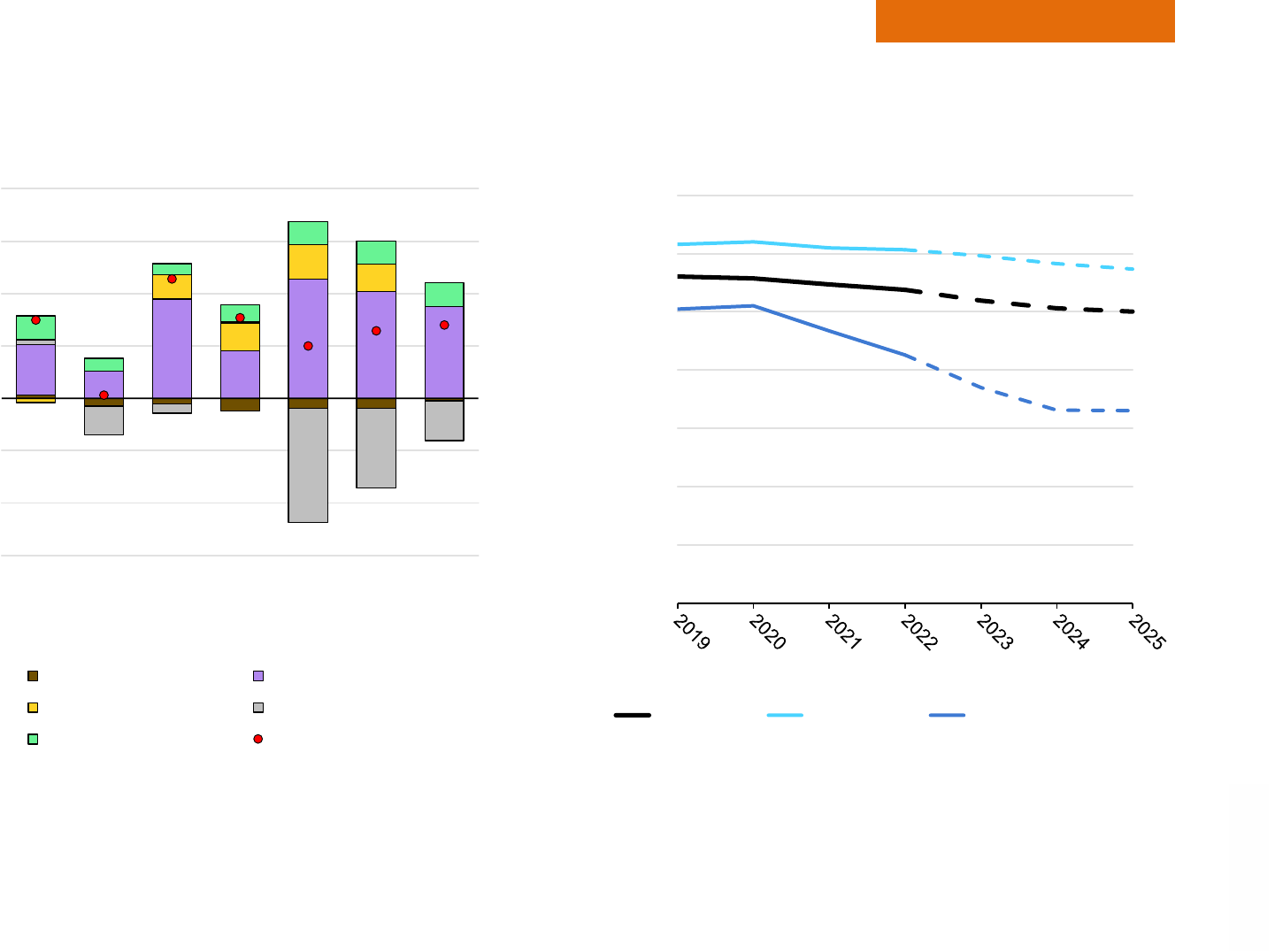

Year-on-year relative global change in electricity demand,

2015-2025

IEA. CC BY 4.0.

Year-on-year change in electricity demand by region, 2019-2025

IEA. CC BY 4.0.

-1%

0%

1%

2%

3%

4%

5%

6%

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

Electricity demand growth

Historical demand

Updated forecast

Previous forecast (July 2022)

- 500

- 300

- 100

100

300

500

700

900

1 100

1 300

1 500

2019 2020 2021 2022 2023 2024 2025

TWh

China India Southeast Asia

United States European Union Others

Net change

Electricity Market Report 2023

P

AGE | 15

IEA. CC BY 4.0.

Global overview

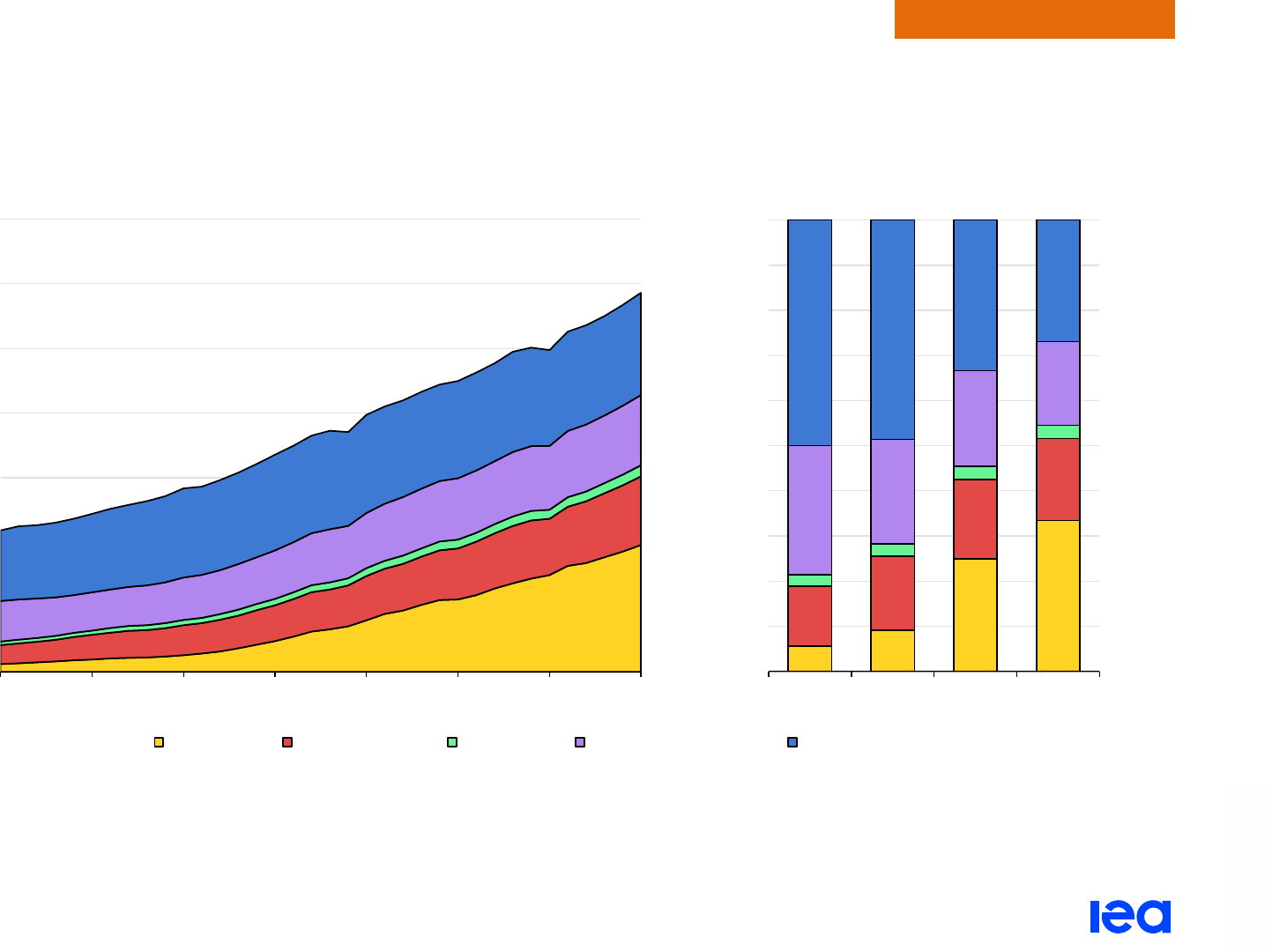

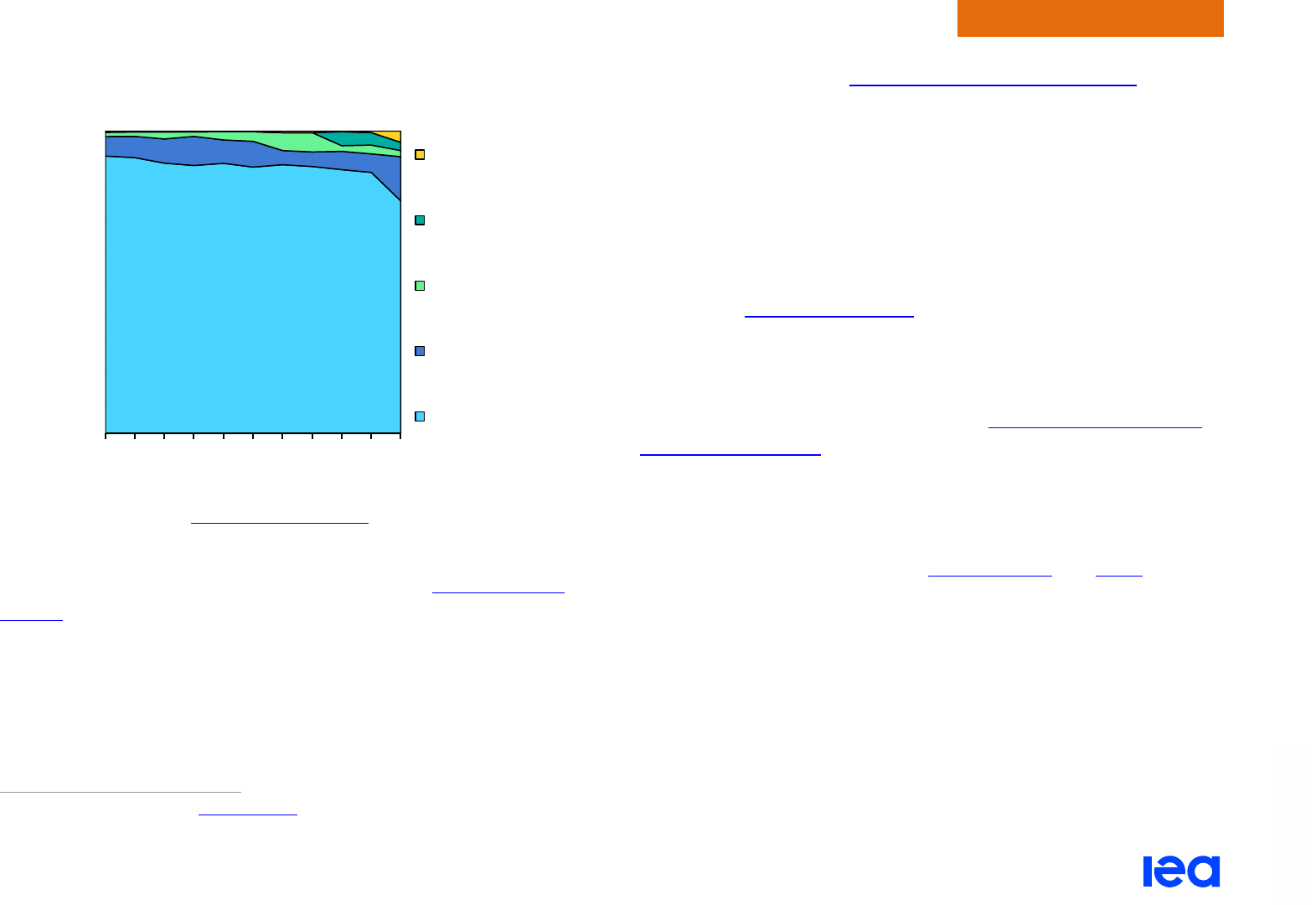

By 2025, Asia will account for half of the world’s electricity consumption and one-third of global

electricity will be consumed in China

Evolution of global electricity demand by region (left) and regional shares (right), 1990-2025

IEA. CC BY 4.0.

0

5 000

10 000

15 000

20 000

25 000

30 000

35 000

1990 1995 2000 2005 2010 2015 2020 2025

TWh

China Other Asia Africa Rest of the world United States & OECD Europe

5%

10%

25%

33%

13%

16%

18%

18%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1990 2000 2015 2025

Electricity Market Report 2023

P

AGE | 16

IEA. CC BY 4.0.

Global overview

Global economic growth shows signs of resilience but continues to face challenges

The global economy continues to face myriad challenges in the

wake of Russia’s war in Ukraine and the rise in central bank rates

aimed at combating persistent inflation. The International Monetary

Fund’s (IMF) January 2023 World Economic Outlook

pr

ovides

forecasts up to 2024 and shows global GDP growth of 6.2% in 2021

contracting to 3.4% in 2022 and easing to 2.9% in 2023. By 2024,

growth inches higher again, to 3.1%. The latest forecast represents

downward revisions of 0.2%, 0.7% and 0.3%, respectively,

compared with the

April 2022 forecast, w

hich underpinned our July

update. The January 2023 outlook, however, was slightly more

optimistic than the previous October 2022

forecast f

or the short

term, with global GDP growth for both 2022 and 2023 raised by

0.2 percent points. The October outlook, which provided projections

up to 2027, forecast a global GDP growth rate of 3.4% in 2025.

For the United States,

the IMF revised its latest GDP estimate to

2% for 2022 from 3.7% in April and its outlook to 1.4% from 2.3%

for 2023. Growth is forecast at a slower 1% in 2024. The contracting

trend reflects persistent and broadening inflation pressures and

higher interest rates that will continue to temper purchasing power.

2025 growth from the October outlook is 1.8%.

For the Euro area, GDP growth is estimated in the January outlook

at 3.5% for 2022 before plummeting to just 0.7% in 2023 and then

recovering to 1.6% in 2024. The latest forecast shows a sharp

downward revision from the April estimate of 2.3% for 2023. The

weaker outlook largely reflects the spillover effects from the war in

Ukraine and rate hikes from the European Central Bank, which are

partially offset by lower wholesale energy prices and support from

energy price controls. For 2025, a growth of 1.9% was forecast in

the October outlook.

Under pressure from its zero-Covid policy, China’s economy slowed

from the pre-pandemic average growth of 6.7% between 2015-2019

to 3% in 2022. However, the country’s sudden easing of its stringent

pandemic restrictions prompted an upward revision to 5.2% for

2023, up three percentage points from the October projections but

similar to its 5.1% estimate in April. Growth is forecast to slow to

4.5% in 2024. The October forecast estimated growth of 4.6% for

2025.

The GDP growth for India is estimated at 6.8% for 2022.The

outlook was revised downward in January to 6.1% from 6.9% for

2023, largely due to slow economic growth in its trading partner

countries. GDP growth for 2024 was unchanged at 6.8%. The 2025

forecast from the previous October outlook is 6.8%.

Sub-Saharan Africa’s GDP growth is estimated to ease from 4.7%

in 2021 to 3.8% in 2022, due to higher inflation and slower-than-

expected progress on poverty reduction. However, economic growth

will speed up from 3.8% in 2023 to above 4% in 2024 and 2025.

The IMF expects Latin America and the Caribbean’s GDP to grow

by 3.9% in 2022, 1.8% in 2023 and 2.1% in 2024. October forecast

for 2025 was 2.5%.

Electricity Market Report 2023

P

AGE | 17

IEA. CC BY 4.0.

Global overview

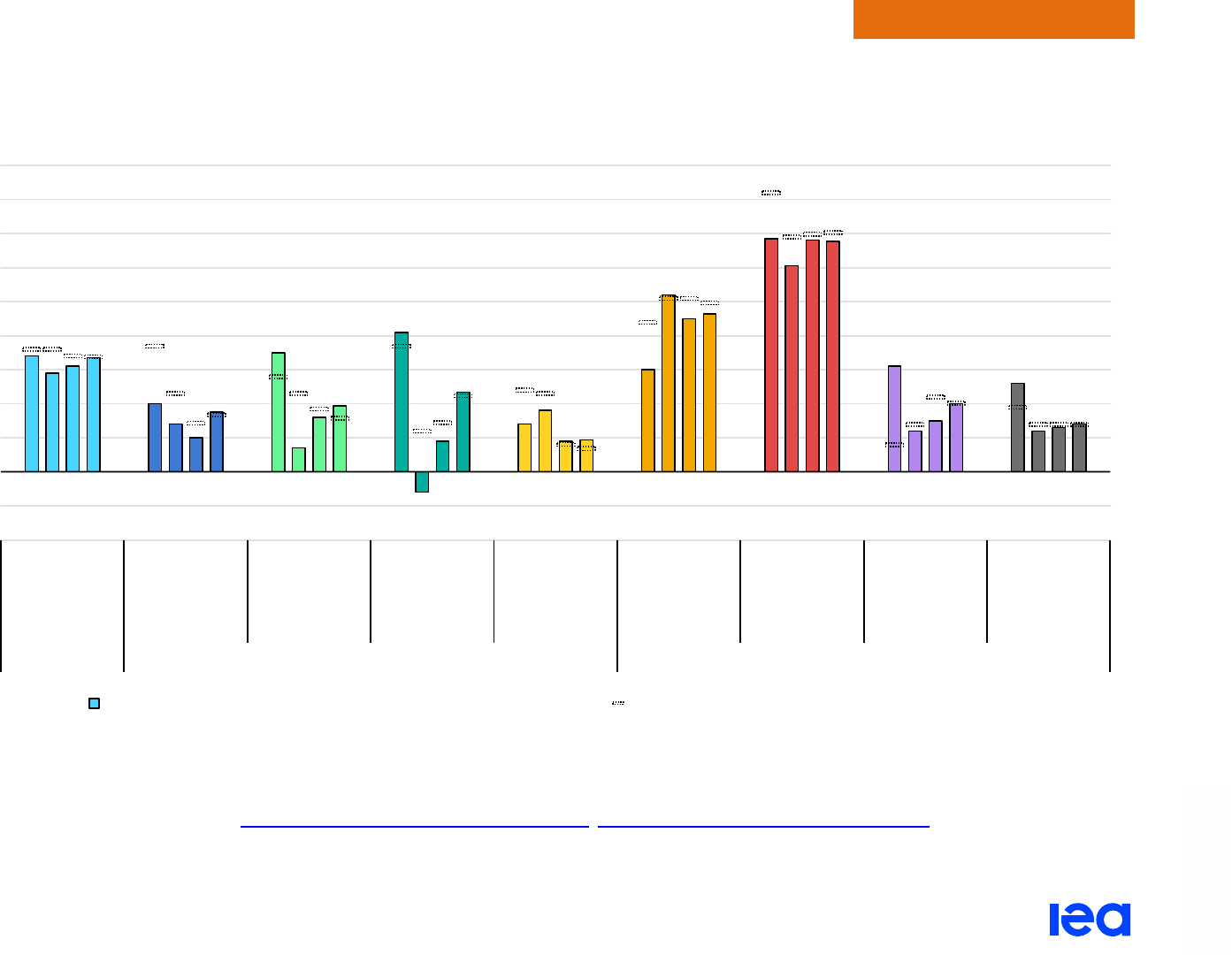

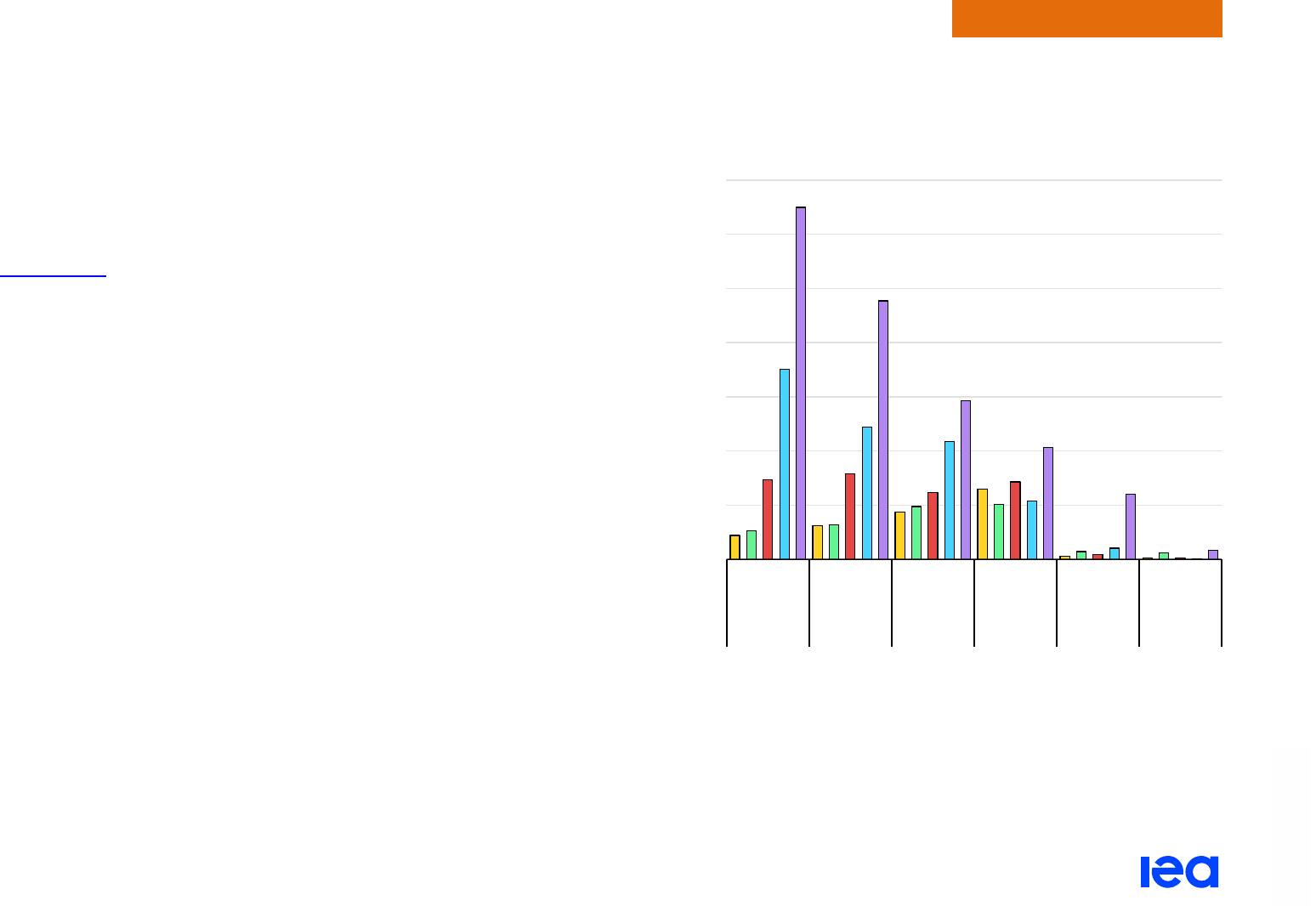

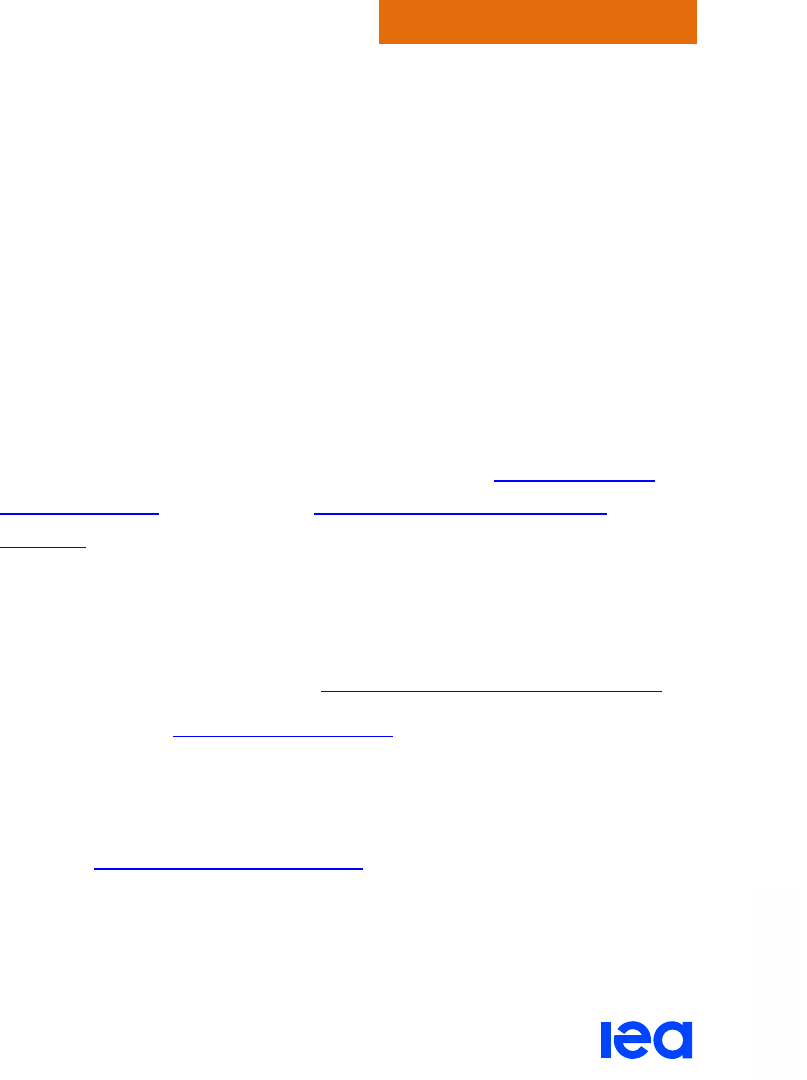

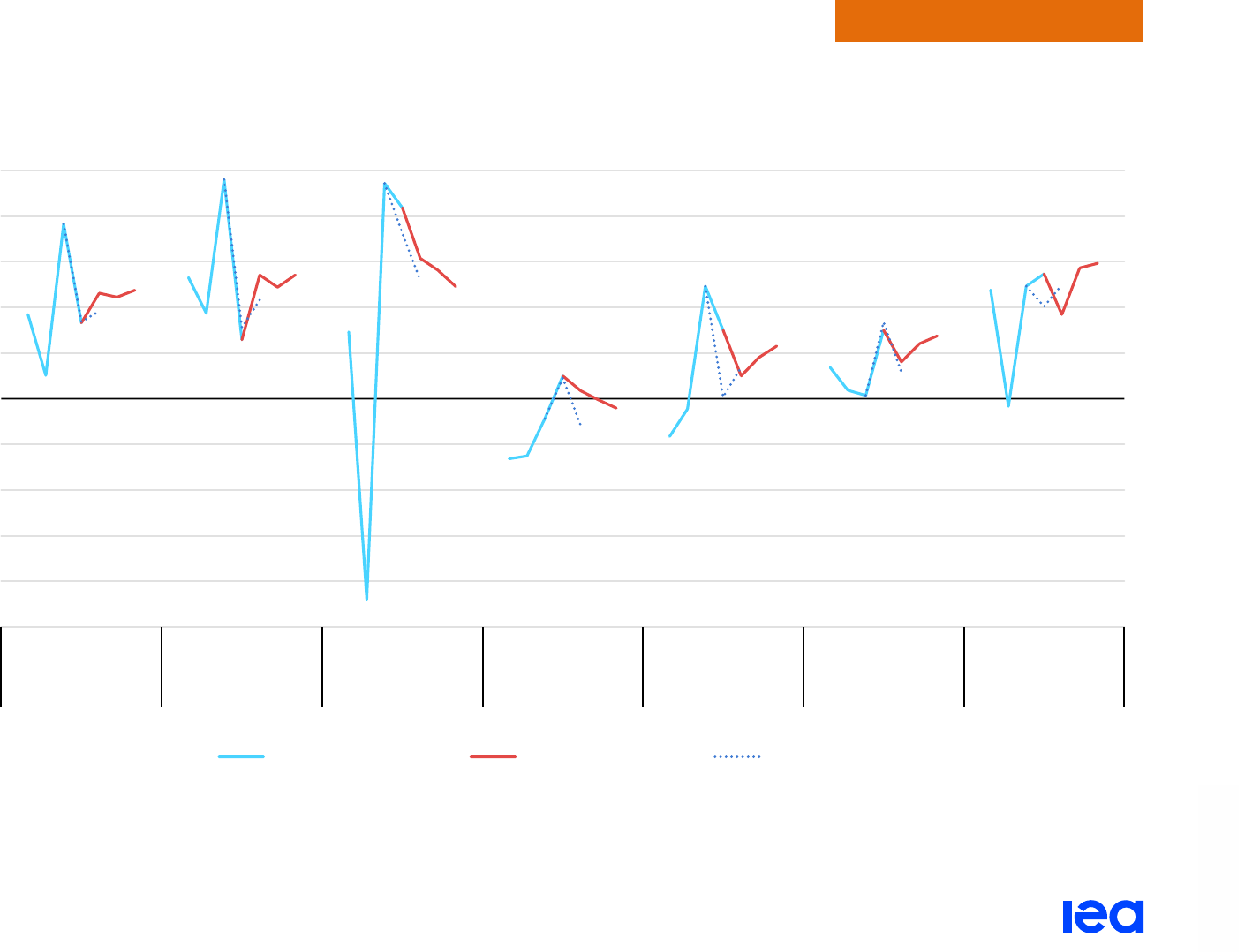

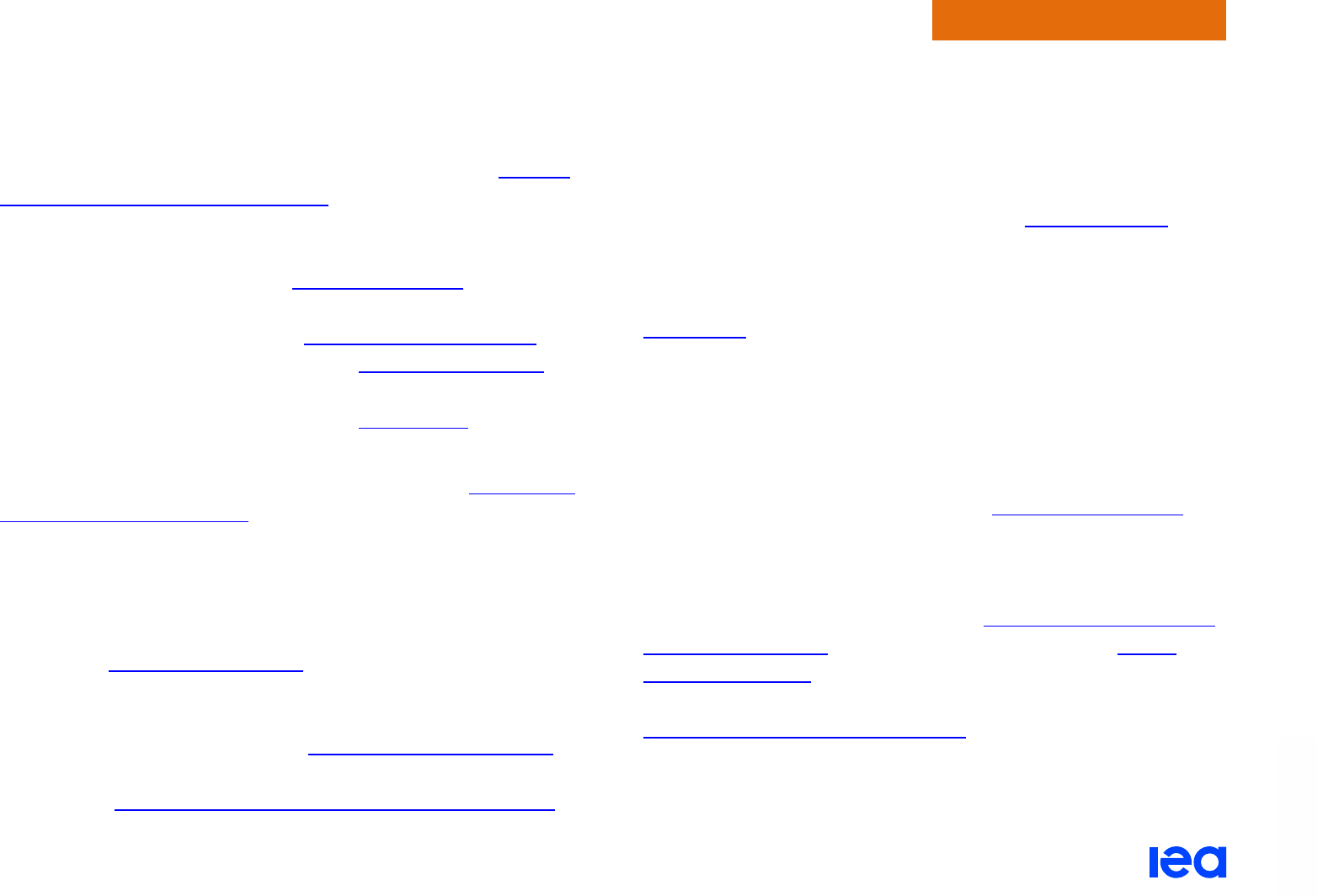

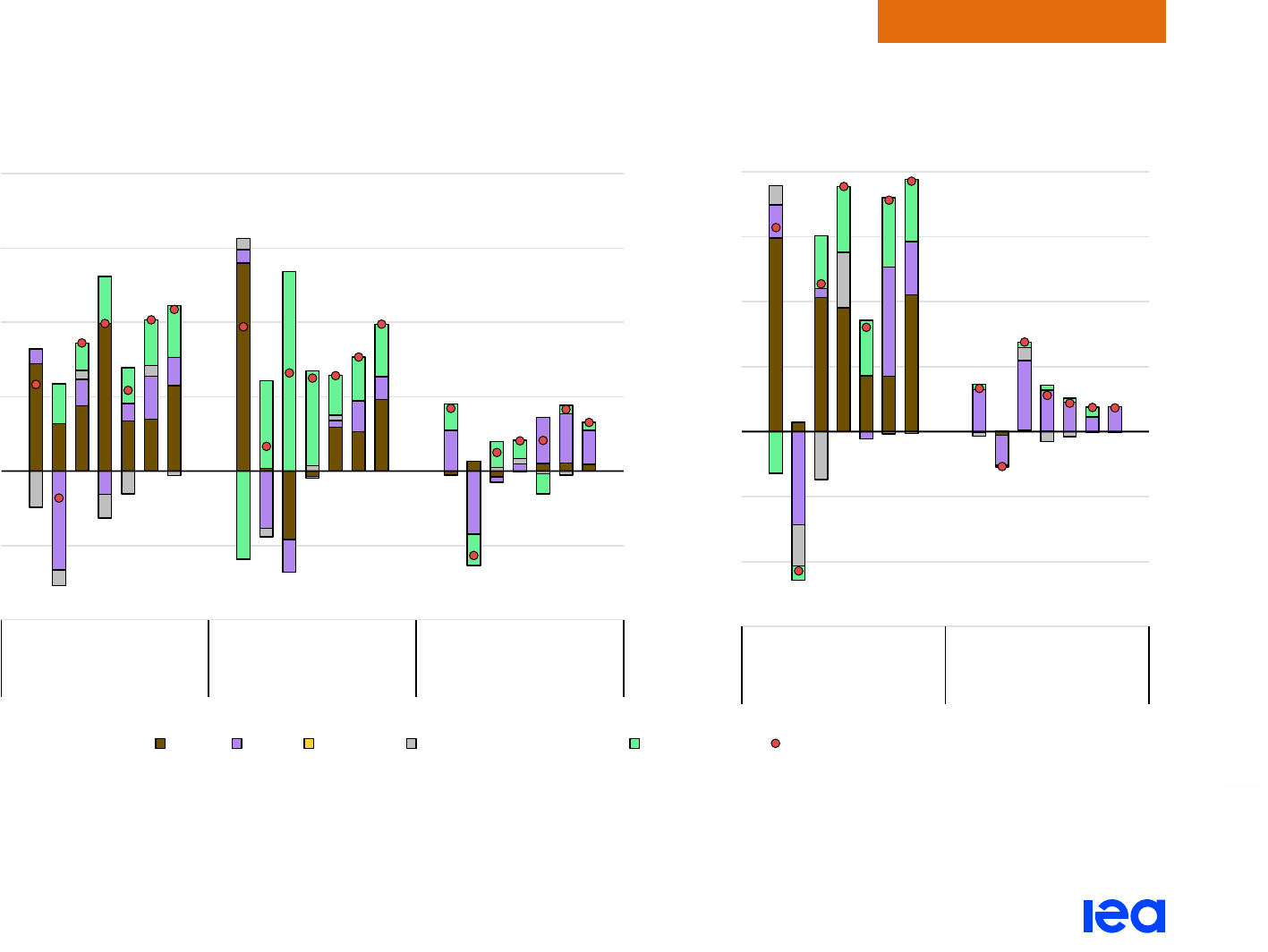

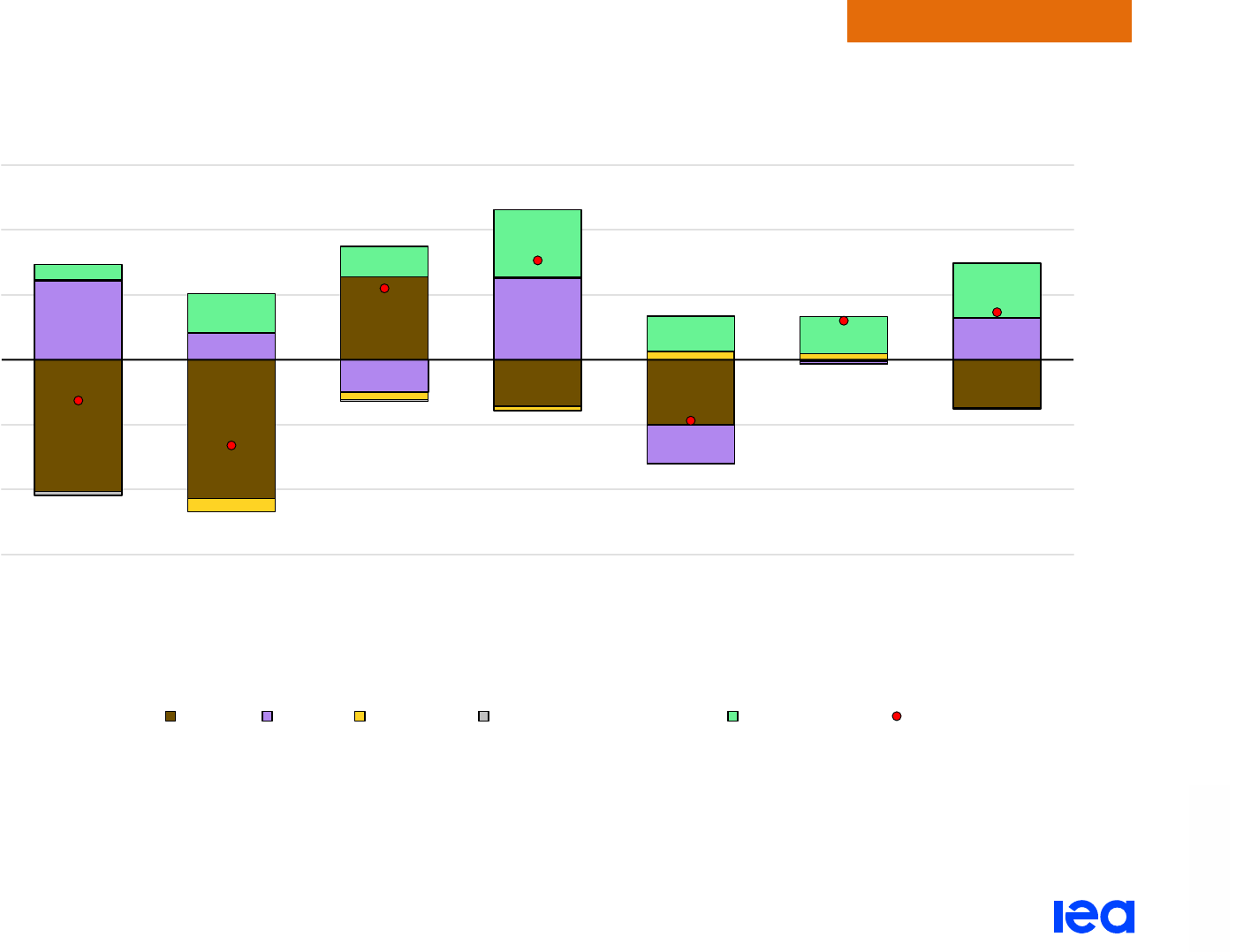

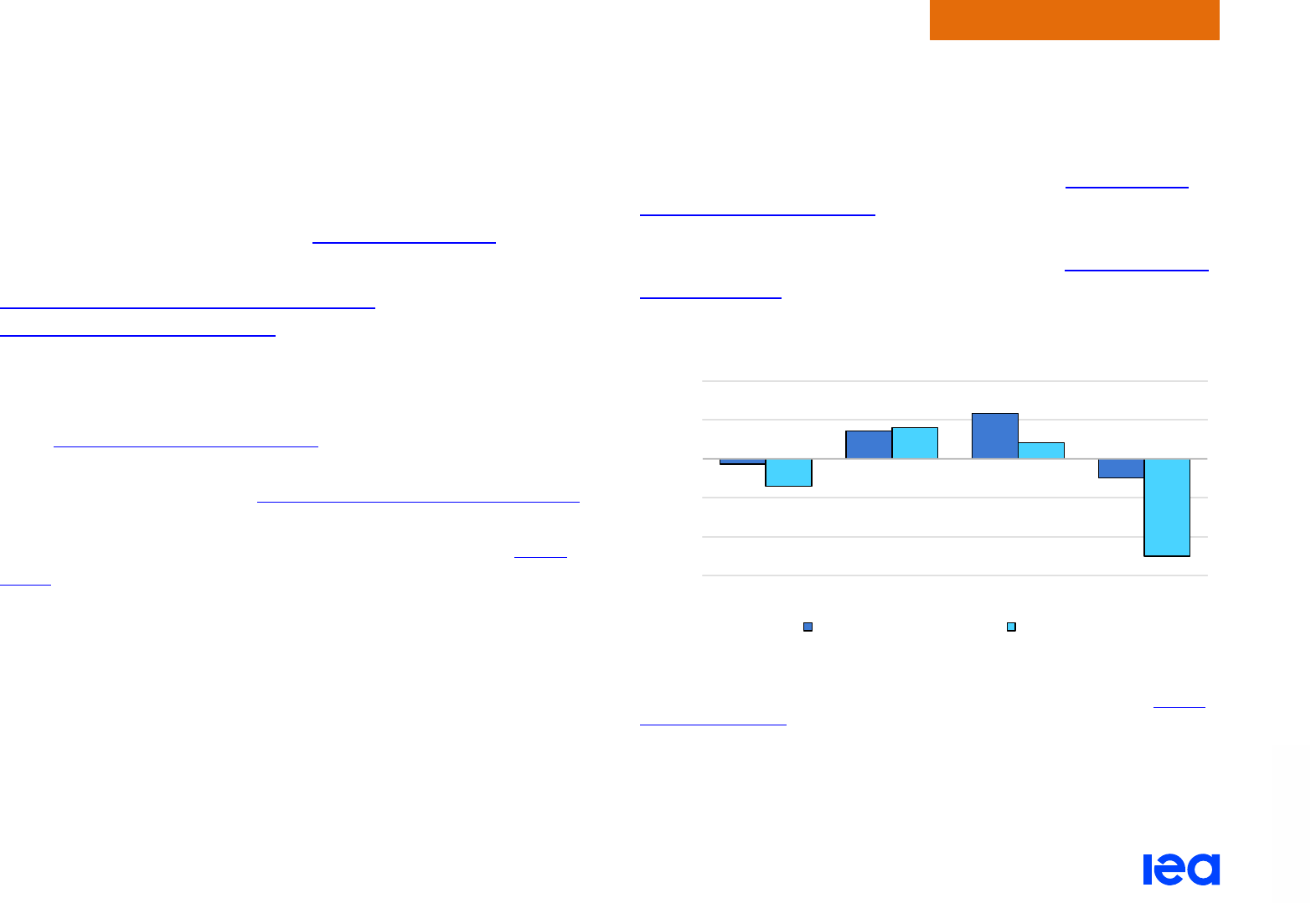

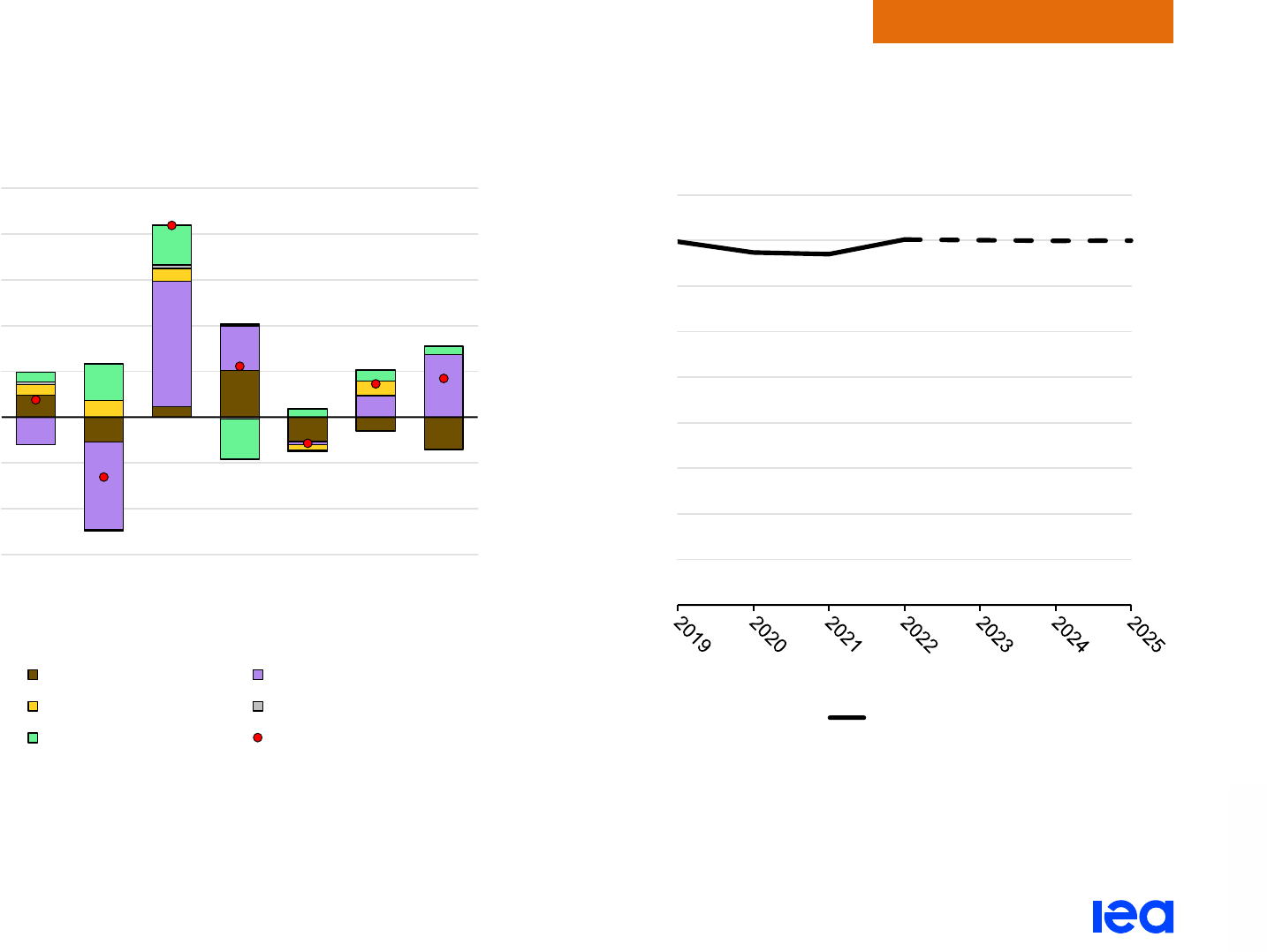

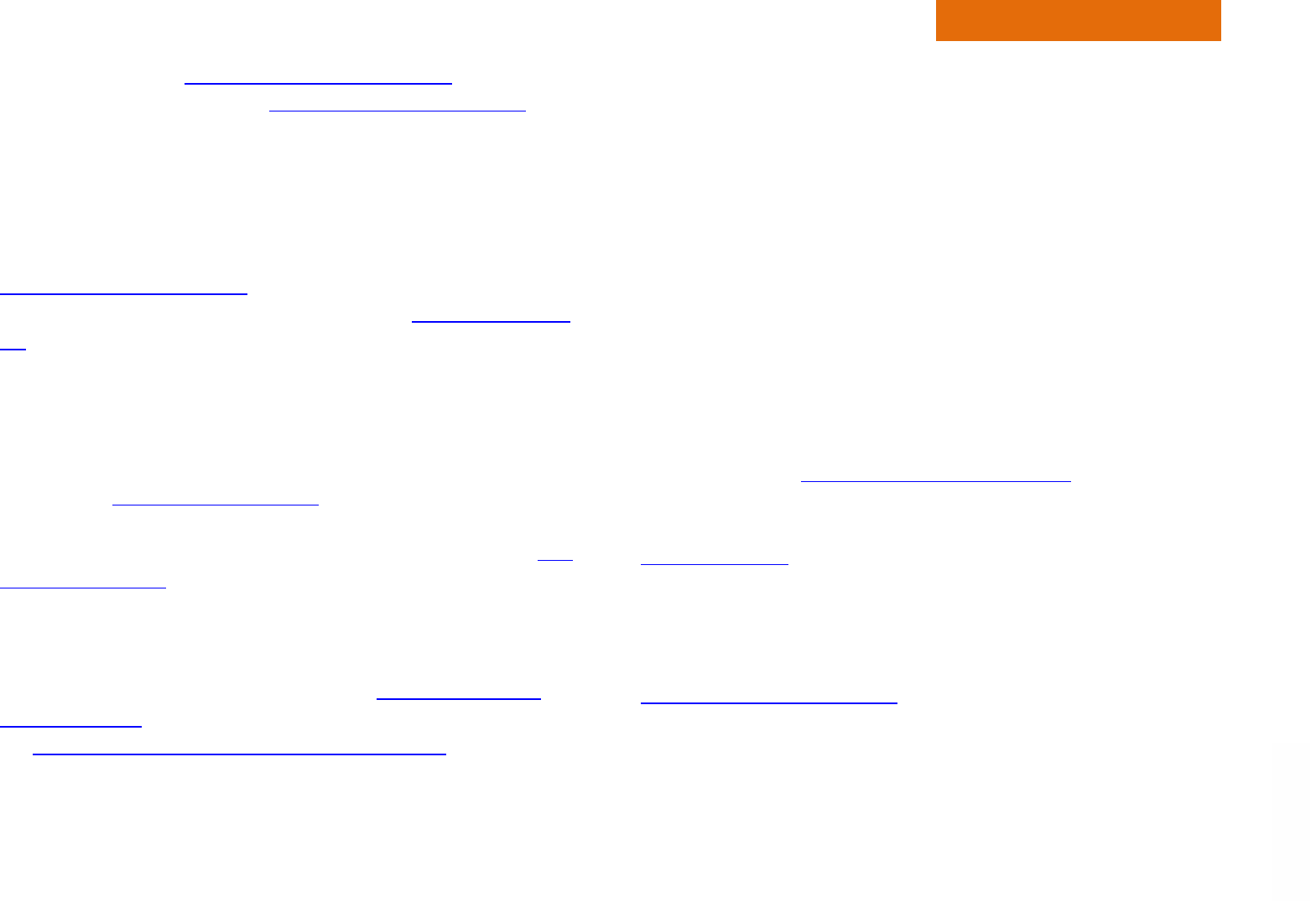

The war in Ukraine, energy crisis and persistent inflation suppress the economic outlook

Gross domestic product growth assumptions by country and region, 2022-2025

IEA. All rights reserved.

Notes: The bars represent annual changes in GDP relative to the previous year. The hollow lines show the previous April 2022 forecast. 2022-2024 values are from the January 2023

World Economic Outlook Update of International Monetary Fund (IMF). 2025 values are from IMF’s October 2022 outlook.

Sources: Based on International Monetary Fund (2023), World Economic Outlook October 2022 Database, World Economic Outlook Update January 2023

, 1 F

ebruary 2023.

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

2022

2023

2024

2025

2022

2023

2024

2025

2022

2023

2024

2025

2022

2023

2024

2025

2022

2023

2024

2025

2022

2023

2024

2025

2022

2023

2024

2025

2022

2023

2024

2025

2022

2023

2024

2025

United

States

Euro area United

Kingdom

Japan China India Brazil South Africa

World Advanced economies Emerging and developing economies

Real GDP, annual change

Updated forecast (IMF October 2022, January 2023) Previous forecast (IMF April 2022)

Electricity Market Report 2023

P

AGE | 18

IEA. CC BY 4.0.

Global overview

Industrial electricity demand plummeted to historic lows in multiple countries in 2022

In 2021, many countries started to gradually phase out Covid-19

public policy measures and return to more normal economic activity.

However, some economies (e.g. China) still imposed lockdowns in

2022, which had an impact on both residential and industrial

electricity consumption. Equally, persistently high electricity prices

continued to add downward pressure on consumption, particularly in

the residential and industrial sectors.

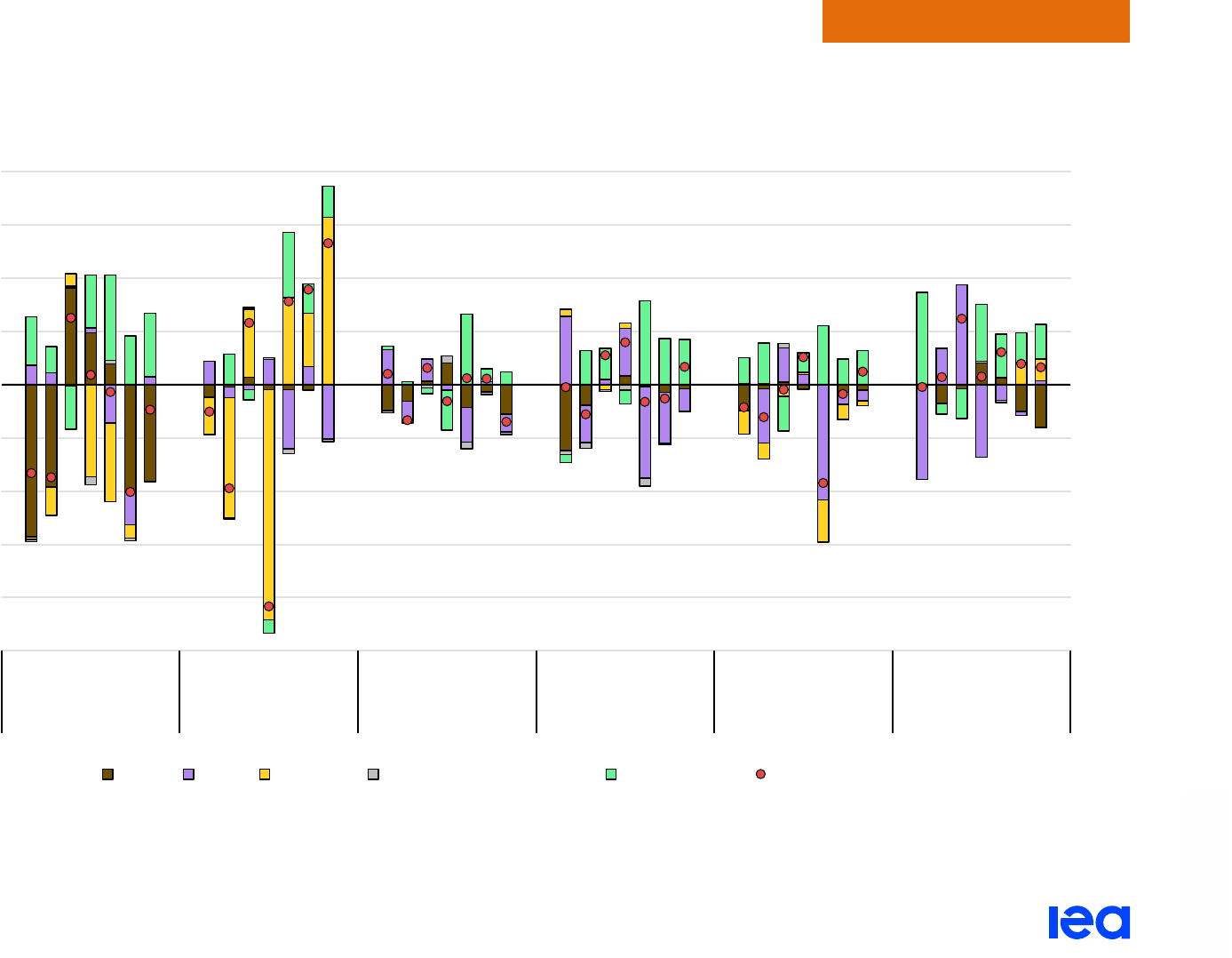

Comparing the first three quarters of the years, both the

United Kingdom and Spain experienced the lowest industrial

electricity consumption in over 20 years in 2022. Spain saw a

decrease of more than 10% compared to 2019, while the

United Kingdom posted a drop of almost 15% in 2022 versus 2019.

Spain’s electricity-intensive manufacturing activity was especially

hard hit by the rise in prices. The country’s industrial electricity

consumption posted a similar y-o-y decline in 2022 as it did in 2020

when severe Covid-related lockdowns led to substantial demand

destruction. Of the countries surveyed, the United Kingdom saw the

sharpest rise in average wholesale electricity prices. Spain followed

with the second highest level, despite the June 2022

implementation of the Iberian exception, a cap on wholesale gas

prices adopted to reduce the cost of electricity.

In the United Kingdom and Spain, as elsewhere, residents spent

more time at home during widespread Covid-19 lockdowns in 2021,

which led to higher residential electricity consumption that was well

above the subsequent 2022 levels when pandemic restrictions were

eased. Although formal Covid restrictions were lifted in the

United Kingdom in July 2021, many employees continued to

telework through the end of the year, which was less the case in

2022. In addition to the surge in prices amid the energy crisis, a

return to more normal work patterns and warmer temperatures

weighed heavily on UK residential consumption in 2022.

China’s

zero-Covid policy in 2022 boosted residential electricity

demand while growth in the industrial sector was tempered by

weaker economic activity. Residential power consumption has been

steadily increasing as the electrification of homes rapidly expands,

with a growing share of electricity used in cooling, heating, cooking

and appliances. The country’s house-bound population propelled

residential electricity demand up by a sharp 13.5% in 2022.

By contrast, China’s strict pandemic restrictions and lockdowns

disrupted the country’s economic activity. As a result, electricity

demand in the industrial sector was up a modest 1.7%. Coal supply

shortages also caused power restrictions and outages in industrial

hubs such as in Northeast China and the provinces of Guangdong

and Hunan, further contributing to the slowdown.

In the United States, residential electricity consumption saw a

similar y-o-y growth in 2022 as in the previous two years. Weaker

industrial electricity demand growth mainly reflected the slowdown

in the economy.

Electricity Market Report 2023

P

AGE | 19

IEA. CC BY 4.0.

Global overview

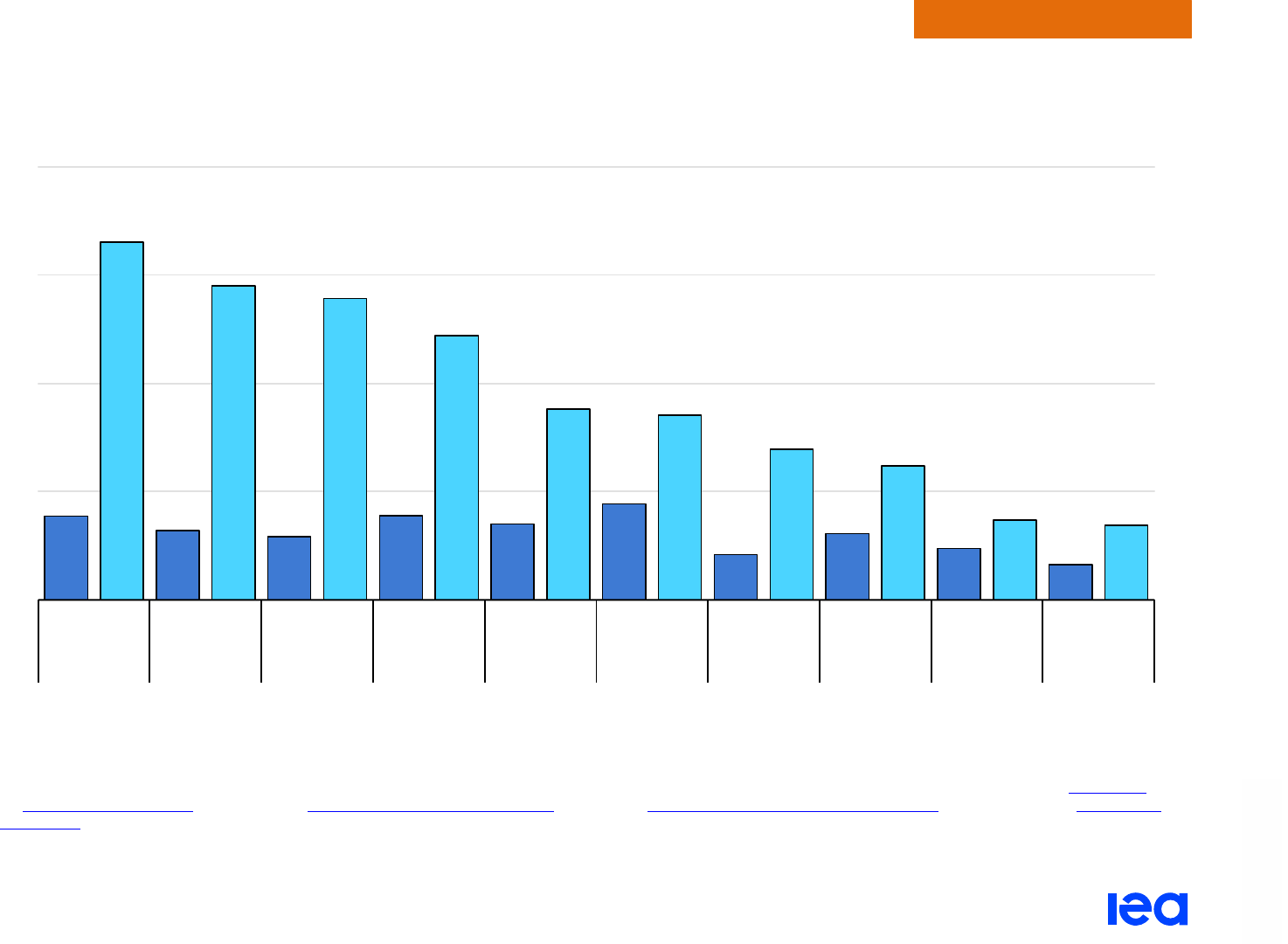

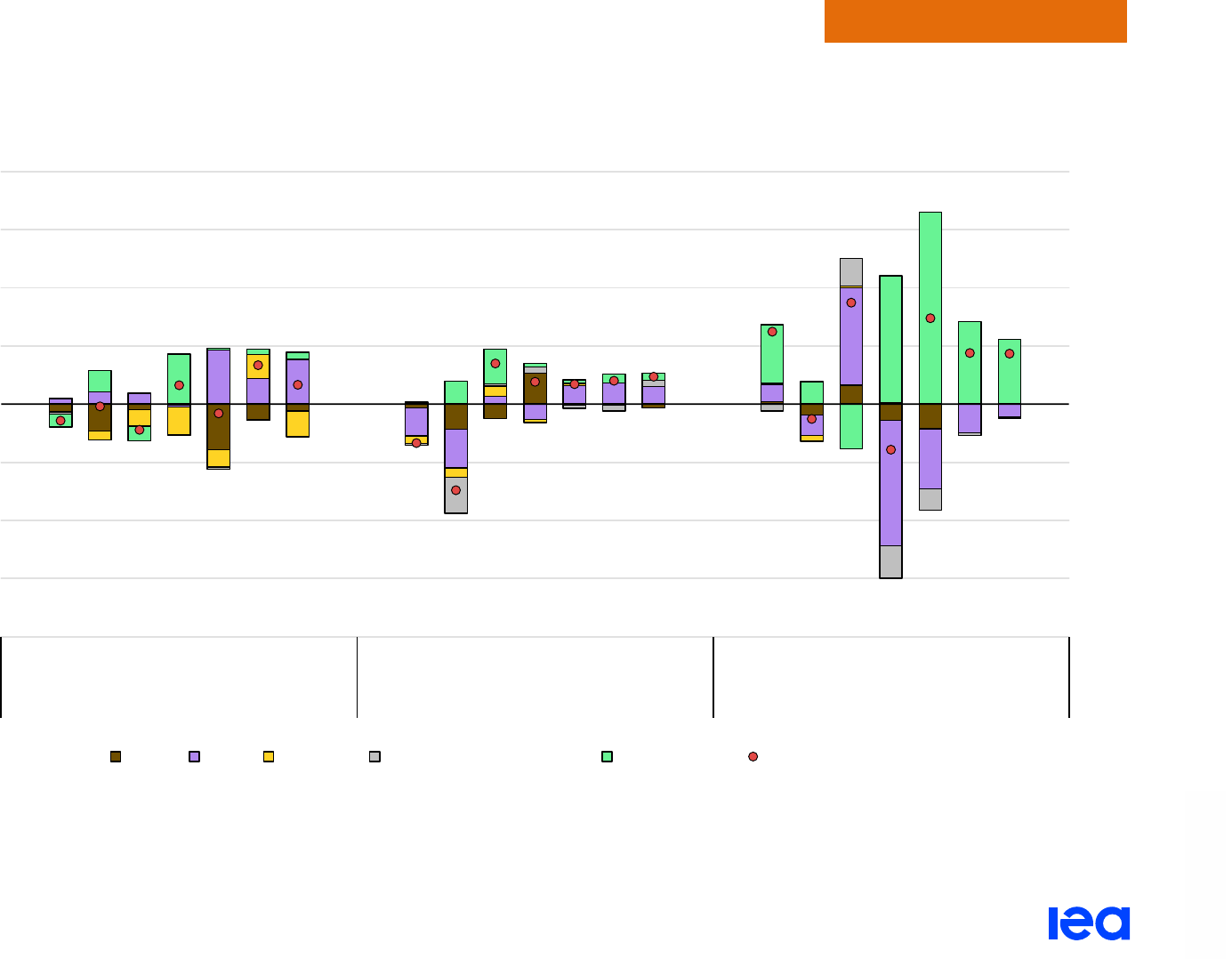

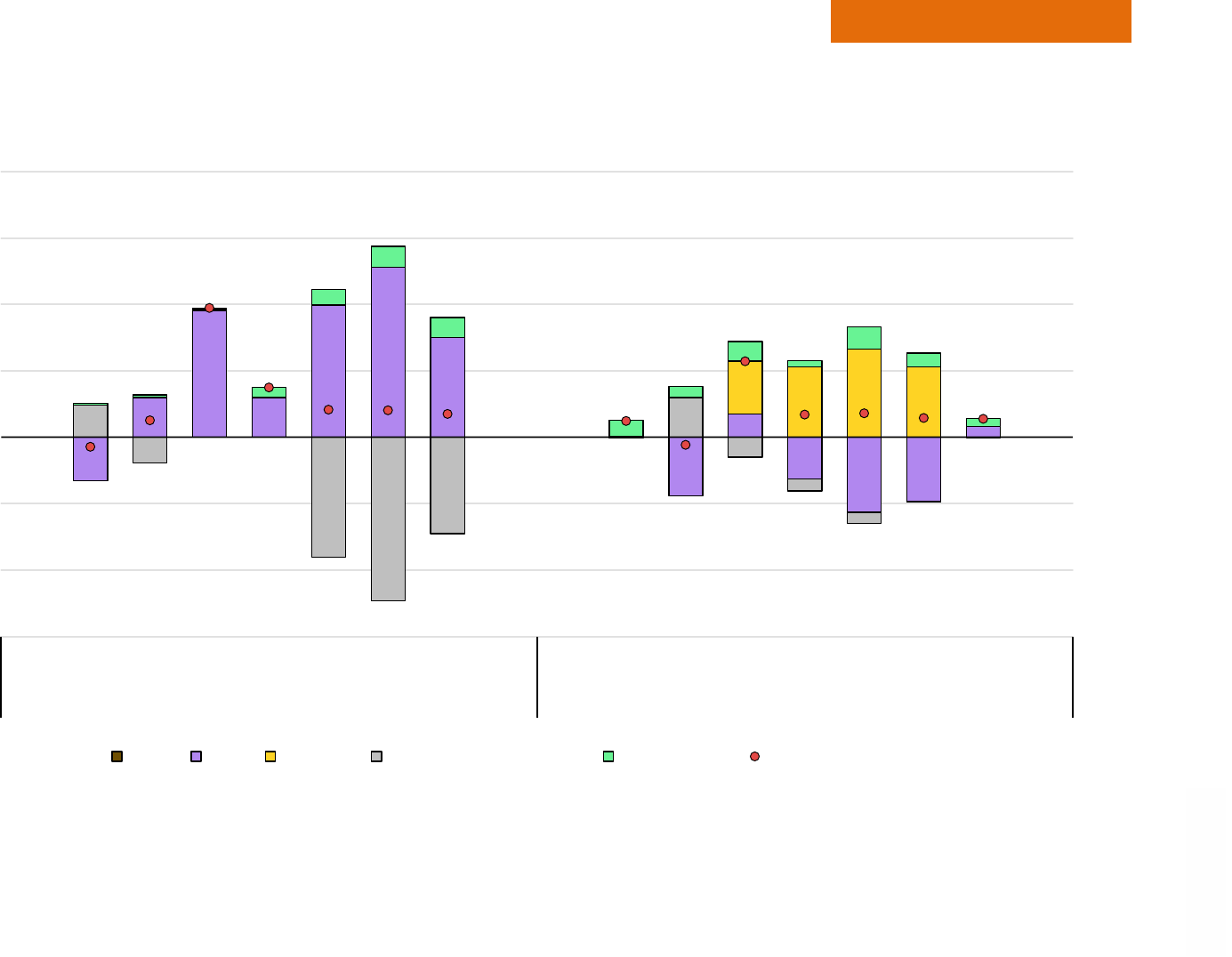

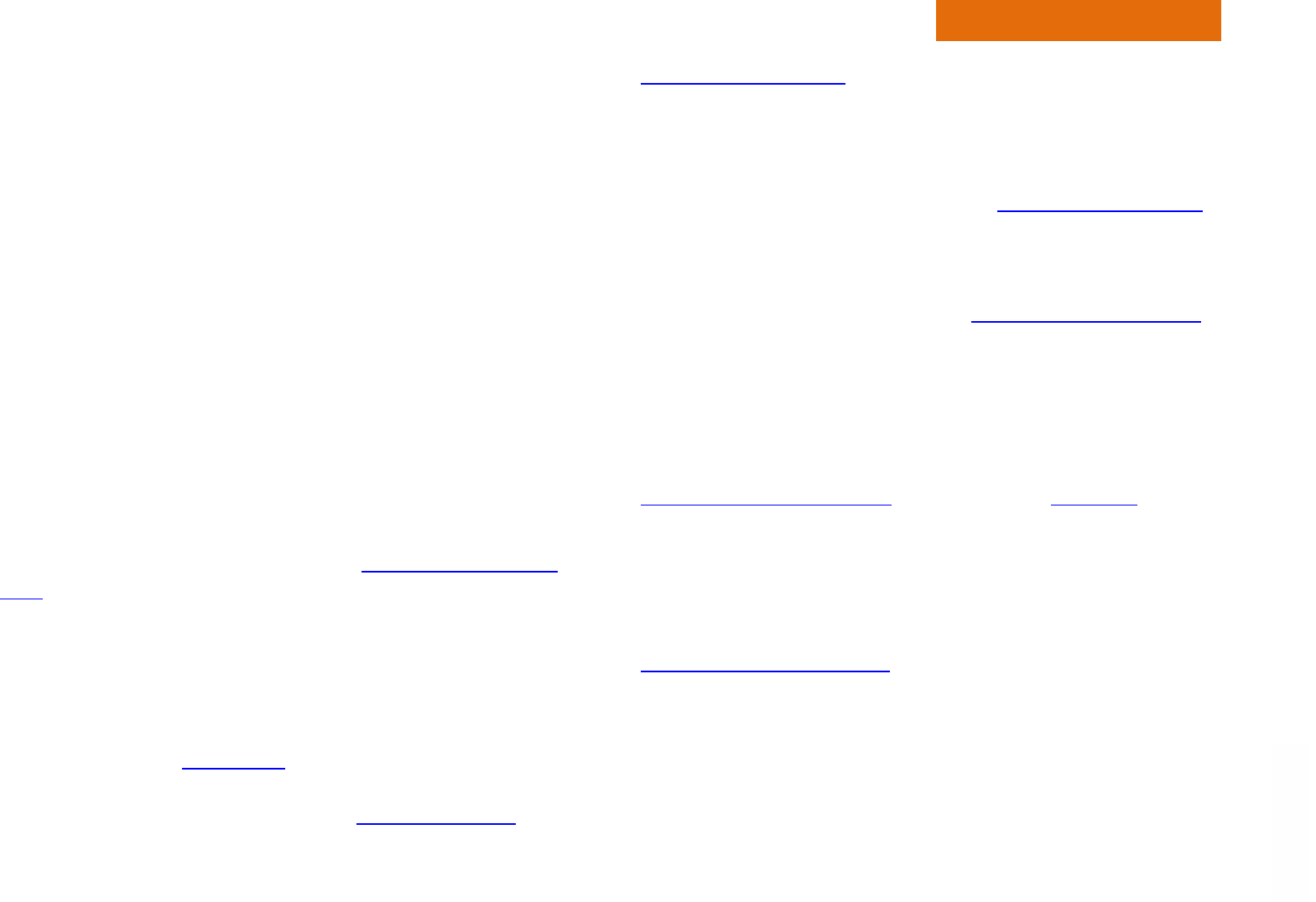

The United Kingdom and Spain saw a decline in industrial electricity consumption in 2022

Year-on-year change in sectoral electricity consumption in selected large economies, 2019-2022

IEA. All rights reserved.

Note: The analysis is based on data for the first three quarters of 2019-2022.

Sources: IEA analysis using data from the China Electricity Council (China) (2023), U.S. Energy Information Administration (United States) (2023), GOV.UK

(

United Kingdom) (2023),

Red Eléctrica (Spain) (2023), 31 January 2023.

-20%

-10%

0%

10%

20%

2019

2020

2021

2022

2019

2020

2021

2022

2019

2020

2021

2022

2019

2020

2021

2022

United States United

Kingdom

China Spain

Residential

-20%

-10%

0%

10%

20%

2019

2020

2021

2022

2019

2020

2021

2022

2019

2020

2021

2022

2019

2020

2021

2022

United States United

Kingdom

China Spain

Industrial

Electricity Market Report 2023

P

AGE | 20

IEA. CC BY 4.0.

Global overview

Supply

Electricity Market Report 2023

P

AGE | 21

IEA. CC BY 4.0.

Global overview

Low-carbon sources set to cover almost all the growth in global electricity demand by 2025

Power systems faced challenges in multiple regions in 2022 due to

extreme weather events. Heatwaves and droughts strained the

supply situation in both China and India. A historic drought in

Europe resulted in low hydropower output, putting increased

pressure on dispatchable capacities amid record-low nuclear

generation in France. In the United States, winter storms caused

widespread power outages. These extreme events reinforce the

urgent need to increase the flexibility of the power system and

enhance security of electricity supply to better cope with weather-

related contingencies.

In 2022, the surge in fossil fuel prices following Russia’s invasion of

Ukraine also compounded the supply situation, especially for gas.

The relatively higher increase in natural gas and LNG prices

prompted a wave of fuel switching in the world to coal for use in

power generation. Global coal-fired generation rose by 1.5% in

2022, with the largest absolute increases in the Asia Pacific region.

Coal-fired generation also rose significantly in the European Union

amid low hydro and nuclear output. However, 2022 is likely to be an

exception and global coal-fired generation is forecast to plateau in

2023-2025, as higher output in the Asia Pacific region is offset by

declines in Europe and the Americas.

Global gas-fired generation remained relatively unchanged in

2022 compared to 2021, as declines in China, India and other

regions were largely offset by a rise in gas-fired output in the

United States. We expect global gas-fired generation to stagnate to

2025 on average, after declining by 3% in 2023, then growing by

1.4% in 2024 and 2% in 2025. Substantial declines in the EU will

partly be offset by significant growth in the Middle East.

Low-carbon generation from renewables and nuclear had diverging

trends in 2022. Renewables saw a year-on-year rise of 5.7%,

making up almost 30% of the generation mix. A surge in renewable

generation in the Asia Pacific region accounted for more than half of

the increase, followed by Americas. By contrast, nuclear output fell

4.3%. This was due to maintenance outages at a large number of

French plants, decommissioning of units in Germany and Belgium,

and reduced Ukrainian output.

Our outlook for 2023 to 2025 shows that renewable power

generation is set to increase more than all other sources combined,

with an annualised growth of over 9%. Renewables will make up

over one-third of the global generation mix by 2025. This trend is

supported by government pledges to increase spending on

renewables as part of economic recovery plans such as the Inflation

Reduction Act in the United States. Nuclear output is expected to

grow by 3.6% per year on average, mainly due to the increase in

Asia Pacific, plus French generation returning to normal. As a result,

low-carbon generation sources – renewables and nuclear together –

are expected to meet on average more than 90% of the additional

electricity demand over the next three years, unless developments

in the global economy and weather events change the trends in

electricity demand and fossil-fired generation.

Electricity Market Report 2023

P

AGE | 22

IEA. CC BY 4.0.

Global overview

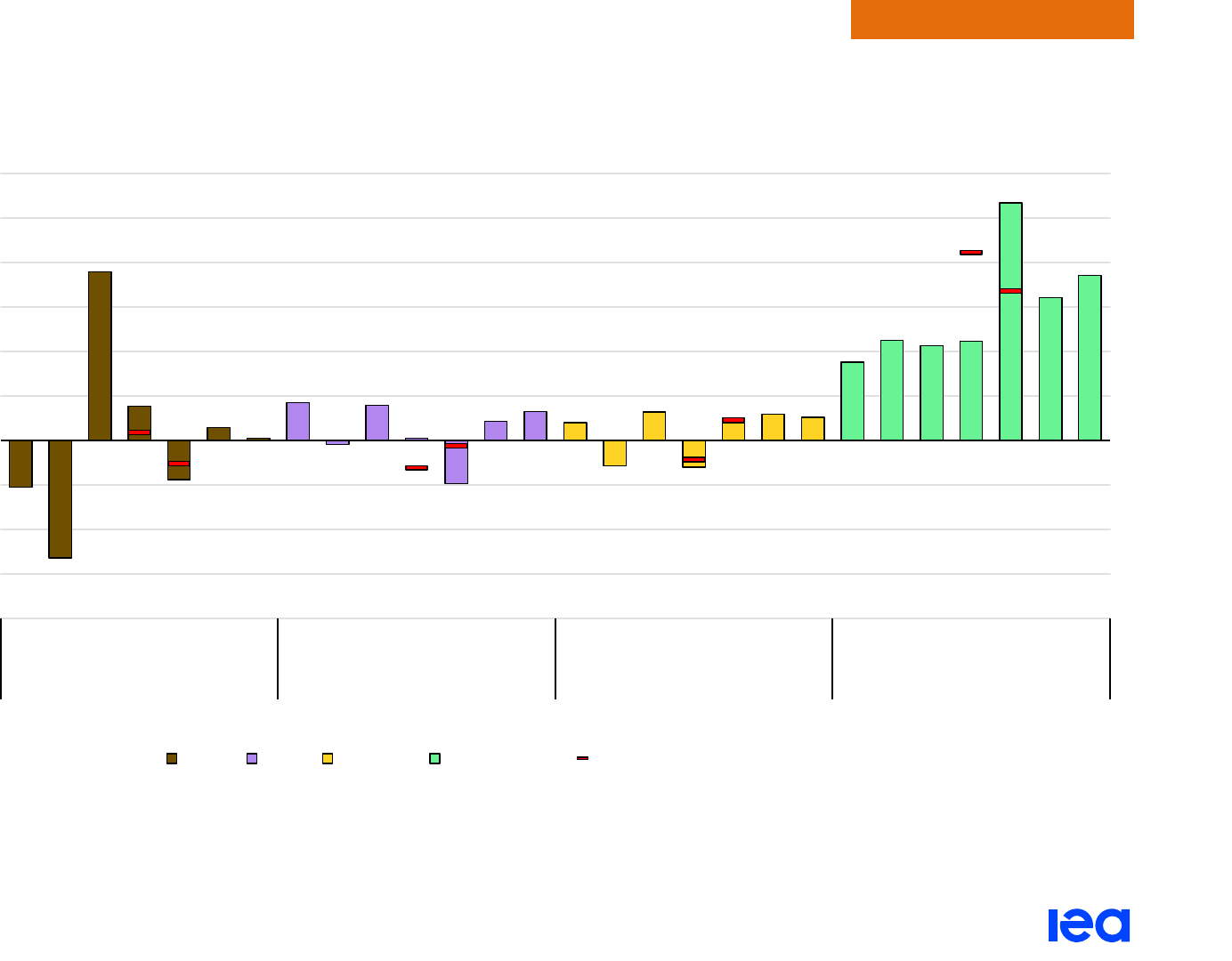

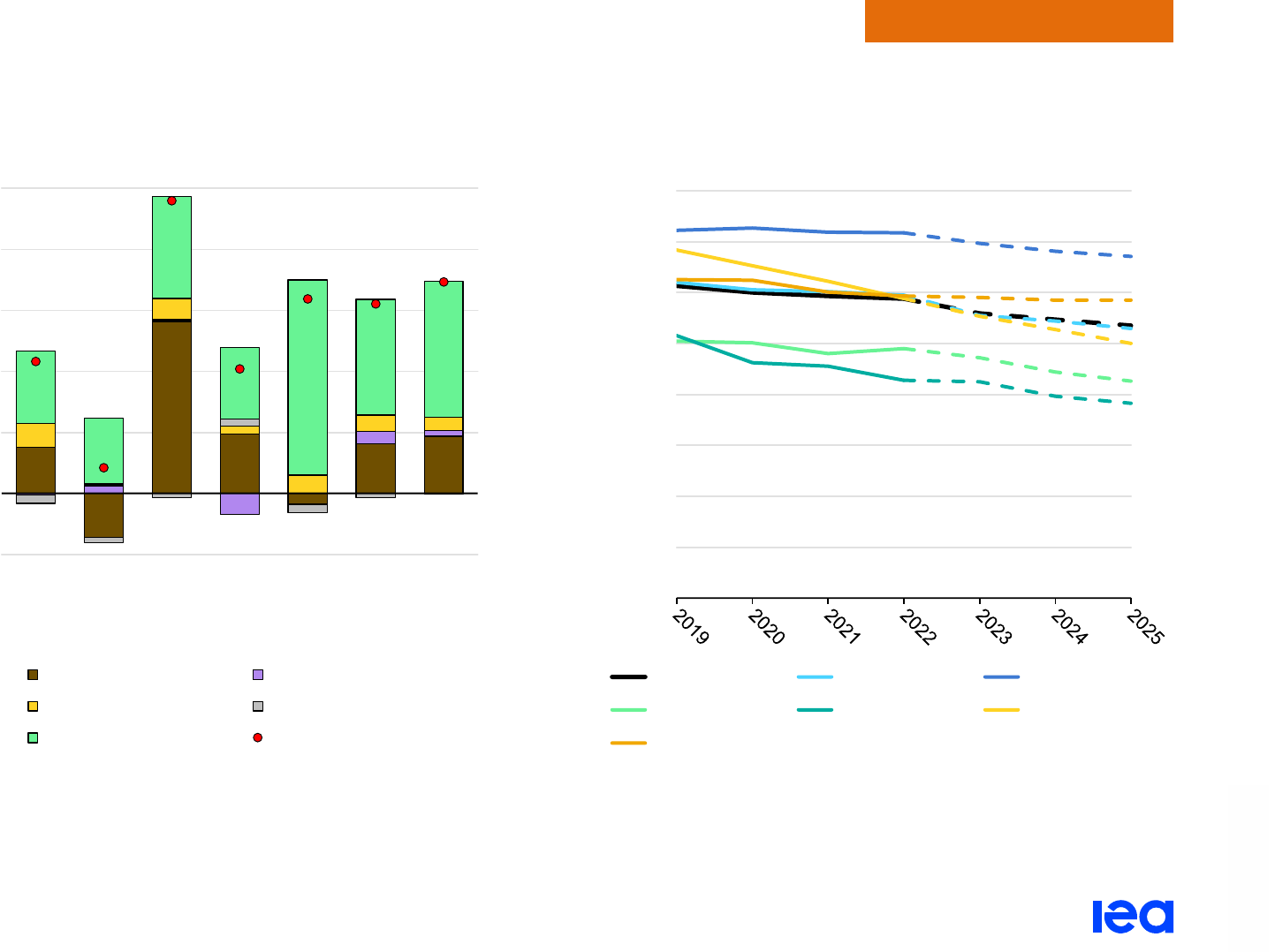

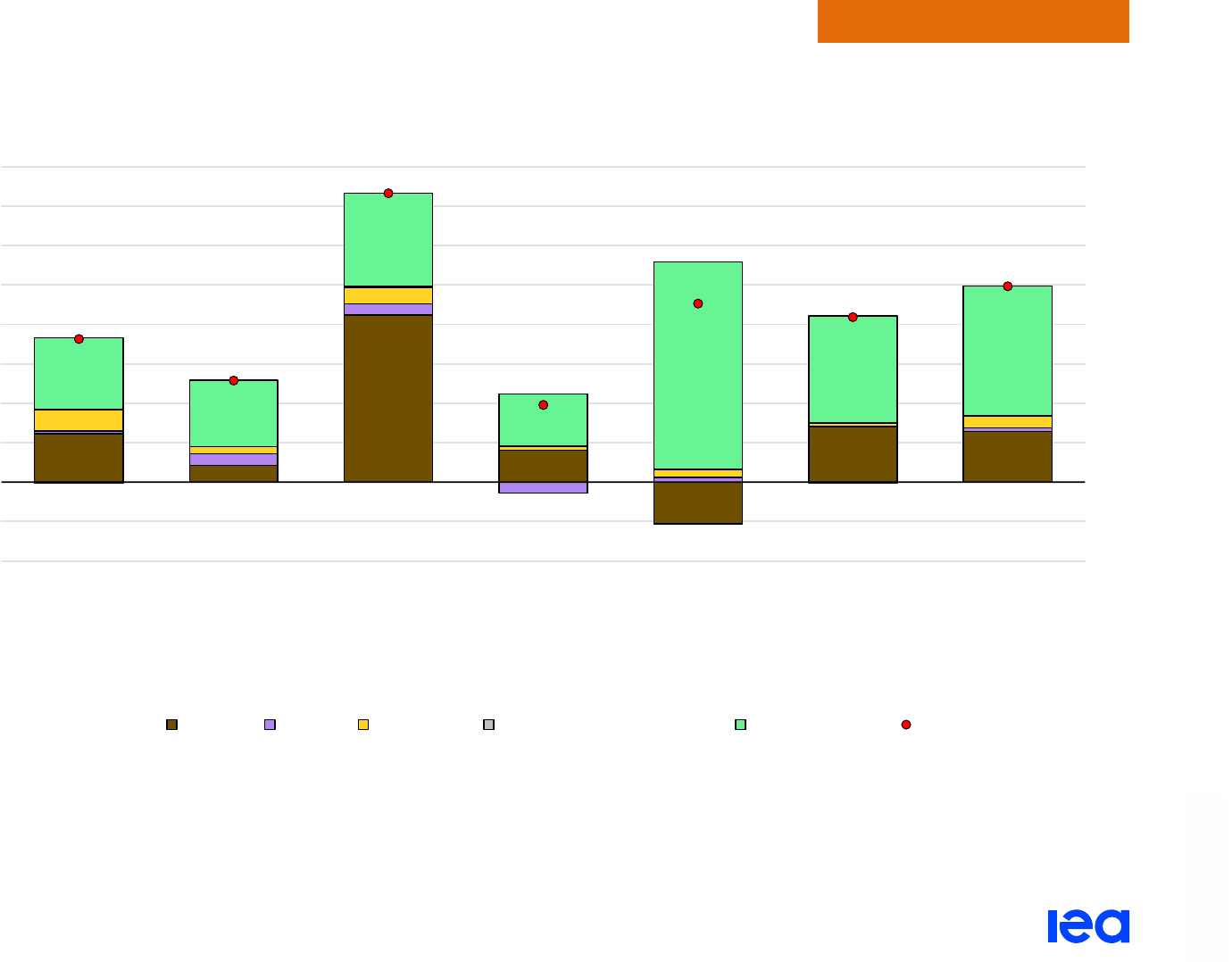

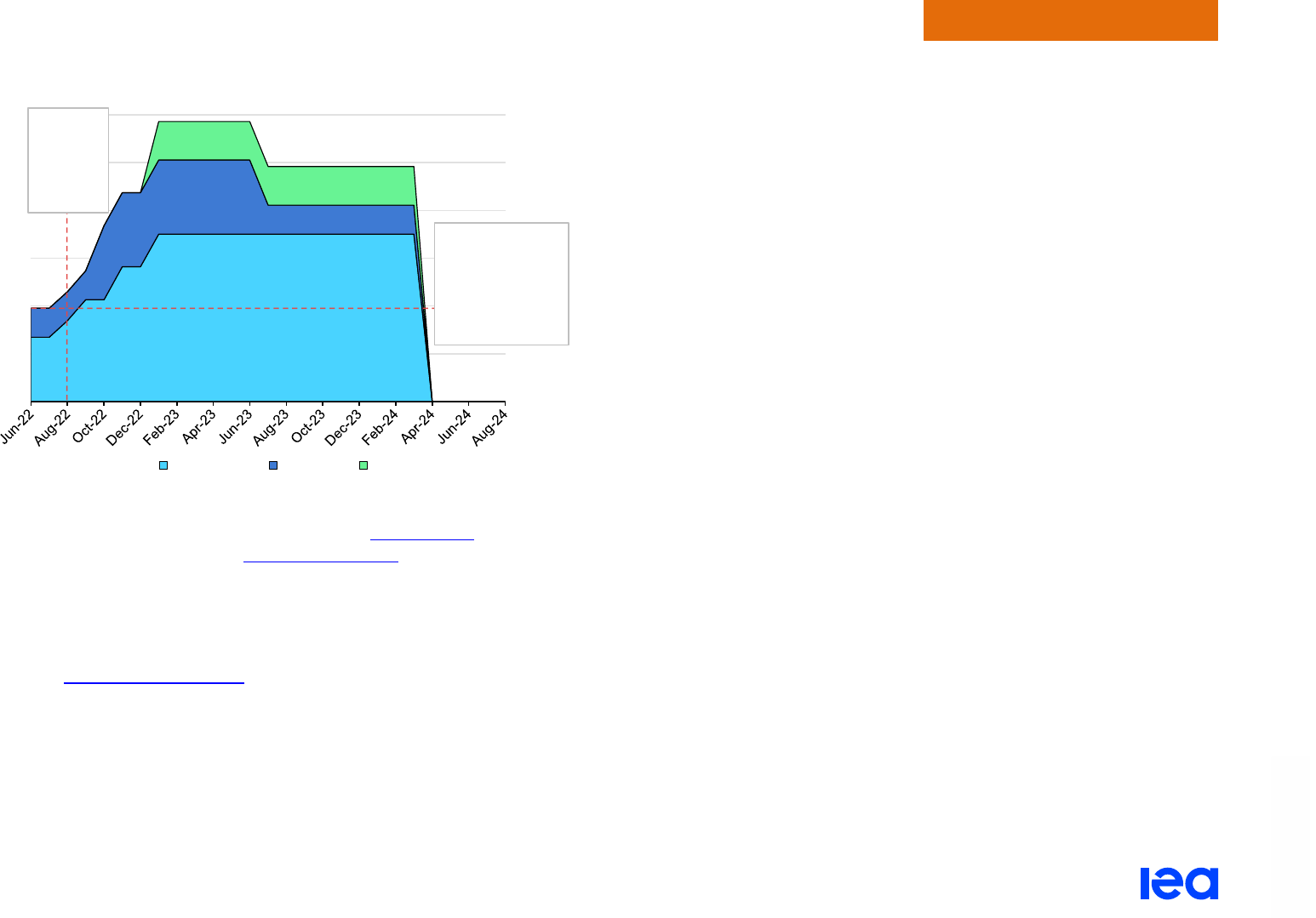

Renewables growth dampens fossil fuel-fired generation from 2023 to 2025

Year-on-year global change in electricity generation by source, 2019-2025

IEA. CC BY 4.0.

- 800

- 600

- 400

- 200

0

200

400

600

800

1 000

1 200

2019

2020

2021

2022

2023

2024

2025

2019

2020

2021

2022

2023

2024

2025

2019

2020

2021

2022

2023

2024

2025

2019

2020

2021

2022

2023

2024

2025

Coal Gas Nuclear Renewables

TWh

Coal Gas Nuclear Renewables Previous forecast (July 2022)

Electricity Market Report 2023

P

AGE | 23

IEA. CC BY 4.0.

Global overview

Hydropower generation exceptionally low in Europe in 2022 due to the historic drought

The year 2022 was characterised by heatwaves and droughts in

many regions, causing significant declines in hydropower output.

This has underscored the potential impacts of changing climate

patterns on power systems as low hydropower generation puts

additional strain on the remaining dispatchable conventional fleet

and increases the cost of electricity supply. Despite these

uncertainties, our current outlook sees global hydropower supply

grow in 2023 to 2025 on planned capacity expansions.

Europe saw its worst drought in 500 years

in 2022. Italy had a

record drop in hydropower output, posting its lowest hydropower

generation in the last two decades in the February-April 2022

period. Italy’s hydro use was down more than 30% compared to

2017-2021 averages, followed closely by Spain at 29% and France

at 20%. Norway had the

driest 12-month period in 26 years, wit

h

hydro reservoir levels in September declining to the lowest monthly

output in the last decade. Republic of Türkiye (hereafter “Türkiye”),

which saw its lowest hydro output in 2021 since 2014, had a strong

20% year-on-year rebound in 2022 but remained 5% below its

2017-2021 average.

In C

hina, drought conditions in Sichuan caused a significant drop in

hydropower output during August and September, depressing

annual growth to just below 1% in 2022. In India, despite a record

heatwave in 2022, hydropower generation increased more than

10% above its 2017-2021 average.

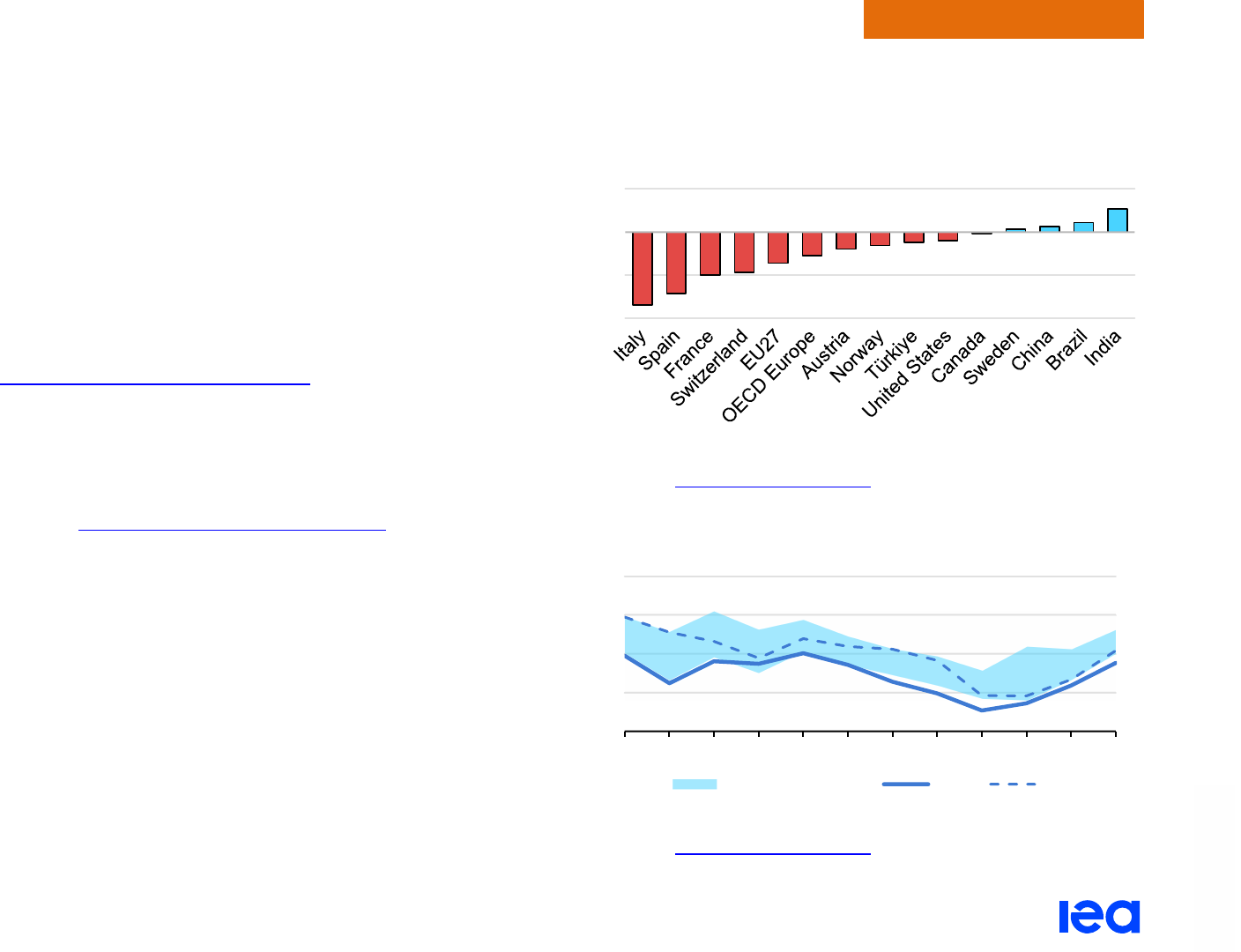

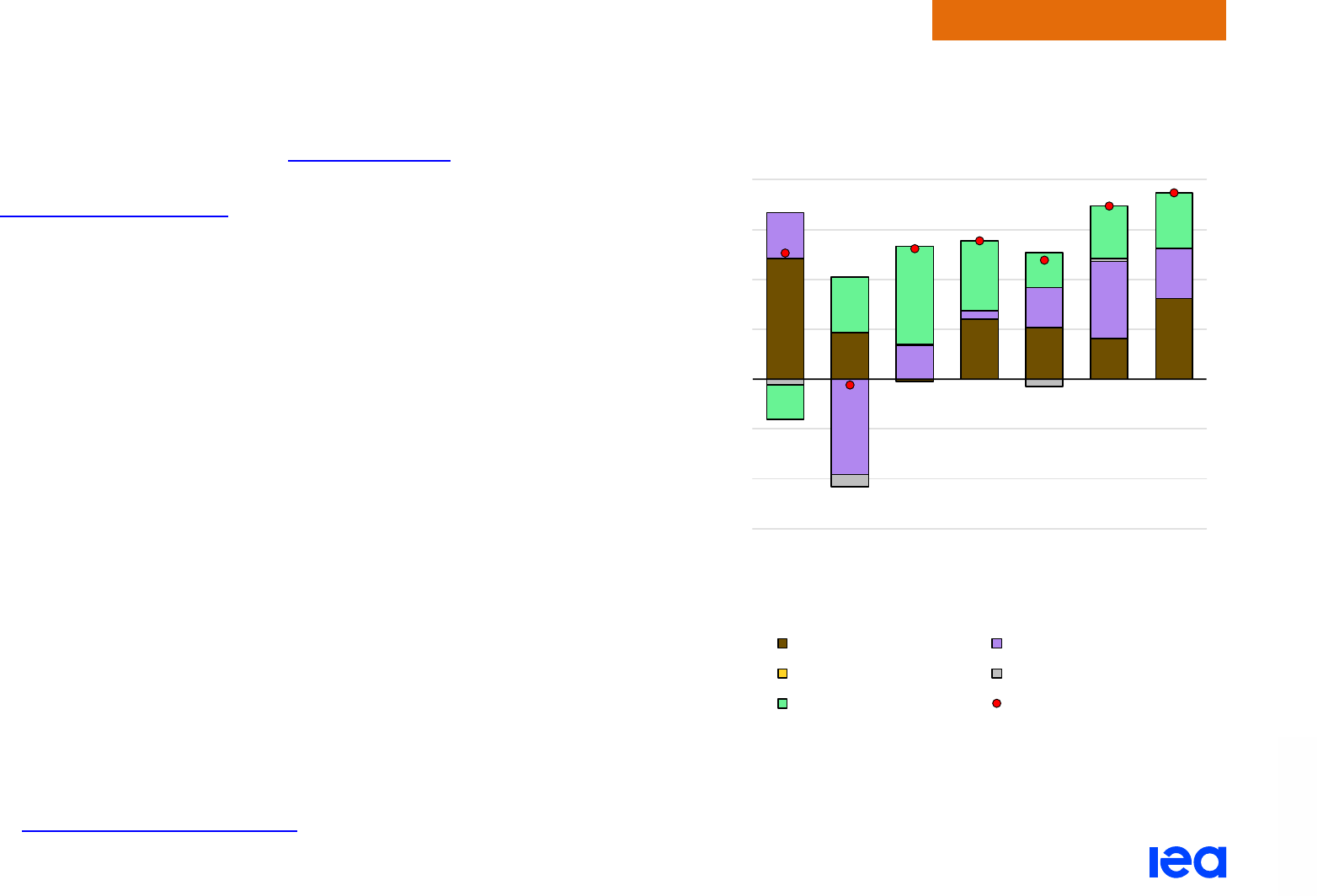

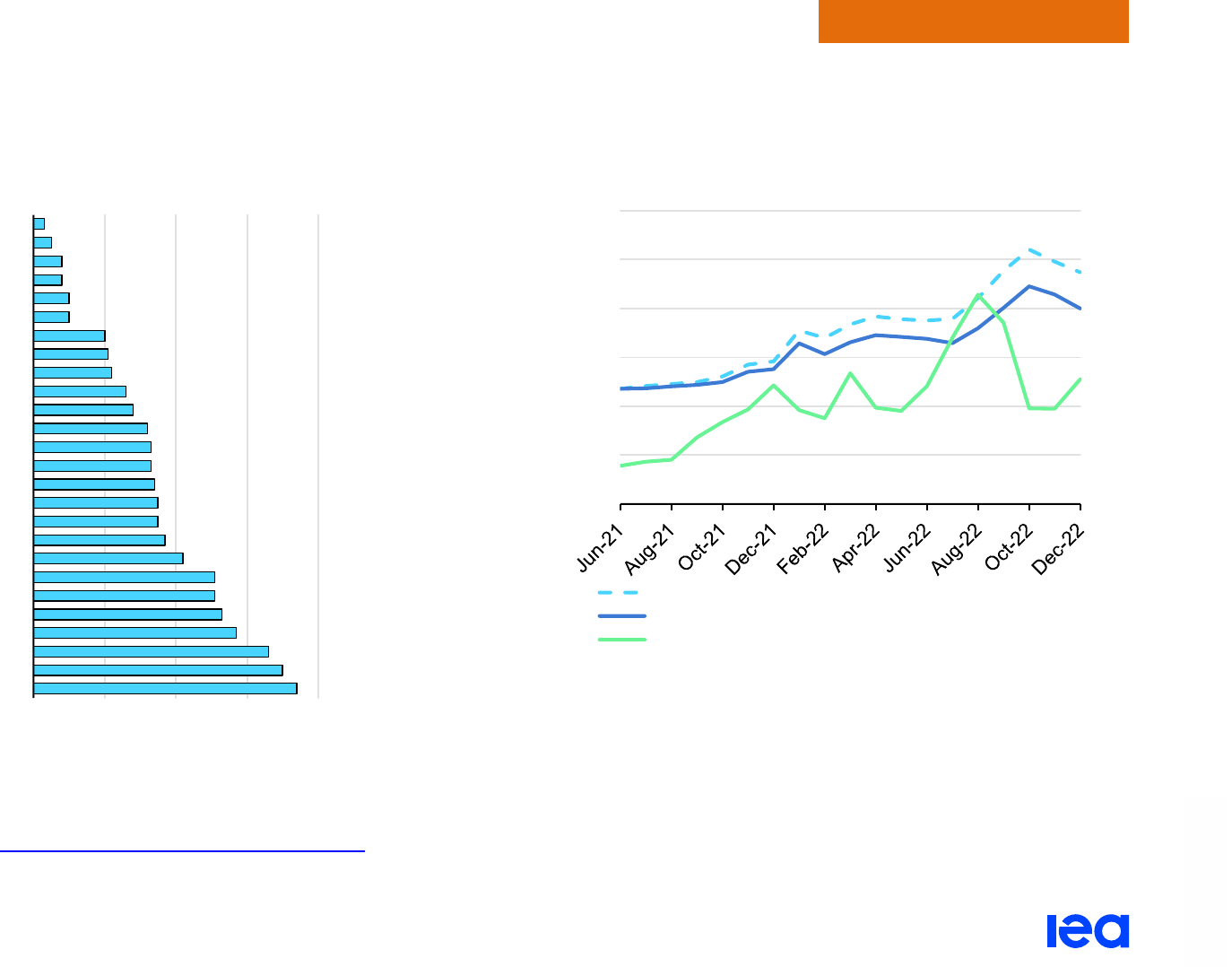

Percentage change in hydropower generation in 2022 compared

to the 2017-2021 average in selected countries and regions

IEA. CC BY 4.0.

Source: IEA (2023), Monthly Electricity Statistics, 31

January 2023.

Monthly hydropower generation in OECD Europe, 2017-2022

IEA. CC BY 4.0.

Source: IEA (2023), Monthly Electricity Statistics, 31

January 2023.

-40%

-20%

0%

20%

30

40

50

60

70

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

TWh

2017-2021 range 2022 2021

Electricity Market Report 2023

P

AGE | 24

IEA. CC BY 4.0.

Global overview

Significant potential to integrate more renewables in the world’s electricity generation fleet

Global installed capacity of renewables is estimated to have

increased at a faster year-on-year rate of almost 11% in 2022

compared to the average 9% growth seen in the 2017-2021 period.

Variable renewables – wind and solar PV – continued to see strong

growth in combined capacity, up nearly 18%. This corresponds to

about 300 GW in additional installed capacity of variable

renewables, which is greater than the current combined wind and

solar PV cumulative capacity in the United States (approximately

280 GW).

Despite continued growth in 2022, the share of variable renewable

capacity in the total generation fleet remains below 25% in the

world, whereas in Europe it is 35%. In countries with high variable

renewables penetration, variable wind and solar PV can make up

more than 60% of the total generation capacity (e.g. Denmark,

Germany). From a global perspective, there is enough potential for

further capacity expansions of variable renewables in many regions

of the world without facing major system integration bottlenecks.

As the share of variable renewables increases in the generation

fleet, their successful integration into the power system will

increasingly become more challenging. For the balancing of variable

generation, apart from expanding storage capacities and increasing

demand-side flexibility, having sufficient dispatchable capacity will

be crucial. In a decarbonised electricity sector, dispatchable

renewables such as hydro reservoir, geothermal and biomass

plants will be essential for complementing the variable renewables.

Evolution of dispatchable and variable generation capacities in

the world and in Europe, 2012-2022

IEA. CC BY 4.0.

Note: Dispatchable renewable capacity in the figure also includes run-of-river

hydropower plants.

Sources: IEA (2022), World Energy Outlook 2022; IEA (2022), Renewables 2022.

0

2 000

4 000

6 000

8 000

10 000

2012 2014 2016 2018

2020 2022

GW

Dispatchable conventional Dispatchable renewable

Variable wind Variable solar

World

0

200

400

600

800

1 000

1 200

1 400

1 600

2012

2014 2016 2018 2020 2022

Europe

Electricity Market Report 2023

P

AGE | 25

IEA. CC BY 4.0.

Global overview

Affordability of energy remains a challenge for emerging and developing economies

The cost of electricity generation in 2022 increased in many parts of

the world, led by surging energy commodity prices. The rise in

generation costs has been more moderate in places with regulated

tariffs and long-term fuel supply agreements. However, regions

depending on short-term markets for fuel procurement were

severely affected by the steep rise in prices. In particular, record-

high LNG prices created financial hardships for South Asian

countries – most notably Bangladesh and Pakistan – trying to

procure gas for the electricity sector, and significantly contributed to

power outages and rationing.

In Bangladesh, natural gas plays a prominent role in electricity

supply, making up about 80% (2018-2022 average) of the

generation mix. At the same time, Bangladesh relies on LNG

imports to meet fuel demand for power generation and was

therefore hit hard by high LNG prices in 2022. LNG accounts for

approximately 20% of the total natural gas

c

onsumption of

Bangladesh. Because of a notable decrease in its foreign exchange

reserves, the government stopped buying LNG from the spot

market during the period of July-November 2022, which resulted in

fuel shortages for the power sector.

Following the LNG shortage, Bangladesh faced harsh power

di

sruptions due to load shedding, where forced supply interventions

were carried out to resolve the imbalance between electricity

demand and supply. During these outages, electricity supply to

areas with industrial production activities

w

ere given priority to

minimise the impact on the industrial sector. Nevertheless,

industries as well as households faced electricity scarcity and

outages.

Year-on-year monthly change in electricity peak demand and

load shedding, Bangladesh, January-October 2022 vs. 2021

IEA. All rights reserved.

Note: Average load shed is calculated as an average of day peak and evening peak

load shed.

Source: IEA analysis based on Ministry of Information and Broadcasting (Bangladesh)

(2023), Monthly Management Report, 10 January 2023.

0

250

500

750

1 000

0%

10%

20%

30%

40%

Jan Feb Mar Apr May Jun Jul Aug Sep Oct

MW/day

Relative change in peak demand

Absolute change in average monthly load shed (right axis)

Electricity Market Report 2023

P

AGE | 26

IEA. CC BY 4.0.

Global overview

Pakistan was also severely affected by the high prices of fossil

fuels due to its strong reliance on fossil fuel imports, as gas (20%)

and coal (30%) play a significant role in its power generation mix. In

2022, electricity production from imported LNG fell by approximately

13% compared to 2021. The reduced LNG imports were attributed

to the country's inability to afford the supplies at the sharply

elevated price levels.

Similarly, in the face of a tight coal market,

imports of high calorific-

value coal declined in 2022, leading to closures of coal-fired power

plants. By contrast, lignite-fired plants experienced a surge in output

during 2022, attributed to an increase in domestic lignite production

coupled with a

fourfold expansion in imports from Afghanistan,

payable in Pakistani rupees, in H1 2022.

Fuel

shortages for the power sector were further exacerbated by the

country’s severe flooding between July and September.

Consequently, a quarter of the total

operational power generation

capacity had to be shut down. This contributed to scarcity of

electricity supply and subsequent power outages.

In 2022, Pakistan’s liquid foreign exchange reserves reached their

lowest level since 2014, leading to the

prioritisation of energy

imports to the detriment of other imports. This caused the shutdown

of some industrial facilities due to a lack of imported raw materials.

For em

erging markets and developing economies, fuel procurement

will continue to be an important issue if energy commodity prices

remain high in the coming years. Increased integration of renewable

energy sources will not only serve to decarbonise the energy sector

but would also reduce reliance on fossil fuel imports and help shield

the economies from external fuel price shocks.

Quarterly evolution of liquid foreign exchange reserves and the

share of payments for oil and LNG imports in the payments for

total imports, Pakistan, 2019-2022

IEA. All rights reserved.

Note: Oil refers to petroleum products and crude oil.

Sources: IEA analysis based on State Bank of Pakistan (2023), Import Payments by

Commodities and Groups, Gold and Foreign Exchange Reserves of Pakistan,

10 January 2023.

0%

10%

20%

30%

40%

0

20 000

40 000

60 000

80 000

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

2019 2020 2021 2022

Million USD

Total Liquid FX Reserves

Share of import payments for oil and LNG in total

import payments (right axis)

Electricity Market Report 2023

P

AGE | 27

IEA. CC BY 4.0.

Global overview

Stationary battery storage capacity additions are speeding up in emerging economies

As the share of variable renewable sources in electricity systems

further increase globally, battery systems are expected to play a

growing role by providing frequency control and operational

reserves as well as for wholesale arbitrage, while helping reduce

grid integration costs. The deployment of stationary battery systems

is speeding up

. In absolute magnitude, the United S

tates, Europe

and China are leading the latest annual capacity additions.

However, based on our 2022 estimates, emerging markets and

developing economies are on the way to catching up.

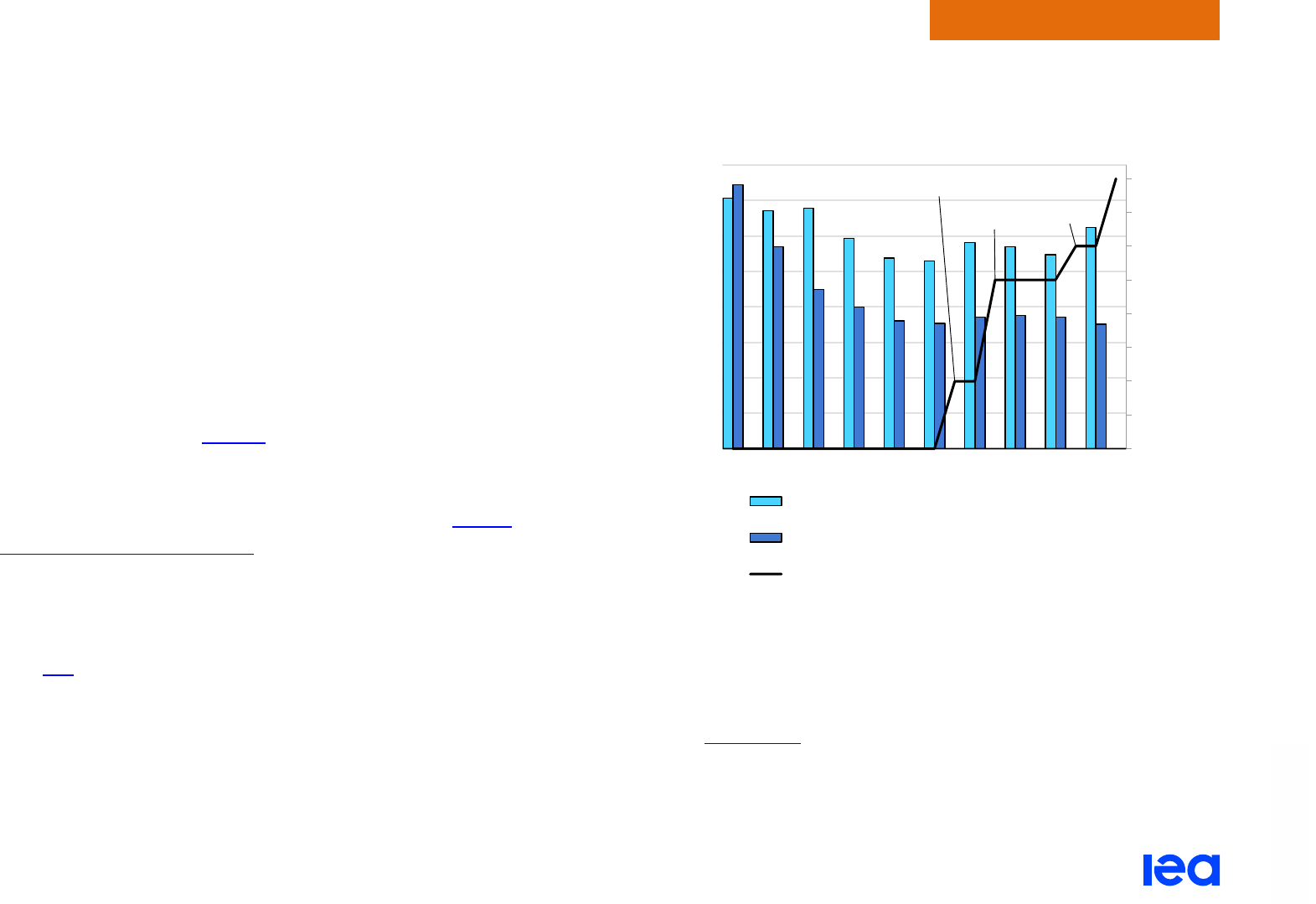

Compared with 2021, capacity additions in 2022 rose by over 80%

i

n the United States, almost 100% in China, roughly 35% in Europe,

90% in OECD Pacific (i.e. Japan, Korea, Australia and

New Zealand) and about sixfold in EMDEs, excluding China. In

2022, the largest fleet of cumulative battery systems installed

remains in the United States while China surpassed Europe in

cumulative capacity, reaching a total of 10 500 MW compared to

Europe's 9 400 MW.

The deployment rate in EMDEs gathered pace in 2022, with

capacity additions more than twice as high as the total cumulative

additions in 2015-2021. In China and the United States, over 45%

of the installed cumulative capacity was deployed in 2022. By

contrast, in EMDEs (excluding China), capacity additions in 2022

had a relatively much higher impact, accounting for almost 70% of

the total cumulative capacity in these regions.

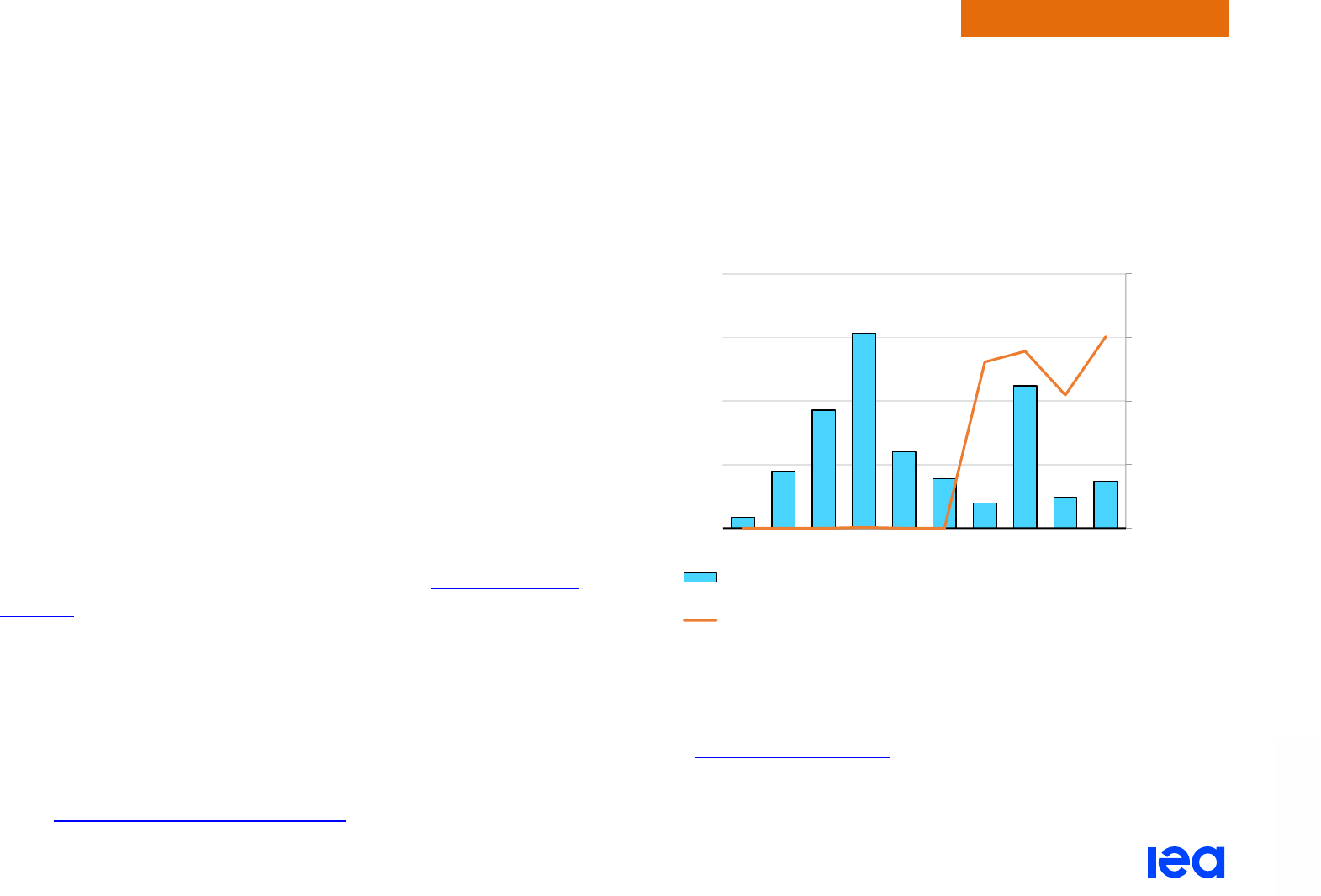

Yearly stationary battery system additions by country and region,

2018-2022

IEA. All rights reserved.

Note: 2022 values are estimates.

Sources: IEA calculations based on Clean Horizon (2022), BNEF (2022), China Energy

Storage Alliance (2022).

0

1 000

2 000

3 000

4 000

5 000

6 000

7 000

2018

2019

2020

2021

2022E

2018

2019

2020

2021

2022E

2018

2019

2020

2021

2022E

2018

2019

2020

2021

2022E

2018

2019

2020

2021

2022E

2018

2019

2020

2021

2022E

United

States

China Europe OECD

Pacific

EMDEs

excl. China

Others

Yearly additions (MW)

Electricity Market Report 2023

P

AGE | 28

IEA. CC BY 4.0.

Global overview

The surge in coal and gas prices raised thermal generation costs to decade highs in 2022

Russia’s invasion of Ukraine put unprecedented pressure on

European and global energy markets. Natural gas and thermal coal

prices in Asian and European spot markets rose to all-time highs

throughout 2022, sharply increasing the cost of thermal generation

in those markets. In the United States, tight supply and demand

fundamentals drove both coal and natural gas prices to decade

highs. Thermal generation costs are expected to remain well above

historical averages out to 2025, further eroding their

competitiveness compared to low-emission alternatives.

In the European Union, estimated gas-based thermal generation

cost more than doubled in 2022 compared to the previous year, to

an average of USD 350/MWh. Coal-based thermal generation costs

almost doubled to an average of USD 190/MWh. This has been

primarily driven by the rapidly tightening gas and coal market

fundamentals. Russia more than halved its pipeline gas supplies to

the European Union in 2022 – a year-on-year drop of 80 bcm in

absolute terms. Consequently, European gas prices soared to

record highs. Gas prices on the Title Transfer Facility (TTF) in the

Netherlands, the region’s leading hub, averaged USD 37/MBtu

(EUR 123/MWh) in 2022 – more than five times their 2016-2021

average. The strong increase in gas prices provided upward

pressure on thermal coal prices through fuel-switching dynamics in

the power sector. Rotterdam thermal coal prices averaged at an all-

time high of USD 290/t (EUR 40/MWh) in 2022. Despite record-high

prices for coal and gas, gas- and coal-fired generation rose in the

European Union by about 2% and 6% y-o-y, respectively, as low

hydro and nuclear power output increased the call on thermal power

plants.

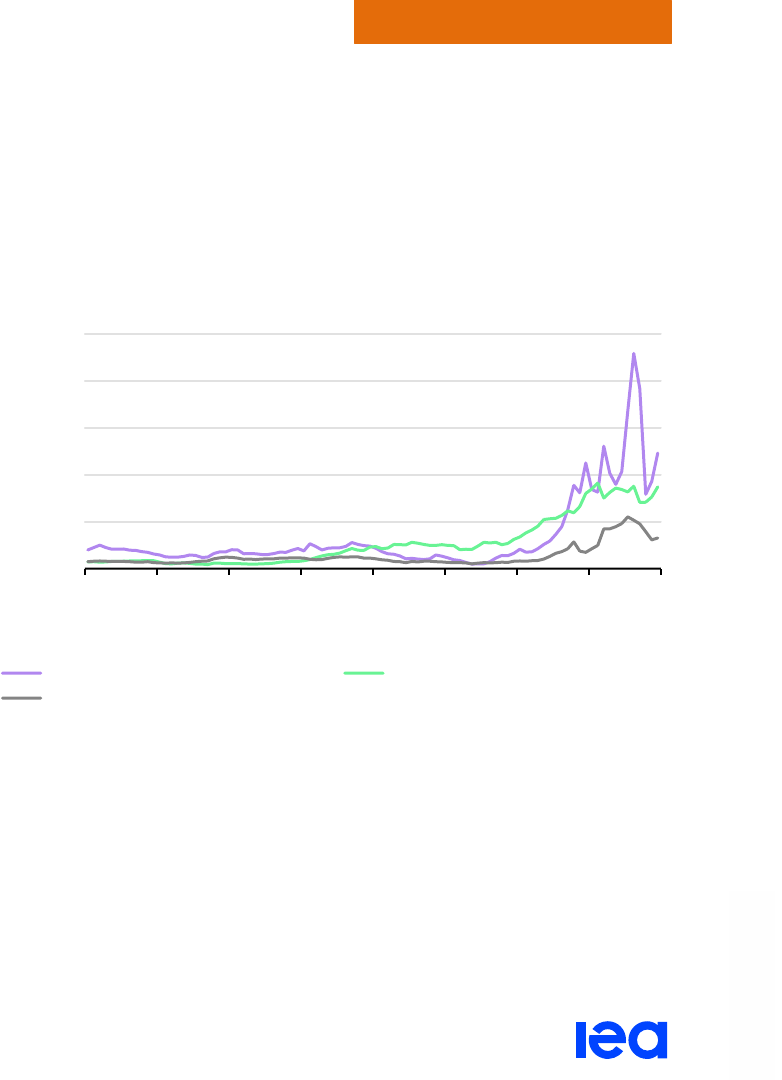

Monthly average prices of natural gas, thermal coal and emission

certificates, Europe, 2015-2022

IEA. All rights reserved.

Sources: Natural gas prices from TTF; coal prices are CIF ARA; emission certificate

prices are EUA prices from EU ETS.

The price of the emissions allowances (EUA) on the EU Emissions

Trading System (EU ETS) saw record highs, reaching almost

EUR 100/t CO

2

in August 2022. The surge in emission prices was

mainly driven by the increase in coal-fired generation, which then

resulted in stronger demand for the allowances. Later in 2022,

0

50

100

150

200

250

2015

2016

2017

2018

2019

2020

2021

2022

EUR/MWh and EUR/t CO

2

Natural gas (TTF) Emission certificates (EUA)

Thermal coal (ARA)

Electricity Market Report 2023

P

AGE | 29

IEA. CC BY 4.0.

Global overview

carbon prices fell, as lower gas prices reduced gas-to-coal

switching in power generation. Despite this, in 2022 EU ETS prices

at an average EUR 81/t CO

2

were 50% more expensive than in

2021. Even with the rising costs of CO

2

emissions in 2022 – which

weigh proportionally on coal power much more due to higher CO

2

emission factors – the generation cost of coal-fired power plants in

Europe remained substantially below that of gas-fired plants.

Forward curves as of late January 2023 indicate that, despite

declining, both natural gas and coal prices remain well above their

pre-2021 historical averages through to 2025, at USD 15-20/MBtu

and USD 130-170/t, respectively. By 2025 generation costs from

gas are expected to decline and approach coal-fired generation cost

levels.

In Asia, estimated gas-based thermal generation costs in Japan

and Korea rose by 65% in 2022, to an average of USD 135/MWh.

Coal-based thermal generation costs increased by more than 70%

to over USD 100/MWh. The steep drop in Russian piped gas

supply to the European Union was largely offset by LNG, driving

up competition between Asian and European buyers. This put

strong upward pressure on Asian spot LNG prices, which

averaged an all-time high of USD 30/MBtu in 2022. Oil-indexed

LNG prices displayed less volatility, averaging about

USD 15/MBtu. High spot LNG prices and flood-induced supply

outages in Australia also drove Newcastle coal prices to peak

levels, to an average of USD 360/t.

Forward curves as of late January 2023 indicate that spot LNG and

thermal coal prices are expected to remain elevated, putting

upwards pressure on thermal generation costs out to 2025. Despite

this, the thermal generation costs in Korea and Japan would be

roughly half that of Europe in 2025 according to the forward prices.

In the United States, the cost of gas supplied to power plants

increased substantially, by more than 50% y-o-y, driving up the cost

of gas-fired generation by a similar magnitude in 2022. This was

driven by a number of factors: supply constraints and low inventory

levels elevated thermal coal prices; the Central Appalachia

benchmark averaged USD 170/t – its highest level since 2010;

reduced availability of thermal coal increased the call on gas-fired

power plants; and higher gas burn in the power sector, together with

below-average gas storage levels and rising LNG exports, tightened

gas market fundamentals. As a result, Henry Hub prices rose by

more than 60% y-o-y, to an average of USD 6.50/MBtu in 2022.

Tight market conditions are expected to linger into the medium term

based on forward curves at the start of January 2023 that show

natural gas and coal prices remaining above their historical

averages, at USD 3-5/MBtu and USD 110-150/t, respectively, in

2023-2025. The generation cost gap between electricity generation

from coal and gas narrows based on the forward prices.

Electricity Market Report 2023

P

AGE | 30

IEA. CC BY 4.0.

Global overview

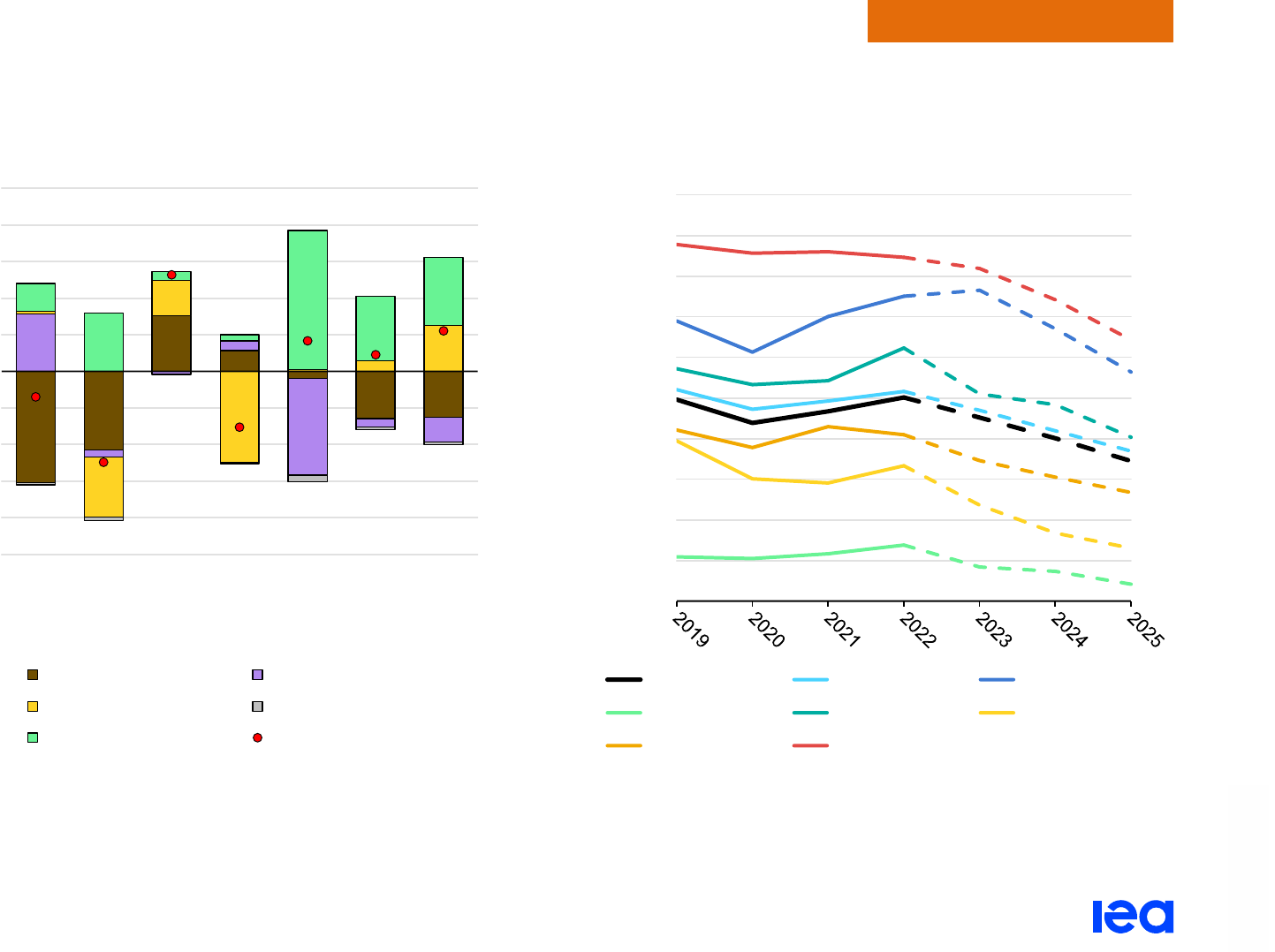

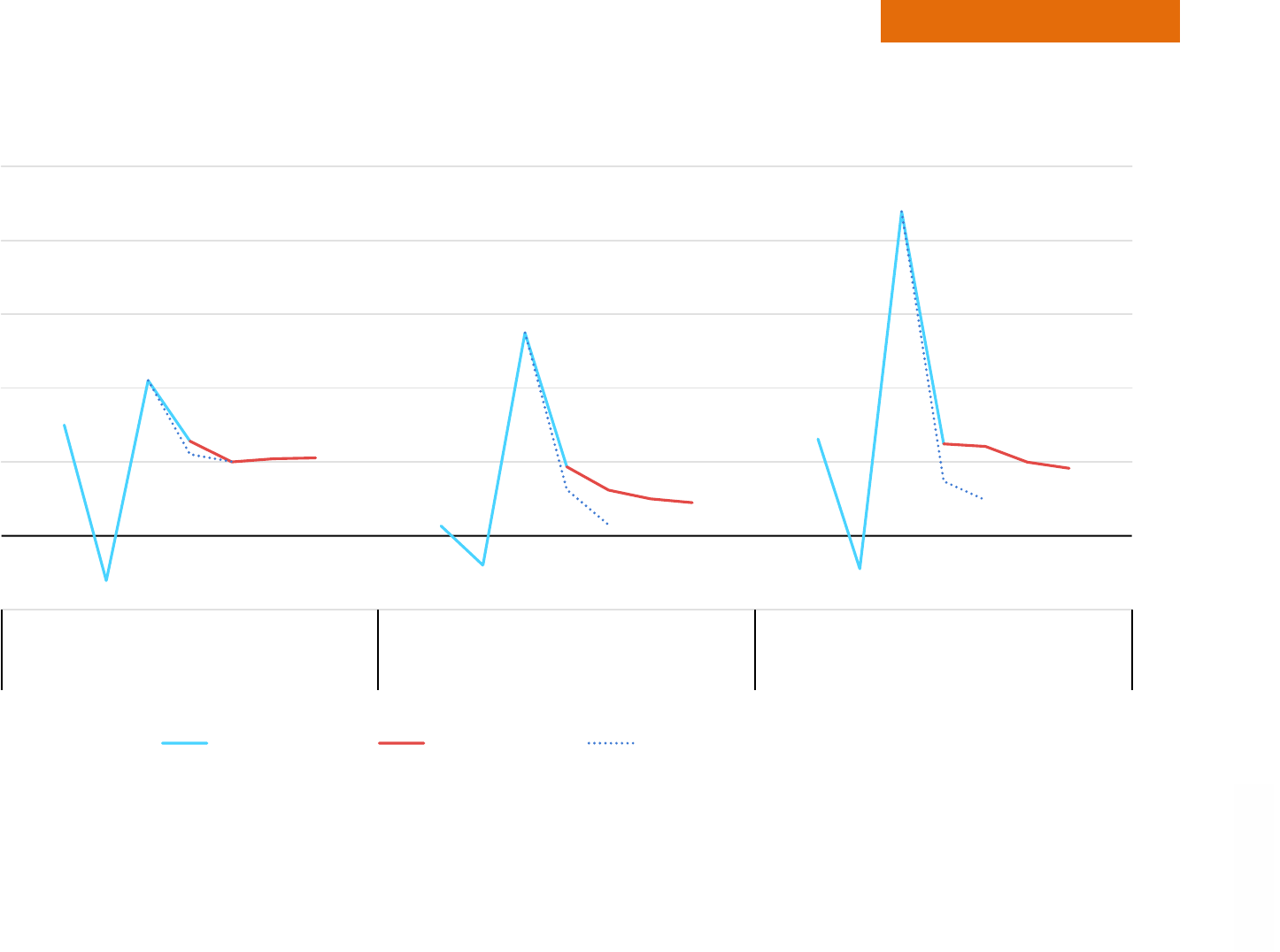

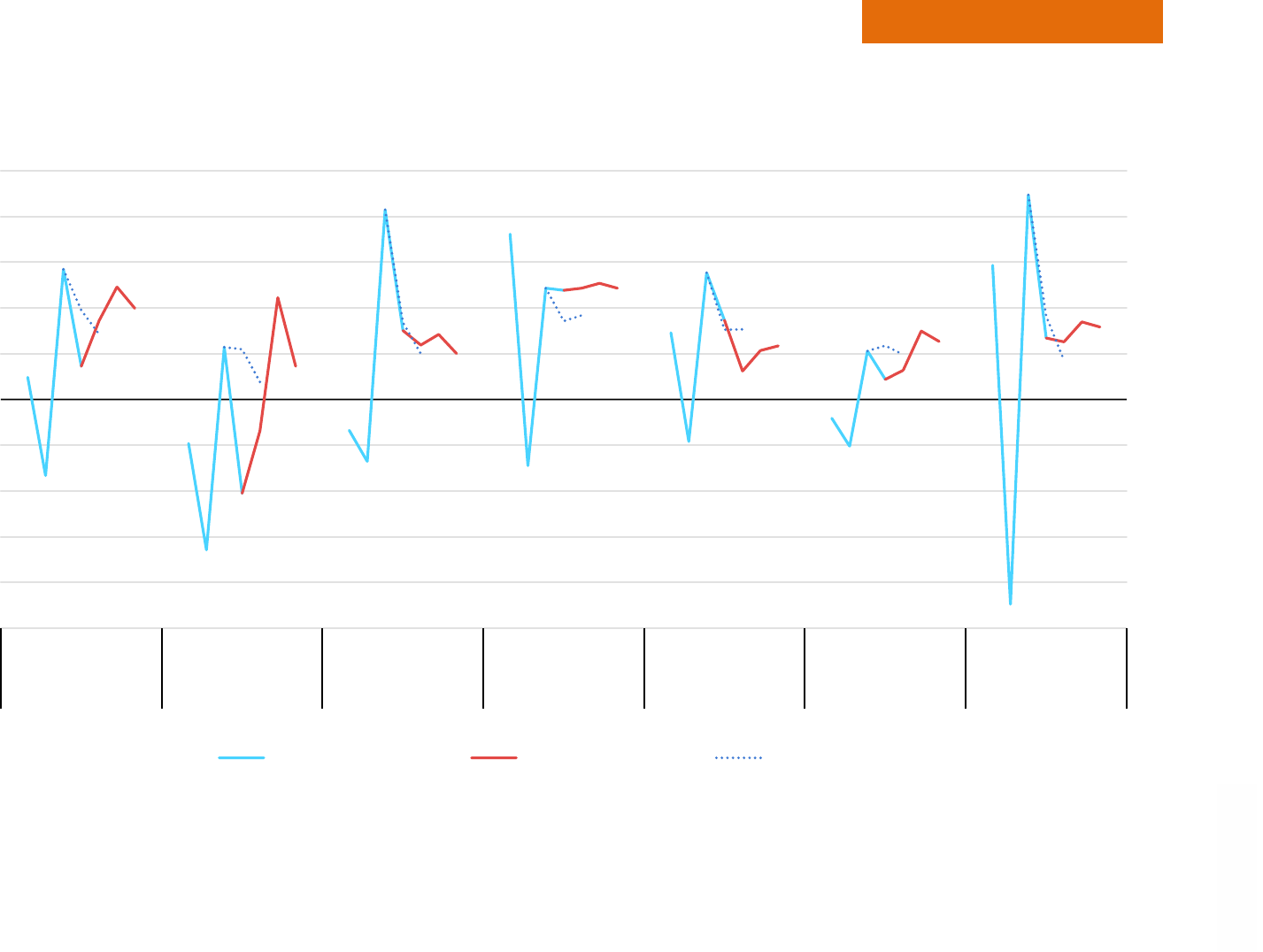

Large regional differences in thermal generation costs by 2025, with Europe about twice as high

as Asia

Generation costs of coal- and gas-fired power plants including emission costs, 2019-2025

IEA. All rights reserved.

Notes: Coal range reflects 33-45% efficiency; gas range reflects 43-55% efficiency. Due to the large geographic areas covered in each region, costs can differ between and within

countries and should therefore be interpreted as general trends. In the United States, natural gas prices increased significantly (exceeding USD 15/MBtu) in February 2021 due to

supply constraints. 2023-2025 costs for the regions are based on forward prices of fuels as of end of January 2023 and should not be interpreted as forecasts, rather as costs reflecting

the current market expectations. Fuel price assumptions for the model forecasts presented in this report are based on average forward prices.

Sources: United States: based on EIA (2023), STEO January 2023

. European Union: natural gas prices TTF; coal prices CIF ARA; emission costs EU ETS. Japan and Korea: natural

gas prices reflect estimated LNG import prices, including via oil-indexed LNG contracts and spot procurements; coal prices are Japan marker prices. Latest update: 31 January 2023.

0

100

200

300

400

500

600

2019

2020

2021

2022

2023

2024

2025

USD/MWhₑₗ

European Union

Gas Coal

0

100

200

300

400

500

600

2019

2020

2021

2022

2023

2024

2025

USD/MWhₑₗ

Japan and Korea

Gas Coal

0

100

200

300

400

500

600

2019

2020

2021

2022

2023

2024

2025

USD/MWhₑₗ

United States

Gas

Coal

Electricity Market Report 2023

P

AGE | 31

IEA. CC BY 4.0.

Global overview

Emissions

Electricity Market Report 2023

P

AGE | 32

IEA. CC BY 4.0.

Global overview

The world reached a new all-time high in power generation-related emissions in 2022

We estimate that the world reached a new all-time high of about

13.2 Gt CO

2

in power sector emissions in 2022, a year-on-year

increase of 1.3%. Record-level emissions in 2022 were mainly due

to growth in fossil-fired generation in Asia Pacific. Europe and

Eurasia also contributed to this increase. Similar to what was

highlighted in the IEA’s World Energy Outlook 2022

f

or the overall

energy sector, the rise in power sector emissions in 2022 was still

less than the y-o-y change in 2021 related to the post-pandemic

rebound.

After a projected decline i

n global electricity generation CO

2

emissions in 2023 due to lower gas- and oil-fired generation, we

forecast that emissions will plateau out to 2025. In the 2023-2025

period, lower emissions in regions such as Europe and the

Americas (each down roughly 70 Mt/yr on average) partly offset the

significant increases in Asia Pacific (up 100 Mt/yr on average),

mostly attributed to China and India. By 2025, the Asia Pacific

region will account for 67% of global power sector emissions (up

from 64% in 2022). Trends from other regions show mild growth or

remain flat.

In 2025, CO

2

intensity of global power generation would reach

417 g CO

2

/kWh, a decline of 3% on average each year to 2025.

The average annual rate of decline from 2023 to 2025 is markedly

steeper in Europe (-12%) and the United States (-4%).

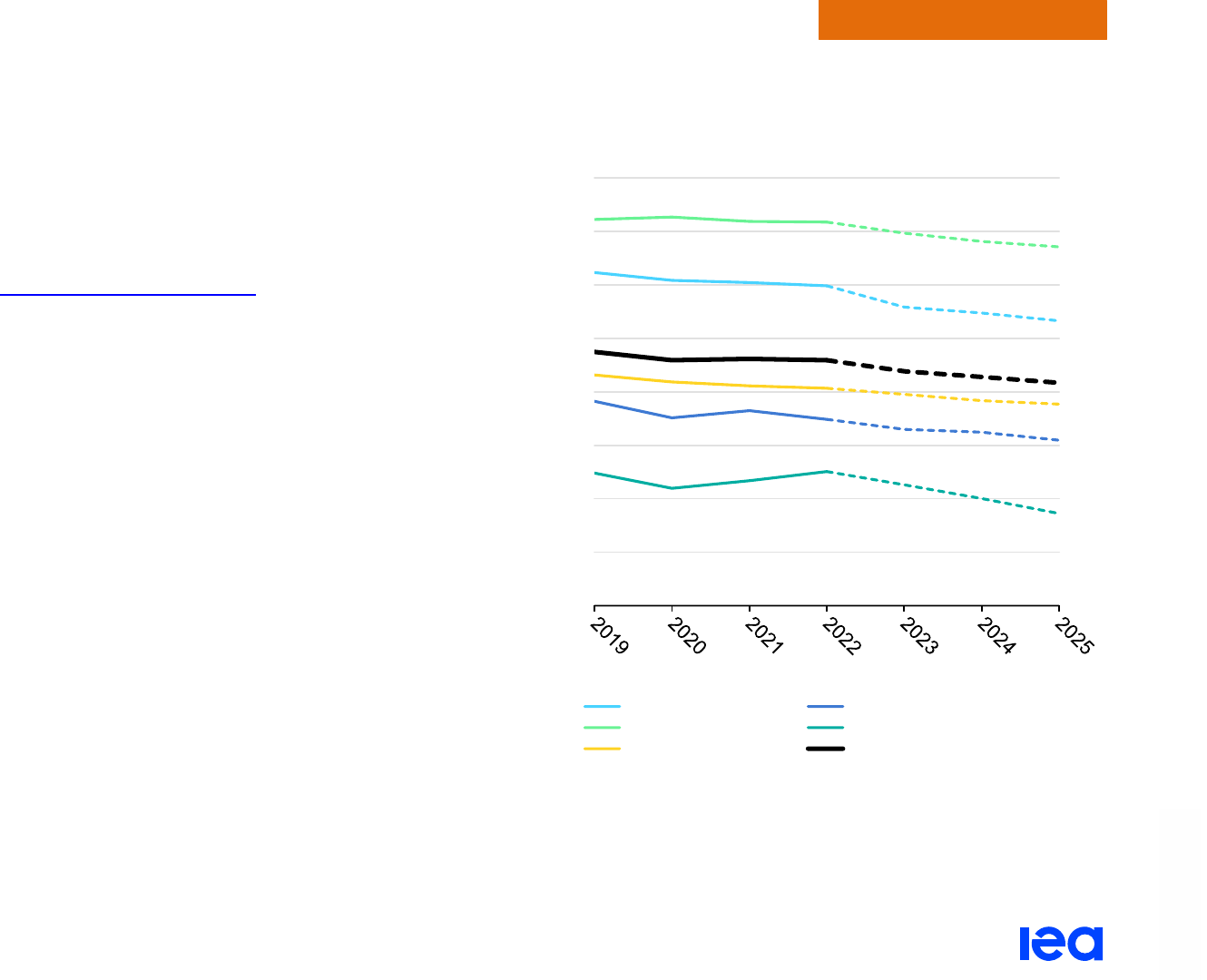

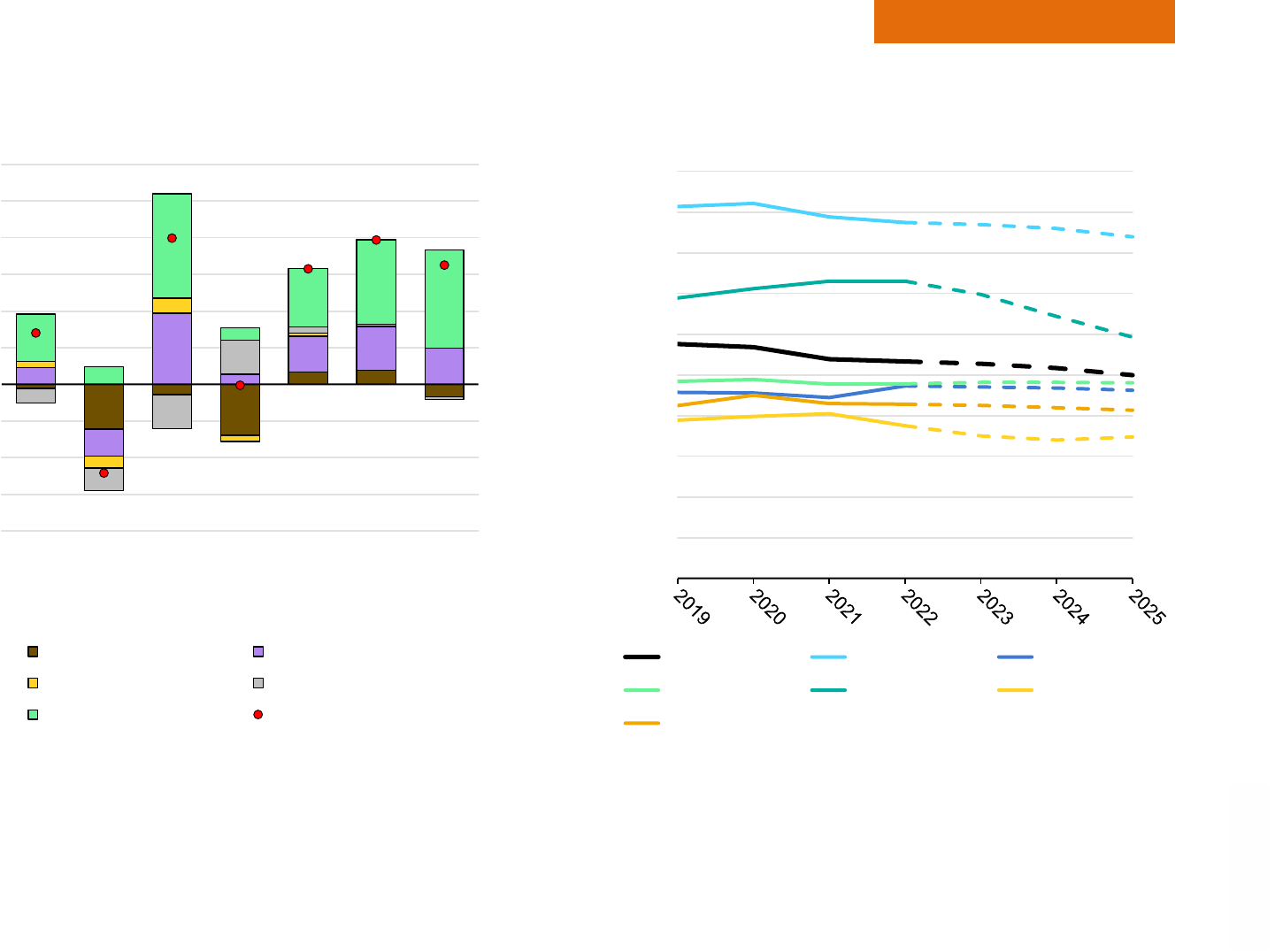

Regional evolution of power system CO

2

intensity, 2019-2025

IEA. CC BY 4.0.

Note: The CO

2

intensity is calculated as total CO

2

emissions divided by total

generation.

0

100

200

300

400

500

600

700

800

g CO

₂

/kWh

China

United States

India European Union

Others World

Electricity Market Report 2023

P

AGE | 33

IEA. CC BY 4.0.

Global overview

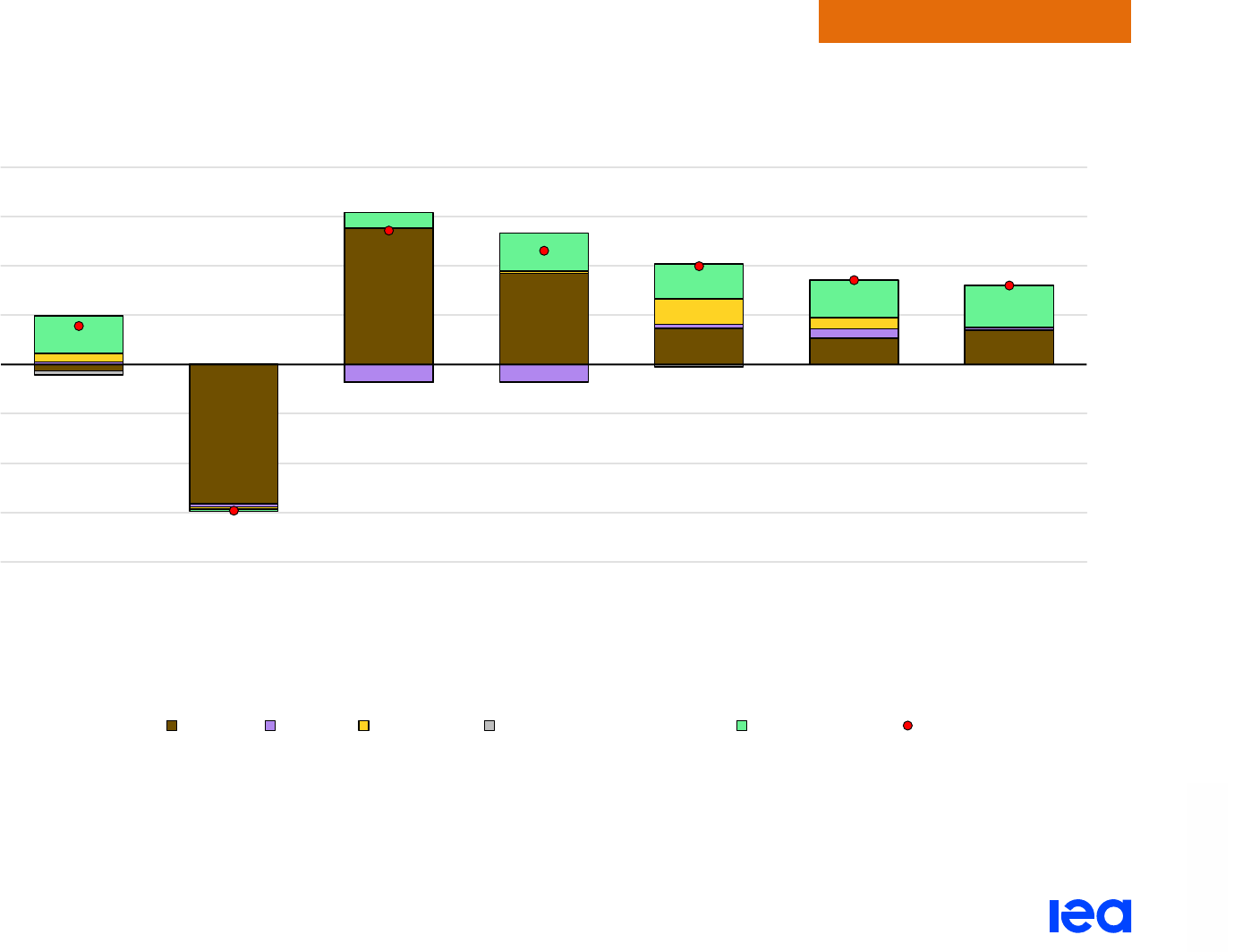

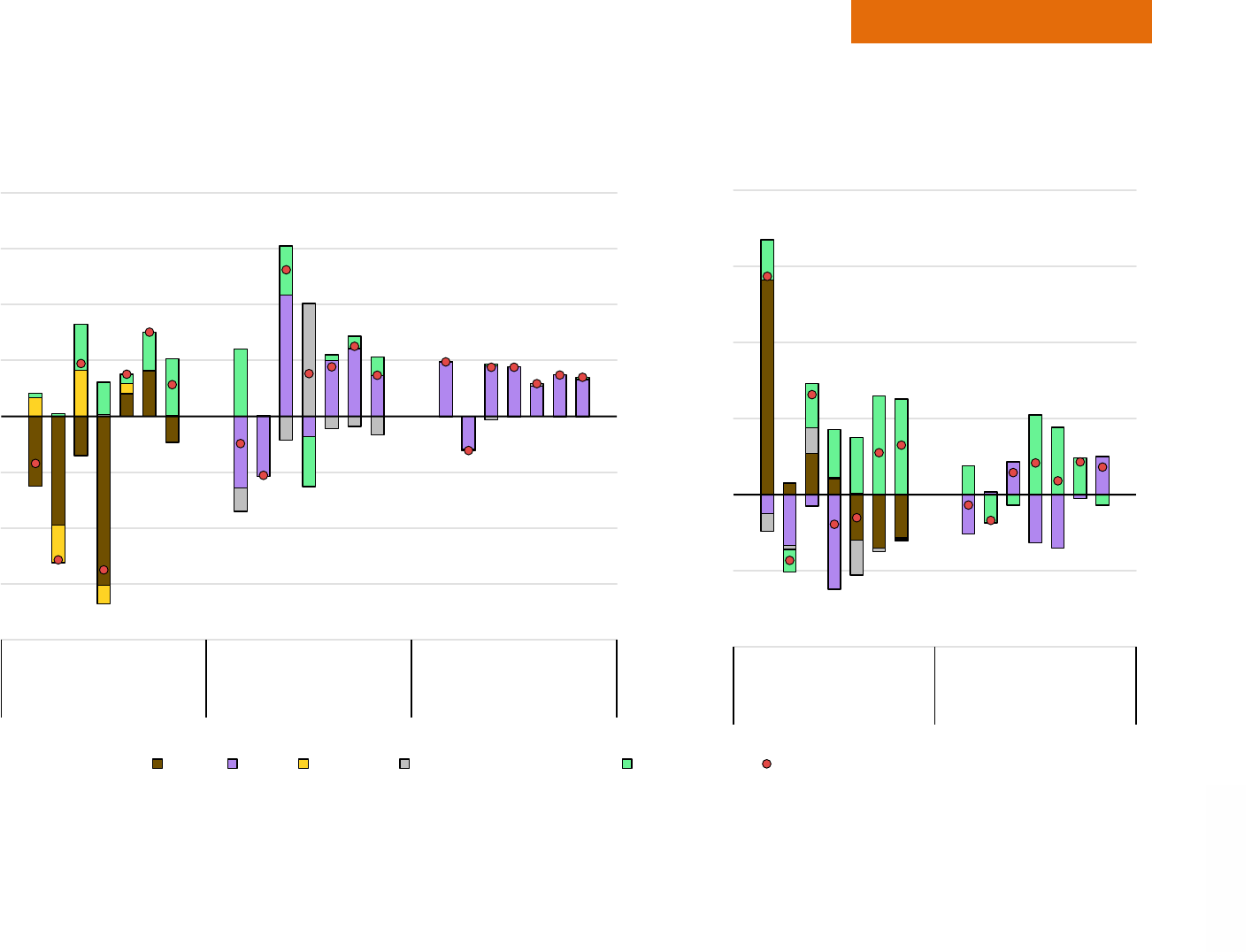

Global emissions of power generation are expected to plateau from 2023 through 2025

Global emissions of power generation, 2015-2025

IEA. CC BY 4.0

Changes in global emissions of power generation, 2021-2025

IEA. CC BY 4.0.

0

2 000

4 000

6 000

8 000

10 000

12 000

14 000

2015 2017 2019 2021 2023 2025

Mt CO

2

China India

Other Asia Pacific

United States Other Americas EU

Other Europe Middle East

Africa

Eurasia

-202

-58

-166

-53

+161

+98

+40

+16

12 500

12 600

12 700

12 800

12 900

13 000

13 100

13 200

13 300

Mt CO

2

European Union Other Europe United States

Other Americas China India

Other Asia Pacific Rest of world

Electricity Market Report 2023

P

AGE | 34

IEA. CC BY 4.0.

Global overview

Wholesale prices

Electricity Market Report 2023

P

AGE | 35

IEA. CC BY 4.0.

Global overview

Electricity prices remain elevated in many regions, led by the high cost of energy commodities

The global energy crisis, with soaring prices of energy commodities

combined with the pandemic rebound and supply chain issues, has

resulted in substantially higher wholesale electricity prices in many

regions of the world in 2022 over year-ago levels.

In a large number of European countries, wholesale electricity

prices (i.e. day-ahead spot prices) in H2 2022 exceeded the

second-half average prices between 2019 and 2021, e.g. fourfold in

France. In H2 2022, the average wholesale price reached almost

EUR 330/MWh in Germany and surpassed EUR 320/MWh in

France, exacerbated by nuclear unavailabilities. By contrast, in

Spain, average prices were much lower for the same time period at

about EUR 130/MWh due to the Iberian price cap. The demand-

weighted average price for Germany, France, Spain and the United

Kingdom in H2 2022 was almost four times as high as the

H2 2019-2021 average.

The elevated futures prices in Europe for winter 2023/24 reflect the

continued uncertainties associated with gas supply for Europe.

Futures with delivery in Q4 2023 are EUR 227/MWh in France and

EUR 184/MWh in Germany while those for Q1 2024 are

EUR 258/MWh in France and EUR 186/MWh in Germany.

On the Nord Pool power exchange, average wholesale electricity

prices remained at unprecedented high levels in H2 2022,

exceeding EUR 150/MWh. Low hydro availability in the Nordics and

increased cross-zonal demand pushed prices up by almost 90%

year-on-year, yet they remained below European averages.

In the United States, the average wholesale price in H2 2022 stood

at about USD 91/MWh, more than twice the 2019-2021 second-half

average, and 65% higher than the price in H2 2021. This increase

was driven by exceptionally high gas prices.

Japanese wholesale prices in H2 2022 averaged almost

YEN 22 000/MWh (EUR 155/MWh), three times higher compared to

H2 2021 because of the tight supply situation. The increased prices

of fossil fuels also affected Japan because of its

low energy self-

sufficiency ratio. However, the majority of the imported LNG

volumes is contracted under oil-indexed long-term contracts which

alleviated some of the effects of soaring spot prices.

In 2022, Australian w

holesale prices averaged AUD 170/MWh

(Australian dollars; EUR 110/MWh), more than double the H2 2021

levels. This was due to surging electricity demand and gas prices

.

In India, despite increased coal stocks, higher electricity

consumption resulted in a 10% price rise in H2 2022 over the

H2 2021 level. The average wholesale price in H2 2022 was

INR 5 000/MWh (Indian rupees; EUR 55/MWh). Strong growth of

solar PV

helped to meet peak loads dr

iven by higher refrigeration

and space cooling.

Electricity Market Report 2023

P

AGE | 36

IEA. CC BY 4.0.

Global overview

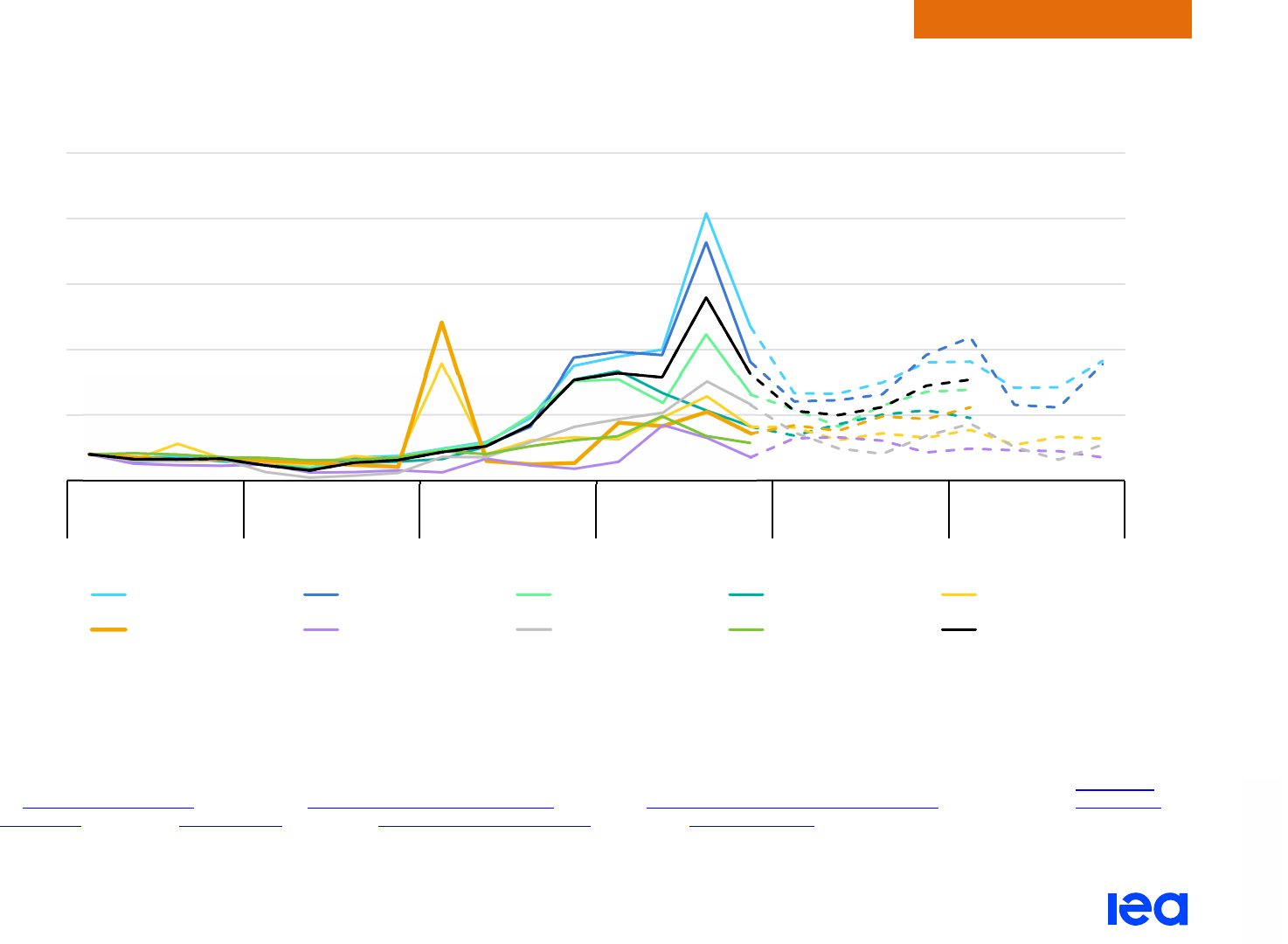

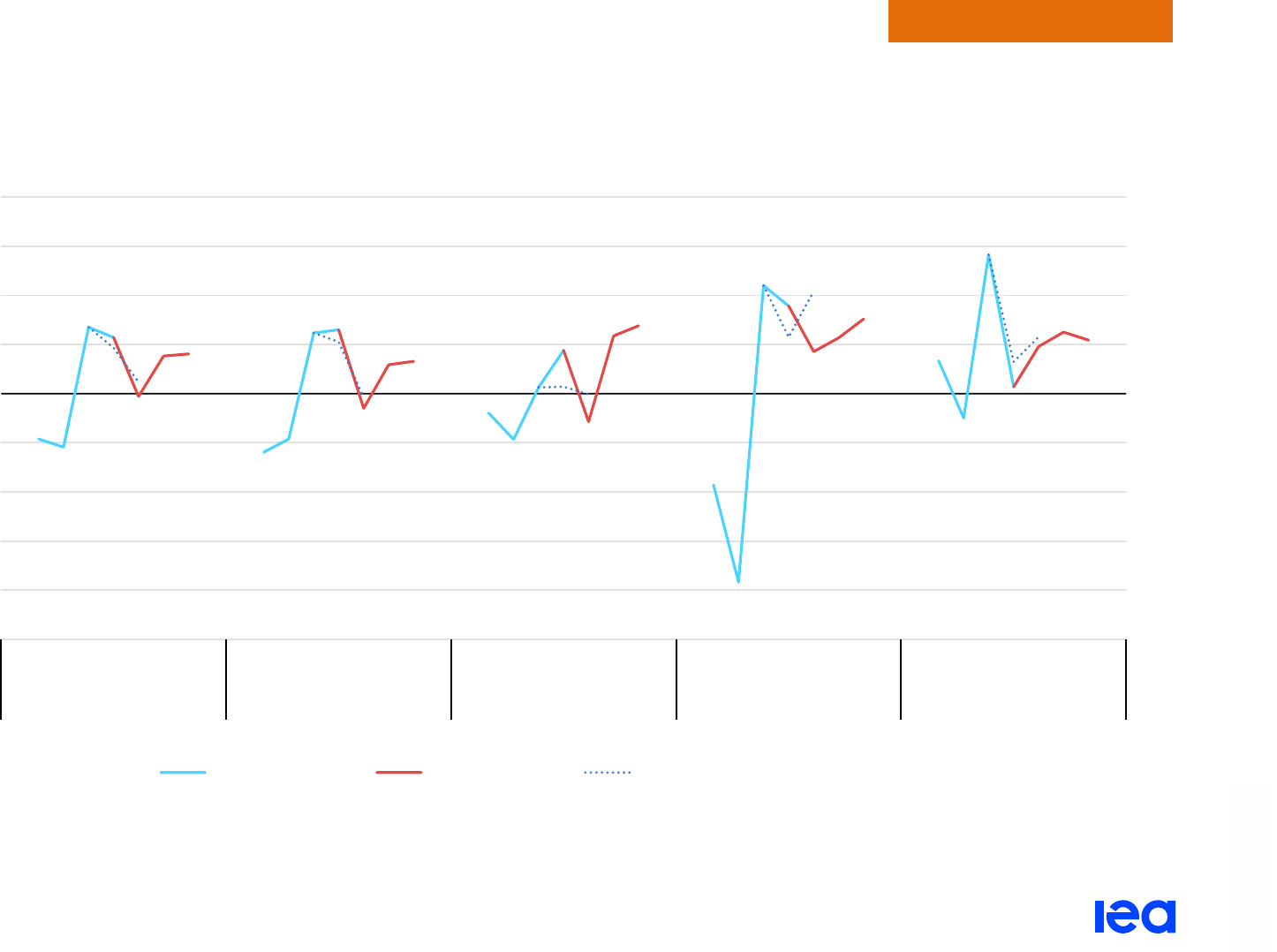

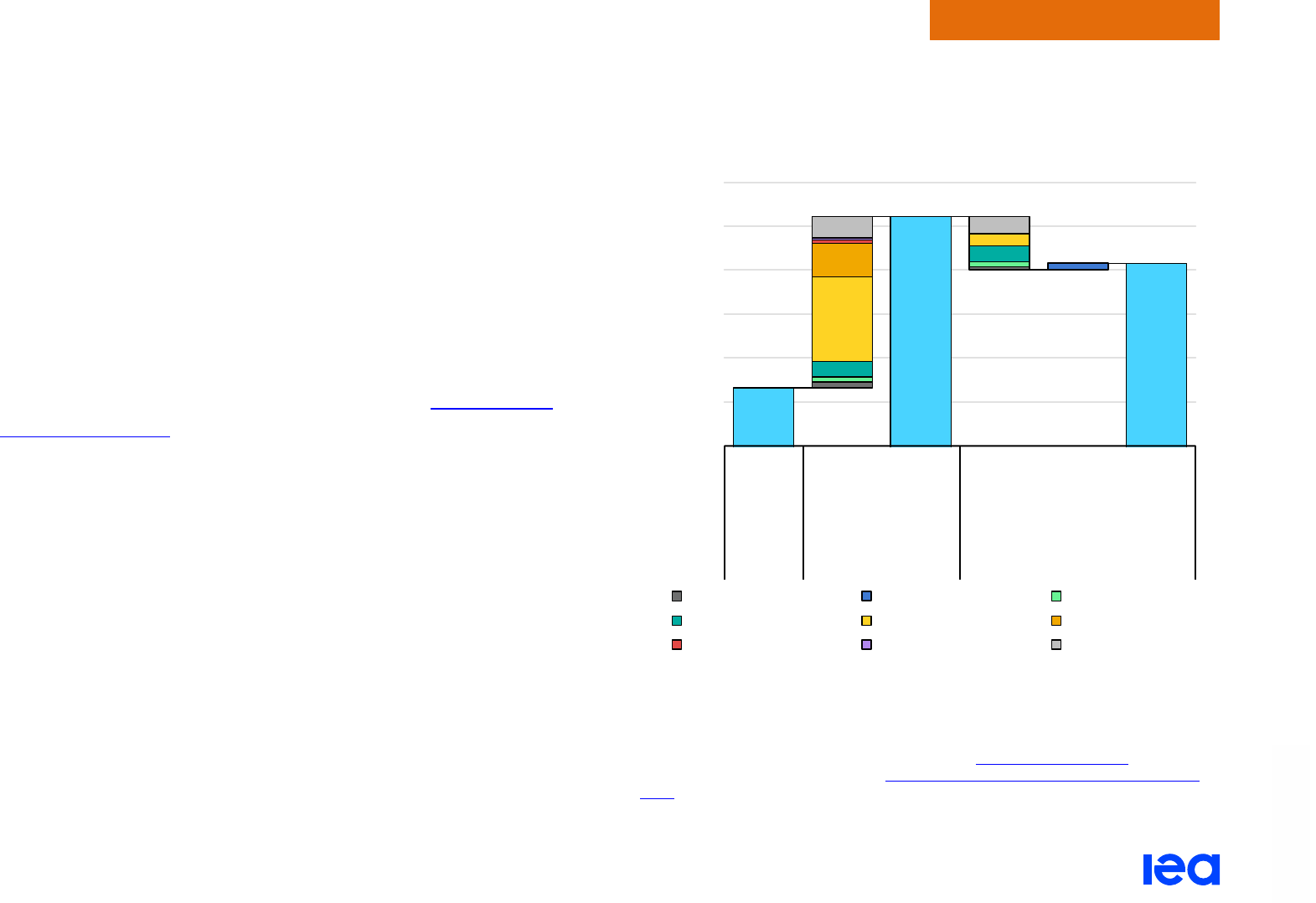

Elevated futures prices in Europe reflect risks of tight supply in the winter of 2023/24

Indexed quarterly average wholesale prices for selected regions, 2019-2024

IEA. All rights reserved.

Notes: The European Index is calculated as the demand-weighted average of the prices for the European countries included in the analysis. For the Nordics region, the Nord Pool

system price is used for the historical prices and EEX Nordics futures are used for forward prices. The prices for Australia and the United States are calculated as the demand-

weighted average of the available prices of their regional markets. Continuous lines show historical data and dashed lines refer to forward prices. Price estimates for Q1 2023 and

beyond are based on the historical prices and the latest forward baseload electricity prices, except for the United States, where we use EIA (2023) values. The forward prices for Japan

are volume-weighted estimates of the latest JPX settlement prices, considering the baseload contracts (areas B1 and B3).

Sources: IEA analysis using data from RTE (France) and Red Eléctrica (Spain) – both accessed via the ENTSO-E Transparency Platform; Bundesnetzagentur (2023), SMARD.de;

Elexon (2023), Electricity data summary; AEMO (2023), Aggregated price and demand data; EIA (2023), Short-Term Energy Outlook January 2023; Nord Pool (2023), Market Data;

IEX (2023), Area Prices; EEX (2023), Power Futures; JPX (2023), Daily Data (Electricity Futures); ASX (2023), Electricity Futures © ASX Limited ABN 98 008 624 691 (ASX) 2020. All

rights reserved. This material is reproduced with the permission of ASX. This material should not be reproduced, stored in a retrieval system or transmitted in any form whether in

whole or in part without the prior written permission of ASX. Latest update: 31 January 2023.

0

250

500

750

1 000

1 250

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

Q4

Q1 Q2 Q3 Q4 Q1 Q2

Q3

Q4 Q1 Q2 Q3 Q4

2019 2020 2021 2022 2023 2024

Indexed electricity price (Q1 2019 = 100)

Germany France United Kingdom Spain United States

Japan Australia Nordics India European Index

Electricity Market Report 2023

IEA. CC BY 4.0.

Global overview

Electricity markets were impacted differently across the world – Europe being hit the hardest

Annual wholesale prices in selected countries, 2022 and 2017-2021 average

IEA. All rights reserved.

Notes: Avg refers to an average of the years from 2017 to 2021. The annual averages are calculated from the daily wholesale electricity prices.

Source: IEA analysis using data from RTE (France) and Red Eléctrica (Spain) – both accessed via the ENTSO-E Transparency Platform; Bundesnetzagentur (2023), SMARD.de

;

Elexon (2023), Electricity data summary; AEMO (2023), Aggregated price and demand data; EIA (2023), Short-Term Energy Outlook January 2023; Nord Pool (2023), Market Data;

IEX (2023), Area Prices. Latest update: 31 January 2023.

P

AGE | 37

0

100

200

300

400

avg 2022 avg 2022 avg 2022 avg 2022 avg 2022 avg 2022 avg 2022 avg 2022 avg 2022 avg 2022

Italy France Germany United

Kingdom

Spain Japan Norway Australia India United

States

USD/MWh

Electricity Market Report 2023

P

AGE | 38

IEA. CC BY 4.0.

Global overview

Carbon pricing trends

Electricity Market Report 2023

P

AGE | 39

IEA. CC BY 4.0.

Global overview

Status and trends of carbon pricing mechanisms in 2022

Carbon pricing is a key instrument to mitigate emissions, incentivise

investments in low-carbon technologies and reduce demand for

greenhouse gas (GHG)-intensive activities. Such policy instruments

usually take the form of a carbon tax, an Emission Trading System

(ETS) or a hybrid of the two. Due to the ongoing energy crisis, carbon

pricing policies have entered uncharted territory, and are facing new

challenges hindering their effectiveness. While the EU’s carbon price

influences the variable generation cost, and hence the merit-order of

the power plants, carbon pricing is currently unable to perform its

traditional role of incentivising a coal-to-gas switch in electricity

production given exceptionally high gas prices. Nevertheless, carbon

pricing still has a crucial role to play in maintaining a long-term

investment signal and making carbon-intensive fossil generation

such as coal-fired electricity an economically unattractive solution. In

addition, it can be a useful instrument to generate additional revenue

for governments to support faster clean energy transitions, and

mitigate social and competitiveness impacts.

As of April 2022, 68 carbon pricing initiatives

we

re in place

worldwide, covering over 23% of GHG emissions, with the majority in

the form of an ETS. Many of them saw carbon price increases

compared to 2021. The price of allowances in the EU ETS, the most

established ETS globally, rose from an average of USD 50/t CO

2

-eq

to more than USD 90/t CO

2

-eq for January to April 2022. Prices in

the UK ETS rose to more than USD 100/t CO

2

-eq, and doubled in the

New Zealand ETS (USD 50/t CO

2

-eq) and in state-level systems in

the United States. Allowance prices in Korea (USD 19/t CO

2

-eq) and

China’s national ETS (USD 9/t CO

2

-eq) increased only slightly.

Despite these increases, less than 10% of global emissions are

covered by a carbon price that is higher than USD 10/t CO

2

-eq. In

some jurisdictions in 2022, carbon pricing instruments have had

difficulty incentivising a fuel switch to lower-carbon sources due to

high natural gas prices. For example, EU coal-fired generation rose

by 6% in 2022.

Price evolution of selected carbon pricing instruments (as of

April 2022, annual average levels)

IEA. All rights reserved.

*The EU ETS operates in all EU countries, Iceland, Liechtenstein and Norway.

Notes: The year-on-year increase compares the 2021 full-year averages versus the

2022 January-April averages.

Sources: World Bank Carbon Pricing Dashboard, ICAP, and Ember.

0%

20%

40%

60%

80%

100%

120%

China

EU ETS*

Korea

New Zealand

United Kingdom

California

Québec

South Africa

ETS Carbon

tax

Year-on-year increase in carbon

price (2021-2022)

Electricity Market Report 2023

P

AGE | 40

IEA. CC BY 4.0.

Global overview

Share of global GHG emissions covered by a carbon price, by

price level, 2012-2022

IEA. All rights reserved.

Source: World Bank (2022), Carbon Pricing Dashboard, 15 November 2022.

Increases in carbon prices and coverage have led to a new record

of revenues raised by these instruments, reaching

USD 140 bi

llion

in 2021, with ETS revenues more than doubling within a year

(USD 26 billion to USD 56 billion). Schemes differ in the use of their

revenues. California’s Cap-and-Trade, for example, returns the

majority of revenues to power companies and, ultimately, electricity

consumers, while another part is used for carbon mitigation

1

Least Developed Countries is a UN classification for “low-income countries confronting severe

structural impediments to sustainable development”.

programmes through its Greenhouse Gas Reduction Fund. This

notably includes programmes on renewable energy integration

towards low-income households.

China's national ETS, introduced in 2021 and covering the power

s

ector only, is the biggest carbon market, and accounts for about

9% of global GHG emissions. The introduction of partial auctioning

of allowances – instead of free allowance allocation – in the power

sector as well as expansion to industry are currently being

considered. Japan’s GX League

, composed of over 500 companies,

has started pilot trading in its voluntary carbon market, with official

trading starting in April 2023. This includes major participants in the

electricity, gas and heat and water sectors, such as TEPCO,

Kanden and Chuden. India also recently

adopted a carbon market

framework legislation, envisioning the construction of a national

carbon market.

Electricity projects are also being affected by rules decided in

v

oluntary carbon markets. Most notably, since 2020 the two biggest

carbon credits standards issuers, Gold Standard and Verra

, decided

to no longer register new renewable projects, except for those

located in Least Developed Countries

1

. This is because large-scale

renewable electricity projects are already cost-effective, not